Question: Why are there so many mutual funds?

Answer: Mutual fund management is profitable, so Wall Street creates more products to sell.

The large number of mutual funds has little to do with serving your best interests as an investor. More reliable & proprietary fundamental data, proven in The Journal of Financial Economics, drives our research and analysis of fund holdings and provides investors with a new source of alpha. We leverage this data to identify two red flags you can use to avoid the worst mutual funds:

1. High Fees

Mutual funds should be cheap, but not all of them are. The first step is to benchmark what cheap means.

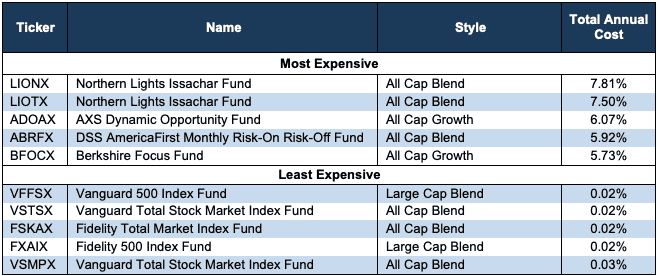

To ensure you are paying at or below average fees, invest only in mutual funds with total annual costs below 1.61% – the average total annual cost of the 5,461 U.S. equity Style mutual funds we cover. The weighted average is lower at 0.84%, which highlights how investors tend to put their money in mutual funds with low fees.

Figure 1 shows Northern Lights Issachar Fund (LIONX) is the most expensive style mutual fund and Vanguard 500 Index Fund (VFFSX) is the least expensive. Northern Lights (LIONX and LIOTX) provides two of the most expensive mutual funds while Vanguard (VFFSX, VSTSX, and VSMPX) mutual funds are among the cheapest.

Figure 1: 5 Most and Least Expensive Style Mutual Funds

Sources: New Constructs, LLC and company filings

Investors need not pay high fees for quality holdings.[1] Fidelity 500 Index Fund (FXAIX) is the best ranked style mutual fund in Figure 1. FXAIX’s Neutral Portfolio Management rating and 0.02% total annual cost earns it an Attractive rating.[2] Royce Small-Cap special Equity Fund (RSEIX) is the best ranked style mutual fund overall. RSEIX’s Attractive Portfolio Management rating and 1.37% total annual cost also earns it a Very Attractive rating.

On the other hand, T Rowe Price Mid-Cap Value Fund (TRTZX) holds poor stocks and earns our Unattractive rating, yet has low total annual costs of 0.12%. No matter how cheap a mutual fund, if it holds bad stocks, its performance will be bad. The quality of a mutual fund’s holdings matters more than its price.

2. Poor Holdings

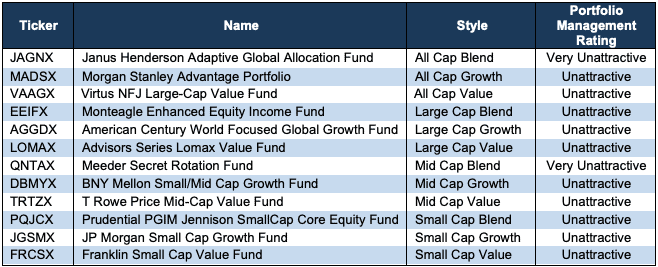

Avoiding poor holdings is by far the hardest part of avoiding bad mutual funds, but it is also the most important because a mutual fund’s performance is determined more by its holdings than its costs. Figure 2 shows the mutual funds within each style with the worst holdings or portfolio management ratings.

Figure 2: Style Mutual Funds with the Worst Holdings

Sources: New Constructs, LLC and company filings

Janus Henderson Adaptive Global Allocation Fund (JAGNX) is the worst rated mutual fund in Figure 2 based on our predictive overall rating. Meeder Secret Rotation Fund (QNTAX), Morgan Stanley Advantage Portfolio (MADSX), BNY Mellon Small/Mid Cap Growth Fund (DBMYX), Franklin Small Cap Value Fund (FRCSX), Prudential PGIM Jennison SmallCap Core Equity Fund (PQJCX), and JP Morgan Small Cap Growth Fund (JGSMX) also earn a Very Unattractive predictive overall rating, which means not only do they hold poor stocks, they charge high total annual costs.

Our overall ratings on mutual funds reflects our stock ratings of their holdings and a measure of the total annual costs of investing in the fund.

The Danger Within

Buying a mutual fund without analyzing its holdings is like buying a stock without analyzing its business model and finances. Put another way, research on mutual fund holdings is necessary due diligence because a mutual fund’s performance is only as good as its holdings. Don’t just take our word for it, see what Barron’s says on this matter.

PERFORMANCE OF MUTUAL FUND’s HOLDINGs – FEES = PERFORMANCE OF MUTUAL FUND

Analyzing each holding within funds is no small task. Our Robo-Analyst technology enables us to perform this diligence with scale and provide the research needed to fulfill the fiduciary duty of care. More of the biggest names in the financial industry (see At BlackRock, Machines Are Rising Over Managers to Pick Stocks) are now embracing technology to leverage machines in the investment research process. Technology may be the only solution to the dual mandate for research: cut costs and fulfill the fiduciary duty of care. Investors, clients, advisors and analysts deserve the latest technology to get the diligence required to make prudent investment decisions.

This article was originally published on May 2, 2024.

Disclosure: David Trainer, Kyle Guske II, and Hakan Salt receive no compensation to write about any specific stock, style, or theme.

Questions on this report or others? Join our Society of Intelligent Investors and connect with us directly.

[1] Three independent studies from respected institutions prove the superiority of our data, models, and ratings. Learn more here.

[2] Harvard Business School features the powerful impact of our research automation technology in the case New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.