The S&P 500’s free cash flow (FCF) yield remains well above average levels on a trailing basis and is at its highest levels since 12/31/18.

This report is an abridged and free version of S&P 500 & Sectors: Free Cash Flow Yield in 3Q22 Rises to Highest Level Since 2018, one of our quarterly series on fundamental market and sector trends. The full report is available to our new Professional (previously known as Unlimited) and Institutional members.

The full version of this report analyzes[1],[2] free cash flow, enterprise value, and the trailing FCF yield for the S&P 500 and each of its sectors (last quarter’s analysis is here).

This report leverages our cutting-edge Robo-Analyst technology to deliver proven-superior[3] fundamental research and support more cost-effective fulfillment of the fiduciary duty of care.

Trailing FCF Yield Rises in 3Q22

The trailing FCF yield for the S&P 500 rose from 2.4% on 9/30/22 to 2.8% as of 11/25/22.

See Figure 1 in the full version of our report for the chart of FCF Yield for the S&P 500 from December 2004 through 11/25/22.

Just four S&P 500 sectors saw an increase in trailing FCF yield from 9/30/22 to 11/25/22.

Key Details on Select S&P 500 Sectors

With a 9.2% FCF Yield, investors are getting more FCF for their investment dollar in the Financials sector than any other sector as of 11/25/22. On the flip side, the Real Estate sector, at -4.0%, currently has the lowest trailing FCF yield of all S&P 500 sectors.

The Financials, Real Estate, Consumer Cyclicals, and Healthcare sectors each saw an increase in trailing FCF yield from 9/30/22 to 11/25/22.

Below, we highlight the Financials sector, which had the highest FCF yield as of 11/25/22.

Sample Sector Analysis[4]: Financials

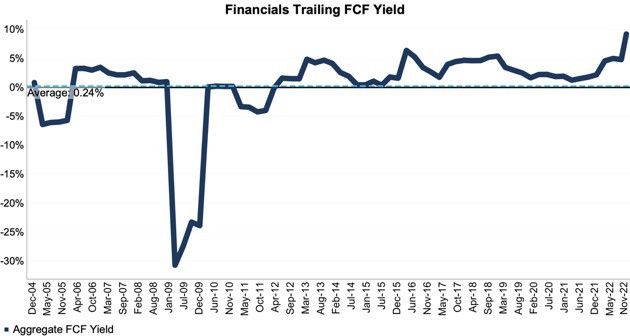

Figure 1 shows the trailing FCF yield for the Financials sector rose from 4.8% as of 9/30/22 to 9.2% as of 11/25/22. The Financials sector FCF rose from $199.1 billion in 2Q22 to $438.7 billion in 3Q22, while enterprise value rose from $4.2 trillion as of 9/30/22 to $4.8 trillion as of 11/25/22.

Figure 1: Financials Trailing FCF Yield: Dec 2004 – 11/25/22

Sources: New Constructs, LLC and company filings.

The November 25, 2022 measurement period uses price data as of that date and incorporates the financial data from 3Q22 10-Qs, as this is the earliest date for which all the 3Q22 10-Qs for the S&P 500 constituents were available.

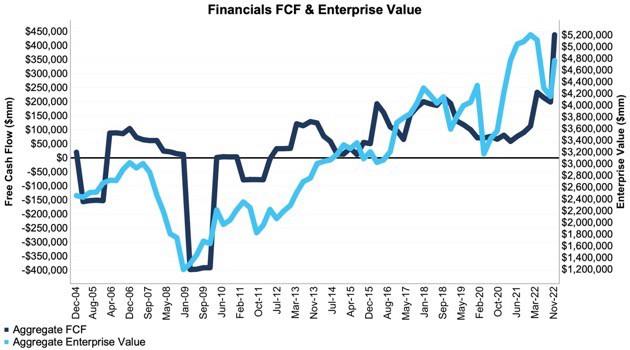

Figure 2 compares the trends in FCF and enterprise value for the Financials sector since 2004. We sum the individual S&P 500/sector constituent values for free cash flow and enterprise value. We call this approach the “Aggregate” methodology, and it matches S&P Global’s (SPGI) methodology for these calculations.

Figure 2: Financials FCF & Enterprise Value: Dec 2004 – 11/25/22

Sources: New Constructs, LLC and company filings.

The November 25, 2022 measurement period uses price data as of that date and incorporates the financial data from 3Q22 10-Qs, as this is the earliest date for which all the 3Q22 10-Qs for the S&P 500 constituents were available.

The Aggregate methodology provides a straightforward look at the entire S&P 500/sector, regardless of market cap or index weighting, and matches how S&P Global (SPGI) calculates metrics for the S&P 500.

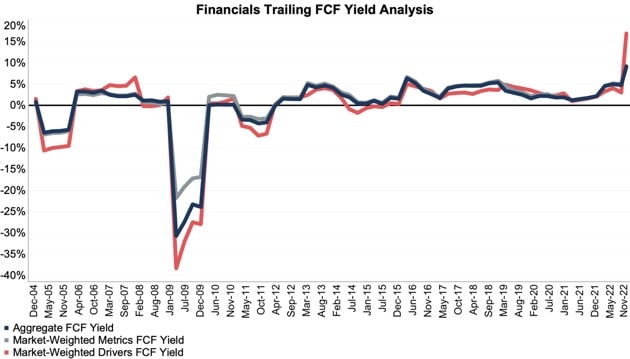

For additional perspective, we compare the Aggregate method for free cash flow with two other market-weighted methodologies: market-weighted metrics and market-weighted drivers. Each method has its pros and cons, which are detailed in the Appendix.

Figure 3 compares these three methods for calculating the Financials sector’s trailing FCF yields.

Figure 3: Financials Trailing FCF Yield Methodologies Compared: Dec 2004 – 11/25/22

Sources: New Constructs, LLC and company filings.

The November 25, 2022 measurement period uses price data as of that date and incorporates the financial data from 3Q22 10-Qs, as this is the earliest date for which all the 3Q22 10-Qs for the S&P 500 constituents were available.

This article was originally published on December 8, 2022.

Disclosure: David Trainer, Kyle Guske II, Matt Shuler, and Italo Mendonça receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

Appendix: Analyzing Trailing FCF Yield with Different Weighting Methodologies

We derive the metrics above by summing the individual S&P 500/sector constituent values for free cash flow and enterprise value to calculate trailing FCF yield. We call this approach the “Aggregate” methodology.

The Aggregate methodology provides a straightforward look at the entire S&P 500/sector, regardless of market cap or index weighting, and matches how S&P Global (SPGI) calculates metrics for the S&P 500.

For additional perspective, we compare the Aggregate method for free cash flow with two other market-weighted methodologies. These market-weighted methodologies add more value for ratios that do not include market values, e.g. ROIC and its drivers, but we include them here, nonetheless, for comparison:

- Market-weighted metrics – calculated by market-cap-weighting the trailing FCF yield for the individual companies relative to their sector or the overall S&P 500 in each period. Details:

- Company weight equals the company’s market cap divided by the market cap of the S&P 500/ its sector

- We multiply each company’s trailing FCF yield by its weight

- S&P 500/Sector trailing FCF yield equals the sum of the weighted trailing FCF yields for all the companies in the S&P 500/sector

- Market-weighted drivers – calculated by market-cap-weighting the FCF and enterprise value for the individual companies in each sector in each period. Details:

- Company weight equals the company’s market cap divided by the market cap of the S&P 500/ its sector

- We multiply each company’s free cash flow and enterprise value by its weight

- We sum the weighted FCF and weighted enterprise value for each company in the S&P 500/each sector to determine each sector’s weighted FCF and weighted enterprise value

- S&P 500/Sector trailing FCF yield equals weighted S&P 500/sector FCF divided by weighted S&P 500/sector enterprise value

Each methodology has its pros and cons, as outlined below:

Aggregate method

Pros:

- A straightforward look at the entire S&P 500/sector, regardless of company size or weighting.

- Matches how S&P Global calculates metrics for the S&P 500.

Cons:

- Vulnerable to impact of companies entering/exiting the group of companies, which could unduly affect aggregate values. Also susceptible to outliers in any one period.

Market-weighted metrics method

Pros:

- Accounts for a firm’s market cap relative to the S&P 500/sector and weights its metrics accordingly.

Cons:

- Vulnerable to outlier results disproportionately impacting the overall trailing FCF yield.

Market-weighted drivers method

Pros:

- Accounts for a firm’s market cap relative to the S&P 500/sector and weights its free cash flow and enterprise value accordingly.

- Mitigates the disproportionate impact of outlier results from one company on the overall results.

Cons:

- More volatile as it adds emphasis to large changes in FCF and enterprise value for heavily weighted companies.

[1] We calculate these metrics based on S&P Global’s (SPGI) methodology, which sums the individual S&P 500 constituent values for free cash flow and enterprise value before using them to calculate the metrics. We call this the “Aggregate” methodology.

[2] This report is based on the latest audited financial data available, which is the 3Q22 10-Q in most cases. Price data is as of 11/25/22.

[3] Our research utilizes our Core Earnings, a more reliable measure of profits, as proven in Core Earnings: New Data & Evidence, written by professors at Harvard Business School (HBS) & MIT Sloan and published in The Journal of Financial Economics.

[4] The full version of this report provides analysis for every sector like what we show for this sector.