Question: Why are there so many ETFs?

Answer: ETF providers tend to make lots of money on each ETF so they create more products to sell.

The large number of ETFs has little to do with serving your best interests. Only our research utilizes the superior data and earnings adjustments featured by the Harvard Business School and MIT Sloan paper, "Core Earnings: New Data and Evidence.” We leverage this data to identify three red flags you can use to avoid the worst ETFs:

1. Inadequate Liquidity

This issue is the easiest issue to avoid, and our advice is simple. Avoid all ETFs with less than $100 million in assets. Low levels of liquidity can lead to a discrepancy between the price of the ETF and the underlying value of the securities it holds. Plus, low asset levels tend to mean lower volume in the ETF and larger bid-ask spreads.

2. High Fees

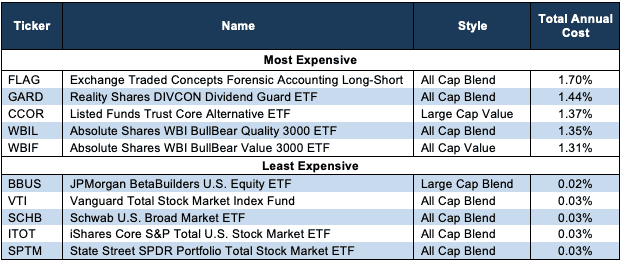

ETFs should be cheap, but not all of them are. The first step here is to know what is cheap and expensive.

To ensure you are paying at or below average fees, invest only in ETFs with total annual costs below 0.45%, which is the average total annual cost of the 516 U.S. equity Style ETFs we cover. The weighted average is lower at 0.14%, which highlights how investors tend to put their money in ETFs with low fees.

Figure 1 shows Exchange Traded Concepts Forensic Accounting Long-Short (FLAG) is the most expensive style ETF and JPMorgan BetaBuilders U.S. Equity ETF (BBUS) is the least expensive. Absolute Shares Trust (WBIL, WBIF) provides two of the most expensive ETFs while Schwab U.S. Broad Market ETF (SCHB) is among the cheapest.

Figure 1: 5 Most and Least Expensive Style ETFs

Sources: New Constructs, LLC and company filings

Investors need not pay high fees for quality holdings.[1] JPMorgan BetaBuilders U.S. Equity ETF (BBUS) is one of the best ranked style ETFs in Figure 1. BBUS’s Neutral Portfolio Management rating and 0.02% total annual cost earns it an Attractive rating.[2] Alpha Architect U.S. Quantitative Value ETF (QVAL) is one of the best ranked style ETFs overall. QVAL’s Attractive Portfolio Management rating and 0.54% total annual cost also earns it a Very Attractive rating.

On the other hand, Vanguard Small Cap Growth Index Fund (VBK) holds poor stocks and earns our Unattractive rating, yet has low total annual costs of 0.08%. No matter how cheap an ETF, if it holds bad stocks, its performance will be bad. The quality of an ETF’s holdings matters more than its price.

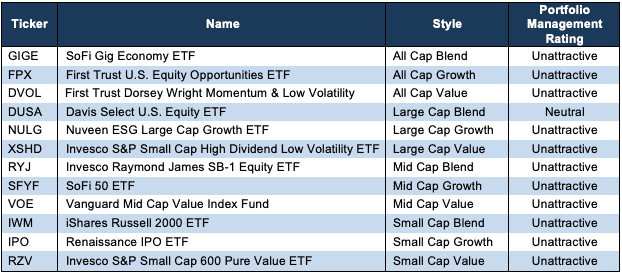

3. Poor Holdings

Avoiding poor holdings is by far the hardest part of avoiding bad ETFs, but it is also the most important because an ETF’s performance is determined more by its holdings than its costs. Figure 2 shows the ETFs within each style with the worst holdings or portfolio management ratings.

Figure 2: Style ETFs with the Worst Holdings

Sources: New Constructs, LLC and company filings

Invesco appears more often than any other providers in Figure 2, which means that it offers the most ETFs with the worst holdings.

Renaissance IPO ETF (IPO) is the worst rated ETF in Figure 2. SoFi Gig Economy ETF (GIGE) and SoFi 50 ETF (SFYF) also earn a Very Unattractive predictive overall rating, which means not only do they hold poor stocks, they charge high total annual costs.

Our overall ratings on ETFs are based on our stock ratings of their holdings and the total annual costs of investing in the ETF.

The Danger Within

Buying an ETF without analyzing its holdings is like buying a stock without analyzing its business and finances. Put another way, research on ETF holdings is necessary due diligence because an ETF’s performance is only as good as its holdings’ performance. Don’t just take our word for it, see what Barron’s says on this matter.

PERFORMANCE OF ETF’s HOLDINGS = PERFORMANCE OF ETF

Analyzing each holding within funds is no small task. Our Robo-Analyst technology enables us to perform this diligence with scale and provide the research needed to fulfill the fiduciary duty of care. More of the biggest names in the financial industry (see At BlackRock, Machines Are Rising Over Managers to Pick Stocks) are now embracing technology to leverage machines in the investment research process. Technology may be the only solution to the dual mandate for research: cut costs and fulfill the fiduciary duty of care. Investors, clients, advisors and analysts deserve the latest in technology to get the diligence required to make prudent investment decisions.

This article originally published on February 6, 2020.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] This paper compares our analytics on a mega cap company to other major providers. The Appendix details exactly how we stack up.

[2] Harvard Business School features the powerful impact of our research automation technology in the case New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.