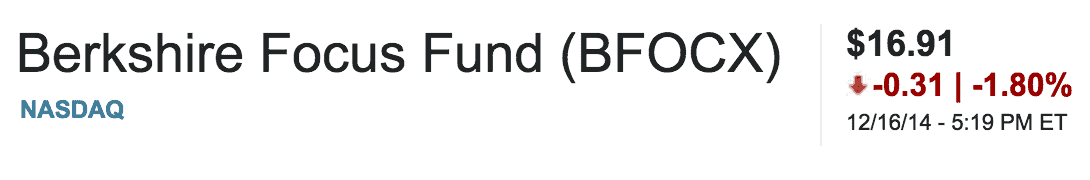

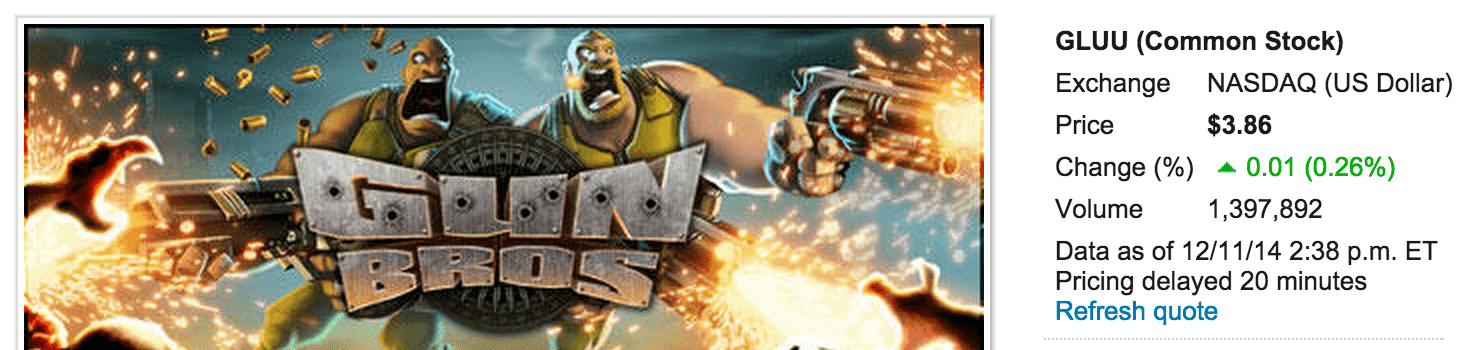

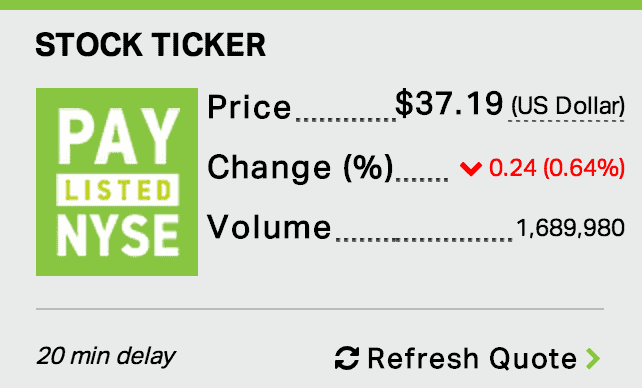

Danger Zone: Make Sure You’re in These Two Stocks for 2015

Instead of our usual weekly sell/short call, we are going to open 2015 with two of our favorite stocks for the upcoming year. These stocks have strong growth potential in the coming year, and are attractively valued, trading below their economic book values.

Andre Rouillard