Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life.

We regularly warn investors not to trust fund labels. All too often, investors make the decision to buy a fund based on its name rather than on diligent research of its holdings and methodology. When people ignore such basic due diligence, they miss significant red flags that cause funds to underperform or not deliver the promised portfolio allocation.

This ETF’s label capitalizes on the growing interest in Artificial Intelligence by a portfolio selected by AI, but its holdings show little differentiation from the market, and its methodology is a black box. As we wrote in “Cutting Through the Smoke and Mirrors of AI on Wall Street”, most AI-driven funds today are more effective at marketing than at delivering returns to investors. These concerns, plus significant allocation to Very Unattractive stocks and higher than average fees, make the AI Powered Equity ETF (AIEQ) this week’s Danger Zone pick.

AIEQ Looks Like a Closet Indexer

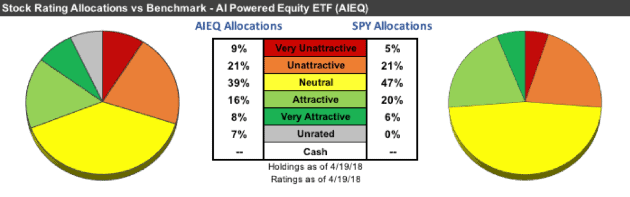

You’d expect a fund managed by AI to have a unique strategy that is uncorrelated with the rest of the market. Instead, as Figure 1 shows, our holdings analysis reveals that AIEQ has a very similar ratings distribution to the S&P 500 (SPY).

Figure 1: Asset Allocation: AIEQ vs. SPY

Sources: New Constructs, LLC and company filings

To make our determination of holdings quality, we leverage our Robo-Analyst technology[1] to drill down and analyze the individual stocks in every fund we cover.

AIEQ allocates 24% of its assets to Attractive-or-better stocks versus 26% for SPY. It allocates 30% to Dangerous-or-worse stocks versus 26% for SPY. Both funds count Alphabet (GOOGL) and Amazon (AMZN) among their top five holdings.

AIEQ Performs Like its Index

As Figure 2 shows, AIEQ has performed almost exactly in-line with SPY since its inception last October. After volatility in its first few weeks of trading, AIEQ has moved in lockstep with the market so far in 2018.

Figure 2: No Difference Between AIEQ Performance and the Market

Sources: Google Finance

It looks as if AIEQ initially debuted with a genuinely unique strategy, but after that strategy underperformed, it was tweaked to make sure it didn’t lag its benchmark. Just like so many human managers before it, AIEQ seems to have become a “closet indexer” rather than risk the fund outflows that result from underperformance.

Passive Management with Active Costs

AIEQ’s index-like performance makes it hard to justify the fees it charges investors. Its total annual costs of 0.83% are more than eight times higher than SPY (0.10%). Overall, AIEQ is more expensive than 89% of the 650+ ETFs we cover.

These high costs hurt AIEQ significantly in our rating system. Even though its holdings are not that different from SPY, which earns an Attractive rating, AIEQ only earns our Neutral rating and is one of the five worst ETFs in the All Cap Growth style.

Applied correctly, the use of AI in asset management should give investors the benefits of active management with passive costs. Instead, AIEQ gives investors the results of passive management with active costs.

Lack of Transparency Puts Investors at Risk

As we wrote in “Opening the Black Box: Why AI Needs to Be Transparent”, transparency is key for artificial intelligence to achieve widespread adoption in Finance. EquBot, the company behind AIEQ, says all the right things about transparency. COO Chida Khatua told Bloomberg Businessweek:

“Our core philosophy is that we don’t want to create a black box for AI.”

However, that’s exactly what they’ve done. In its public documents, AIEQ provides almost no insight into its stock-selection methodology. For instance, consider the “Investment Process” paragraph from its fact sheet, which reads:

“The fund applies proprietary analytical algorithms to artificial intelligence (AI) technology, which can process over one million pieces of information per day, to build predictive financial models on approximately 6,000 U.S. companies. The technology continually analyzes data and models in its active stock selection process, and derives an optimal risk adjusted portfolio consisting of 30 to 70 companies with high opportunities for capital appreciation.”

This section raises a number of questions, such as:

- What data points compose the “one million pieces of information” being analyzed daily?

- Where does AIEQ get the data from, and what processes are in place to ensure data quality?

- What is the methodology behind its “predictive models”?

- How does the AI process the data to decide which companies have “high opportunities of capital appreciation”?

However, none of these questions are answered in any substantial manner in the fact sheet, the prospectus, or on the fund’s website. We understand that AIEQ may not want to reveal all the secrets behind its methodology, but certainly it can give some investors some insight into its process.

We try to be as transparent as possible with our clients, breaking down exactly how our ratings and metrics are calculated and showing where we collect all our data from in the filings. We do this because:

- We want investors to see all the work we’re doing so they can have trust in the process, and

- We believe our technological and organizational advantages make it impossible for someone else to emulate our work even if they do know our methodology.

If AIEQ believes in its technological advantages as much as they say they do, they should be willing to give investors more information about their process. There’s no downside to showing potential investors how much work is being done behind the scenes. Furthermore, transparency doesn’t just build trust with investors, it also makes it easier to address errors and optimize your technology.

Red Flags in the Holdings

The lack of transparency in AIEQ’s methodology raises serious questions about some of its holdings. Forest City Realty Trust (FCE.A) is one of AIEQ’s top five holdings, and it earns our Very Unattractive rating.

Because AIEQ doesn’t disclose its data sources, we have no way of knowing whether its decision to allocate 2.9% of its assets to FCE.A might be based on inaccurate data. For instance, does the fund’s model take into account the $28 million deferred tax benefit that artificially increased FCE.A’s net income and funds from operations in 2017? What about the $270 million in operating leases and $990 million in accumulated asset write-downs, which, when combined, account for 17% of reported net assets?

Maybe it does. Maybe one of the million data points processed by the AI suggests the company’s 1.7% return on invested capital (ROIC)[2] can improve, and that it will be able to increase its 2.2% free cash flow yield to support its 3.6% dividend yield. Without any ability to examine the fund’s models, though, investors can’t have any trust in its investment process.

Look Past the Marketing and Demand Diligence

While AIEQ hasn’t lived up to its promise as an investment, it’s been extremely successful as a marketing tool. In a short amount of time, the fund has amassed over $130 million in assets, won the ETF.com award for “Best New Active ETF”, and spawned enough interest that the creators are already looking to roll out a second fund for international stocks.

Investors are excited about all things AI, and rightly so. AI is a transformative technology that’s going to have a massive impact on asset management in the coming years. However, investors can’t get so excited about AI that they forget about due diligence and fall prey to marketing gimmicks that are all style and no substance.

This article originally published on April 23, 2018.

Disclosure: David Trainer, Sam McBride, and Kyle Guske II receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1]Harvard Business School features the powerful impact of our research automation technology in the case New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.

[2] Ernst & Young’s Recent white paper “Getting ROIC Right” proves the importance of a diligent calculation of ROIC and the superiority of our data and metrics.

Click here to download a PDF of this report.

Photo Credit: geralt (Pixabay)

2 replies to "Don’t Believe the Hype About this “AI Powered” ETF"

AEIQ is not a closet indexer. It’s active share as of today is 85% (vs Russell 3000).

At the time we wrote this article, the performance of AIEQ had closely tracked the S&P 500 for most of its history. Since then, its performance has diverged significantly, which suggests a change in strategy. AEIQ has performed well over the past couple months, but the lack of transparency makes it difficult to assess the sustainability of the ETF’s performance and whether the technology is truly as sophisticated as they claim.