Teledentistry company SmileDirectClub (SDC: $20.50/share midpoint of IPO price range) is expected to IPO on Thursday, September 12. At a price range of $19-$22 per share, the company plans to sell up to $1.5 billion of shares with an expected market cap of ~$7.9 billion. At the midpoint of the IPO price range, SDC currently earns our Unattractive rating.

SmileDirectClub launched in 2014 with a simple value proposition: teeth straightening without the cost and hassle of in-office visits to an orthodontist. The company claims to offer the same service for less than half the price and half the time of the traditional orthodontic model. This new business model has grown rapidly, but also faces significant risks from regulators and potential competitors.

This report aims to help investors sort through SmileDirectClub’s financial filings to understand the fundamentals and valuation of this IPO.

Rapid Growth Creates Enemies

SDC has grown revenue from $146 million in 2017 to $423 million in 2018, a 190% increase. Through the first six months of 2019, revenue is up 113% year-over-year. For comparison, SDC has roughly the same total revenue and growth rate as Uber (UBER) did in 2014, its fifth year of operation.

Like Uber, many question the legality of SDC’s business practices. Specifically, the American Association of Orthodontists (AAO) has lodged complaints in 36 states with state dental boards and attorneys general alleging that SDC’s service is “illegal and creates medical risks.”

The way SDC’s business model currently works is that customers – either at home or in one of its 300+ retail locations – make a bite cast (or “impression”) of their teeth that is used to develop a treatment plan. A licensed doctor reviews the treatment plan and prescribes a clear aligner, which the company manufactures and ships to the patient. Over the course of the treatment – typically five to ten months – the doctor monitors the patient’s progress through the company’s online platform, called “SmileCheck.”

In SDC’s telling, its role in this process is simply as a middleman between doctors and patients. It facilitates communication between the two parties and supplies the prescribed aligners, but it is not performing medical work itself.

According to the AAO, however, activities such as taking bite casts constitute medical work that is reserved for licensed medical professionals. In both Georgia and Alabama, the state boards of dentistry have required that a licensed dentist be present for all oral-imaging services. SDC has filed suit against these state boards on antitrust grounds, and litigation is still pending in both these matters. While the FDA and FTC – the two federal agencies that would have jurisdiction to regulate SDC - have yet to take any action against SDC on a federal level, the AAO and other organizations continue to press for more regulation.

On top of its conflict with orthodontists, SDC has had issues with its former business partner, Align Technologies (ALGN). ALGN, which manufactures the Invisalign brand of clear aligners, used to own a 17% stake in SDC, and it acted as a supplier for the company. However, SDC sued ALGN for breach of the non-compete clause in its contract after ALGN opened its own chain of Invisalign stores. A judge ruled in favor of SDC, so ALGN had to close its stores and sell its shares back to SDC for $54 million.

SDC now manufactures 100% of its aligners in house, and ALGN is barred from competing with them until 2022. However, numerous smaller competitors, such as Candid Co., Smilelove, and SnapCorrect, have recently launched with similar business models.

Realizing Economies of Scale

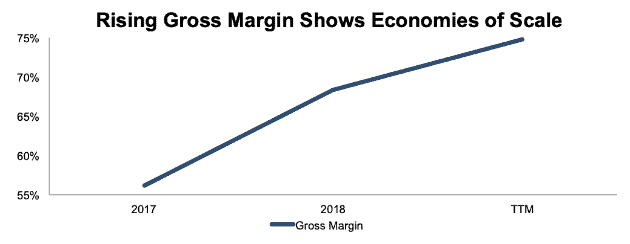

Despite the pressure from orthodontists and potential competitors, SDC has, so far, been able to grow without any real competition to its business model. As a result, the company’s gross margin has rapidly increased, as shown in Figure 1.

Figure 1: SDC Gross Margin: 2017-TTM

Sources: New Constructs, LLC and company filings

SDC’s gross margin increased from 56% in 2017 to 68% in 2018, and it has improved to 75% over the trailing twelve months (TTM) period. SDC credits this improvement in gross margin to producing more of its aligners internally, as well as increased automation.

This improvement on the cost side will be crucial to SDC’s long-term success. The company has a first-mover advantage currently, but as the competition increases it will need to continue to improve its manufacturing efficiency to retain a competitive advantage.

Increased Capital Requirements Come with Risks

While the shift to in-house manufacturing has been a boon for SDC’s gross margins, it also requires the company to invest a significant amount of capital into its operations. SDC’s property, plant, and equipment on the balance sheet increased from $12 million at the end of 2017 to $87 million as of June 30, 2019, as a result of investment in new manufacturing facilities and retail locations.

However, physical property is no longer SDC’s largest capital requirement. Instead, the company’s financing program, SmilePay, has driven the largest increase in invested capital. SmilePay allows SDC’s customers to finance their aligners – which typically cost $1,895 – for a $250 down payment and 17% APR over two years. Roughly 65% of customers use SmilePay to finance their aligners.

As a result, accounts receivable on the balance sheet now total $275 million, over half of SDC’s total assets. The valuation of the receivables on the balance sheet currently accounts for the 9% delinquency rate among the company’s borrowers, but an economic downturn could cause delinquencies to spike and significantly reduce the value of this key asset.

In the short-term, SDC’s strategy of rapidly building up its physical capital while simultaneously allowing the majority of its customers to defer payment over two years has led to a significant cash burn. SDC had free cash flow of -$309 million in 2018. With just $149 million in cash on the balance sheet as of June 30, the company clearly needs the cash infusion of an IPO in order to maintain its current growth rate.

Public Shareholders Have No Rights

SDC will go public with a dual class share structure. The shares sold to the public will be Class A shares with one vote each, while the shares held by insiders and pre-IPO investors will be Class B shares with 10 votes each. The company’s S-1 also states that, through an agreement with other Class B shareholders, CEO David Katzman will control a majority of the voting power and have sole control over the company after the IPO.

This poor corporate governance should be of extra concern for investors due to the fact that SDC has engaged in many related party transactions with affiliates of Katzman’s investment group, Camelot Venture Group. SDC paid Camelot over $3 million last year under a consulting agreement, paid over $8 million to an affiliate of Camelot for freight costs, and paid $1 million to another Camelot affiliate to lease a private plane. The company also specifically notes in its S-1 that:

“David Katzman and Camelot may engage in activities where their interests conflict with our interests or those of our stockholders.

In other words, investors have no recourse to prevent Katzman from acting in a way to benefit himself and Camelot at the expense of SDC shareholders. Beware this major red flag.

DCF Model Reveals High Expectations

When we use our dynamic DCF model to analyze the future cash flow expectations baked into the midpoint of the IPO price range, we find that SDC must achieve impressive growth and profitability in order to justify its expected valuation.

To justify the midpoint of its IPO range of $20.50/share, SDC must achieve 16% after-tax profit (NOPAT) margins – comparable to ALGN and much higher than its current NOPAT margin of -21% – and grow revenue by 41% compounded annually for 7 years. See the math behind this dynamic DCF scenario.

In this scenario, SDC would earn $4.8 billion in revenue in year 7 (2026), or 68% of the $7 billion projected market for clear aligners estimated for 2026. However, SDC claims that, by making orthodontics cheaper and more accessible, it can expand the market for its product much more rapidly, and it projects a total addressable market in the U.S. of $234 billion or over 30x greater than the estimated market potential.

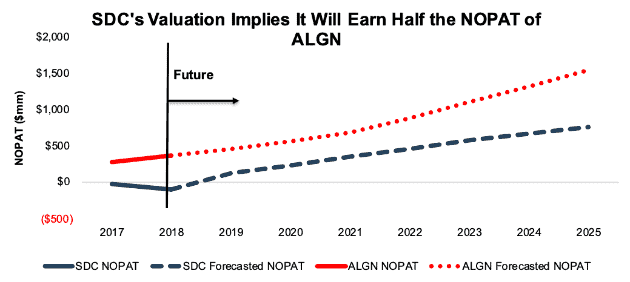

While SDC’s valuation may imply high growth expectations, it looks more reasonable when compared to ALGN’s valuation. As Figure 2 shows, SDC’s market-implied NOPAT is just half of ALGN’s.

Figure 2: Historical and Market-Implied NOPAT: SDC vs. ALGN

Sources: New Constructs, LLC and company filings

The market clearly sees high potential growth in the clear aligners market. While SDC may be expensive, it doesn’t appear particularly overvalued when compared to ALGN.

In fact, there’s an argument that SDC’s vertically integrated model should allow it to earn higher margins and justify a premium valuation. If SDC can earn a 20% NOPAT margin – similar to generic pharmaceutical manufacturers such as Amneal Pharmaceuticals (AMRX) or Endo International (ENDP) – and grow revenue at the same rate as the prior scenario, it has a fair value of $25/share today, a 22% upside to the midpoint of the IPO range. See the math behind this dynamic DCF scenario.

While the potential for upside exists with SDC, it has to be balanced with the significant risks that come with investing in an unproven business model and very expensive stock. Further, regulatory risk, credit risk, and poor corporate governance make it hard to justify buying at the IPO price despite the upside potential.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

As investors focus more on fundamental research, research automation technology is needed to analyze all the critical financial details in financial filings. Below are specifics on the adjustments we make based on Robo-Analyst[1] findings in SmileDirectClub’s S-1:

Income Statement: we made $108 million of adjustments, with a net effect of removing $58 million in non-operating income (14% of revenue). You can see all the adjustments made to SDC’s income statement here.

Balance Sheet: we made $353 million of adjustments to calculate invested capital with a net decrease of $282 million. The most notable adjustment was $208 million in excess cash. This adjustment represented 48% of reported net assets. You can see all the adjustments made to SDC’s balance sheet here.

Valuation: we made $399 million of adjustments with a net effect of increasing shareholder value by $17 million. You can see all the adjustments made to SDC’s valuation here.

This article originally published on September 9, 2019.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Harvard Business School Features the powerful impact of research automation in the case study New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.