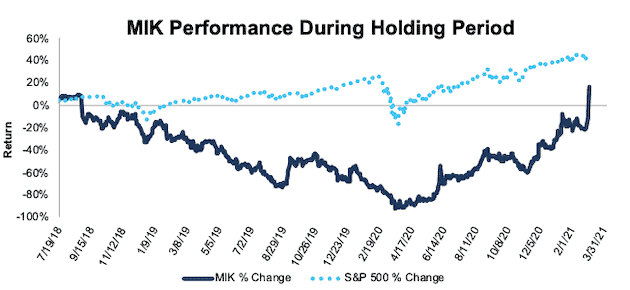

The Michaels Companies Inc (MIK) – Closing Long Position – up 16% vs. S&P up 41%

We made The Michaels Companies (MIK: $22/share) a Long Idea on June 27, 2018 and reiterated it on September 11, 2019. At the time of each report, MIK received a Very Attractive rating. Our long thesis focused on the competitive advantage physical stores provide given the high-touch nature of the arts & crafts industry and increased demand in the industry driven by apps such as Pinterest (PINS), Instagram, and Etsy (ETSY).

This report, along with all of our research[1], leverages our more reliable fundamental data[2] to get the truth about earnings, as shown in the Journal of Financial Economics paper, “Core Earnings: New Data and Evidence.”

During the 2.5+ year holding period, MIK underperformed as a long position from the date of our original report, rising 16% compared to a 41% gain for the S&P 500. Since we reiterated the idea in September 2019, MIK increased 124% while the S&P is up 26%.

After bottoming out at ~$1.50/share in March 2020, the stock rallied to $15/share before Apollo Global announced it was taking Michaels private at $22/share. As a result of the pending acquisition, we are closing this long position.

Figure 1: MIK vs. S&P 500 – Price Return – Underperforming Long Idea

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

This article originally published on March 5, 2021.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Harvard Business School features the powerful impact of our research automation technology in the case New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.

[2] Three independent studies from respected institutions prove the superiority of our data, models, and ratings. Learn more here.