After a weekend marked by Warren Buffett officially announcing his departure from Berkshire Hathaway, investors are reminded of the importance of disciplined, fundamentals-based investing. Now, perhaps more than ever, investors need to be diligent in an increasingly speculative market.

This week’s Danger Zone pick is one stock that, after doing due diligence, is not worth owning. The company is burning cash at zombie stock-like levels, yet its valuation implies massive profit growth and a near quadrupling of the business’ market share. That disconnect is dangerous to any portfolio.

We originally put Rivian (RIVN: $14/share) in the Danger Zone on October 22, 2021 prior to its IPO. We’ve reiterated our bearish opinion on the stock multiple times since then. See all our reports on RIVN here.

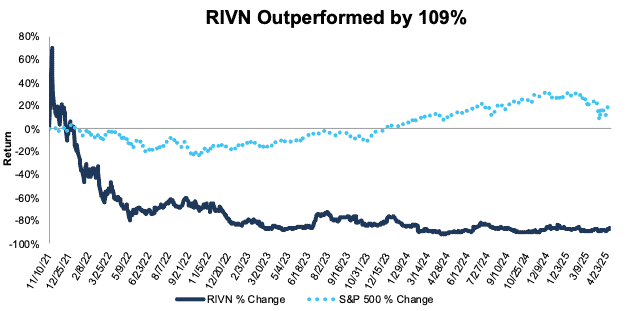

Since its IPO, this Danger Zone pick outperformed as a short by 109%, falling 86% versus the S&P 500 up 22%.

Despite the outperformance as a short, this stock remains dangerous. The company’s growth is slowing, yet its stock was up over 50% last year and up 4% year-to-date.

We’re here to remind you, as the market attempts to rally in recent days, that some very unprofitable businesses remain highly overvalued. Rivian’s stock price remains far too expensive at current levels.

Rivian’s stock could fall further based on:

- slowing production and deliveries,

- dwindling market share,

- large cash burn,

- more profitable competitors, and

- a stock valuation that implies Rivian will quadruple its market share.

Figure 1: Rivian Outperformance as a Short From 11/10/21 Through 5/2/25

Sources: New Constructs, LLC

What’s Working

Rivian’s vehicle deliveries grew 3% year-over-year, from 50,122 in 2023 to 51,579 in 2024. The increase in deliveries helped Rivian grow its revenue 12% YoY in 2024.

Rivian produced 14,611 and delivered 8,640 vehicles in 1Q25, which topped the company’s previous guidance for ~14,000 vehicles produced, and 8,000 vehicles delivered. For the full year 2025, the company guided for a delivery range of 46,000 to 51,000.

What’s Not Working

When we dig below the surface, we find that the company’s fundamentals remain poor and the stock continues to be overvalued, as we’ll show below.

Stagnant Sales and Declining Market Share

Bulls have tried to justify Rivian’s large losses by arguing that the company is in its high-growth, ramp up phase.

However, the company’s deliveries (EV’s sold) grew just 3% YoY in 2024, compared to 147% YoY growth in 2023. Going forward, Rivian’s new guidance of 46,000 to 51,000 deliveries for 2025 would, at the high-end, represent a YoY decline in vehicles delivered in 2025. The growth in this “growth-story” simply isn’t there.

On a quarterly basis, Rivian’s U.S. deliveries fell from 13,588 in 1Q24 to 8,553 in 1Q25, a 37% YoY decrease.

Rivian’s production also dropped in 2024. Despite initial production guidance for 57,000 vehicles in 2024 (which would have been flat YoY), the company managed to produce only 49,476 vehicles, which was down 13% YoY.

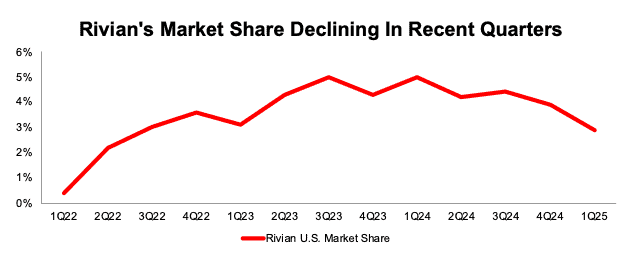

Rivian is not keeping pace and is losing market share in the U.S. After growing its U.S. market share from 0.4% in 1Q22 to its peak 5.0% in 3Q23 (and in 1Q24), Rivian’s market share has fallen to 2.9% in 1Q25. See Figure 2.

Figure 2: Rivian’s U.S. Market Share: 1Q22 – 1Q25

Sources: Kelley Blue Book EV Sales Reports

Volkswagen Provided a Zombie Lifeline

We originally named Rivian a Zombie Stock in August 2022 as the company could sustain its cash burn rate for just 10 months at the time without additional capital or a significant slowdown in cash burn.

However, we removed the stock from our Zombie Stock List in July 2024, after Volkswagen announced an investment of $5 billion, which later turned into nearly $6 billion and a joint venture between the two companies. The large investment, and backing of Volkswagen, diminished the likelihood of a bankruptcy for Rivian.

Fast forward to early 2025, and Rivian still has all the markings of a Zombie Stock even after the recent investment, as we’ll show below.

Zombie-Like Cash Burn

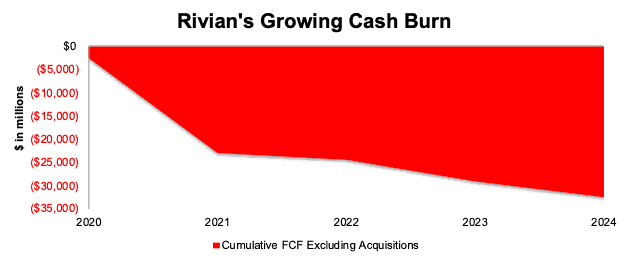

Since 2020, Rivian has burned $32.5 billion (159% of enterprise value) in free cash flow (FCF) excluding acquisitions. See Figure 3. Rivian burned $8.1 billion in FCF in the last two years alone.

Not surprisingly, the company’s economic earnings, the true cash flows of the business that take into account changes to the balance sheet, fell from -$692 million in 2019 to -$6.3 billion in 2024.

Despite having $7.7 billion of cash on hand as of December 31, 2024, Rivian can only sustain its 2024 cash burn rate for 22 months from the end of April 2025. Additionally, Rivian’s interest coverage ratio is currently -13.6.

Rivian meets all the criteria of a Zombie Stock, but we aren’t putting it back on the list is because we think Volkswagen is likely to provide additional investment and would not let Rivian go bankrupt.

If Rivian’s business doesn’t improve, and Volkswagen slows its investment in the company, we’ll be ready to add it back to the Zombie Stock list.

Figure 3: Rivian’s Cumulative FCF: 2020 – 2024

Sources: New Constructs, LLC and company filings.

Breakeven Still a Distant Dream

Not only does Rivian continue to burn billions in cash, but its operations also remain far from breakeven.

The company’s total operating costs, which include cost of revenue, R&D, and SG&A were 229% of revenue in 2023 and 194% in 2024. We would expect Rivian’s operating costs to remain high as the company continues to build out production capacity and aim to take market share.

With total operating costs nearly twice as high as its revenue, it’s no surprise Rivian is racking up losses.

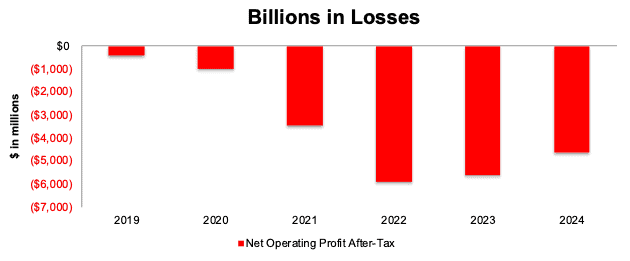

The company’s net operating profit after-tax (NOPAT) declined from -$399 million in 2019 to -$4.6 billion in 2024. See Figure 4.

Figure 4: Rivian’s NOPAT Since 2019

Sources: New Constructs, LLC and company filings.

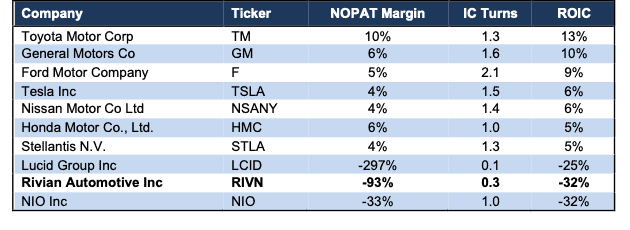

Profitability Significantly Lags Competition

Of the 55 Automobiles & Auto Parts companies under our coverage, only four have a lower return on invested capital (ROIC) than Rivian. Fellow EV manufacturer and Danger Zone pick Nio Inc. (NIO) is one of them.

The legacy car makers have proven their ability to enter and take EV market share. For instance, Ford (F) and Chevrolet (owned by General Motors) hold 7.7% and 6.5% share of the US. EV market in 1Q25. These auto manufacturers generate billions in profits through their legacy and hybrid offerings that they can then pour into EVs to take market share while remaining profitable. The path for Rivian to achieve lasting profitability while also taking market share looks increasingly challenging.

Per Figure 5, Rivian’s NOPAT margin, invested capital turns, and ROIC all rank near industry lows. The gap between the industry leaders and laggards is particularly stark. We don’t think it is a coincidence that the laggards are relatively new EV-focused vehicle manufacturers.

Figure 5: Rivian’s Profitability Vs. Competitors: TTM

Sources: New Constructs, LLC and company filings.

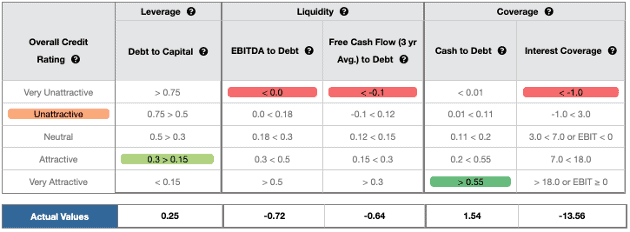

Credit Rating Looks Poor as Well

After analyzing Rivian’s latest 10-K, it earns a Very Unattractive Credit rating in three of the five metrics that drive our Overall Credit Rating, As a result. Rivian earns an Unattractive Credit Rating. See Figure 6.

With negative EBITDA to Debt, FCF to Debt, and Interest Coverage, it could be more difficult for Rivian to raise additional capital without significantly diluting existing investors, especially given the current uncertain market conditions.

Figure 6: Rivian’s Credit Rating Details

Sources: New Constructs, LLC and company filings.

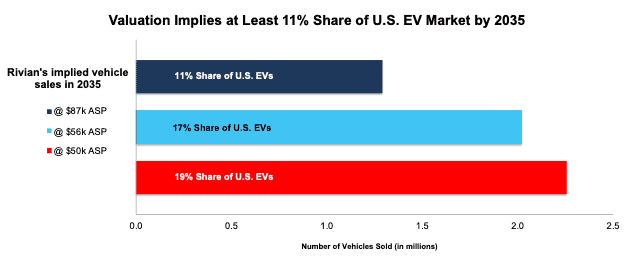

Valuation Implies Rivian Will Grow Its U.S. Market Share Nearly 4x

Below, we use our reverse discounted cash flow (DCF) model to analyze the future cash flow expectations baked into Rivian’s stock price. Rivian’s stock is priced as if it will significantly improve profitability while nearly quadrupling its market share in the U.S. EV market. We also present an additional DCF scenario to highlight the downside risk in the stock if Rivian fails to achieve these overly optimistic expectations.

To justify its current price of $14/share, our model shows that Rivian would have to:

- immediately achieve a 4% NOPAT margin (equal to Tesla’s, Stellantis’, and Nissan’s TTM NOPAT margin, compared to Rivian’s NOPAT margin of -93% in 2024) and

- grow revenue 37% compounded annually through 2035.

In this scenario, Rivian would generate $124.4 billion in revenue in 2035, which is 148%, 134%, 92% of Nissan’s (NSANY), Tesla’s (TSLA), and Honda Motor’s (HMC) TTM revenue, respectively. It would also equal 25x Rivian’s 2024 revenue.

This scenario also implies that Rivian would generate $5.0 billion in NOPAT in 2035, which would equal 130% of Tesla’s 2024 NOPAT and 153% of Nissan’s TTM NOPAT, compared to the company’s -$4.6 billion NOPAT in 2024. Contact us for the math behind this reverse DCF scenario.

If we assume automotive revenue remains 90% of total revenue, as in 2024, then Rivian would generate $112.3 billion in automotive revenue in 2035 in this scenario. This revenue figure implies Rivian will sell the following number of vehicles based on these ASPs:

- 1.3 million vehicles – Rivian’s 2024 ASP of $87k

- 2.0 million vehicles – ASP of $56k (equal to average new-EV price in Dec 2024)

- 2.3 million vehicles – ASP of $50k (equal to average new-vehicle price in Dec 2024)

Next, we can analyze the implied U.S. market share for the sales volumes above based on the total estimated number of new EV sales in 2035, according to data compiled by Edison Electric Institute (EEI).

The vehicle sales noted above would represent the following implied U.S. market share in 2035:

- 11% for 1.3 million vehicles

- 17% for 2.0 million vehicles

- 19% for 2.3 million vehicles.

The likelihood of achieving any of these market share scenarios is unlikely in such a competitive industry. For reference, at an ASP of $56k, Rivian would have to sell 2.0 million vehicles in 2035, or more than the 1.8 million vehicles Tesla sold in 2024.

For reference, the two best-selling vehicles, not just EVs, in the U.S. in 2024 were the Toyota RAV4 with ~475,000 sales and the Ford F-150 with ~470,000 sales. In other words, to justify its valuation, Rivian must maintain an ASP well above average new-vehicle prices, while, in 2035, selling more vehicles than the two top selling models combined in 2024, while also fending off competition from all other automakers.

Figure 7: Rivian’s Implied Vehicle Sales in 2035 to Justify $14/Share

Sources: New Constructs, LLC and company filings.

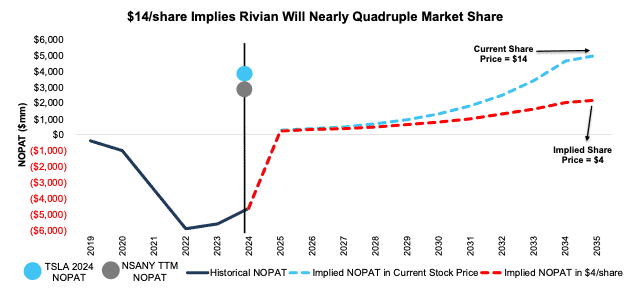

70%+ Downside If Revenue Grows at 2x the Projected Industry Growth Rate

If we instead assume Rivian:

- immediately improves NOPAT margin to 4% and

- grows revenue by 26% (2x the projected industry growth) compounded annually through 2035, then

our model shows the stock would be worth just $4/share today – 71% downside to the current price. In this scenario, Rivian’s NOPAT would still grow to $2.2 billion, which is 57% of Tesla’s 2024 NOPAT and 67% of Nissan’s TTM NOPAT. Contact us for the math behind this reverse DCF scenario.

At its current ASP, assuming automotive revenue remains 90% of revenue, this scenario implies Rivian will sell over 568,000 vehicles in 2035. In other words, Rivian would sell 20% more vehicles in 2035 than the Toyota RAV4, the most sold vehicle in the U.S. in 2024.

Figure 8 compares Rivian’s implied future NOPAT in these scenarios to its historical NOPAT. For additional comparison, we include the 2024 NOPAT of Tesla (TSLA) and Nissan (NSANY).

Figure 8: Rivian’s Historical and Implied NOPAT: DCF Valuation Scenarios

Sources: New Constructs, LLC and company filings.

Stock Is Not Worth $1

Each of the above scenarios assumes Rivian grows revenue, NOPAT and FCF without increasing working capital or fixed assets. This assumption is highly unlikely but allows us to create best-case scenarios that highlight the unrealistically high expectations embedded in the current valuation. For reference, Rivian’s invested capital grew 42% compounded annually from 2019 through 2024. If we assume Rivian’s invested capital increases at a similar rate in the DCF scenarios above, the downside risk is even larger.

Given that the performance required to justify its current price is overly optimistic, we dig deeper to see if Rivian is worth buying at any price. The answer is no.

The company has $5.0 billion in total debt, $447 million in outstanding employee stock options, and no excess cash. Rivian has an economic book value, or no-growth value, of -$39/share. In other words, we do not think equity investors will ever see $1 of economic earnings under normal operations, which means the stock would be worth $0 today.

This article was originally published on May 5, 2025.

Disclosure: David Trainer, Kyle Guske II, and Hakan Salt receive no compensation to write about any specific stock, sector, style, or theme.

Questions on this report or others? Join our online community and connect with us directly.