Merger Monday is back, but the market’s not buying it. Comcast (CMCSA), Michael Kors (KORS), and Sirius XM (SIRI) all announced multi-billion-dollar acquisitions on Monday. The market responded by sending shares of all three companies deep into the red.

The big drop in all three stocks – which fell by an average of 8% – shows that investors do not want any of these companies to carry out these overpriced acquisitions. Meanwhile, the ongoing struggles of Newell Brands (NWL), which fell a further 6% on Monday and is down 50% over the past year, shows exactly how these acquisitions can destroy even more shareholder value if they are consummated.

Market Reaction Shows Deals Are Overpriced

Comcast made the biggest splash over the weekend, beating out Fox (FOXA) in a blind auction with a $49 billion bid for UK broadcaster Sky. The cable giant’s $22.60/share offer represents a 61% premium to the initial Fox offer in December 2016 that kicked off the bidding war. The market believes that Comcast overpaid by $11 billion (~22%) based on CMCSA’s corresponding $11 billion drop in market value.

Michael Kors also made waves on Monday with its $2 billion deal to acquire the Italian fashion house Gianni Versace. Despite Versace’s slim margins and stagnant growth, KORS was willing to pay a premium to move into the high-end European fashion market. The market believes that the firm overpaid by $850 million (~36%) based on KORS’s corresponding $850 million drop in market value.

SIRI Investors Have the Most to Worry About

The biggest overpay, however, comes from Sirius XM, which agreed to pay $3.5 billion to take control of Pandora Media (P). We put Pandora in the Danger Zone in March 2017, but we closed our short call just two months later (after an 18% drop in stock price) due to the risk of a stupid money acquisition just like this one.

The market’s reaction suggests that investors agree with our assessment that Pandora has little-to-no value. SIRI lost ~$3.1 billion in market cap on Monday, or ~87% of the proposed acquisition value.

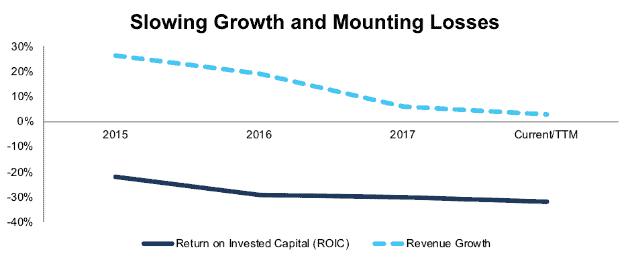

Figure 1 shows why the market is rightfully down on the Pandora acquisition. From 2015 to the trailing twelve month (TTM) period, Pandora’s revenue growth fell from 26% to 3%, and its return on invested capital (ROIC) fell from -22% to -32%.

Figure 1: P’s Revenue Growth and ROIC Since 2015

Sources: New Constructs, LLC and company filings

For SIRI to earn a 5.8% ROIC – equal to its weighted average cost of capital (WACC) – on the acquisition, Pandora would need to earn ~$200 million in annual after-tax operating profit (NOPAT). For reference, P’s NOPAT in the TTM period was -$301 million. To achieve this target, P must achieve NOPAT margins of 8% (up from -20%), and grow revenue by 10% compounded annually for the next 10 years. That growth rate also justifies the ~$9/share acquisition price according to our dynamic discounted cash flow model.

Based on the trend in Figure 1, there’s no reason to believe Pandora can achieve that level of growth and profitability at the same time.

Instead, SIRI’s executives appear to be acting based on misaligned incentives. While the Pandora acquisition seems likely to destroy shareholder value, it will help SIRI grow revenue and subscribers, two of the key metrics that determine executive compensation. These misaligned incentives play a big role in driving overpriced acquisitions.

The Consequences of Overpriced Acquisitions

KORS and CMCSA were two of the three worst performers in the S&P 500 on Monday. Newell Brands, the other company in the bottom three, dropped by 6% with no news to explain the decline. Instead, investors appear to be fed up with the company’s ongoing struggles from the overpriced acquisition of Jarden in 2016.

We recently highlighted how NWL shareholders lost 100x more money on the Jarden deal compared to the Jarden short-sellers that understood how overvalued it was. NWL’s ROIC fell from 5% before the deal to 2% TTM, and now it’s selling off pieces of Jarden at a loss.

With NWL serving as a reminder that most acquisitions destroy value, it’s no surprise that the market gave a thumbs down to expensive deals from CMCSA, KORS, and SIRI. Hopefully the negative reaction from investors will make other companies think twice before going through with similarly overpriced acquisitions in the future.

This article originally published on September 25, 2018.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

Click here to download a PDF of this report.

Photo Credit: rawpixel (Pixabay)