On October 26, 2022, Mobileye (MBLY: $19/share, midpoint of expected IPO range) is expected to go public. At its current targeted valuation, the stock gets our Unattractive rating. Given increased competition, a history of unprofitability, and an undifferentiated product offering, we expect investors will lose money in this IPO at $19/share.

Key points of this report:

- $19/share implies the business will grow revenue more than 10x by 2031 and increase share of the global driver-assist market from 5% in 2021 to 20% in 2031

- increased competition means Mobileye will likely lose share in driver-assist market, not gain

- the transition to full self-driving technology will be take many more years, and Mobileye will not enjoy a significant competitive advantage in the industry

- we think Mobileye is worth closer to $4/share if the company can keep pace with driver-assist industry growth

- Mobileye’s net operating profit after tax (NOPAT) has fallen since the Intel acquisition and is heading in the wrong direction over the TTM

Our IPO research aims to provide investors with more reliable fundamental research.

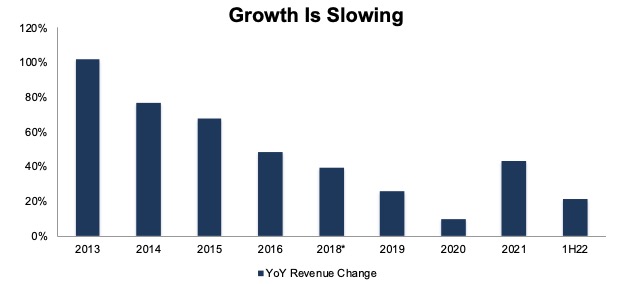

Revenue Growth Is Quickly Decelerating

Even though revenue has grown at an impressive 47% CAGR since 2012, Mobileye’s growth story is running out of gas. The company’s revenue growth rate was already in decline before Intel acquired it in 2017, and revenue growth has continued to slow since. Per Figure 1, Mobileye’s year-over-year (YoY) revenue growth fell from 102% in 2013 to just 21% in 1H22. At 21%, Mobileye’s YoY change is below pre-pandemic levels of 26% in 2019.

Figure 1: Mobileye’s YoY Change in Revenue

Sources: New Constructs, LLC, and company filings

*Full-year 2017 revenue is not available. 2018 value is CAGR from 2016 – 2018.

A Missed Opportunity With Intel

Intel viewed Mobileye as a passive investment and never invested additional capital into the business. As a result, Mobileye’s technology has fallen behind in both of its target markets: driver-assist and self-driving.

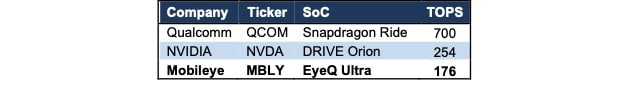

In the driver-assist segment, Mobileye’s EyeQ system on chips (SoCs), which accounts for 94% of revenue in 2021, is now behind the SoCs offered from larger chip designers. Per Figure 2, Qualcomm (QCOM) and NVIDIA (NVDA) already boast SoCs that are more powerful [as measured by tera operations per second (TOPS)] than Mobileye’s EyeQ Ultra which is set to go into production in 2025.

Figure 2: Mobileye’s System On Chip TOPS Vs. Competition

Sources: New Constructs, LLC

The picture isn’t any rosier in the company’s self-driving segment either. According to the most recently available Guidehouse Insights self-driving systems leaderboard, Mobileye ranked eighth out of the top-ten self-driving companies in 2021, which is down from fifth in 2020.

One might expect a partnership with one of the most profitable tech companies in the world would have helped Mobileye further its market-leading technological edge. Unfortunately, it did not.

Though Intel will still own ~94% of Mobileye post IPO, investors shouldn’t expect Intel to change its approach with Mobileye. On the contrary, Intel is laser-focused on allocating all of its capital to expand its chip manufacturing capabilities.

Mobileye Won’t Enjoy a First Mover Advantage in Self-Driving

Despite the tremendous accomplishments the industry has made, self-driving is an extremely complicated challenge to solve. Truly reliable self-driving could take decades, if not years. Furthermore, it is unlikely that a single company will be equipped to solve all the complexities involved in achieving widespread adoption of self-driving. The road to self-driving will likely continue to be marked with many years of small incremental improvements, and it will take years before self-driving works well enough for mass adoption.

Not to be overlooked, consumers must also be ready to embrace self-driving technology, which takes time as well. According to the J.D. Power 2022 U.S. Mobility Confidence Index (MCI) Study, “consumer readiness for automation is nowhere close to where it will need to be to bring mainstream vehicle buyers into the market for fully automated passenger cars and trucks in the years ahead”. According to the MCI study, consumer readiness for self-driving vehicles fell from 42 in 2021 to 39 in 2022.

A Larger TAM Doesn’t Fix Mobileye’s Problems

Self-driving vehicles promise to save current drivers time and money, while reducing accidents. No doubt, the self-driving industry will have immense value, which contributes to the bull thesis for any self-driving company.

The expected growth of the global self-driving vehicle market drives Mobileye’s estimated TAM from $16 billion as of October 2022 to $480 billion by 2030. While the company hopes to improve its top-line growth and margins as the self-driving market expands, Mobileye will continue to face competitors with superior technology and greater financial resources, which will make achieving massive revenue growth and significant margin improvement very difficult.

Regulations Could Level the Data Playing Field

Mobileye collects real-world data through the systems it has already installed throughout the world. Though the company’s wealth of data may help it develop its technology, Mobileye’s data collection may not be a true differentiator from the competition. Afterall, other companies, i.e. Alphabet’s (GOOGL) Waymo, also have their own treasure troves of data.

Furthermore, over the long run, it seems unlikely that regulators would permit any meaningful data advantage in the self-driving industry to persist in a world of full automation due to the emphasis regulators place on public safety. In order to make self-driving as safe as possible, regulators would likely force self-driving companies to share their data with one another to create the most comprehensive, and safest, integrated self-driving system possible.

Lack of Differentiators Means Low-Barriers to Entry

The less-technologically-advanced driver-assist market in which Mobileye currently competes presents a picture of what the future of the self-driving industry will eventually become. Due to the relatively low barriers to entry in the driver-assist market, Mobileye faces pressure on its margins as evidenced by the company’s negative NOPAT since 2020 (see details below). Looking ahead, Mobileye’s driver-assist segment’s margins will continue to face pressure from auto part suppliers, chip designers, and automakers that enter the driver-assist market.

Similarly, Mobileye, along with the rest of the self-driving industry, incorporates chips, cameras, radar, and lidar to support self-driving systems. Mobileye’s use of equipment that is standard across the industry leaves the company little room to develop a competitive edge that would enable it to achieve the margins required to meet the expectations embedded in the midpoint of its targeted IPO price of $19/share.

Automakers Could Use their Own Tech

Mobileye’s SoC has been well received across the driver-assist industry and has been deployed in over 125 million vehicles. However, the early widespread adoption of Mobileye’s SoC may not persist as automakers and auto part suppliers that look to build self-driving systems in house. Not long ago, Tesla equipped its models with Mobileye products until the two companies parted ways in 2016, after which, Tesla replaced Mobileye with its own technology. General Motors (GM), Mercedes-Benz, NIO (NIO), Volvo Cars, and Xpeng Motors are all pursuing in-house solutions for their driver-assist needs. Should automakers continue to improve their driver-assist and self-driving capabilities, Mobileye would lose pricing power, which would diminish already negative margins and pose significant risk to revenue growth opportunities.

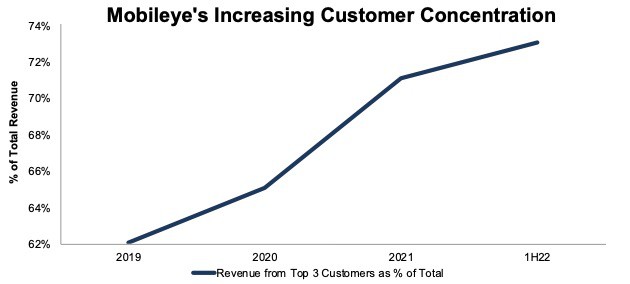

The risk of losing sales from customers taking driver-assist production in house is exacerbated by the large and growing concentration of Mobileye’s business across a handful of customers. Per Figure 3, Mobileye’s top three customers (ZF Friedrichshafen, Valeo, and Aptiv) accounted for 73% of Mobileye’s revenue in 1H22, up from 62% in 2019.

Figure 3: Mobileye’s Top 3 Customers as Percent of Total Revenue

Sources: New Constructs, LLC and company filings

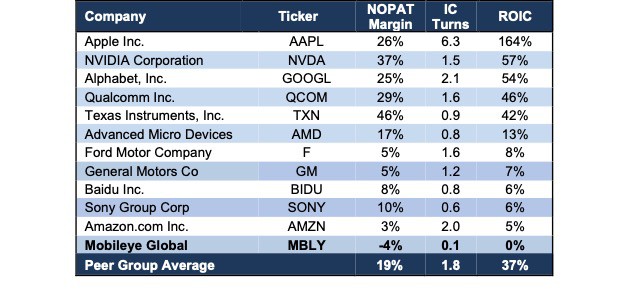

Mobileye’s Tough Competition Is Much More Profitable

Unlike Mobileye, most competitors in the driver-assist and self-driving industries operate other profitable businesses that provide the funding required to develop the technology that will bring self-driving to fruition. Mobileye’s more formidable competition ranges from Big Tech to advanced semiconductor designers to automakers. Given the competitive environment, it is unsurprising that Mobileye’s NOPAT margin, invested capital turns, and return on invested capital (ROIC) rank last among listed competitors in Figure 4.

Figure 4: Mobileye’s Profitability Vs. Competitors

Sources: New Constructs, LLC and company filings

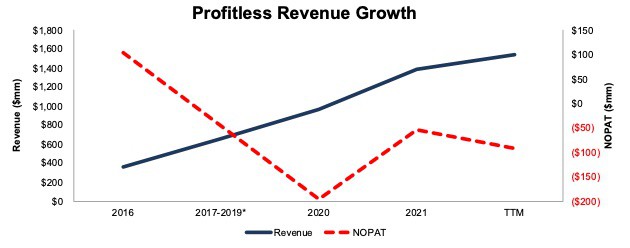

Profits Are Negative and Heading Lower

Mobileye’s NOPAT fell from $104 million in 2016 to -$55 million in 2021. Over the TTM, Mobileye’s NOPAT[1] of negative $92 million fell even farther. With competition increasing and Mobileye’s need to continually invest in improving its technology, significant profits in the foreseeable future seem elusive.

Figure 5: Mobileye Revenue & NOPAT: 2016 – TTM

Sources: New Constructs, LLC and company filings

*Data unavailable – chart tracks NOPAT and revenue decline from 2016-2020

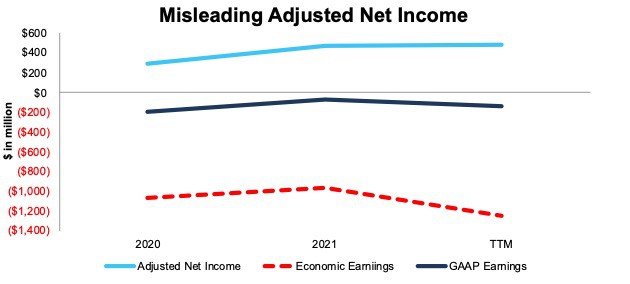

Ignore the Non-GAAP Adjusted Income Head Fake

Mobileye’s management makes full use of the leeway provided by non-GAAP Adjusted Net Income when presenting results. For instance, Mobileye’s Adjusted Net Income over the TTM removes $546 million (36% of revenue) in amortization of acquired intangible assets and $124 million (8% of revenue) in stock-based compensation expense. After removing all items, Mobileye reports Adjusted Net Income of $480 million over the TTM. Meanwhile, economic earnings[2], the true cash flows of the business, are much lower at -$1.2 billion.

Figure 6: Mobileye’s Adjusted, GAAP, & Economic Earnings: 2020 – TTM

Sources: New Constructs, LLC and company filings.

Own Intel (INTC) to Get MBLY at a Discount

The Mobileye IPO provides a way for Intel to track the market value of its asset and raise capital.

Since Intel retains ~94% ownership in Mobileye after the IPO, investors can still gain exposure to Mobileye’s potential through owning shares in the much more profitable Intel, whose stock is trading at a big discount. INTC currently trades at a price-to-economic book value (PEBV) ratio of 0.7, which means the market expects its earnings to permanently fall by 30%. We think these expectations are too low as we outlined in our latest report on Intel in February 2022. You can find all of our reports on Intel here.

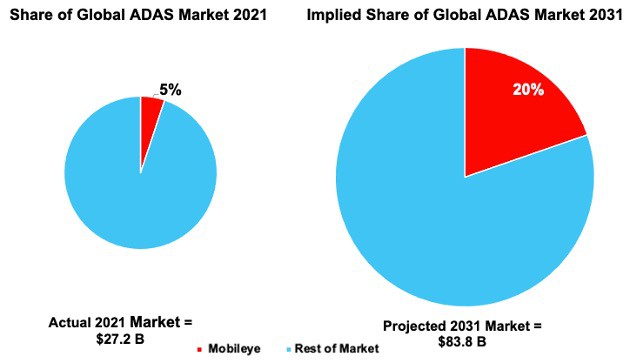

Mobileye Must Take 20% of the Driver-Assist Market to Justify $19/share

When we use our reverse discounted cash flow model to quantify the market's expectations for future profit growth required to justify this IPO’s valuation, we think the market is vastly overestimating Mobileye’s business potential.

For example, the revenue growth baked into Mobileye’s midpoint IPO valuation implies the company takes ~20% of the driver-assist market in 2031, which would be up from 5% in 2021. Anything less than 20% market share in 2031, and Mobileye’s stock holds significant downside.

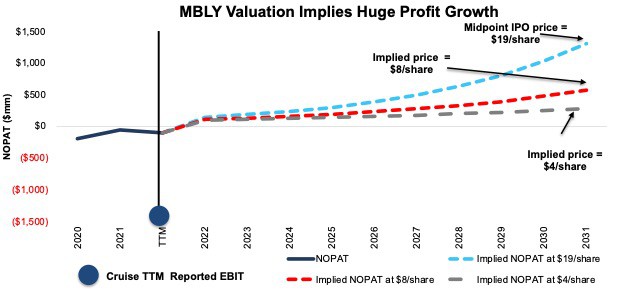

To justify a $19/share valuation, Mobileye must:

- immediately improve its NOPAT margin to 8% (above auto part supplier average TTM NOPAT margin of 7%[3] vs. Mobileye’s -4% TTM NOPAT margin) and

- grow revenue by 28% compounded annually through 2031

In this scenario, Mobileye would generate $16.5 billion in revenue and $1.3 billion in NOPAT in 2031. For reference, General Motors’ Cruise division generated a reported EBIT of -$1.5 billion over the TTM and Alphabet’s Other Bets segment, which includes Waymo, generated a reported operating loss of -$4.5 billion over the TTM.

In this history of the world, the number of companies that grow revenue by 20%+ compounded annually for such a long period is unbelievably rare, which make the expectations baked into Mobileye’s expected IPO valuation look even more unrealistic.

Figure 7: Mobileye Market Share vs. Implied Market Share in 2031

Sources: New Constructs, LLC, company filings, and Markets And Markets

DCF Scenario 2:

We review an additional DCF scenario to highlight the downside risk should Mobileye’s revenue grow at a 20% CAGR over the next decade.

If we assume Mobileye’s:

- NOPAT margin immediately improves to 7%, and

- revenue grows by 20% compounded annually through 2031, then

Mobileye is worth $8/share today – a 58% downside to the midpoint IPO valuation. In this scenario, Mobileye would generate $568 million in NOPAT in 2031, or 5.5x its highest NOPAT, previously achieved in 2016.

Should Mobileye struggle to improve margins at such a rapid pace or grow revenue at a lower rate, the stock is worth even less.

DCF Scenario 3:

We review an additional DCF scenario to highlight the downside risk should Mobileye’s revenue grow more in line with driver-assist industry expectations.

If we assume Mobileye’s:

- NOPAT margin immediately improves to 7%, and

- revenue grows by 12% compounded annually (equal to driver-assist industry forecasted CAGR through 2030) through 2031, then

Mobileye is worth just $4/share today – a 79% downside to the midpoint targeted IPO valuation. In this scenario, Mobileye would generate $283 million in NOPAT in 2031, or $384 million higher than TTM levels.

Figure 8 compares the firm’s implied future NOPAT in these three scenarios to its historical NOPAT.

Figure 8: Midpoint IPO Valuation Is Too High

Sources: New Constructs, LLC and company filings

Each of the above scenarios also assume Mobileye grows revenue, NOPAT, and FCF without increasing working capital or fixed assets. This assumption is highly unlikely but allows us to create best-case scenarios that demonstrate the extraordinarily high expectations embedded in the current valuation.

Public Shareholders Have No Say

Investors should be aware that investing in Mobileye’s IPO provides little to no say over corporate governance. Investors in the IPO will get Class A shares, which provide just one vote per share. Intel, on the other hand, will have more than 99% of the voting power of Mobileye’s common stock, largely through its ownership of Class B shares, which provide 10 votes per share.

In other words, Intel is raising capital through Mobileye’s IPO while giving effectively no control of corporate decision making and governance to IPO investors.

No White Knight to IPO Bailout Investors

With Intel owning ~94% of Mobileye’s outstanding shares after the IPO, Class A shareholders have no hope of a white knight coming along and overpaying for Mobileye’s business anytime soon.

This article originally published on October 25, 2022.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] We estimate NOPAT over the TTM by using Mobileye’s reported operating loss in 1H22 and 1H21.

[2] We estimate economic earnings over the TTM by assuming TTM NOPAT is -$92 million and invested capital over the TTM is unchanged from 2021.

[3] Includes the 30 auto part suppliers in our coverage universe.