For March 8, 2018, our forensic accounting red flag comes from a claims management company with artificially low invested capital.

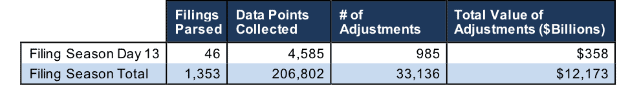

We pulled this highlight from yesterday’s research of 46 10-K filings, from which our Robo-Analyst technology collected 4,585 data points. Our analyst team used this data to make 985 forensic accounting adjustments with a dollar value of $358 billion. The adjustments were applied as follows:

- 416 income statement adjustments with a total value of $25 billion

- 405 balance sheet adjustments with a total value of $149 billion

- 164 valuation adjustments with a total value of $184 billion

Figure 1: Filing Season Diligence for Thursday, March 8th

Sources: New Constructs, LLC and company filings.

We believe this research is necessary to fulfill the Fiduciary Duty of Care. Ernst & Young’s recent white paper, “Getting ROIC Right”, demonstrates how these adjustments contribute to meaningfully superior models and metrics.

Today’s Forensic Accounting Needle in a Haystack Is for Insurance Investors

Senior Analyst Lindsay Bohannon found an unusual item yesterday in Crawford & Company’s (CRD.B) 10-K.

On page 89, CRD.B disclosed $196 million (25% of total assets) in accumulated other comprehensive loss due to foreign currency adjustments and increases to retirement liabilities. These unrealized losses artificially reduce reported assets and should be added back to calculate invested capital.

In addition to its other comprehensive loss, CRD.B also has $136 million in off-balance sheet debt and $213 million in accumulated asset write-downs. These hidden items comprise the majority of CRD.B’s invested capital. The debt+equity formula used by many data providers calculates CRD.B’s average invested capital as $383 million, roughly a third of the $1.1 billion in capital the company has actually invested in its business.

This article originally published on March 9, 2018.

Disclosure: David Trainer, Lindsay Bohannon, and Sam McBride receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter (#filingseasonfinds), Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.