We closed this position on November 7, 2018. A copy of the associated Position Update report is here.

Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life and MarketWatch.com.

As the owner and operator of eight racing facilities, Speedway Motorsports’ (TRK: $22/share) business is heavily tied to the popularity of racing, particularly NASCAR. Since October 2014, TRK is up over 29%, despite the business being in steep decline since 2008. Shrinking revenues, large fixed costs, and an overall decline in NASCAR attendance have Speedway Motorsports crashing into the Danger Zone this week.

Reported Results Are a Head Fake

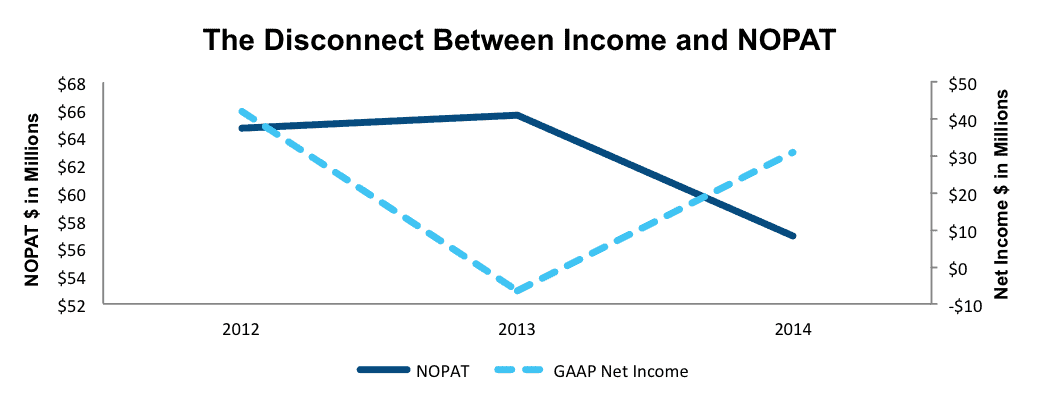

The price appreciation of TRK since last October appears to be a case of GAAP net income misleading investors. Speedway reported a loss of $6 million in 2013. A year later, the company reported a 500% rise in net income to $31 million. This net income growth is not as robust as it may appear. By depressing 2013 results with $139 million in non-operating expenses, mostly comprised by an $89 million asset write down, Speedway set up an easy comp for 2014.

By removing these non-operating expenses, we see that after-tax profit (NOPAT) was actually $65 million in 2013 and declined 13% in 2014 to $57 million. Without analyzing the footnotes to find these non-operating expenses hidden from the income statement, investors cannot get a true picture of Speedway’s profits.

Figure 1: Net Income Paints a Distorted Picture

Sources: New Constructs, LLC and company filings.

Speedway Motorsports’ performance is directly linked to NASCAR’s. Unfortunately, NASCAR’s popularity may have peaked long ago. Since 2008, the most profitable year in Speedway’s history, Speedway’s NOPAT has fallen by 12% compounded annually.

The company’s return on invested capital (ROIC) has fallen from 8% in 2008 to its current bottom-quintile 3%. In addition, Speedway’s NOPAT margin nearly halved over the same time frame, from 21% to 11%.

TV Revenue Can’t Overcome Dwindling Attendance

In 2013, NASCAR signed a 10-year television rights deal worth $8.2 billion, which is 46% higher than the previous deal. This deal was signed in spite of NASCAR’s television ratings falling 47% since 2005, the year the previous deal was signed.

Speedway Motorsports directly benefits from this new deal, as it receives a portion of its revenues from NASCAR’s broadcasting revenues. Management expects the deal, which lasts through 2024, to increase revenue by 4% annually. However, this TV deal revenue is insignificant when compared to Admissions revenue and Event Related revenue (sponsors, food/beverage, merchandise), which have been in a long-term decline.

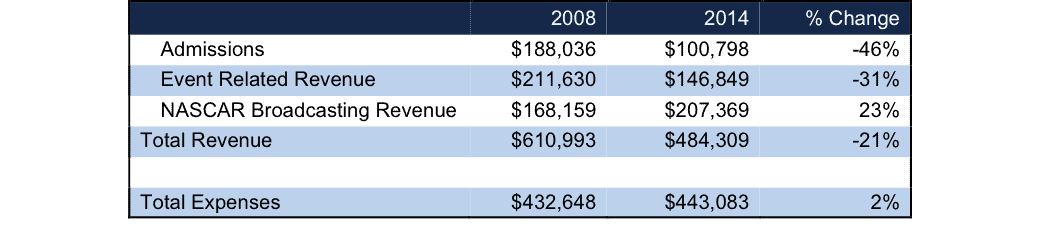

Since 2008, Speedway’s Admissions revenue has declined by 10% compounded annually and its Event Related revenue is down 6% compounded annually. Over this same time frame, revenue received from NASCAR broadcasting rights has grown by only 4% compounded annually. No new TV deal can make up for the fact that fans aren’t attending races anymore.

Making matters worse, Speedway’s costs to operate and maintain racing stadiums are relatively fixed. Fixed costs are a boon to growing businesses but a curse on shrinking ones. Even with a smaller audience to serve and the removal of entire sections of seating, expenses have not improved. Since 2008, direct event day expenses have been almost stagnant while total expenses actually increased 2%. This fixed cost structure puts pressure on Speedway, largely because any pricing tactic used to grow attendance that doesn’t grow revenue dollar for dollar will actually cost the company on the bottom line.

Figure 2: Speedway Motorsports On the Decline

Sources: New Constructs, LLC and company filings.

Bull Case is Weakened by Market Conditions

The future growth of Speedway depends not only on the popularity of NASCAR but also NASCAR’s ability to get fans attending races again. NASCAR has made many changes lately: from the way its champion is determined to entire overhauls of the racecars. However, these changes have increased neither viewership nor attendance. While bulls may point to NASCAR’s new TV deal as a positive sign, this deal does not offset the revenue loss from declining attendance, as shown in Figure 2.

NASCAR stopped disclosing attendance numbers in 2013 and it remains unclear when or if they will disclose them moving forward. The issues Speedway faces are not unlike that of other track operators International Speedway (ISCA) and Dover Motorsports (DVD). Both these companies have seen a similar drop in profits since 2008. Until NASCAR can start improving attendance, raceway operators will be left behind.

Stupid Money (Buyout) Risk

Since the company operates in such a niche market, the odds of Speedway Motorsports being bought out are low. Potential suitors would most likely be its main competitor, International Speedway. The specialized nature of the business doesn’t lend to merger activity occurring very often, if at all.

NASCAR itself could be a potential suitor as they previously purchased Iowa Speedway in 2013. However, NASCAR has made no plans to host any Sprint Cup races at the course. In addition, 33 of the 36 regular Sprint Cup races in 2015 are at courses owned by either Speedway Motorsports, International Speedway Corporation, or Dover Motorsports. NASCAR is better off not incurring the day-to-day expenses of running numerous racetracks. As such, odds of NASCAR purchasing Speedway seem low.

Impact of Footnotes Adjustments and Forensic Accounting

In order to derive the true recurring cash flows, an accurate invested capital, and a real shareholder value, we have made several adjustments to Speedway Motorsports’ 2014 10-K. The adjustments are:

Income Statement: we removed $44 million in non-operating expenses. One key adjustment made was the removal of $22 million (5% of revenue) related to the write down of assets hidden in operating line items. After removing non-operating income, the net effect of adjustments was $26 million. As shown earlier, without making this adjustment in 2013 and 2014, investors would have been led to believe 2014 was a standout year in terms of GAAP net income growth. Adjusting for non-operating items hidden in the income statement and footnotes revealed otherwise.

Balance Sheet: we made $393 million worth of balance sheet adjustments to calculate invested capital. One of the largest adjustments made was the removal of $86 million in excess cash. This adjustment represented 5% of reported net assets.

Valuation: we made $855 million worth of adjustments. The largest adjustment to shareholder value was the removal of $348 million related to net deferred tax liabilities. These liabilities represent 57% of Speedway’s current market cap.

Valuation Has Spun Out of Control

Taking into account all the above issues, it is alarming how overvalued Speedway Motorsports’ shares have become. To justify its current price of $22/share, Speedway must stabilize and maintain its NOPBT margins at 17% (the margin achieved in 2014) and grow NOPAT by 8% compounded annually for the next 17 years. Speedway grew NOPAT by 10% compounded annually from 1998 to 2008. Keep in mind that NASCAR was quite possibly the most popular it ever will be during this time period. Expecting Speedway to grow profits at such high levels again seems unrealistic.

Even if we assume Speedway is able to maintain 2014 NOPAT margins of 17% and grow NOPAT by a more reasonable 4% compounded annually over the next decade, the stock is worth only $9/share today – a 59% downside.

Catalyst for Shares

The biggest potential catalyst for Speedway, much like other recent Danger Zone stocks, is the continued decline of business operations. As attendance revenues continue dropping, and they have through 1Q15, investors will begin to realize that the NASCAR broadcasting revenues are not enough to sustain the current valuation of Speedway.

Short Interest

Short interest stands at 283 thousand shares, or less than 1% of shares outstanding.

Heavy Insider Selling, Not Much Buying

In the past 12 months, insiders have bought 158 thousand shares and sold 34 thousand shares, for a net of 124 thousand shares purchased. This figure represents less than 1% of all shares outstanding.

Executive Compensation Not Based On Profits

Speedway’s executives are paid annual cash bonuses and long-term stock awards that are tied to meeting a company defined EPS target. If Speedway’s actual EPS is more than 50% below the target, executives do not receive any bonuses. However, if Speedway achieves an EPS greater than half the target EPS executives will receive bonuses in order of magnitude that the company exceeded the target EPS. Given that EPS do not reflect cash flows and can rise despite the quality of management, we think TRK’s compensation plan does little to help this stock maintain its height.

Dangerous Funds That Hold TRK

The following mutual fund allocates significantly to TRK and earns our Very Dangerous rating.

- Centaur Total Return Fund (TILDX) — 3.2% allocation to TRK and Very Dangerous rating

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, sector, or theme.

Click here to download a PDF of this report.

Photo Credit: Raniel Diaz (Flickr)