Birkenstock Holding (BIRK: $44-$49/share), better known for its iconic sandals, is expected to start trading October 11, 2023 at an $8.7 billion valuation. At $47/share, the midpoint of its IPO price range, Birkenstock earns our Very Unattractive Stock Rating and is this week’s Danger Zone pick.

At the expected $8.7 billion valuation, Birkenstock would have a larger market capitalization than peers such as Skechers (SKX), Crocs (CROX), and Steve Madden (SHOO). Even more shockingly, the only footwear companies with a larger market cap are Nike (NKE) and Deckers Outdoor (DECK). While Birkenstock is profitable, we think it is fair to say that the $8.7 billion valuation mark is too high, especially for a company that was valued at just $4.3 billion in early 2021. Not a whole lot has changed since then.

To justify an $8.7 billion valuation, Birkenstock would need to generate more than $3.8 billion in revenue, which is more than three times its revenue in 2022. We don’t see this happening anytime soon, if ever.

BIRK looks more than fully valued and does not provide investors much upside potential, as we’ll illustrate with our reverse discounted cash flow (DCF) model.

Investors should have learned a valuable lesson in the past few weeks when it comes to IPOs. Arm Holdings (ARM) and Instacart (CART) went public at sky high valuations, and the stock prices of both companies have fallen significantly over the past few weeks.

We don’t doubt that Birkenstock has strong brand equity and produces stylish sandals, but there is really no reason for this company to be public. We do not think investors should expect to make any money by buying this IPO.

Our IPO research aims to provide more investors with more reliable fundamental research.

Generating Real Profits

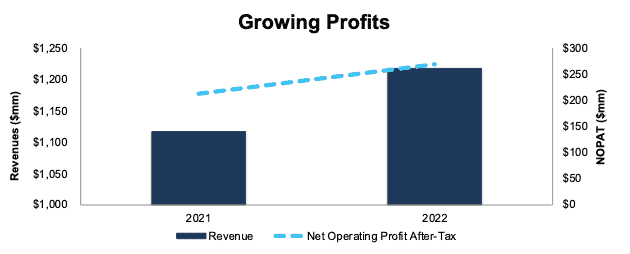

Birkenstock, along with other recent IPOs Arm Holdings (ARM) and Instacart (CART) is profitable. The company grew revenue and net operating profit after tax (NOPAT) by 9% and 27% year-over-year (YoY) in 2022, respectively. See Figure 1.

Figure 1: Birkenstock’s Revenue & NOPAT: 2021 – 2022

Sources: New Constructs, LLC and company filings

Large Market Potential

The global footwear industry is a large and fragmented market and Birkenstock estimates its market share is less than 1%. According to Euromonitor, the global footwear industry generated approximately $358 billion in retail sales in 2022. The top five brands accounted for 20% of the overall footwear market.

Going forward, the global footwear market is projected to grow at a compound annual growth rate (CAGR) of ~5% through 2027. Birkenstock aims to capture market share globally, particularly in Asia Pacific, which is expected to be one of the fastest growing regions at a CAGR of ~6% through 2027. However, despite a large market potential, Birkenstock must grow much faster than the industry to justify its expected IPO valuation, as we’ll show below.

We also note that there are meaningful challenges to growing international sales that we detail in the “Weak IP Protection and Knock-off Risk” section below.

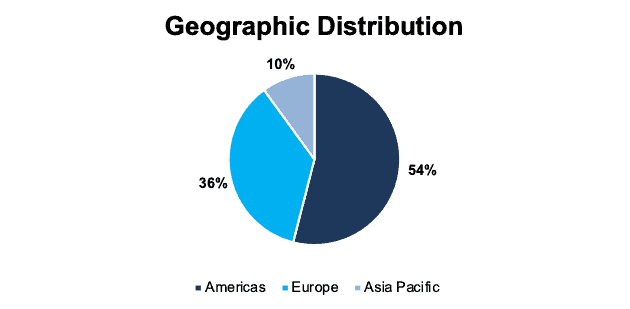

Geographically Diversified

Birkenstock aims to expand in Asia Pacific largely due to the fact that it is a region where the company is, in its own words, “meaningfully underpenetrated.” In fiscal 2022, the Americas, Europe, and Asia Pacific regions made up 54%, 36%, and 10% of revenues, respectively.

Figure 2: Birkenstock’s Revenue by Region: Fiscal 2022

Sources: New Constructs, LLC and company filings

Distribution Shift Gives Birkenstock More Control Over Customer Experience

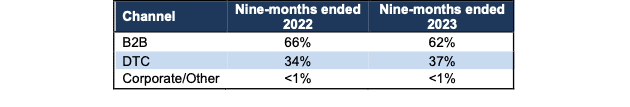

In recent years, Birkenstock has aimed to move away from wholesale and sell more products through its direct-to-consumer (DTC) channels. Since 2016, Birkenstock has invested in its online platform to support the penetration of its DTC channel by establishing its own e-commerce sites in more than 30 countries with ongoing expansion into new markets. In addition, the company has opened its own retail stores, rather than relying solely on other partners to sell its products.

As a result of these efforts, Birkenstock’s DTC channel expanded from 18% of revenues in fiscal 2018 to 38% of revenues in fiscal 2022. The shift towards DTC and away from selling mainly through third-parties is beneficial in multiple ways. It gives the company more control over its brand, as it has more control over product placement, marketing, outreach, and more. Additionally, it brings customer preferences and purchase data in house, which allows Birkenstock to more directly target consumers most likely to purchase additional products and, ideally, bring down customer acquisition costs.

Birkenstock expects that future DTC growth will be primarily driven by e-commerce, which is rapidly growing through active customer growth and new online store openings. The company also intends to increase its retail footprint given its relatively limited presence today with just 45 owned stores, 20 of which are in Germany.

Figure 3: Birkenstock’s Revenue by Source

Sources: New Constructs, LLC and company filings

Happy Customers Buy Again

According to a Consumer Survey conducted by Birkenstock:

- 70% of existing U.S. consumers indicated they had purchased at least two pairs of Birkenstocks

- The average Birkenstock consumer in the U.S. owns 3.6 pairs

- 86% of recent purchasers indicated a desire to purchase again

- 40% of consumers indicated they did not even consider another brand when purchasing.

Furthermore, the survey found that nearly 90% of Birkenstock buyers come through unpaid marketing channels, such as word of mouth, seeing the product on another person, or growing up with the product. Effective unpaid marketing should enable highly efficient operations, as the company can save on sales and marketing to boost margins. However, as we’ll show below, this survey finding doesn’t result in lower sales expenses, as we’ll show in the Expenses Rising Faster Than Revenue section below.

Profits Alone Don’t Make a Good Investment

Despite the positives above, there are many risks disclosed in Birkenstock’s F-1 and revealed through analysis of its financials. Each of the risks below add material risk to the bull case for the expected $8 billion valuation.

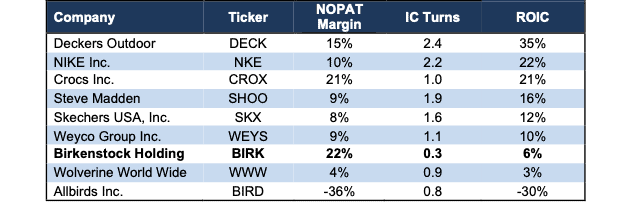

Low Profitability Compared to Peers

Despite loyal customersand a growing DTC business, Birkenstock has the lowest invested capital turns, a measure of balance sheet efficiency, of all nine footwear companies in our coverage universe. Even with the leading NOPAT margin of the group, Birkenstock’s low IC turns means the company generates just a 6% ROIC, which is below all but two of its peers, one of which is Zombie Stock Allbirds (BIRD).

Birkenstock touts its numerous investments to improve the business throughout its F-1, but as evidenced by Figure 4, these investments built operational efficiency, but not an efficient balance sheet, and both are required to build and sustain a highly profitable business.

Figure 4: Birkenstock’s Profitability Vs. Competition: TTM

Sources: New Constructs, LLC and company filings

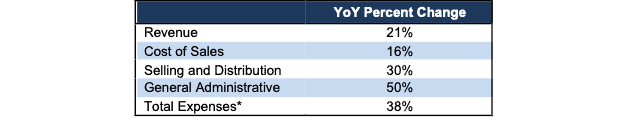

Expenses Rising Faster Than Revenue

As pointed out above, Birkenstock noted in its F-1 that 90% of Birkenstock buyers come through unpaid channels. However, this finding seems at odds with Birkenstock’s expenses, particularly Selling and Distribution. Inthe nine months ended June 2022 to nine months ended June 2023, Birkenstock’s selling and distribution expenses rose 30% YoY. Additionally, general and administrative costs increased 50% YoY while revenue increased only 21% over the same period. Altogether, total expenses increased 38% YoY and from 69% of revenue to 79% of revenue over the same period. See Figure 5.

In other words, Birkenstock’s expenses grew much faster than revenue in the nine months ended 2023, which is not a good sign for continued margin expansion moving forward.

Figure 5: Increase in Birkenstock’s Expenses: YoY Change Nine Months Ended 2023

Sources: New Constructs, LLC and company filings

*Total Expenses also includes foreign exchange gain(loss) and other income(loss) that isn’t shown in the table.

Weak IP Protection and Knock-off Risk

Knock-off risk throws a major wrench in Birkenstock’s ability to sustain growth. This risk is large enough that the company specifically points out in its F-1 filing that it faces “competition from counterfeit or ‘knock-off’ products.” Birkenstock explicitly notes that many countries do not protect intellectual property (IP) rights to the same extent as the United States and points out that it has limited IP protection on its core products when it states:

“Some [of] our footwear designs, including in several of our core products, are not protected by design patents or other design rights. This may mean that we cannot legally prevent third parties from creating ‘lookalike’ products or products that otherwise use our designs.”

Counterfeits and knock-offs have been a large issue in the past, which ultimately led Birkenstock to remove all its products from Amazon due to “unacceptable business practices which we believe jeopardize our brand”. While such a move certainly protects brand integrity, it also puts a cap on revenue growth potential – growth it will need to justify its IPO valuation.

Status as Foreign Private Issuer = Shareholders Have Almost No Control

Just as with Arm holdings, investors should take note and beware of Birkenstock Holding’s use of its status as a Foreign Private Issuer.

Under the rules of the SEC, Birkenstock Holdings qualifies as a foreign private issuer, which exempts the company from compliance with certain laws and rules of the SEC and NASDAQ. Birkenstock intends to take advantage of exemptions from the following requirements:

- a majority of the board of directors be comprised of independent directors and that there be regularly scheduled meetings with only the independent directors present.

- the Company have a compensation committee and a corporate governance and nominating committee that is composed entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities.

- listed companies adopt and disclose corporate governance guidelines that cover certain minimum specified subjects related to director qualifications and responsibilities.

- to disclose within four business days any determination to grant a waiver of the Code of Conduct to directors and executive officers.

- a quorum is required for an official meetings of shareholders.

- it must obtain shareholder approval for certain issuances of securities, including shareholder approval of share option plans.

Birkenstock notes in its F-1 that it expects “to maintain our status as a foreign private issuer under the applicable corporate governance requirements of the Sarbanes-Oxley Act of 2002” and as a result, “shareholders may not have the same protections afforded to shareholders of companies that are subject to all of the corporate governance requirements of the NYSE”.

Our spidey sense goes off anytime anyone chooses to forgo shareholder rights and maintain control within a select few. Especially in business, we think it’s a bad omen whenever companies consolidate power internally and create systems that explicitly take power away from public shareholders.

Another “Controlled Company” IPO

Not only will Birkenstock be exempt from specific requirements regarding board construction and shareholder votes, it will also be considered a “controlled company” which further diminishes public shareholders’ say on matters relevant to the company.Upon completion of the IPO, entities affiliated with L Catterton, a private equity firm between Catterton, LVMH, and the family holding company of Bernard Arnault (CEO of LVMH), will hold 83% of outstanding shares. As a controlled company new investors will have little say in determining the outcome of matters submitted for shareholder approval.

Additionally, Birkenstock notes in its F-1 that controlled companies are exempt from certain corporate governance standards and that it “may take advantage of certain of these exemptions, and, as a result, you may not have the same protections afforded to shareholders of companies that are subject to all of the NYSE corporate governance requirements.”

In other words, this IPO will take investors’ money while giving them no voting power or control of corporate governance.

We Don’t Know If We Can Trust the Financials

Investors should take Birkenstock’s reported numbers with a grain of salt because the company identified a material weakness in its internal control over financial reporting. Specifically, the company identified a deficiency related to:

- a lack of sufficient accounting and supervisory personnel with the appropriate level of technical accounting experience and training

- a lack of internal controls and processes, including a lack of segregation of duties and oversight of advisors, related to our financial statement close process, income taxes and cash flow statement presentation.

The company states that it has historically prepared its books and records in accordance with German GAAP, which have since been converted to IFRS. Through the conversion process, the company identified the weaknesses above, and notes that “these deficiencies represent material weaknesses in our internal control over financial reporting in both design and operation.

Weaknesses in internal controls increase the risk that the company’s financials are fraudulent and/or misleading.

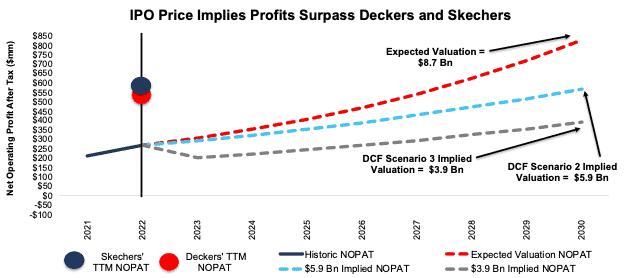

Birkenstock Is Priced to Grow Profits by 3x

When we use our reverse discounted cash flow (DCF) model to analyze the future cash flow expectations baked into Birkenstock’s expected valuation, we can provide clear, mathematical evidence that the $8.7 billion midpoint valuation is too high and offers unattractive risk/reward.

To justify the midpoint of its IPO valuation, our model shows Birkenstock would have to:

- maintain NOPAT margin at 22% (equal to fiscal 2022) and

- grow revenue by 15.4% (over 3x the expected global footwear market growth) compounded annually through 2030.

In this scenario, Birkenstock would generate over $3.8 billion in revenue, or over 3x its 2022 revenue and NOPAT would grow 15% compounded annually to $829 million in 2030. This NOPAT level would be equal to the TTM NOPAT of Crocs Inc. and 1.5x the TTM NOPAT of Deckers Outdoor Corp (makers of UGG boots, Sanuk, and Hoka shoes).

In this scenario, Birkenstock’s ROIC would more than triple to 21% in 2030, which would place it near the top of the industry alongside Crocs and Nike.

DCF Scenario 2: Growth Is Double Industry Expectations

We review an additional DCF scenario to highlight the downside risk should Birkenstock’s revenue grow at “just” 2x projected industry growth.

If we assume Birkenstock:

- maintains NOPAT margin at 22% through 2030 and

- grows revenue by 10% (2x the expected global footwear market growth) compounded annually from 2023-2030, then

BIRK would be worth just $5.9 billion today – a 32% downside to the expected IPO valuation.

In this scenario, Birkenstock would generate over $2.6 billion in revenue, or over 2x its 2022 revenue and NOPAT would grow 10% compounded annually to $569 million in 2030. This NOPAT level would be nearly equal to the TTM NOPAT of Skechers USA, Inc.

In this scenario, Birkenstock’s ROIC would more than double to 14% in 2030, which would be above Skechers and Weyco Group’s TTM ROIC.

DCF Scenario 3: Margins fall to Competitor Levels

We review a final DCF scenario to highlight the downside risk should Birkenstock’s NOPAT margin drop as it aims to reach a more mainstream consumer base, which could bring down average selling prices.

In this scenario, we assume Birkenstock’s:

- NOPAT margin falls to 15% in 2023 (equal to Deckers Outdoor’s TTM NOPAT margin) through 2030 and

- revenue grows by 10% (2x the expected global footwear market growth) compounded annually from 2023-2030, then

BIRK would be worth just $3.9 billion today – a 55% downside to the expected IPO valuation.

In this scenario, Birkenstock would generate over $2.6 billion in revenue and NOPAT would grow 5% compounded annually to $392 million in 2030. This NOPAT level would be more than double the TTM NOPAT of Steve Madden.

Figure 6 compares the firm’s implied future NOPAT in these three scenarios to its historical NOPAT. For reference, we also include the TTM NOPAT of peers Skechers and Deckers Outdoor.

Figure 6: Expected IPO Valuation Is Too High

Sources: New Constructs, LLC and company filings

Each of the above scenarios also assumes Birkenstock grows revenue, NOPAT, and FCF without increasing working capital or fixed assets. This assumption is highly unlikely given the firm’s required new investment to increase sales, but it allows us to create best-case scenarios that demonstrate the expectations embedded in the current valuation.

This article was originally published on September 25, 2023.

Disclosure: David Trainer, Kyle Guske II, Italo Mendonça, and Hakan Salt receive no compensation to write about any specific stock, style, or theme.

Questions on this report or others? Join our Society of Intelligent Investors and connect with us directly.

Click here to download a PDF of this report.

Editors Note: Valuation scenarios were updated on 10/2/23 when Birkenstock filed its IPO price range.