We published an update on AFRM on February 11, 2022. A copy of the associated update report is here.

We counsel investors to take care not to be cut by falling knives – stocks that have seen steep declines but still have further to fall. As the market rotates away from high-flying growth names to more stable cash generators, investors need reliable fundamental research, more than ever, to protect their portfolios from falling knives.

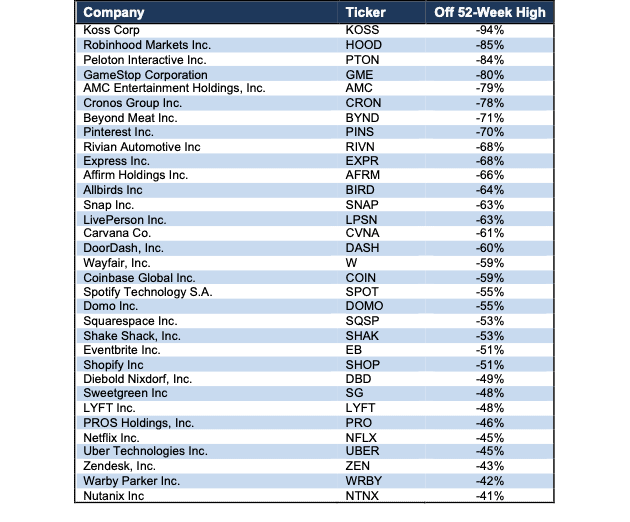

We continue to post an exceptional hit rate on spotting overvalued stocks. Currently, 62 out of our 65 Danger Zone stock picks are down from their 52-week highs by more than the S&P 500. Figure 1 lists the open Danger Zone picks that are down at least 40% from their 52-week highs. Our Focus List Stocks: Short Model Portfolio, the best-of-the-best of our Danger Zone picks, outperformed the S&P 500 as a short portfolio by 36% in 2021 with 29 out of our 31 picks outperforming the index.

This report highlights one particularly dangerous falling knife: Affirm (AFRM: $60/share). We highlight four other falling knives in other reports published today: Uber (UBER: $35/share) here, Rivian (RIVN: $60/share) here, DoorDash (DASH: $104/share) here, and Warby Parker (WRBY: $35/share) here. Each of these stocks have dropped at least 40% from all-time highs, yet still carry at least 40% additional downside risk.

Figure 1: Danger Zone Picks Down >40% From 52-Week High – Performance through 1/28/22

Sources: New Constructs, LLC

Falling Knife: Affirm Holdings (AFRM): Down 66% from 52-Wk High & 83%+ Downside Remaining

We put Affirm Holdings (AFRM) in the Danger Zone in October 2021 and the stock has outperformed the S&P 500 as a short by 47% since then. The drop from its 52-week high has been even larger, and the stock could fall another 83%. We detail Affirm’s falling market share, lack of competitive advantages, negative profitability, and other risks facing the firm in our report here. The recent struggles at Peloton (PTON), one of Affirm’s largest merchant partners, add pressure to an already unprofitable business.

Current Valuation Implies Affirm Will Be Biggest BNPL Firm in the World

Despite facing larger, more profitable competition, Affirm is priced as if it will be the largest buy now pay later (BNPL) provider, measured by gross merchandise volume (GMV), in the world, on top of immediately achieving profitability.

To justify its current price of $60/share, Affirm must:

- immediately improve its NOPAT margin to 8% (above Block’s [formerly Square Inc.] 1% and Affirm’s -41% TTM NOPAT margin), and

- grow revenue by 38% compounded annually (nearly 2x expected industry CAGR through 2028) for the next eight years.

In this scenario, Affirm’s revenue grows to $11.4 billion in fiscal 2029, or 13 times higher than the company’s fiscal 2021 revenue.

If we assume Affirm maintains a revenue per GMV rate of just over 10% (equal to fiscal 2021), then this scenario implies Affirm’s GMV in fiscal 2029 is $109 billion, which is 1.6x Klarna’s TTM GMV at the midway point of 2021. For context, Statista estimates Walmart’s 2020 ecommerce GMV was $92 billion. Affirm must process more than double Walmart’s 2020 ecommerce GMV simply to justify its current valuation. We are skeptical of any BNPL firm ever achieving such high merchandise volume.

57% Downside If Consensus Growth is Realized

We review additional DCF scenarios below to highlight the downside risk should Affirm’s revenue grow at consensus rates, or if margins do not improve as much as the scenario outlined above.

If we assume Affirm:

- immediately improves its NOPAT margin to 8%,

- grows revenue by 46% in fiscal 2022 and 43% in fiscal 2023 (equal to consensus), and

- grows revenue by 22% each year thereafter through fiscal 2029 (equal to projected industry growth), then,

Affirm is worth just $26/share today – a 57% downside to the current price

83% Downside If Margins Remain Capped by Competition

If we assume Affirm:

- immediately improves its NOPAT margin to 4%, which equals Block’s highest ever margin,

- grows revenue by 46% in fiscal 2022 and 43% in fiscal 2023, and

- grows revenue by 22% each year through fiscal 2029 then,

Affirm is worth just $10/share today – an 83% downside to the current price.

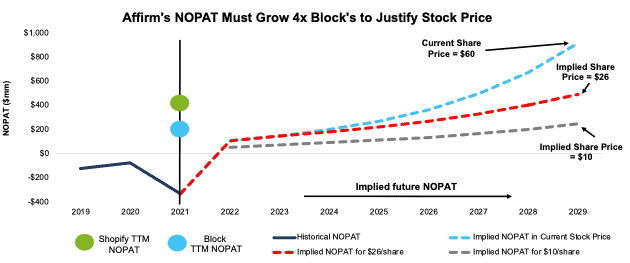

Figure 2 compares Affirm’s implied future NOPAT in these three scenarios to its historical NOPAT. For reference, we include Block (SQ) and Shopify’s NOPAT.

Figure 2: Affirm’s Historical vs. Implied NOPAT: DCF Scenarios

Sources: New Constructs, LLC and company filings.

Each of the above scenarios assumes Affirm grows revenue, NOPAT, and FCF without increasing working capital or fixed assets. This assumption is highly unlikely but allows us to create best-case scenarios that demonstrate the expectations embedded in the current valuation. For reference, Affirm’s invested capital has grown 4x from fiscal 2019 to fiscal 2021. If we assume Affirm’s invested capital increases at a similar rate in DCF scenarios two and three above, the downside risk is even larger.

Fundamental Research Provides Clarity in Frothy Markets

2022 has quickly shown investors that fundamentals matter and stocks don’t only go up. With a better grasp on fundamentals, investors have a better sense of when to buy and sell – and – know how much risk they take when they own a stock at certain levels. Without reliable fundamental research, investors have no way of gauging whether a stock is expensive or cheap.

As shown above, disciplined, reliable fundamental research shows that even after plummeting, Uber, Affirm, Rivian, DoorDash, and Warby Parker still hold significant downside.

Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life.

This article originally published on January 31, 2022.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.