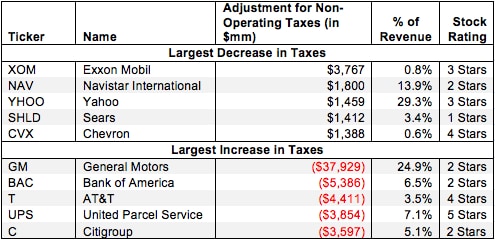

Non-Operating Tax Adjustment – NOPAT Adjustment

Without removing the tax impact of non-operating items, one still gets distorted picture of a company’s operating profitability.

David Trainer, Founder & CEO