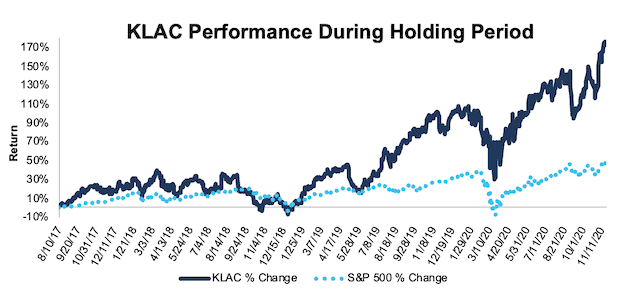

KLA Corp (KLAC) – Closing Long Position – up 175% vs. S&P up 46%

We made KLA Corp (KLAC: $243/share) a Long Idea on August 10, 2017. At the time, KLAC received a Very Attractive rating. Our long thesis highlighted the firm’s large market share, increasing net operating profit after-tax (NOPAT) margin, and favorable industry trends.

This report, along with all of our research[1], utilizes our superior data[2] to get the truth about earnings, as shown in the Harvard Business School and MIT Sloan paper, “Core Earnings: New Data and Evidence.”

During the more than three-year holding period, KLAC outperformed the S&P 500 by 129%, rising 175% compared to a 46% gain for the S&P 500.

While the firm’s return on invested capital (ROIC) has fallen from 59% in 2018 to 25% TTM, KLA’s economic earnings of $1.1 billion over the TTM are nearly equal to 2018. Even though KLA is still creating value for shareholders, its stock price is trading at all-time highs. With a price-to-economic book value (PEBV) ratio of 2.0, which is the highest since 2006, the expectations implied by KLA’s stock price have grown and we believe there is better risk/reward available in the semiconductor industry. We’re taking the gains and closing this long position.

Figure 1: KLAC vs. S&P 500 – Price Return – Successful Long Idea

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

This article originally published on November 23, 2020.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Harvard Business School features the powerful impact of our research automation technology in the case New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.

[2] Our core earnings are a superior measure of profits, as demonstrated in Core Earnings: New Data & Evidence a paper by professors at Harvard Business School (HBS) & MIT Sloan. The paper empirically shows that our data is superior to “Operating Income After Depreciation” and “Income Before Special Items” from Compustat, owned by S&P Global (SPGI).