Website infrastructure and security company Cloudflare (NET: $11/share midpoint of IPO price range) is expected to IPO on Friday, September 13. At a price range of $10-$12 per share, the company plans to sell up to $483 million of shares with an expected market cap of ~$3.2 billion. At the midpoint of the IPO price range, NET currently earns our Unattractive rating.

Cloudflare offers a variety of cloud-based services that used to be performed by many different on-premise solutions – such as firewalls, routing, virtual private networks (VPNs), traffic optimization, and load balancing – for businesses and websites. The company’s services have become integral to the operations of millions of websites around the world – but it has struggled to turn that global reach into positive cash flow.

This report aims to help investors sort through Cloudflare’s financial filings to understand the fundamentals and valuation of this IPO.

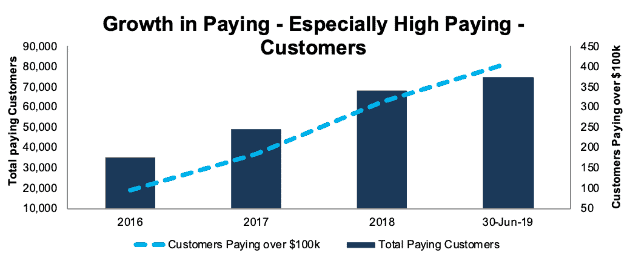

Growing Paid Customers

Like many other recent software-as-a-service (SaaS) IPO’s, Cloudflare operates on a “freemium” model. The company’s free tier protects websites from distributed denial of service (DDoS) attacks, reduces loading times, and protects certain information from malicious attacks. Paying customers get more advanced security offerings, as well as mobile optimization, faster network speeds, and a variety of other customized features.

As with any company that pursues this model, Cloudflare’s key challenge is to move its users up the value chain, getting free customers to pay and getting paying customers to pay more. The company currently provides services for over 20 million internet properties, but it only has ~75 thousand paying users.

As Figure 1 shows, though, the company has rapidly grown its paying user base over the past two and a half years, especially among its highest paying customers. Total paying customers have more than doubled, from 35 thousand at the end of 2016 to 75 thousand as of June 20, 2019. Customers that pay over $100,000 annually have more than quadrupled over the same time, from 95 to 408.

Figure 1: Total and >$100k Paying Customers: 2016-June 30, 2019

Sources: New Constructs, LLC and company filings

However, as we saw with Slack (WORK), growing paid customers doesn’t always lead to positive cash flows. Cloudflare’s revenue grew from $135 million in 2017 to $193 million in 2018, a 43% increase. Its NOPAT, on the other hand, declined from -$8 million to -$83 million.

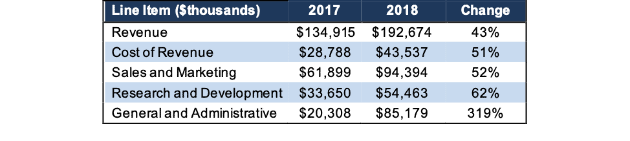

No Economy of Scale

Cloudflare’s mounting losses raise a key concern. Despite rapid top-line growth, the company does not appear to have achieved any economies of scale. As Figure 2 shows, Cloudflare’s cost of revenue, sales and marketing, research and development, and general and administrative expenses all grew faster than revenue in 2018.

Figure 2: Cloudflare’s Expenses Growing Faster than Revenue: 2018 vs. 2017

Sources: New Constructs, LLC and company filings

Part of the large increase in general and administrative expense comes from unusually high stock-based compensation expense recorded as part of a secondary stock sale, as well as IPO preparation in 2018, but these factors don’t explain all of the increase. The company disclosed that general and administrative headcount increased by 63% last year.

Through the first six months of 2019, cost of revenue, sales and marketing, and research and development expense continued to grow faster than revenue. Only general and administrative grew slower due to the unusual expenses in 2018, but it still represented 25% of revenue compared to 15% in 2017.

It’s not abnormal to see early stage companies such as Cloudflare spending heavily on marketing and R&D. What is highly unusual is the fact that the company’s cost of revenue and general and administrative costs, which should theoretically benefit from scale, are also growing rapidly. The company will need to find a way to reverse these trends in order to achieve profitability.

Tech Giants Could Be Partners, Competitors, or Acquirers

Cloudflare’s relationship with the giants of the tech world could play a major role in determining its future. Amazon (AMZN), Alphabet (GOOGL), Microsoft (MSFT), and IBM (IBM) all have major cloud platforms, and all but AMZN currently partner with Cloudflare. Google Cloud, Microsoft Azure, and IBM Cloud integrate Cloudflare into their platforms to deliver its services to their customers.

However, Cloudflare notes in its S-1 that these partnerships may be temporary. On page 143, it writes:

“Today, we work closely with these companies, some of whom are both partners and investors. In the long term, we may increasingly compete with them.”

It seems unlikely that these tech giants will want to rely on a third-party for key elements of their cloud platform over the long-term. This disclosure from Cloudflare clearly suggests they expect GOOGL, MSFT, and IBM to try to replicate its services in-house before too long.

Alternatively, any of those companies could be a potential acquirer. An acquisition would allow these large public cloud providers to more fully integrate Cloudflare’s technology into their platforms while simultaneously denying that technology to key competitors. In the race to dethrone Amazon’s AWS as the dominant cloud platform, that technological edge could prove decisive. Cloudflare’s $3.2 billion market cap would be little more than a drop in the bucket for any of those companies.

Public Shareholders Have No Rights

While an acquisition could be good for investors, Cloudflare’s poor corporate governance could derail it. The company plans to go public with a dual-class share structure that will give shares held by insiders and early investors 10 times the voting rights of the shares sold to the public. As a result, executives and directors will control 66% of the voting power in the company, preventing public shareholders from having any say in corporate governance.

This dual-class structure could allow executives to block a potential acquisition that would be in the best interest of shareholders simply because they want to remain in charge.

DCF Model Reveals High Expectations

When we use our dynamic DCF model to analyze the future cash flow expectations baked into the midpoint of the IPO price range, we find that Cloudflare must achieve impressive growth and profitability in order to justify its expected valuation.

As noted above, Cloudflare’s prospects for profitability as a standalone entity seem poor, so it makes more sense to analyze the company’s potential value to an acquirer.

To justify GOOGL paying the midpoint of its IPO range of $11/share, Cloudflare must achieve 18% NOPAT margins – equal to GOOGL and up from its current margin of -43% – and grow revenue by 30% compounded annually for 8 years. See the math behind this dynamic DCF scenario.

If Microsoft acquired Cloudflare, and the company achieved Microsoft’s NOPAT margin of 30% while maintaining the same growth rate, the stock is worth $18/share today, a 67% upside to the midpoint of the IPO price range. See the math behind this dynamic DCF scenario.

While these scenarios suggest the company could justify or even exceed its IPO valuation, they rely on acquisitions, that may never materialize, to significantly boost margins. If Cloudflare doesn’t get acquired, it becomes much harder to see how this company creates value for its IPO investors.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

As investors focus more on fundamental research, research automation technology is needed to analyze all the critical financial details in financial filings. Below are specifics on the adjustments we make based on Robo-Analyst[1] findings in Cloudflare’s S-1:

Income Statement: we made $8 million of adjustments, with a net effect of removing $4 million in non-operating expense (2% of revenue). You can see all the adjustments made to NET’s income statement here.

Balance Sheet: we made $115 million of adjustments to calculate invested capital with a net decrease of $27 million. The most notable adjustment was $44 million in operating leases. This adjustment represented 19% of reported net assets. You can see all the adjustments made to NET’s balance sheet here.

Valuation: we made $258 million of adjustments with a net effect of increasing shareholder value by $258 million. You can see all the adjustments made to NET’s valuation here.

This article originally published on September 10, 2019.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Harvard Business School Features the powerful impact of research automation in the case study New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.