Cooler company Yeti Holdings (YETI: $20/share midpoint of IPO price range) will IPO on Thursday, October 25. At a price range of $19-$21 per share, the company plans to sell up to $460 million of shares with an expected market cap of ~$1.7 billion. At the midpoint of the IPO price range, YETI currently earns our Unattractive rating.

This is the second attempt at an IPO for Yeti. The company initially filed for an IPO in 2016, but after a sharp downturn in its business, the company postponed its IPO and eventually withdrew its filing earlier this year. However, the company’s business has rebounded so far in 2018, and it hopes now to have a successful debut on the public markets.

This report aims to help investors sort through Yeti’s financial filings to understand the fundamentals and valuation of this IPO.

Bouncing Back from a Nightmare 2017

Yeti, which was founded by brothers Roy and Ryan Seiders in 2006, made a name for itself with its high-end coolers. These coolers are manufactured via “rotomolding,” the same process used to make kayaks. This process is much more expensive than traditional manufacturing processes, but it leads to coolers that are significantly more insulated than mass-market models.

The company initially gained traction with hunters and fishers, but in the past few years the company has gained a much broader following and expanded into drinkware, backpacks, and a wide variety of outdoor gear. However, the company chased growth too rapidly, overstocked its inventory, and pushed too much product to retailers. As a result, both the company and its distributors had far more inventory than there was demand leading into 207, and margins and revenue took a hit. Revenue declined by 22% in 2017, while after-tax operating profit (NOPAT) margins fell from 18% to 7%.

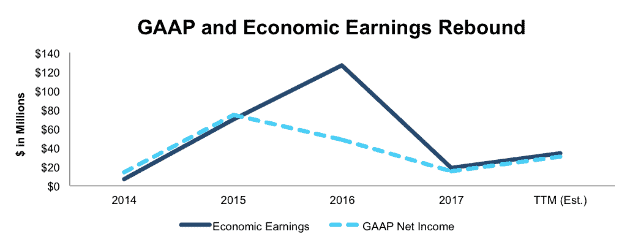

Figure 1 shows the impact that declining revenue and margins had on profitability. Economic earnings declined from $126 million in 2016 to $19 million in 2017, an 85% drop. The company’s profitability has rebounded so far over the trailing twelve-month period (TTM),[1] but it remains significantly below its 2016 peak.

Figure 1: YETI GAAP Net Income and Economic Earnings Since 2014

Sources: New Constructs, LLC and company filings

As Figure 1 shows, GAAP earnings misleadingly suggest that YETI’s profit decline was less severe, where economic earnings show a sharper decrease over just one year. This disconnect comes primarily from a $104 million charge (13% of revenue) due to the accelerated vesting of stock options in 2016.

Some of the company’s underlying numbers also suggest the current rebound in economic earnings should be sustainable. Revenue is up 34% year over year through the first six months of 2018, and inventory is at just 21% of TTM revenue, compared to 30% at the end of 2016. The company appears to have successfully sold off its excess inventory and is at a place where it can grow revenue and margins again.

The primary question now for potential investors is just how large the high-end cooler market is. Yeti and its distributors clearly overestimated the demand for $300 coolers in 2016, but it remains to be seen if the market is large enough to justify the company’s proposed IPO valuation.

Direct-To-Consumer Strategy Drives Growth

The decline in Yeti’s sales through brick-and-mortar retailers in 2017 led to a much greater emphasis on its direct-to-consumer (DTC) channels. The DTC channel – which consists of sales through its own website and its Amazon Marketplace offerings – has grown from 8% of revenue in 2015 to 30% of revenue in 2017. For comparison, the company’s single largest retail partner, Dick’s Sporting Goods (DKS), accounted for just 14% of revenue in 2017.

Transitioning from selling through brick and mortar retail partners to a primarily DTC offering brings several significant advantages for Yeti, including:

- Higher gross margins due to the lack of a middleman taking a cut of the profits

- Greater ability to manage inventory and avoid a repeat of 2017

- Increased brand loyalty as customers interact directly with the company rather than through an intermediary

There are significant logistical and technological challenges with successfully implementing a DTC strategy, but if Yeti can navigate these hurdles, it could become a more sustainable and profitable business in the long run.

Knockoffs and Competitors Pose Risks

Outside of its DTC offerings, Yeti’s primary growth strategy involves expanding its target market, both geographically and demographically.

Geographically, the company wants to expand from what it calls its “heritage” market, the Southeastern United States, into the rest of the country and around the globe. Yeti’s brand awareness has significantly grown in these non-heritage markets, especially the western U.S., and it’s already entered Canada, Australia, and Japan. Its S-1 states that the company believes it has significant growth opportunities from potential expansion into Europe and China.

Demographically, the company also wants to expand away from its core customer base of hunters and fishers. The company estimates that its customer base has evolved from 69% hunters and fishers in 2015 to just 38% in 2018.

This expansion could fuel growth, but it also reduces Yeti’s competitive advantage. Hunters and fishers genuinely need the superior insulation of Yeti’s products, but the average consumer likely doesn’t need that level of insulation and would be tempted to buy one of the slightly cheaper copycat brands.

Furthermore, Yeti already has a problem with people creating and selling knockoff versions of its product – so much so that a question about this issue is on the company’s FAQ page. Overseas expansion, especially into China, with its notorious counterfeiting, should only exacerbate this problem. Knockoff competitors might make it difficult for Yeti to maintain its prices and margins as it expands.

Public Shareholders Have No Rights

After the completion of the IPO, private equity firm Cortec Group will control a majority of the voting shares, which means public shareholders won’t have any say in the governance of the firm.

Cortec will also be the primary beneficiary of this IPO, as it plans to sell 13.3 million out of the 20 million shares being offered. The proceeds from the 2.5 million shares that Yeti itself plans to sell will go towards paying back the debt it incurred in 2016 when it paid out a $450 million special dividend, most of which went to Cortec.

YETI Is Overvalued Compared to Peers

Numerous case studies show that getting return on invested capital (ROIC) right is an important part of making smart investments. Ernst & Young recently published a white paper that proves the material superiority of our forensic accounting research and measure of ROIC. Harvard Business School features the technology that empowers this research.

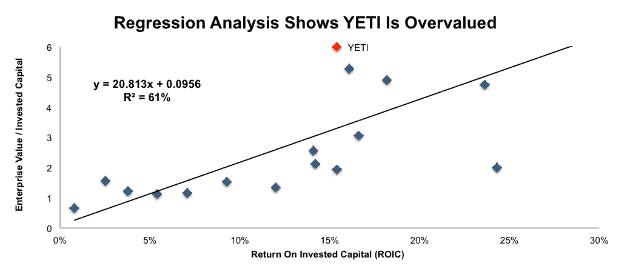

Per Figure 2, ROIC explains 61% of the difference in valuation for the 18 Recreational Products companies under coverage. YETI trades at a significant premium to its peers based on its position above the trendline.

Figure 2: ROIC Explains 61% of Valuation for Recreational Products Companies

Sources: New Constructs, LLC and company filings

Based on its enterprise value per invested capital (a cleaner version of price to book) of 6, the market expects YETI’s ROIC to increase from 15% to 28%. Notably, no other company in the industry earns an ROIC above 25%.

If YETI were to trade at parity with its peers, the stock would be worth just $8/share, a 59% downside from the midpoint of the proposed IPO range.

Our Discounted Cash Flow Model Reveals YETI Is Overvalued

When we use our dynamic DCF model to analyze the future cash flow expectations baked into the stock price, we find that YETI is overvalued at the midpoint of its IPO price range.

To justify the midpoint of its IPO range of $20/share, YETI must immediately achieve 18% pre-tax margins – equal to its 2014 level – and grow NOPAT by 15% compounded annually for 9 years. See the math behind this dynamic DCF scenario.

This scenario assumes that Yeti’s struggles are in the past, and the company can immediately return to high profitability and solid growth. We don’t think the company’s recent history or growing competition justifies such optimism.

Meanwhile, If YETI can maintain TTM pre-tax margins of 11% and grow NOPAT by 12% compounded annually for the next decade, the stock is worth just $15/share today, 25% below the midpoint of the IPO range. See the math behind this dynamic DCF scenario.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

As investors focus more on fundamental research, research automation technology is needed to analyze all the critical financial details in financial filings. Below are specifics on the adjustments[2] we make based on Robo-Analyst[3] findings in Yeti Holdings’ S-1:

Income Statement: we made $39 million of adjustments, with a net effect of removing $29 million in non-operating expense (5% of revenue). You can see all the adjustments made to YETI’s income statement here.

Balance Sheet: we made $142 million of adjustments to calculate invested capital with a net increase of $40 million. The most notable adjustment was $44 million in off-balance sheet debt (which will soon have to be reported on the balance sheet). This adjustment represented 12% of reported net assets. You can see all the adjustments made to YETI’s balance sheet here.

Valuation: we made $590 million of adjustments with a net effect of decreasing shareholder value by $508 million. Apart from $519 million in total debt – including the off balance sheet debt reference above – the most notable adjustment to shareholder value was $30 million in outstanding employee stock options. This option adjustment represents 2% of YETI’s proposed market cap.

This article originally published on October 24, 2018.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] YETI’s S-1 does not give us enough information to definitively calculate its economic earnings over the TTM period.

[2] Ernst & Young’s recent white paper “Getting ROIC Right” demonstrates the link between an accurate calculation of ROIC and shareholder value.

[3] Harvard Business School Features the powerful impact of research automation in the case study New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.