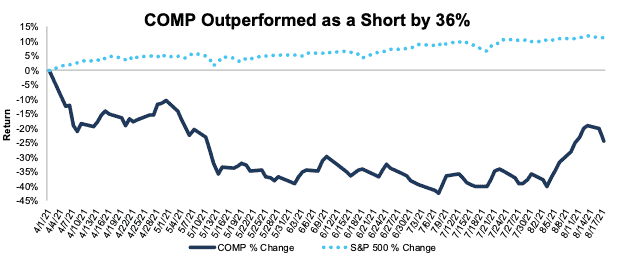

Compass Inc. (COMP) – Closing Short Position – down 24% vs. S&P up 11%

We made Compass Inc. (COMP: $16/share) a Danger Zone pick on March 29, 2021 before the firm’s IPO on April 1, 2021. At the time of the report, COMP earned an Unattractive rating. We felt the firm’s flashy marketing and ability to burn cash failed to create lasting competitive advantages, and its expected IPO valuation implied unrealistic gains in market share.

This report, along with all of our research[1], leverages our more reliable fundamental data[2] to get the truth about earnings, as shown in the Journal of Financial Economics paper, “Core Earnings: New Data and Evidence.”

During the 138-day holding period, COMP outperformed as a short position by 36% (94% annualized), falling 24% from its opening price compared to an 11% gain for the S&P 500.

Fundamentally, Compass looks no better than when we first put it in the Danger Zone in March 2021. The firm earns a -18% return on invested capital (ROIC) and burned through $501 million in free cash flow (FCF) in 2Q21. Even after falling 20% from the opening price on its IPO day, COMP remains overvalued. If we assume the firm can improve net operating profit after-tax (NOPAT) margin, grow revenue at a 10% CAGR through 2030, and take 10% of the U.S. home sale market, the stock is worth just $5.4 billion – an 18% downside to current prices.

With such strong outperformance in a short period of time, we’re taking gains and closing this short position.

Figure 1: COMP vs. S&P 500 – Price Return – Successful Short Idea

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

Return measured from opening prices on April 1, 2021, which is Compass’ IPO date.

This article originally published on August 18, 2021.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Harvard Business School features our Robo-Analyst research automation technology in the case New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.

[2] Three independent studies from respected institutions prove the superiority of our data, models, and ratings. Learn more here.