We closed this position on June 24, 2022. A copy of the associated Position Update report is here.

Change Healthcare (CHNG: $17.50/share midpoint of IPO price range), a healthcare software platform, is expected to IPO on Thursday, June 27. At a price range of $16-$19 per share, the company plans to sell up to $700 million in common stock and an additional $250 million in tangible equity units. At the midpoint of the IPO price range, CHNG will have an expected market cap of $5.2 billion and currently earns our Attractive rating.

Even if you’re not familiar with CHNG, there’s a good chance you’ve interacted with the company. CHNG facilitated 14 billion healthcare transactions with a total value of ~$1 trillion last year, or roughly 1/3 of all U.S. healthcare expenditures. Their customer base includes over 900,000 physicians, and they transact clinical records for over 112 million patients. In other words, the company has become an integral part of the U.S. healthcare system.

This report aims to help investors sort through Change Healthcare’s financial filings to understand the fundamentals and valuation of this IPO.

GAAP Earnings Mislead Investors

CHNG was founded in 2017 through a joint venture between Nashville-based Change Healthcare (formerly HCIT Holdings) and the Technology Solutions segment of McKesson Corporation (MCK). CHNG is a holding company that has no assets aside from its interest in the joint venture.

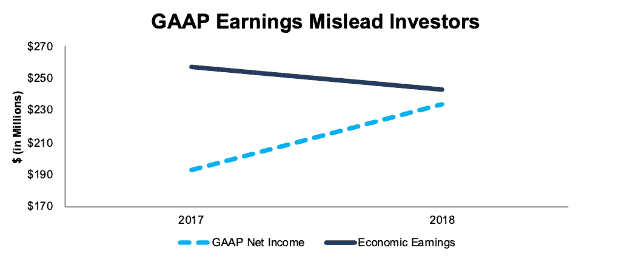

At first glance, CHNG appears to be growing rapidly. GAAP net income increased from $192 million in 2017 to $234 million in 2018, or 22% year-over-year (YoY). However, CHNG’s economic earnings – the true cash flows of the business – actually declined from $257 million to $243 million, or -5% YoY. See Figure 1.

Figure 1: CHNG GAAP Net Income and Economic Earnings: 2017-2018

Sources: New Constructs, LLC and company filings

A variety of factors – integration costs, new accounting rules, tax reform, and the sale of its Extended Care business, among others – distort CHNG’s reported earnings. In both years, the company incurred significant integration and restructuring costs that make reported earnings lower than economic earnings. The biggest items contributing to the increase in GAAP net income for 2018 are:

- $38 million in severance costs that decreased earnings in 2017

- A $111 million gain on sale that increased earnings in 2018

These items are partially offset by:

- A $50 million accretion gain that increased earnings in 2017

- A $35 million gain from tax reform that increased earnings in 2017

The decrease in economic earnings, on the other hand, can be entirely attributed to the increase in CHNG’s weighted average cost of capital (WACC) from 6.1% in 2017 to 6.4% in 2018. Net operating profit after tax (NOPAT) and invested capital – the two other components of economic earnings – both changed by less than 1% from 2017 to 2018.

Stable Cash Flows

The minimal change in CHNG’s NOPAT and invested capital suggests that the cash flows of this business should be fairly stable going forward. In addition, 88% of the company’s sales come from recurring revenue, and the business had a 100% retention rate for its top 50 payer customers and its top 50 provider customers in 2018.

As a result of this high retention rate, we would expect CHNG’s cash flows to grow in-line with U.S. healthcare spending over the long term. U.S. per capita healthcare spending has grown by 6% compounded annually since 1970 and never had a year-over-year decline in that time period, according to data from Peterson-Kaiser. The Center for Medicare and Medicaid Services projects U.S. healthcare spending will continue to grow at ~6% annually over the next decade.

On the other hand, this steady rise in healthcare costs has led to increasing calls for reform of the healthcare system, including Medicare for All plans that would abolish private insurance. A reform on this scale would put many of CHNG’s customers out of business and significantly alter the company’s business.

As a result, investors must model significant uncertainty when analyzing CHNG. If the healthcare system stays more or less the same, the company should experience consistent growth in cash flows. If, however, there is significant governmental reform, it could impact the company in a massive (and unpredictable) manner.

Public Shareholders Have No Rights

As with many other recent IPO’s, CHNG gives public shareholders no say in the governance of the company. However, CHNG locks out public shareholders from governance through a different method than the standard dual-class share structure. The company that is going public, CHNG, is a holding company with no assets aside from its economic interest in the joint venture created by McKesson and Change Healthcare. The joint venture itself, which runs the operations of the company, is controlled by these two partners, with McKesson having 70% control.

As a result, investors that buy shares in CHNG will have no ability to hold management accountable, or to stop the company from operating in a way that might benefit McKesson at the expense of shareholders.

ROIC Regression Reveals Shares Are Undervalued

Numerous case studies show that getting ROIC right is an important part of making smart investments. This paper compares our analytics on a mega cap company to other major providers. The Appendix details exactly how we stack up. The technology that enables this research is featured by Harvard Business School.

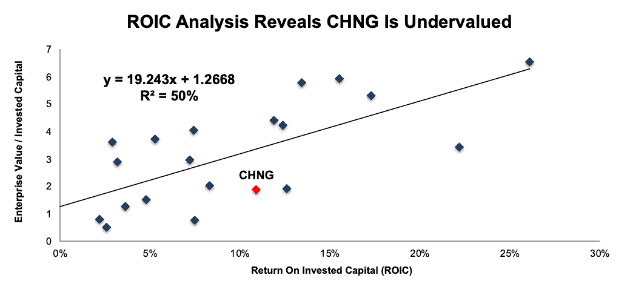

Per Figure 2, ROIC explains 50% of the difference in valuation for the 21 payment-focused software companies CHNG lists as peers in its S-1. CHNG trades at a discount to peers as shown by its position below the trend line.

Figure 2: ROIC Explains 50% of Valuation for CHNG Peers

Sources: New Constructs, LLC and company filings

If the stock were to trade at parity with its peer group, it would be worth $45/share, a 155% upside to the midpoint of the IPO range. CHNG’s valuation implies that its ROIC will decline from 11% to 3%.

DCF Model Reveals Potential Upside

At the midpoint of its IPO range, $17.50/share, CHNG has a price to economic book value (PEBV) ratio of 1.2. This ratio means the market expects CHNG to grow NOPAT by no more than 20% for the remainder of its corporate life. Given the high historical growth rate of healthcare spending, this expectation seems pessimistic.

Our reverse discounted cash flow (DCF) model quantifies the potential upside from CHNG’s cheap valuation.

If CHNG can maintain 2018 NOPAT margins of 18% and grow NOPAT by 3% compounded annually for the next decade, the stock is worth ~$23/share today, a 29% upside from the midpoint of the IPO range. See the math behind this dynamic DCF scenario.

Even if investors believe CHNG will grow at just half the rate of the overall healthcare industry, the stock still has significant potential upside.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

As investors focus more on fundamental research, research automation technology is needed to analyze all the critical financial details in financial filings. Below are specifics on the adjustments[1] we make based on Robo-Analyst[2] findings in Change Healthcare’s S-1:

Income Statement: we made $625 million of adjustments, with a net effect of removing $356 million in non-operating expense (11% of revenue). You can see all the adjustments made to CHNG’s income statement here.

Balance Sheet: we made $229 million of adjustments to calculate invested capital with a net increase of $147 million (3% of net assets). You can see all the adjustments made to CHNG’s balance sheet here.

Valuation: we made $5.1 billion of adjustments with a net effect of decreasing shareholder value by $5.1 billion. You can see all the adjustments made to CHNG’s valuation here.

This article originally published on June 25, 2019.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] This paper compares our analytics on a mega cap company to other major providers. The Appendix details exactly how we stack up.

[2] Harvard Business School Features the powerful impact of research automation in the case study New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.