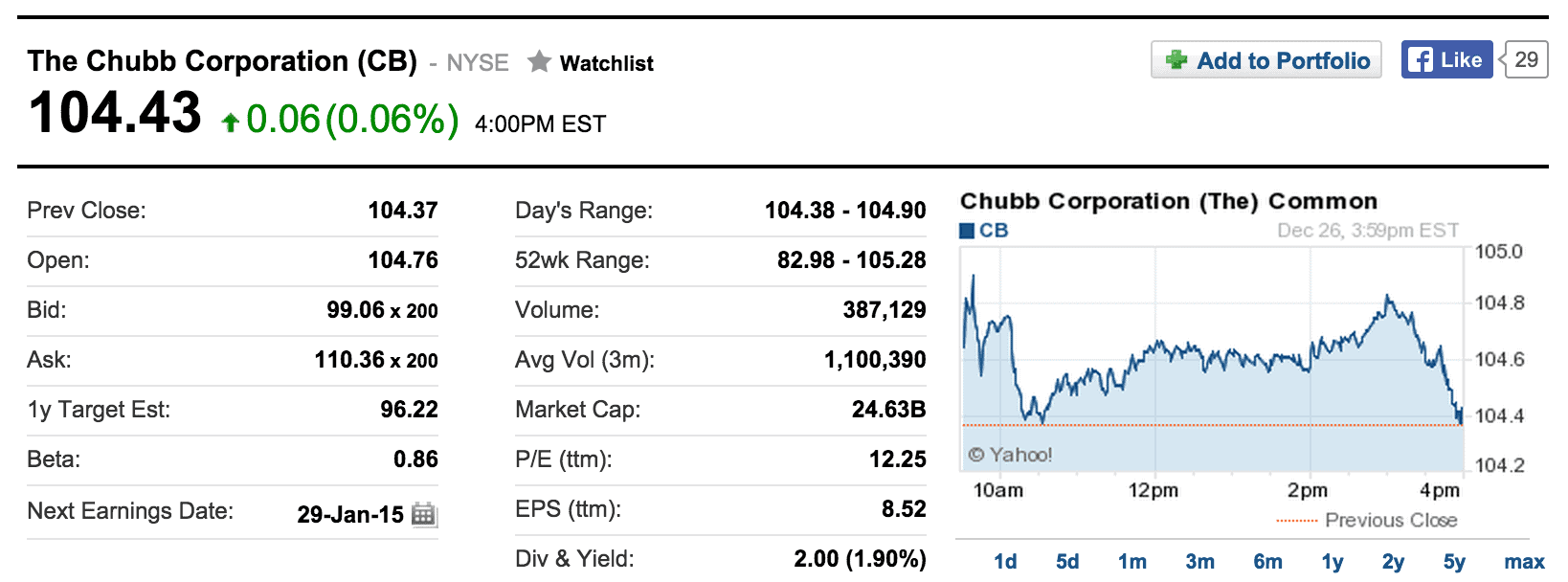

Stock Pick of the Week: The Chubb Corporation (CB)

This week’ stock pick comes from an industry we’ve long been fans of: insurance. Insurance can not only be purchased on almost any item of value, but it also provides great value to consumers in the event of an unexpected disaster.

Kyle Guske II, Senior Investment Analyst, MBA