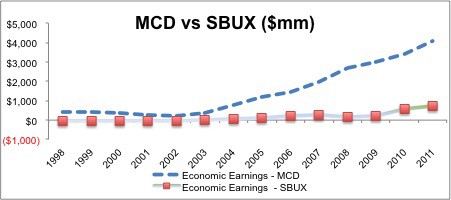

Position Close Update: McDonald’s Corporation (MCD)

With limited upside potential, we’re closing this Long Idea. McDonald’s Corporation (MCD)

Kyle Guske II, Senior Investment Analyst, MBA