Energy Sector ETFs Could Incinerate Your Savings

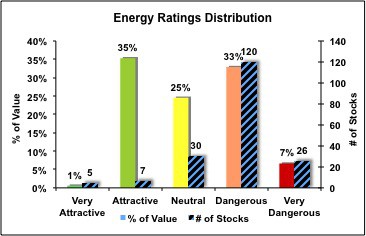

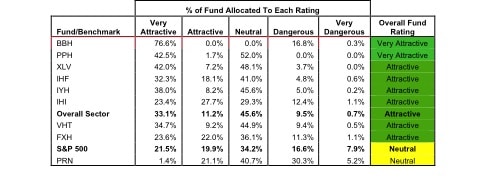

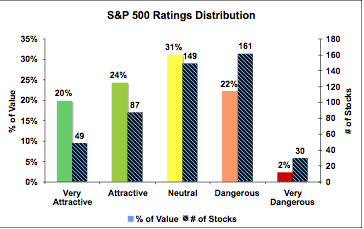

I recommend investors avoid all energy sector ETFs. There are no ETFs in the energy sector with an attractive-or-better rating from my methodology at New Constructs. None of the ETFs rank better than the S&P500.

Investors should sell all dangerous-rated energy sector ETFs. The five ETFs below are the worst-rated of all energy sector ETFs:

David Trainer, Founder & CEO