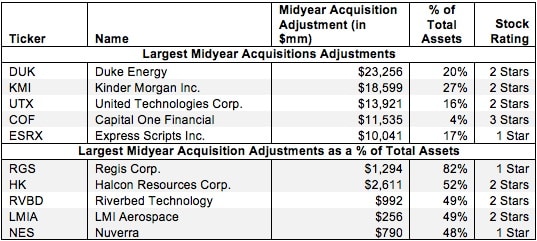

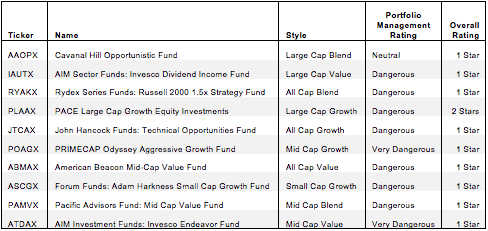

Earnings Distortion Scorecard: Week of 5/11/20-5/15/20

For the week of 5/11/20-5/15/20, we focus on the Earnings Distortion Scores for 19 companies.

Kyle Guske II, Senior Investment Analyst, MBA