We published an update on this Danger Zone pick on January 31, 2022. A copy of the associated Earnings Update report is here.

Despite multiple tailwinds, profits for this buy now, pay later (BNPL) firm are elusive. With market share on the decline, possible regulatory oversight on the horizon, and significant competition, profits later look highly unlikely. Yet, the stock is priced for the firm to take huge amounts of market share and become the largest BNPL firm in the world. Affirm Holdings (AFRM: $119/share) is this week’s Danger Zone pick.

This report helps investors see just how extreme the risk in AFRM is based on:

- larger competitors are taking market share rapidly

- costs are rising faster than revenue and driving deeper losses

- a lack of pricing power due to an undifferentiated service

- doing the math: the stock price implies Affirm will be the largest BNPL firm in the world, as measured by gross merchandise volume (GMV)

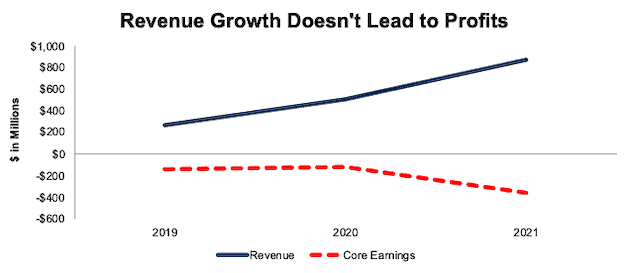

Rapid Revenue Growth Is No Measure of Success

Affirm has garnered the attention of investors, in large part due to its revenue growth, which was 81% compounded annually from fiscal 2019-2021 (fiscal year ends June 30). Multiple tailwinds, such as stimulus-driven consumer spending, retailers’ rapid adoption of ecommerce, and more work-from-home driving ecommerce sales growth, have boosted the firm’s top-line growth. However, top-line growth has not helped the bottom line. Core Earnings[1] fell from -$142 million in fiscal 2019 to -$362 million in fiscal 2021.

Figure 1: Affirm’s Revenue & Core Earnings: Fiscal 2019-2021

Sources: New Constructs, LLC, and company filings

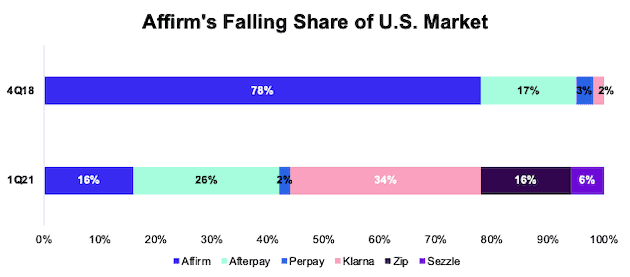

“First-Mover Advantage” Didn’t Last Long

While Affirm may have been one of the first modern-day BNPL firms in the United States to gain attention, its position atop the industry didn’t last long. Other competitors moved into the U.S market and supplanted Affirm’s market position. In 4Q18, Affirm made up 78% of all app downloads for BNPL providers. In 1Q21, Affirm made up just 16% of all BNPL app downloads. Meanwhile, the larger Afterpay and Klarna improved their share from 17% and 2% to 26% and 34% respectively, per Figure 2.

Figure 2: BNPL App Downloads (% of Total): 4Q18 vs. 1Q21

Sources: New Constructs, LLC and emarketer

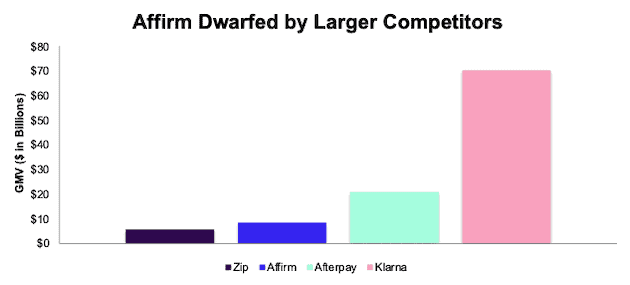

Falling Behind in GMV, Users, and Merchants

As Affirm’s share of the U.S. market fades, its gross merchandise volume (GMV), a measure of total sales facilitated by Affirm’s BNPL service, of $8 billion remains well below Klarna, at $70 billion, and Afterpay (recently acquired by Square [SQ]), at $21 billion.

Figure 3: Gross Merchandise Volume: 4 Largest BNPL Providers: TTM as of June 2021

Sources: New Constructs, LLC and company filings

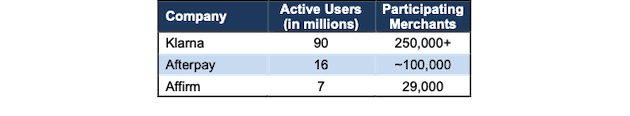

Apart from lower GMV, Affirm also has fewer users and merchants than Afterpay and Klarna. Per Figure 4, Affirm’s user base is less than half the size of Afterpay and one-tenth the size of Klarna. When it comes to number of merchants using the service, Affirm’s merchant base of 29,000 is less than one-third Afterpay and just 12% of Klarna’s 250,000+.

In other words, more merchants are choosing Klarna and Afterpay to facilitate BNPL transactions, which means more consumers are also using these firm’s services compared to Affirm.

Figure 4: Comparing Users and Merchants: Klarna, Afterpay, Affirm: as of June 2021

Sources: New Constructs, LLC and company filings

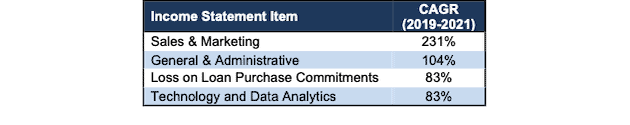

Key Costs Growing Faster Than Revenues

Since fiscal 2019, revenue has grown 81% compounded annually. Meanwhile, sales and marketing costs, general and administrative costs, loss on loan purchase commitments, and technology and data analytics costs have all grown even faster, per Figure 4. As operating costs grow about as fast as revenues, Affirm remains highly unprofitable as it grows. That trend is not good for investors.

Figure 5: Affirm’s Costs Growing Faster Than Revenue

Sources: New Constructs, LLC and company filings

Sales and marketing and general and administrative costs were a combined 40% of revenue in fiscal 2019 and increased to 64% of revenue in fiscal 2021. Over the same time, total operating expenses have hardly budged, falling from 148% of revenue in fiscal 2019 to 144% of revenue in fiscal 2021.

With an already lower merchant base, we expect Affirm’s sales and marketing to remain elevated, and a drag on profitability, as the firm must spend heavily to try and reach more merchants, as it did with Shopify, or take existing merchants from competitors.

Lots of New Entrants Underscores Low Barriers to Entry for BNPL

The BNPL market is littered with multiple undifferentiated providers. Each generally offers the same service, interest free (or low interest for longer timeframes) installment payments. Some firms cater to specific types of purchases, but the underlying operations and value proposition of each firm are the same. Here’s a list of some of the newer BNPL-focused firms:

- Afterpay (acquired by Square)

- GreenSky (acquired by Goldman Sachs)

- Openpay

- Split It

- Sezzle

- Zip

- Perpay

- Klarna

- Uplift

- Monzo

- Revolut

Traditional Firms Stand in Way of Profits for BNPL-Only Firms

BNPL also competes with more traditional firms that can, and, in some cases, already provide BNPL or similar options to consumers.

- JPMorgan Chase (JPM)

- Capital One Financial Corp (COF)

- American Express Company (AXP)

- Bank of America Corp (BAC)

- Citigroup (C)

- Synchrony Financial (SYF)

- Mastercard (MA)

- Visa (V)

- PayPal (PYPL)

- Square (acquired Afterpay)

- Goldman Sachs (acquired GreenSky)

These firms enjoy significant competitive advantages over the BNPL upstarts when it comes to acquiring and retaining the customers needed to create a profitable consumer finance business.

First, the traditional firms already have long-standing, deep relationships with millions of consumers and need not spend as much as BNPL upstarts to acquire customers.

Second, these firms offer consumers more products and services than upstart BNPL providers. Credit cards, for instance, provide consumer protections such as zero-liability fraud protection and the ability to challenge unrecognized charges. Many credit card providers already allow users to create payment pans on larger purchases, and Mastercard recently announced a new BNPL offering that will incorporate consumer protections and be available to merchants with “zero effort on their part”.

Third, traditional firms have proven track records and decades of experience in using rewards programs to attract new and existing users.

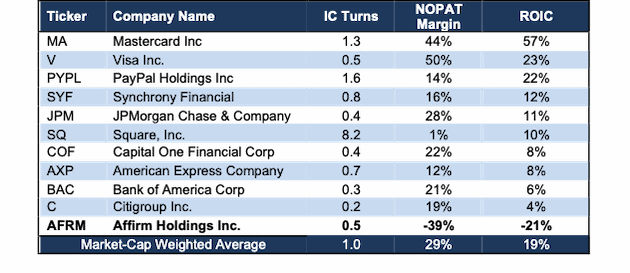

Fourth, existing profitable relationships with millions of consumers provide a war chest of cash that traditional firms can use to offer BNPL as a loss leader to retain and attract consumers. To date, Affirm has burned $2.5 billion and is on track to burn a lot more cash before it breaks even, if it ever breaks even. Per Figure 6, Affirm’s net operating profit after-tax (NOPAT) margin of -39% is well below its competitors and the market-cap-weighted peer group average margin of 29%.

Affirm’s invested capital turns, a measure of balance sheet efficiency, also rank below its biggest competitors in Square (SQ) and PayPal (PYPL), along with Mastercard (MA), Synchrony Financial (SYF), and American Express (AXP). In other words, Affirm has a long way to go before it breaks even.

Figure 6: Affirm’s Competitors Are More Profitable

Sources: New Constructs, LLC, and company filings

All together, we think the traditional firms’ advantages over the BNPL upstarts will make it very hard for the upstarts to ever achieve profitability and impossible for Affirm to achieve the profit expectations implied by its current stock price. Moreover, the amount of cash Affirm will likely burn as it attempts to breakeven means current investors should expect significant dilution from the debt and equity sales required to fund the cash burn.

BNPL Likely to Have Razor Thin Margins

Given the relatively undifferentiated nature of BNPL offerings, any BNPL firms that do achieve profitably will likely be undercut by firms willing to charge lower fees to merchants to acquire customers and take market share. In such a market, the prospects of lasting positive margins are slim. Let ridesharing’s inability to achieve profits, a highly unprofitable “disruptive” technology where the only real differentiator is price, be a warning sign.

BNPL Doesn’t Replace Credit Cards, But Further Increases Consumer Debt

Investors that believe BNPL is replacing credit cards at checkout are wrong. Instead, BNPL is just another form of payment that adds additional debt to consumers without the added “benefits” that traditional consumer finance firms offer.

From October 2019 to March 2021, TransUnion found that BNPL plans did not result in smaller credit card loans. Rather, BNPL users don’t pay down credit cards as much as the general population. Additionally, TransUnion found that delinquency rates on BNPL users’ credit cards six months after application were 3.2%, compared to 2.7% for the general population. In other words, even if the difference is small now, BNPL users have higher delinquency rates.

Should delinquency among BNPL users remain higher than the general population, these programs may lose some of their luster, as consumers avoid taking on additional BNPL debt to pay down their credit cards, or find themselves unable to qualify due to other outstanding balances.

Regulation Could Slow the BNPL Industry

Currently, BNPL firms aren’t generally considered lenders or credit card providers and are not regulated as heavily as traditional consumer lenders. Lack of regulation means BNPL programs do not have the same consumer protections as credit cards, nor must they go through the same credit checks as similar programs.

Given that BNPL programs increase credit usage, rather than replace it, and about one-third of all users fall behind on payments, regulators are taking a closer look at the industry.

In the U.K. the government plans to introduce regulations, such as the requirement that firms make affordability checks before lending and the ability to escalate complaints to the U.K’s Financial Ombudsman.

In Australia, regulators are considering clamping down on the industry. Particularly, analysts believe underlying fees and delinquency charges aren’t always clear up front and obscure the 0% interest advertising. Additionally, the Australian Securities and Investments Commission found that 20% of consumers are in delinquent status, which could mean stricter lending standards are needed.

In the United States, regulation is less clear, as the Consumer Financial Protection Bureau has not come out strongly against the programs. But, should delinquencies rise, or we see more evidence of rising consumer debt, regulations to protect consumers cannot be ruled out. Such regulatory unclarity adds risk to investing in Affirm’s growth story.

Amazon Partnership Lacks Key Details

In August, AFRM soared 47% on the day it announced an upcoming partnership to bring its BNPL services to Amazon (AMZN). However, outside of announcing ongoing testing and upcoming roll out of the service, details are light. For instance, in the fiscal 4Q21 earnings conference call, management noted that guidance did not include any GMV or revenue from the Amazon partnership.

While the lack of detail lets bulls speculate about potential opportunity, it also should give investors pause.

Amazon has a well-known reputation of strong-arming and/or copying its partners. Did Affirm give Amazon a “sweet-deal”, which will result in rising GMV/revenue, but little opportunity for profit? It wouldn’t be the first time in Affirm’s history.

In 2020, Affirm became the exclusive BNPL provider on Shopify, which would seem to be a huge opportunity. However, under the terms of the partnership Affirm pays Shopify a fee for each sale processed through the platform. Affirm also gave Shopify warrants for upwards of 20 million shares at a price of $0.01/share. At Affirm’s current price, these shares are worth $2.3 billion. In other words, Affirm pays Shopify per transaction, and diluted shareholders to enter into this “partnership.”

If Amazon gets a similar deal as Shopify, the market may be vastly overestimating the benefits, especially regarding potential profits, while ignoring potential shareholder dilution. With the rapid rise in Affirm’s stock price post announcement, even the most optimistic results from the Amazon partnership are already baked into Affirm’s valuation.

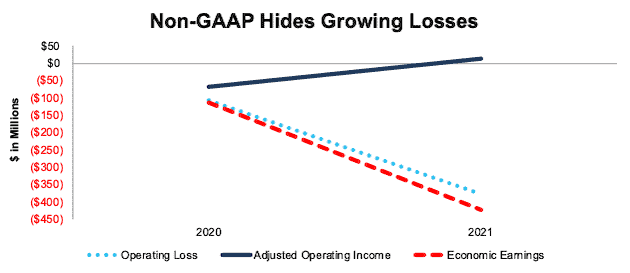

Don’t Fall for Non-GAAP Results Either

As with most unprofitable firms, Affirm uses flawed non-GAAP metrics such as adjusted operating income and revenue less transaction costs, which paint a rosier picture of the firm’s losses. Non-GAAP metrics allow management significant leeway in removing actual costs of the business to present a more optimistic view.

In fiscal 2021, Affirm removed, among other items, $288 million (33% of revenue) in stock-based compensation and $65 million (7% of revenue) in amortization of its Shopify commercial agreement to calculate adjusted operating income. After all of Affirm’s adjustments, adjusted operating income in fiscal 2021 is $14 million, compared to GAAP operating losses of -$379 million. Economic earnings, which remove unusual gains/losses and changes to the balance sheet, are even lower, at -$423 million, per Figure 7.

Figure 7: Non-GAAP Adjusted Operating Income vs. Operating Loss and Economic Earnings

Sources: New Constructs, LLC, and company filings

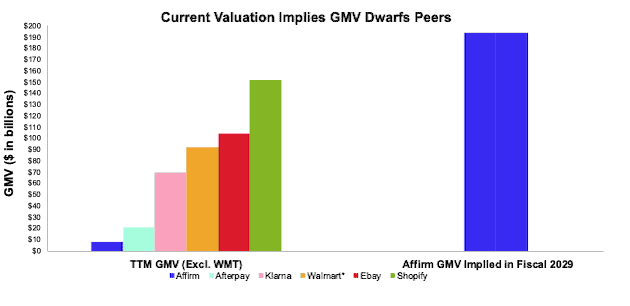

Current Valuation Implies Affirm Will Be Biggest BNPL Firm in the World

Despite facing larger, more profitable competition, Affirm is priced as if it will be the largest BNPL provider, measured by GMV, in the world, on top of immediately achieving profitability.

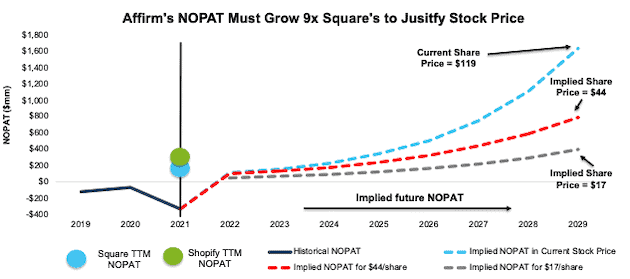

To justify its current price of $119/share, Affirm must:

- immediately improve its NOPAT margin to 8% (above Square’s 1% but below American Express’ 12% TTM margin, compared to Affirm’s -39% fiscal 2021 NOPAT margin), and

- grow revenue by 48% compounded annually (more than 2x expected industry CAGR through 2028) for the next eight years.

For reference, consensus revenue estimates expect revenue to grow 37% in fiscal 2022 and 34% in fiscal 2023 and 2024. In this scenario, Affirm’s revenue grows to $20.4 billion in fiscal 2029. For reference, Worldpay estimates BNPL programs will facilitate nearly $80 billion in U.S. sales in 2024.

If we assume Affirm maintains a revenue per GMV rate of just over 10% (equal to fiscal 2021), then this scenario implies Affirm’s GMV in fiscal 2029 is $194 billion, which is nearly 4x Klarna’s fiscal 2021 GMV. For additional context outside the BNPL market, Statista estimates Walmart’s (a partner with Affirm) 2020 ecommerce GMV was $92 billion. Over the TTM, eBay’s (EBAY) GMV equals $104 billion and Shopify’s (SHOP) equals $152 billion.

In other words, Affirm must process more than double Walmart’s 2020 ecommerce GMV simply to justify its current valuation. We are skeptical of any BNPL firm ever achieving such high GMV. Figure 8 shows Affirm’s implied GMV in this scenario compared to its TTM GMV and the GMV of Afterpay and Klarna.

Figure 8: Current Valuation Implies Unrealistic GMV Growth

Sources: New Constructs, LLC and company filings.

* Walmart GMV estimated as of 2020

DCF Scenario 2: Consensus Growth Continues

We review two more DCF scenarios below to highlight the downside risk should Affirm’s revenue grow at consensus rates, or if its margins don’t improve as much as the scenario outlined above.

If we assume Affirm:

- immediately improves its NOPAT margin to 8% and

- grows revenue by 38% in fiscal 2022 and 35% in fiscal 2023 (equal to consensus) and

- grows revenue by 35% each year through fiscal 2029 (continuation of 2023 consensus) then,

Affirm is worth just $44/share today – a 63% downside to the current price. See the math behind this reverse DCF scenario.

DCF Scenario 3: Margins Limited by Competition

If we assume Affirm:

- immediately improves its NOPAT margin to 4%, which equals Square’s highest ever margin and

- grows revenue by 38% in fiscal 2022 and 35% in fiscal 2023 (equal to consensus) and

- grows revenue by 35% each year through fiscal 2029 (continuation of 2023 consensus) then,

Affirm is worth just $17/share today – an 86% downside to the current price. See the math behind this reverse DCF scenario.

Figure 9 compares the firm’s implied future NOPAT in these three scenarios to its historical NOPAT.

Figure 9: Affirm’s Historical vs. Implied NOPAT: DCF Scenarios

Sources: New Constructs, LLC and company filings.

Each of the above scenarios also assumes Affirm grows revenue, NOPAT, and FCF without increasing working capital or fixed assets. This assumption is highly unlikely but allows us to create best-case scenarios that demonstrate the expectations embedded in the current valuation. For reference, Affirm’s invested capital has grown 4x from fiscal 2019 to fiscal 2021. If we assume Affirm’s invested capital increases at a similar rate in DCF scenarios two and three above, the downside risk is even larger.

Acquisition Would Be Unwise Use of Capital

Often the largest risk to any bear thesis is what we call “stupid money risk”, which means an acquirer comes in and buys Affirm at the current, or higher, share price despite the stock being overvalued. Given our analysis above, the only plausible justification for AFRM trading at such a high price is the expectation that another firm will buy it, especially given Square’s recent $29 billion acquisition of Afterpay.

However, we think potential acquirers would need a significant discount from current prices to even consider acquiring Affirm. For instance, at $29 billion, Afterpay was valued at a 1.4 price to GMV ratio. If we assume a similar ratio in an acquisition of Affirm, the firm would be worth ~$11 billion, or 65% below its current market cap.

Stranger things have happened than firms being acquired at unnecessarily high premiums to their intrinsic value. Below, we quantify how high the acquisition hopes priced into the stock are.

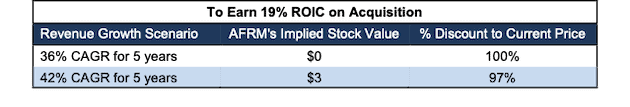

Walking Through the Acquisition Math

First, investors need to know that Affirm has large liabilities that make it more expensive than the accounting numbers would initially suggest.

- $2.8 billion in outstanding employee stock options (9% of market cap)

- $77 million in total debt (<1% of market cap)

After adjusting for all liabilities, we can model multiple purchase price scenarios. For this analysis, we chose Amazon as a potential acquirer of Affirm, given their recent partnership. While we chose Amazon, analysts can use just about any company to do the same analysis. The key variables are the weighted average cost of capital (WACC) and ROIC for assessing different hurdle rates for a deal to create value.

Even in the most optimistic of acquisition scenarios, Affirm is worth less than its current share price.

Figures 10 and 11 show what we think Amazon should pay for Affirm to ensure it does not destroy shareholder value. There are limits on how much Amazon should pay for Affirm to earn a proper return, given the NOPAT or free cash flows being acquired.

Each implied price is based on a ‘goal ROIC’ assuming different levels of revenue growth. In each scenario, we use 38% revenue growth in year one and 35% in year two, which equal consensus estimates. In the first scenario, we extend the fiscal 2022 consensus estimate of 35% to years three through five. In the second scenario, we use 45% in years three through five. We use the higher estimates in scenario two to illustrate a best-case scenario where we assume Affirm could grow revenue faster while being integrated within Amazon’s existing business.

We optimistically assume Affirm achieves a 16% NOPAT margin, which is above its TTM margin of -39%, above Amazon’s TTM margin of 7%, and equal to Synchrony’s TTM NOPAT margin.

We also optimistically assume that Amazon can grow Affirm’s revenue and NOPAT without spending any working capital or fixed assets beyond the original purchase price.

Figure 10: Implied Acquisition Prices for Value-Neutral Deal – Scenario 1

Sources: New Constructs, LLC and company filings

Figure 10 shows the implied values for Affirm assuming Amazon wants to achieve an ROIC on the acquisition that equals its WACC of 5%. This scenario represents the minimum level of performance required not to destroy value. Even if Affirm can grow revenue by 42% compounded annually for five years and achieve a 16% NOPAT margin, the firm is worth less than $50/share. It’s worth noting that any deal that only achieves a 5% ROIC would not be accretive, as the return on the deal would equal Amazon’s WACC.

Figure 11: Implied Acquisition Prices to Create Value – Scenario 2

Sources: New Constructs, LLC and company filings

Figure 11 shows the implied values for Affirm assuming Amazon wants to achieve an ROIC on the acquisition that equals 19%, its current ROIC. Acquisitions completed at these prices would be accretive to Amazon’s shareholders. Even in this best-case growth scenario, the implied value is far below Affirm’s current price. Without significant increases over the margin and/or revenue growth assumed in this scenario, an acquisition of Affirm at its current price destroys significant shareholder value.

Catalyst – Slowing Growth, Wider Losses as Competition Rises

At the end of February, the consensus estimate for Affirm’s fiscal 2022 earnings was -$0.88/share. Jump forward to today, and the fiscal 2022 consensus estimate has risen to -$0.84/share, despite more competition entering the market and making profits less likely. Even management’s guidance lacks a vision to profitability. Guidance for fiscal 2022 adjusted operating losses is between -$135 to -$145 million, which is much worse than adjusted operating income of $14 million in fiscal 2021.

This combination of difficult year-over-year comps and a potential slowdown in consumer ecommerce (as less people are couped up inside their homes) make a future beat even more difficult.

The stock would also likely sink if more competitors further weaken Affirm’s position by entering the BNPL space, or for example, integrating the feature into existing credits cards.

What Noise Traders Miss With AFRM

These days, fewer investors pay attention to fundamentals and the red flags buried in financial filings. Instead, due to the proliferation of noise traders, the focus tends toward technical trading trends while high-quality fundamental research is overlooked. Here’s a quick summary for noise traders when analyzing AFRM:

- Rapidly declining market share vs other BNPL apps

- Smaller user and merchant base vs. competition

- Lack of differentiation in crowded industry, with large incumbents looking to provide more competition

- Profitability already well below competition

- Valuation implies the firm will be the largest BNPL firm in the world

Executive Compensation Plan Is Not Creating Shareholder Value

Affirm qualifies as an Emerging Growth Company, which among other things, means the firm doesn’t have to provide the same disclosure on executive compensation arrangements as other publicly traded firms. Get more details on the risks associated with emerging growth companies, here.

However, in its S-1, Affirm did disclose its new pay arrangement with CEO Max Levchin. Under the arrangement, the CEO is paid a minimal salary and awarded long-term performance-based stock options. These stock options are earned based on different stock price hurdles over a period of five years. In other words, Affirm’s CEO is paid entirely to increase its stock price, regardless of whether any true shareholder value is created. We’ve previously covered risks of executive compensation tied solely to stock price here.

Affirm should link executive compensation with improving ROIC, which is directly correlated with creating shareholder value, so shareholders’ interests are properly aligned with executives’ interests.

Insider Trading and Short Interest

Over the past three months, insiders have purchased 6.7 million shares and sold 9.3 million shares for a net effect of 2.6 million shares sold.

There are currently 9.3 million shares sold short, which equates to 3% of shares outstanding and just over one day to cover. The number of shares sold short has increased by 11% since last month, which indicates investors may be realizing just how overvalued shares are.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

As investors focus more on fundamental research, research automation technology is needed to analyze all the critical financial details in financial filings as shown in the Harvard Business School and MIT Sloan paper, "Core Earnings: New Data and Evidence”.

Below are specifics on the adjustments we make based on Robo-Analyst findings in Affirm’s S-1 and 10-K:

Income Statement: we made $97 million of adjustments, with a net effect of removing $95 million in non-operating expenses (11% of revenue). You can see all the adjustments made to Affirm’s income statement here.

Balance Sheet: we made $1.3 billion of adjustments to calculate invested capital with a net decrease of $1.1 billion. One of the most notable adjustments was $410 million in midyear acquisitions. This adjustment represented 15% of reported net assets. You can see all the adjustments made to Affirm’s balance sheet here.

Valuation: we made $3 billion of adjustments with a net effect of decreasing shareholder value by $3 billion. There were no adjustments that increased shareholder value. The largest adjustment to shareholder value was $3 billion in outstanding employee stock options. This adjustment represents 9% of Affirm’s market cap. See all adjustments to Affirm’s valuation here.

Unattractive Funds That Hold AFRM

There are no funds that receive our Unattractive-or-worse rating and allocate significantly to AFRM.

Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life.

This article originally published on October 4, 2021.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Only Core Earnings enable investors to overcome the inaccuracies, omissions and biases in legacy fundamental data and research, as proven in Core Earnings: New Data & Evidence, written by professors at Harvard Business School (HBS) & MIT Sloan and published in The Journal of Financial Economics.