PVH Corp (PVH) – Closing Long Position – up 75% vs. S&P up 39%

We made PVH Corp (PVH: $104/share) a Long Idea on June 10, 2020. At the time of our report, PVH earned an Attractive rating. We believed the firm’s history of profit growth, strong balance sheet, and rising market share positioned the business well to “See Through the Dip” brought on by the pandemic. Best of all, the stock traded at a historic discount and provided quality risk/reward.

This report, along with all of our research[1], leverages our more reliable fundamental data[2] to get the truth about earnings, as shown in the Journal of Financial Economics paper, “Core Earnings: New Data and Evidence.”

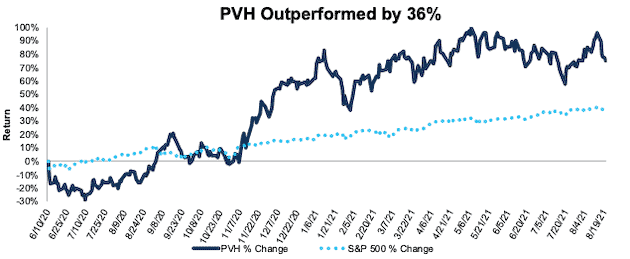

During the 1+ year holding period, PVH outperformed as a long position, rising 75% compared to a 39% gain for the S&P 500.

Our thesis largely played out as expected, as PVH Corp’s revenue and Core Earnings have rebounded in recent quarters, and its stock price followed suit. While profits have yet to recover to pre-pandemic levels, PVH Corp’s stock price has. Now, even if the firm matches consensus estimates, the stock holds little upside and looks nearly fully valued.

Due to the stock no longer trading at a historic discount and its outperformance, we are taking the gains and closing this long position.

Figure 1: PVH vs. S&P 500 – Price Return – Successful Long Idea

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

This article originally published on August 20, 2021.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Harvard Business School features our Robo-Analyst research automation technology in the case New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.

[2] Three independent studies from respected institutions prove the superiority of our data, models, and ratings. Learn more here.