Redfin Corp (RDFN) – Closing Short Position – up 187% vs. S&P up 81%

We made Redfin Corp (RDFN: $55/share) a Danger Zone pick on July 24, 2017. At the time of the report, RDFN earned an Unattractive rating. We felt the firm’s industry-low profitability, strong competition from traditional real estate brokerages, and expensive IPO valuation provided dangerous risk/reward.

This report, along with all of our research[1], leverages our more reliable fundamental data[2] to get the truth about earnings, as shown in the Journal of Financial Economics paper, “Core Earnings: New Data and Evidence.”

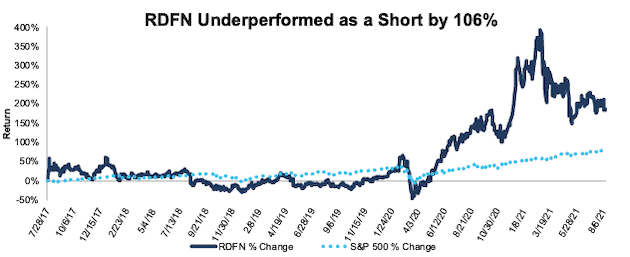

During the 4+ year holding period, RDFN underperformed as a short position, rising 187% compared to an 81% gain for the S&P 500.

We underestimated Redfin’s ability to leverage its tech-based model to use lower fees to attract clients, grow its business, and then eventually expand into the rising iBuying market. Now, Redfin just reported its first profitable year (based on net operating profit after-tax) as a public company in 2020, and its return on invested capital (ROIC) improved from -26% in 2015 to 8% over the trailing-twelve-months.

The hot housing market, which is unlikely to slow (at least until the Fed raises rates) given low supply and strong demand, could drive shares even higher. While RDFN remains overvalued, macro trends, coupled with an improving business mean the stock no longer provides quality risk/reward as a short and we’re closing this short position.

Figure 1: RDFN vs. S&P 500 – Price Return – Unsuccessful Short Idea

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

Return measured from opening prices on July 28, 2017, which is Redfin’s IPO date.

This article originally published on August 13, 2021.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Harvard Business School features our Robo-Analyst research automation technology in the case New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.

[2] Three independent studies from respected institutions prove the superiority of our data, models, and ratings. Learn more here.