“It is the sovereign privilege of a free citizen to lose his money precisely as he pleases.”

By John Kenneth Galbraith

If that’s not the perfect quote for the return of meme stocks, I do not know what is. Well, maybe this quote is a little better:

“I don’t know what the f— I’m doing, I just know I’m making money,”

By Danny Tran in this TikTok video, featured in The Wall Street Journal’s It’s All Just a Game to Me.

My readers know what I think about the meme stocks. New Constructs was early to write reports like Saving Investors from Meme Stocks: GameStop (GME) in April of 2021. That report clearly explained that meme stocks helped make Wall Street and corporate executives more money, not less. It’s all very ironic and sad that meme stocks even exist. They are an insult to the capital markets. They seem like intentional misallocation of capital to those that deserve it least.

The meme stock frenzy highlights the lack of reliable fundamental research, which creates a vacuum for mis-information that elevates sources like Roaring Kitty to undue levels of influence and leads investors to lose perspective.

Without reliable fundamental research, investors have no way of gauging whether a stock is expensive or cheap. Without a reliable measure of valuation, investors have little choice but to gamble if they want to own stocks. The lack of reliable fundamental research is a big problem if we want our market to have integrity and not unfairly advantage those with better information.

Figure 1: Mis-Information for Self-Directed investors Is At an All-Time High

Image Source: Everipedia

In the meantime, if we’re ever going to get out of this mess, more investors need to understand that Wall Street isn’t in the business of warning investors of the dangers in risky stocks because they make too much money from their trading volume and underwriting of debt and equity sales. And, by the way, neither is Roaring Kitty and his like.

Only independent research firms, like us, are free to provide unconflicted research and to counter Wall Street conflicts and analyst biases.

Personally, I think our Robo-Analyst Process is a breakthrough for investors because it makes the incredibly expensive work of doing proper diligence (as explained in Seeing Is Believing) both affordable and accessible to the non-Wall Street insiders. For as little as $49/mo, we empower self-directed investors to make informed decisions more than ever before in the history of the stock market – in my humble opinion.

As an example, I want to share more details from our April 5, 2021 report on GameStop (GME):

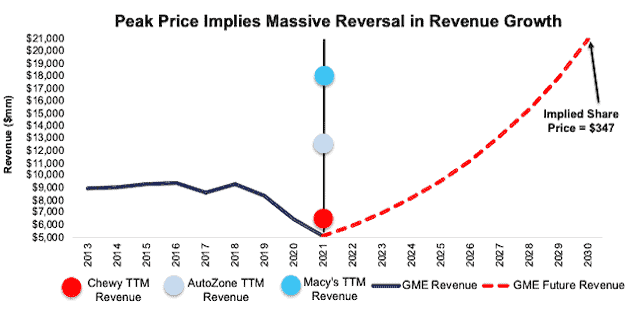

To give readers a sense of just how crazy overvalued the stock was at its peak, we do the math and show how the business would have to perform to justify $347/share.

“Crazy” at $347 Explained: Implies More Revenue Than Macy’s

Our reverse discounted cash flow (DCF) model is an excellent research tool to analyze the expectations implied by stock prices. To justify $347/share, it shows that GameStop must:

- improve its profit margin to 5.5% (10-yr avg from 2010-19 is 3.9% & all-time high was 4.8% in 2008) and

- grow revenue by 17% compounded annually through 2030 (above projected video game industry CAGR of 13% through 2027)

In this scenario, GameStop earns nearly $21 billion in revenue in 2030 or more than the trailing-twelve-months (TTM) revenue of Macy’s (M), AutoZone (AZO), and Chewy Inc. (CHWY). See Figure 3 for details.

Figure 3: GameStop’s Historical Revenue vs. DCF Implied Revenue: Scenario 1

Sources: New Constructs, LLC and company filings

For reference, GameStop’s revenue fell by 3% compounded annually from 2009 to 2019.

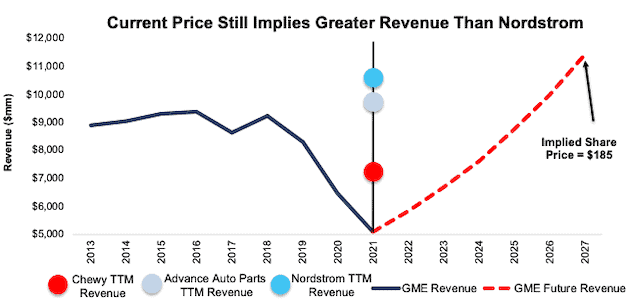

Still Crazy: At $185

For perspective on the current price, we run the same analysis to show what the company must do to justify $185/share:

- immediately improve its profit margin to 4.8% (all-time high in 2008 compared to 0.7% in 2019) and

- grow revenue by 15% compounded annually through 2027 (above projected video game industry CAGR of 13% through 2027)

In this scenario, GameStop earns over $11 billion in revenue in 2027, which is 19% higher than GameStop’s record revenue of $9.6 billion in 2012 and the TTM revenue of Nordstrom (JWN), Advance Auto Parts (AAP), and Chewy. See Figure 4 for details.

Figure 4: GameStop’s Historical Revenue vs. DCF Implied Revenue: Scenario 2

Sources: New Constructs, LLC and company filings

Can anyone reading that excerpt make a straight-faced argument that investing in GameStop during the last meme stock frenzy made any sense? The same is true today. Do you not find it more than a little remarkable that so many investors are willing to fall for the same ploy a few short years later?

For those that follow my e-letters (sign up here), you know that GameStop was a Zombie Stock, but is no more. But, you might not know that we recently wrote an update on another Zombie Stock. The report is available only to our Professional members, Danger Zone report subscribers and those that took advantage of our ROIC Investment Bundle. Out of respect to those customers, I do not want to give out any more freebies, but I will say it is funny how history repeats itself. And, investing is not all just a game to us.

The takeaway for readers today is that you do not have to be played by Wall Street. With access to proper diligence on the fundamentals, you can beat Wall Street at its own game! That’s right, reliable fundamental research gives you an edge on Wall Street analysts because they are beholden to their bankers (as explained in Don’t Believe the Hype and multiple e-letters). Wall Street analysts have to write what’s necessary to sell the IPO and maintain the brown-nosed buy. You do not. So, why should you. Invest with intelligence and reap the rewards – monetarily and psychologically. Make smarter investments and have a better conscience because you know your investments are made based, at least in part, on real diligence on the fundamentals.

We regularly review our work and research on Long Ideas and Danger Zone Ideas with clients. We want you to know how much work we do! Here’s how we share our work:

- Free live Podcast every month. We just did one on May 10th at 12pmET. Get the free replay from our Society of Intelligent Investors (use this form to sign up for free) and ask questions and make requests anytime!

- Monthly Let’s Talk Long Ideas webinars where we do deep dives into our research, analytics, reverse DCF models and ideas for our Professional and Institutional clients. We just did one on May 8th at 3:30pmET. Replay is here for our Professional and Institutional clients.

Diligence matters,

David

This article was originally published on May 20, 2024.

Disclosure: David Trainer, Kyle Guske II, and Hakan Salt, receive no compensation to write about any specific stock, sector, style, or theme.

Questions on this report or others? Join our Society of Intelligent Investors and connect with us directly.