We closed this Long Idea. See the position update report here.

In the search for safe investments in today’s volatile markets, investors should focus on companies that have a history of creating shareholder value, the ability to earn quality returns on capital, and an undervalued stock. This week’s Long Idea, Wells Fargo & Company (WFC: $53/share) not only fits the description of a safe investment, but its shares are also greatly undervalued, which gives long-term investors an excellent investing opportunity.

Profitable Through All Economic Cycles

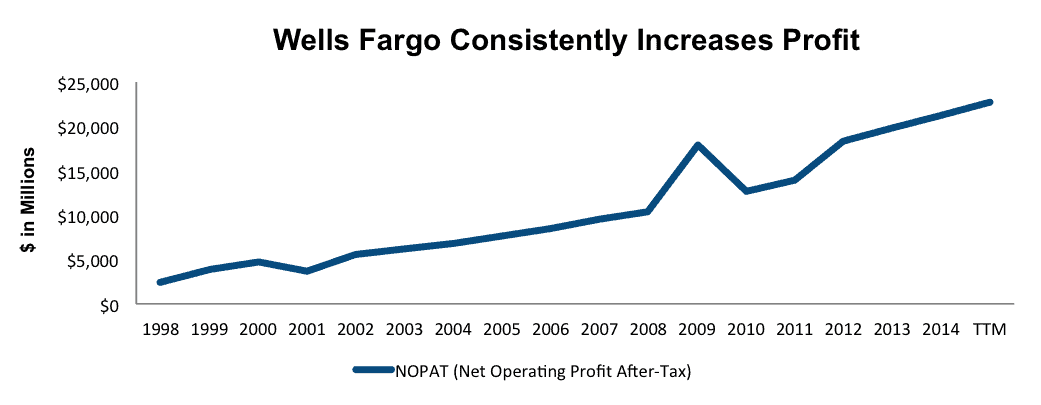

Wells Fargo has run an increasingly profitable business by adopting a strategy that some would describe as boring; focusing on the basics of banking: deposits and loans. Since 1998 the company has grown after-tax profit (NOPAT) by 15% compounded annually. The blip seen in Figure 1 involved Wells’ acquisition and integration of beleaguered Wachovia, which more than doubled Wells Fargo’s asset base.

Figure 1: WFC Profit Growth Is Robust

Sources: New Constructs, LLC and company filings

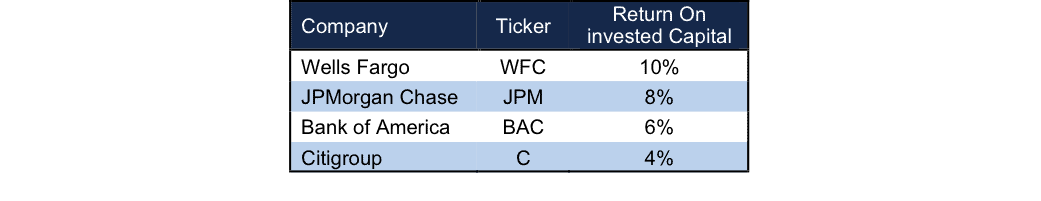

Wells Fargo has emerged from the financial crisis as the most profitable of the big four banks in the United States. The company currently earns a return on invested capital (ROIC) of 10%, up from 8% in 2010.

Additionally, over the past four years Wells Fargo has generated a cumulative $26 billion in free cash flow and currently has a FCF yield of 6%, also the highest among the big four U.S. banks.

A Business Model That Beats the Competition

In 3Q15, when JPMorgan Chase (JPM), Bank of America (BAC), and Citigroup (C) all reported year-over-year revenue declines, Wells Fargo grew revenue by 3%. Without a substantial gain/loss from trading operations, Wells Fargo is able to focus on growing a more sustainable core business. In 3Q15, Wells Fargo’s deposits totaled a record $1.2 trillion, and its loan balance equaled just over $903 billion. Best of all, Wells Fargo has grown its interest earning assets by $123 billion, or 8%, over the past year alone, which is significantly greater than its competition. By focusing on the basics, Wells Fargo has built a business that can be run efficiently, best serve the customer, and create shareholder value.

By asset size, Wells Fargo ranks fourth in the U.S., but as can be seen in Figure 2, Wells Fargo does more with less as it earns the highest ROIC of the competition group. The high ROIC is a testament to management’s ability to extract greater value from the capital vested with it.

Figure 2: Wells Fargo ROIC Ranks On Top

Sources: New Constructs, LLC and company filings

Bear Concerns Imply All Banks Created Equal

If looking only at the headlines, it may appear that the entire financial industry is in trouble. Recent earnings releases have seen big names such as Goldman Sachs (GS), Morgan Stanley (MS), and even JPMorgan miss earnings expectations and disappoint “the Street.” Furthermore, the low interest rate environment and regulatory actions can only create trouble for banks moving forward right? Wrong. The problem with this thinking is that not all banks are created equal.

The Wells Fargo business model allows it to excel when other banks do not. In 3Q15, Wells Fargo reported the strongest retail bank customer growth in four years. This achievement is paramount to Wells Fargo’s success in low interest rate environments because the company has a history of successful cross-selling products to existing customers. This cross-selling creates additional revenue at a low marginal cost. In fact, Wells Fargo cross-sells on average 6.13 products per household. Strong fee-driven businesses (non-interest income was 48% of income in 3Q15) are key to consistent profit growth given the inherent cyclicality of the lending business.

Apart from a business model that works regardless of interest rates, Wells Fargo has a history of meeting the regulatory requirements laid out for systematically-important financial institutions. Wells Fargo has passed the Federal Reserve’s Comprehensive Capital Analysis and Review every year since 2011. Additionally, the bank has maintained a common equity tier 1 ratio well above that required by the Basel Committee since 2013. Wells Fargo excels where many of its financial sector peers seem to struggle.

Shares Are Cheap At the Current Price

Despite the excellent business operations, WFC is down 3% year-to-date and fell 12% in August alone. We think the recent selloff presents an excellent entry point. At its current price of $53/share, Wells Fargo has a price to economic book value (PEBV) ratio of 1.1. This ratio implies that the market expects the company’s profits to grow no more than 10% over its remaining life. This expectation seems rather pessimistic given Wells Fargo’s consistent profit growth through multiple economic cycles.

If Wells Fargo can grow NOPAT by just 5% compounded annually for the next decade, the stock is worth $68/share today – a 28% upside. Keep in mind Wells Fargo has grown NOPAT by 15% compounded annually since 1998.

Continued Loan Growth and Business Expansion Will Propel Shares Higher

In 2015, Wells Fargo has seen broad based growth in its loan balances, with commercial and industrial loans leading the way. However, auto loans, credit card loans, and family-first mortgage loans have each grown year-over-year as well. Wells Fargo is not reliant upon one particular lending group to continue growing its business, and we believe they are well positioned to continue increasing loans through the use of attractive fixed rates or better terms than the competition, which do not operate as profitably as Wells Fargo. Additionally, with the acquisition of General Electric’s property loan portfolio, railcar leasing business, and specialty finance business, Wells Fargo is looking to expand market share while interest rates remain unattractive, i.e. buy business on the cheap. With the addition of these assets and customers, Wells Fargo is positioned to continue it’s profit growth and reap the benefits of cross-selling to an expanded customer base.

Insider Trends Raise No Red Flags

Over the past 12 months, insiders have purchased just over 7.8 million shares and sold nearly 6.9 million shares for a net effect of 1 million insider shares purchased. This amount represents less than 1% of shares outstanding.

Executive Compensation Passes The Test

Much of Wells Fargo’s executive compensation is paid in an “at risk” form such as equity awards. The compensation committee has discretion over when awards are given and outlines performance metrics consistent with ensuring executives grow the business while properly managing risk. The compensation committee uses metrics such as net income, return on realized common equity relative to peers, and the achievement of strategic goals such as growing Wells Fargo loan and deposit balances. While we would prefer executive compensation be tied specifically to ROIC, Wells Fargo’s executive compensation plans raise no red flags.

Share Repurchases and Dividends Approved By Fed

In 2014, Wells Fargo authorized the repurchase of up to 350 million shares, which was approved by the Federal Reserve as part of its annual review of banks. At the end of 2014, the company had 240 million shares remaining for repurchase under this authorization. In 2015 the Federal Reserve once again approved Wells Fargo’s capital return plans, including a dividend increase. At current prices, the 250 million share buyback authorization would represent $13.2 billion and through 3Q15, Wells Fargo has repurchased $6.7 billion of common stock, which represents 2.5% of WFC’s market cap. The total yield to investors (buybacks at 2.5% plus and the dividend at 2.8%) is 5.3% at current prices. With such high yields, it’s easy to see why even Warren Buffett is a fan of Wells Fargo.

Impact of Footnotes Adjustments and Forensic Accounting

We have made several adjustments to Wells Fargo’s 2014 10-K. The adjustments are:

Income Statement: we made $5.9 billion adjustments with a net effect of removing $499 million of non-operating income. The largest adjustment was the removal of $2.1 billion (3% of revenue) from net income due to changes in reserves. Despite this removal, WFC’s NOPAT was still the highest ever achieved in the history of our model, which dates back to 1998.

Balance Sheet: we made $54.2 billion of balance sheet adjustments to calculate invested capital with a net increase of $33.9 billion. The largest adjustment made was the inclusion of $23.2 billion due to accumulated goodwill. This adjustment represented 13% of reported net assets.

Valuation: we made five adjustments that decreased shareholder value by $32 billion. There were no value-increasing adjustments. The most notable adjustment to shareholder value was the removal of $21.6 billion due to preferred stock, which represents 8% of Wells Fargo’s market cap.

Attractive Funds That Hold WFC

The following funds receive our Attractive-or-better rating and allocate significantly to Wells Fargo.

- iShares Dow Jones U.S. Financial Services Index Fund (IYG) – 11.4% allocation and Very Attractive rating

- PFS Funds: Bretton Fund (BRTNX) – 11% allocation and Attractive rating

- Fidelity Select Portfolios: Banking Portfolio (FSRBX) –10.5% allocation and Attractive rating.

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, style, or theme.

Click here to download a PDF of this report.

Photo Credit: Frank Alcazar (Flickr)