Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life.

Many companies are not complying with the Financial Accounting Standards Board’s (FASB) new standard (ASU 2016-02) for reporting operating lease assets and liabilities on the balance sheet. This standard went into effect in 1Q19 and goes a long way towards closing the loophole that allowed companies to hide trillions of dollars in capital off the balance sheet.

This report provides specific examples of compliant and non-compliant disclosures as well as a general overview of how many companies fall into each category. Please contact us if you would like more details on which companies are and are not complying with this new rule.

What Investors Need to Know

For operating lease disclosures to be useful for investors, at a bare minimum, companies must disclose:

- Future annual payments for operating leases

- Rate used to discount the future annual payments into a net present value (NPV) obligation reported on the balance sheet as an asset and liability

- NPV of Operating Lease/right-of-use (ROU) assets and liabilities

Since implementation of ASU 2016-02, many companies have not consistently disclosed all three. While companies are better about disclosing the NPV obligation, the two worst areas of disclosure and compliance are future annual payment tables and discount rates. Without the discount rate and future annual payments data, investors cannot assess the reasonableness of the NPV obligation because companies can manipulate that value with their choice of discount rate, see “How Operating Lease Discount Rates Can Mislead Investors.”

Why Disclosure Matters – Required for Accurate Earnings Models

Without compliant disclosures, investors cannot measure the real value of operating lease/ROU asset & liabilities. Since 1998, and long before ASU 2016-02, our models have leveraged detailed footnotes analysis to capture the impact of off-balance sheet debt from operating leases on NOPAT/income statements, invested capital/balance sheets and the weighted-average cost of capital (WACC).

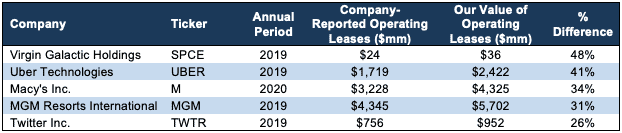

Though ASU 2016-02 aims to relieve investors of at least some of the rigorous footnotes analysis required to assess operating lease liabilities, plenty of footnotes work remains to ensure we get the right value across 5,000+ companies for our clients and partners. Figure 1 shows just how different our measure of the NPV of operating leases compared to what companies disclose.

Figure 1: Balance Sheet Impact: Largest Differences in Reported and Adjusted Operating Lease Assets

Sources: New Constructs, LLC and company filings

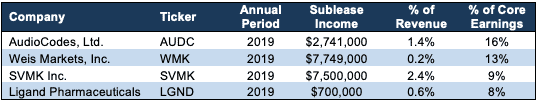

Operating leases also distort EBIT/EBITDA, core earnings and NOPAT. We resolve this distortion by removing sublease income, a non-operating item (excluding Real Estate and Restaurants), from operating expenses. Figure 2 shows how big an impact this adjustment has on core earnings. For example, AudioCodes (AUDC) uses sublease income to overstate core earnings by 16%. Again, investors need adequate disclosure from companies in order to gain an accurate understanding of corporate performance.

Figure 2: Income Statement Impact: Sublease Income Overstates Earnings

Sources: New Constructs, LLC and company filings

At the end of the day, we applaud the FASB for narrowing the loophole that allowed companies to hide trillions of dollars in capital off the balance sheet. The problem is not the new rule, the problem is companies not complying with the rule.

The Good Disclosure Practices

We begin with examples of some of the best disclosures so that investors can see how good disclosures look and how easy it is for companies to provide them. Plus, they provide a point of reference for understanding just how bad the bad disclosures are.

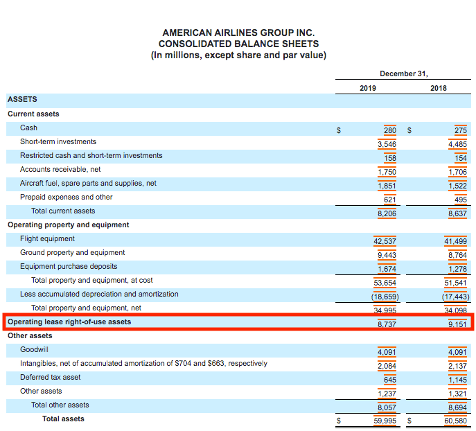

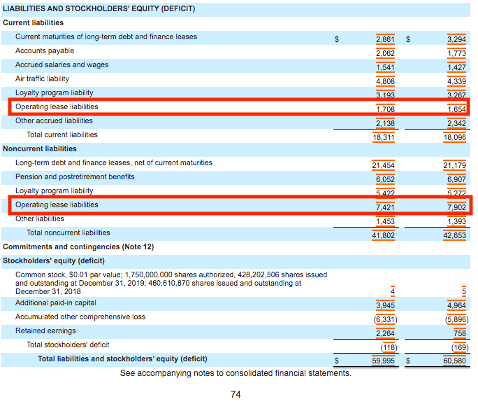

Good Disclosure #1: This 2019 10-K disclosure from American Airlines (AAL) of the operating leaseROU assets and current/long-term liabilities on the balance sheet is an example of the best disclosure of this information. In total, we estimate about 52% of companies provide this level of disclosure for their operating leases in 10-Ks and 43% in 10-Qs. As noted above, contact us to request more details on which companies provide the best/worst disclosures. Note that we will provide certain details to clients only.

Figure 3: American Airlines (AAL) Operating Lease Assets & Liabilities Disclosure in 2019 10-K

Sources: New Constructs, LLC and company filings

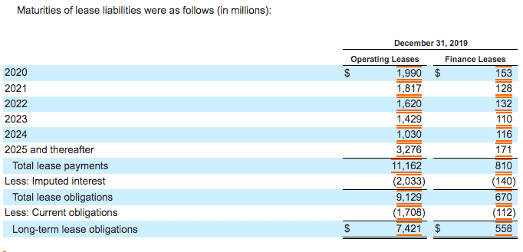

Good Disclosure #2: This 2019 10-K disclosure from American Airlines of the future annual payments in an operating lease note, as a table, with a breakout of each individual year, is an example of the best disclosure of this information. In total, we estimate about 93% of companies provide this level of disclosure for their operating leases in 10-Ks and 50% in 10-Qs.

Figure 4 American Airlines Future Annual Payments Disclosure in 2019 10-K

Sources: New Constructs, LLC and company filings

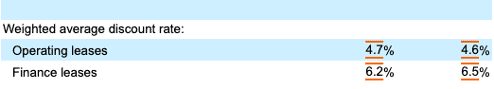

Good Disclosure #3: This 2019 10-K disclosure from American Airlines of the discount rate used to determine the NPV of the operating lease payments in a table in the operating lease note is an example of the best disclosure of this information. Contact us to request more details on which companies provide the best/worst disclosures in this area.

Figure 5: American Airlines (AAL) Operating Lease Discount Rate Disclosure in 2019 10-K

Sources: New Constructs, LLC and company filings

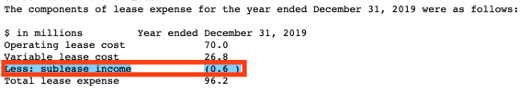

Good Disclosure #4: This 2019 10-K disclosure from Invesco (IVZ)of sublease income reported in a table in the operating lease note is an example of the best disclosure of this information. In total, we estimate about 94% of companies provide this level of disclosure for their operating leases in 10-Ks and 97% in 10-Qs.

Sublease income is usually a non-operating item for most companies (with the exception of Real Estate and Restaurants) that reduces reported operating expenses, such as selling, general, and administrative. We add back sublease income in our adjusted EBIT/EBITDA, core earnings and NOPAT calculations because it leads to overstated profits and represents unusual income not core to the company’s ongoing operations.

Figure 6: Invesco Sublease Income Disclosure in 2019 10-K

Sources: New Constructs, LLC and company filings

The Bad Disclosure Practices

The below examples include disclosures that are not as good as the prior examples because they make the information needed to assess operating leases harder to find in filings.

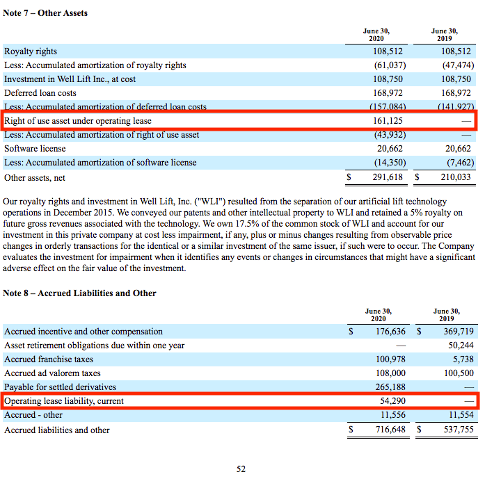

Bad Disclosure #1: Instead of disclosing their operating lease/ROU assets and liabilities on the balance sheet in its 2020 10-K, Evolution Petroleum Corp (EPM)buries that information in “Other” on the balance sheet. Analysts and investors have to find the breakout of the “Other” value in the footnotes. It is far more convenient to get this data from the balance sheet and not have to search through potentially hundreds of pages of footnotes to find it. In total, we estimate about 38% of companies provide this level of disclosure for their operating leases in 10-Ks and 54% in 10-Qs.

Figure 7: Evolution Petroleum Corp “Other Assets” Disclosure in the Footnotes in 2020 10-K

Sources: New Constructs, LLC and company filings

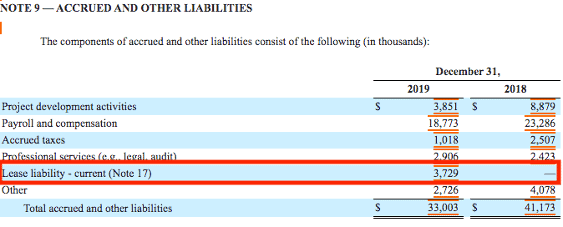

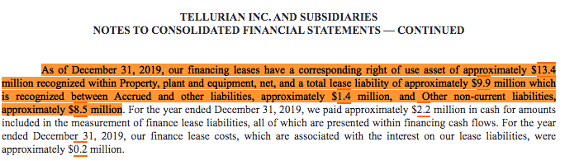

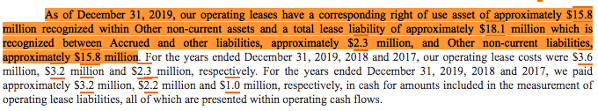

Bad Disclosure #2: In Figure 8, Tellurian Inc. (TELL)double buries, or makes it doubly hard to find, its operating lease right-of-use assets and liabilities in its 2019 10-K because they are not disclosed on the balance sheet and not directly disclosed in a table in the footnotes. We have to dig further into the text supporting the footnotes table to find the operating lease/ROU values. Contact us to request more details on which companies provide the best/worst disclosures in this area.

Figure 8: Tellurian Inc. Operating Lease Disclosures Buried in Footnotes in 2019 10-K

Sources: New Constructs, LLC and company filings

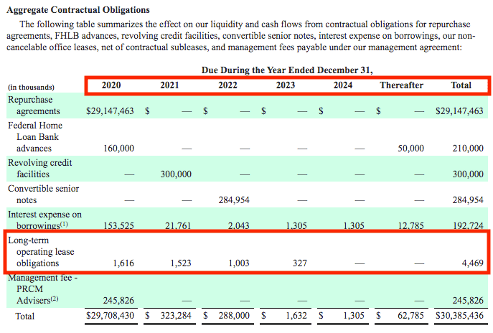

Bad Disclosure #3: In Figure 9, Two Harbors (TWO) discloses its future annual payments in an “aggregate contractual obligations” table in its 2019 10-K, rather than breaking out the values in a table specifically related to operating leases. In total, we estimate about 1% of companies provide this level of disclosure for their operating leases in 10-Ks and less than 1% in 10-Qs.

Figure 9: Two Harbors Future Annual Payments Bundled in Unrelated Table in 2019 10-K

Sources: New Constructs, LLC and company filings

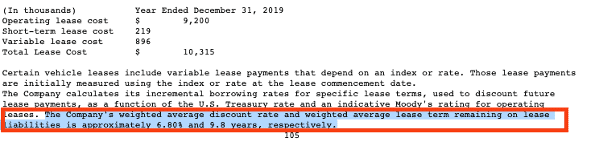

Bad Disclosure #4: EXACT Sciences (EXAS) makes its operating lease discount rate more difficult to find in its 2019 10-K by only disclosing it in a supporting paragraph and not in the operating lease table. Contact us to request more details on which companies provide the best/worst disclosures in this area.

Figure 10: EXACT Sciences Operating Lease Discount Rate Buried in Text in 2019 10-K

Sources: New Constructs, LLC and company filings

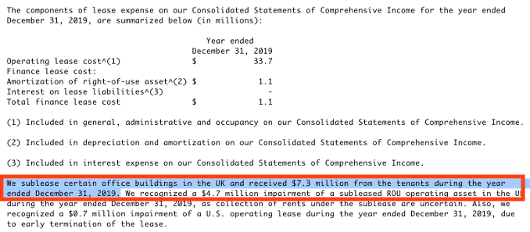

Bad Disclosure #5: Figure 11 shows how Janus Henderson Group (JHG) discloses sublease income in its 2019 10-K, but only within in a paragraph and not a separate table. This disclosure practice is more difficult to identify, especially in filings that can run 200+ pages. In total, we estimate about 6% of companies provide this level of disclosure for their operating leases in 10-Ks and 3% in 10-Qs.

Figure 11: Janus Henderson Group Sublease Income Disclosed in Paragraph in 2019 10-K

Sources: New Constructs, LLC and company filings

The Ugly (and at Times Non-Compliant) Disclosure Practices

These disclosures lack information necessary for investors and analysts to fully measure the impact of a firm’s operating leases on its fundamentals.

Ugly Disclosure #1: Instead of disclosing operating lease/ROU assets and liabilities on the balance sheet in its 2019 10-K, Werner Enterprises (WERN) buries that information in “Other” on the balance sheet. However, unlike the EPM example above, Werner does not break out “Other” in any way in the footnotes, which leaves analysts unable to fully analyze and adjust for operating leases. Contact us to request more details on which companies provide the best/worst disclosures in this area.

Figure 12: Werner Enterprises Operating Lease & ROU Assets & Liabilities Not Broken Out in 2019 10-K

Sources: New Constructs, LLC and company filings

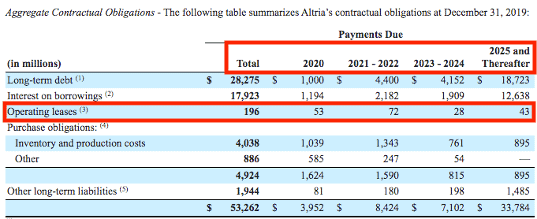

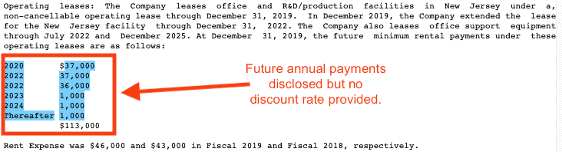

Ugly Disclosure #2: Figure 13 shows that Altria Group (MO) is not compliant with GAAP as it groups future annual payments in its 2019 10-K years into multi-year timeframes. Under GAAP, aggregation of future annual payments is only allowed in the thereafter portion following five individual years. Aggregating multiple years prior to the first five makes it more difficult to assess the accuracy of the firm’s NPV calculation. In total, we estimate about 1% of companies provide this level of disclosure for their operating leases in 10-Ks and 10-Qs.

Figure 13: Altria Group Future Annual Payment Disclosure Lacks Needed Transparency in 2019 10-K

Sources: New Constructs, LLC and company filings

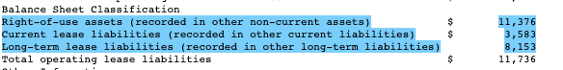

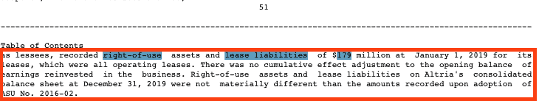

Ugly Disclosure #3: Figure 14 illustrates how Altria Group combines many of the worst disclosures from above by only mentioning operating lease/ROU assets & liabilities in a paragraph in its 2019 10-K, but providing no indication of where these items are recorded on the balance sheet. Contact us to request more details on which companies provide the best/worst disclosures in this area.

Figure 14: Altria Group Operating Lease/ROU Assets & Liabilities Lack Necessary Context in 2019 10-K

Sources: New Constructs, LLC and company filings

Ugly Disclosure #4: American Bio Medica Corp (ABMC) provides a breakdown of its future annual payments in its 2019 10-K but does not disclose the discount rate used to calculate these payments. Without disclosing the discount rate, analysts cannot judge the appropriateness of the rate used and whether the balance sheet impact of the operating leases is reasonable. In total, we estimate about 7% of companies provide this level of disclosure for their operating leases in 10-Ks and 10% in 10-Qs.

Figure 15: American Bio Medica Corp Lack of Discount Rate Disclosure in 2019 10-K

Sources: New Constructs, LLC and company filings

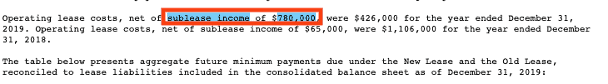

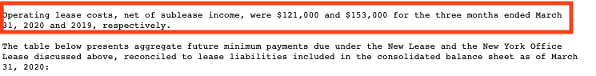

Ugly Disclosure #5: Per Figure 16, Acacia Research (ACTG) disclosed the exact amount of sublease income in its 2019 10-K, but omits this important data in its 1Q20 10-Q. Figure 17 shows how Acacia Research’s poor disclosure makes it impossible for investors to know and adjust earnings for sublease income.

Figure 16: Acacia Research Discloses Sublease Income in 2019 10-K

Sources: New Constructs, LLC and company filings

Note that when companies make no mention of sublease income whatsoever, we do not know whether or not they have sublease income. We have to assume that companies disclose the existence of any material amounts of sublease income. However, given that we see companies not disclose material information in other areas, we also have to assume that some companies with material sublease income may have it, but do not disclose it.

Without adequate enforcement of disclosure compliance, investors are unable to make fully informed decisions.

Figure 17: Acacia Research Fails to Disclose Sublease Income in 1Q20 10-Q

Sources: New Constructs, LLC and company filings

Contact us to request more details on which companies provide the best/worst disclosures in this area.

This article originally published on October 5, 2020.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.