Change Healthcare (CHNG: $23/share) – Closing Long Position – up 67% vs. S&P up 30%

We featured Change Healthcare’s Attractive rating in June 2019, right before the company went public. Unlike other IPOs at the time, the company generated consistent profits and had an undervalued expected IPO valuation. Since then, the firm’s fundamentals have been deteriorating, so we are closing our long position in CHNG.

This report leverages our cutting-edge Robo-Analyst technology to deliver proven-superior[1] fundamental research and support more cost-effective fulfillment of the fiduciary duty of care.

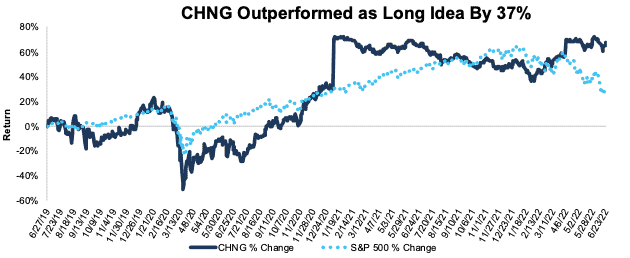

During the three-year holding period, CHNG outperformed as a long position, rising 67% compared to a 30% gain for the S&P 500.

Since going public, Change Healthcare’s fundamentals have deteriorated. It’s return on invested capital (ROIC) fell from 11% in fiscal 2018 (FYE is 3/31) to 2% over the trailing-twelve-months (TTM) while net operating profit after-tax (NOPAT) margin fell from 18% to 5% over the same time.

However, in January 2021, Optum, a part of United Health Group (UNH), agreed to acquire Change Healthcare for ~$26/share. The deal has received significant scrutiny with the Department of Justice (DOJ) first looking into the acquisition in March 2021. DOJ resistance caused the companies to extend the acquisition agreement deadline in December 2021 and again in April 2022.

The DOJ sued to block the acquisition in February 2022, and a trial is set for August 2022. Shares trade slightly below the proposed deal price, indicating investors aren’t convinced the companies will prevail in their legal arguments. With the stock up 67% since its IPO price, we think now is the time to close this winning Long Idea.

Figure 1: CHNG vs. S&P 500 – Price Return – Successful Long Idea

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

This article originally published on June 24, 2022.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Our research utilizes our Core Earnings, a more reliable measure of profits, as proven in Core Earnings: New Data & Evidence, written by professors at Harvard Business School (HBS) & MIT Sloan and published in The Journal of Financial Economics.