There are, however, many more investors that masquerade as activists for shareholders when they are really just looking to create short-term gains for themselves. The first kind of activist can create significant value for your portfolio. The second kind tends to weaken companies in the long-term.

It’s no secret we’ve been on the opposite side of Bill Ackman’s Pershing Square Capital on many recent stock picks, such as Herbalife (HLF), Mondelez (MDLZ), and, most notably, Valeant Pharmaceuticals (VRX). We believe Ackman typifies the activist behaviors that destroy, rather than create, long-term shareholder value.

- “Serial Acquirers”

Valeant remains one of Ackman’s most prominent (and most value-destructive) positions. Valeant has a long history of acquiring other drug makers. This serial acquisition strategy looks superficially accretive due to the high-low fallacy, which allows the acquirer to artificially boost earnings per share (EPS), one of Wall Street’s most hallowed metrics.

Certain activist investors love serial acquirers because they can create the illusion of growth by indiscriminately acquiring other companies. The illusion is growth in revenues, EBITDA, or non-GAAP metrics that overlook the price paid for the acquiree, which, more often than not, is so high that the real cash flows of the deal are highly negative and dilutive to shareholder value.

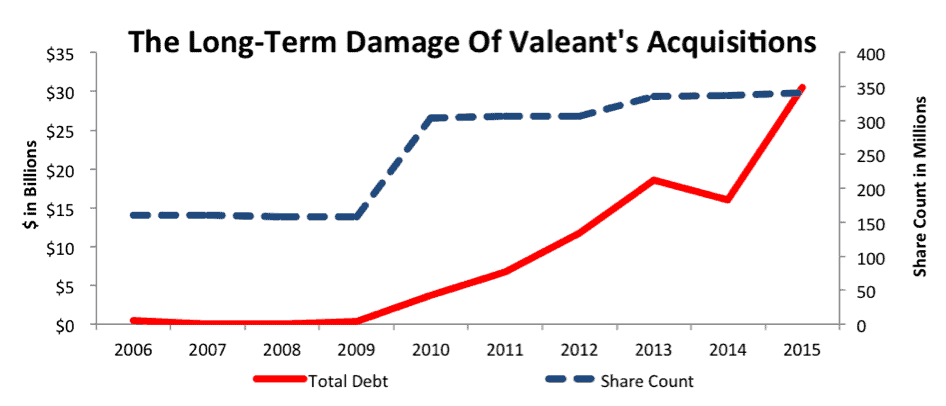

Case in point, Valeant’s debt has increased from $372 million in 2009 to $30 billion over the last twelve months (TTM). At the same time, its shares outstanding have more than doubled while its economic earnings, the true cash flows available to shareholders, have declined from $93 million in 2009 to -$685 million TTM. Valeant has finally given up on its serial acquirer strategy, but the massive debt load seriously limits the company’s strategic flexibility going forward, and the lack of cash flow from all the deals has it in trouble with its creditors.

Figure 1: Increase In Debt And Share Count For Valeant

Activists such as Ackman love to tout the “platform value” of serial acquirers. They claim these companies can unlock value from the companies they acquire through superior management. While it’s true that some companies have this capability (just look at how Disney has unlocked the value in Pixar, Marvel, and Lucasfilm), these cases are few and far between.

- Playing Both Sides Of the Deal

Another favorite Ackman strategy involves buying up shares in one company while working to help another company acquire that position. We saw this with both Allergan (AGN) and Zoetis (ZTS), two companies that Ackman bought shares in while working with Valeant on an acquisition. Beware what you hear about companies where an activist is on both side of the deal. They may be more focused on getting a quick win to boost their performance, while long-term shareholders deserve much more.

Shareholders would be better off if activists just left the company alone. Since 2012, ZTS has grown after-tax profit (NOPAT) by 20% compounded annually and increased its return on invested capital (ROIC) from 11% to a top quintile 17%. Pushing the company to accept an offer from a firm such as Valeant, with a history of value destruction, is a disservice to current shareholders not an unlocking of value.

On top of that, these acquisition dramas create unnecessary distractions from the important work of running the business. Allergan’s CEO David Pyott told CNBC that fending off Ackman and Valeant was a full-time job. The run-up in Allergan’s shares netted Ackman $2.2 billion, but one has to believe the company would have been better off with the CEO devoting his time to running the company.

- Financial Engineering

The Valeant/Allergan saga is far from the first example of Ackman extracting short-term value from a company while hurting it in the long-term. For another case-study, look at his 2005 investment in Wendy’s (WEN). Ackman convinced the fast food chain to refranchise a number of stores, sell off Tim Hortons—its most profitable business—and use the proceeds to buy back over $1 billion in stock.

The move delivered short-term gains to shareholders, and Ackman booked a nearly 100% return when he sold his shares soon after during a feud with management. Wendy’s never recovered from the loss of Tim Horton’s. Its credit rating was cut, making it more difficult to fund investment through debt, and buying back all those shares used up resources that could have helped renovate stores and keep the chain competitive with McDonald’s (MCD), where Ackman tried and failed to push through a similar plan.

Today, Wendy’s stock price remains mired below its level from before Ackman’s involvement, and the company consistently earns an ROIC near the bottom of its peer group. By focusing on financial maneuvers such as refranchising, spin-offs, and buybacks, Ackman successfully extracted short-term value from the company while hurting long-term shareholders.

- Bad Corporate Governance From Focus on Non-GAAP Earnings

The use of non-GAAP metrics is something we have warned about many times. The biggest issue with non-GAAP metrics is that management has wide discretion to add income or remove expenses, which means they can easily manipulate the non-GAAP metrics. Unfortunately, activist investors gravitate towards firms that highlight their non-GAAP metrics because it becomes easier to hide shareholder destruction in the short-term.

Unsurprisingly, Valeant was one of the biggest proponents of non-GAAP metrics. The company’s executives bonuses were tied to a non-GAAP metric they called “Cash EPS” that excluded costs related to acquisitions, as well as stock-based compensation.

Valeant is far from the only example of lax corporate governance on non-GAAP issues. Take for example, Jarden Corporation (JAH), a firm Ackman voiced strong support for in May 2015. We put Jarden in the Danger Zone in October 2015 due in part to its use of non-GAAP metrics for executive compensation.

As long as the firm pays executives based on “adjusted EPS,” which conveniently removes certain restructuring and acquisitions costs, JAH will continue to destroy shareholder value. Jarden also fits the description of serial acquirer and takeover target when it agreed to a deal with Newell Rubbermaid in December 2015.

“Unlocking Value” Misses Opportunities

Valeant might be in the news more of late, but one of Ackman’s most high profile positions might be Herbalife (HLF), about which he released details in a 342 slide presentation in late 2012. We highlighted the strengths of Herbalife’s business in August 2013 and despite continued criticism, the company continues to counter each of Ackman’s claims, as well as investigations by the SEC. Instead of going to $0/share, as Ackman predicted, HLF increased over 144% in 2013 and remains up over 80% since Ackman first announced his position.

We noted the strength of Herbalife’s business in our report and the thesis hasn’t changed. Over the past decade, Herbalife has grown NOPAT by 15% compounded annually and increased its ROIC from 21% to a top quintile 32% over the same timeframe. Best of all, Herbalife remains undervalued. At its current price of $55/share, HLF has a price to economic book value (PEBV) ratio of 1.4. This ratio means that the market expects Herbalife to only grow NOPAT by 30% over the remainder of its corporate life. If Herbalife can grow NOPAT by just 7% compounded annually over the next decade, the stock is worth $80/share today – a 37% upside.

Activists Should Play A Positive Role… But They Don’t

There is no shortage of targets out for activists that truly want to unlock long-term value. Many companies have misguided executive compensation plans that push management towards acquisitions and other activities that destroy shareholder value. Just look at how misaligned executive compensation plans helped push profitable Men’s Wearhouse (TLRD) into the disastrous acquisition of Jos. A. Bank.

Activists have more opportunity than ever to push back against misaligned executive compensation plans. The Dodd-Frank Act in 2010 requires all companies to allow “Say On Pay” votes where shareholders can make their voices heard on executive compensation.

We’d love to see activists with the resources to take on big companies make a push to better align executive compensation with long-term shareholder value. We have compelling proof in the form of AutoZone (AZO) that linking executive compensation to ROIC can help companies deliver market-beating returns.

Unfortunately, activists seem to be going the opposite direction. Between 2009-2014, fewer activist campaigns targeted issues surrounding executive compensation and corporate governance. Instead, activists radically increased their demands for buybacks, spin-offs, acquisitions, and other feats of financial engineering.

Activists also seem to be taking a short-term on their investments. 84% of all activist investments last less than two years, according to FactSet.

The good news? These types of activists have underperformed this year. Ackman has led the pack downward. Even before Valeant dropped 50% in March, his losses in 2015 and 2016 had already erased any gains he made in 2014.

Maybe this underperformance will push activists away from the financial engineering and towards more substantive changes that truly benefit shareholders.

Until then, don’t listen to activist investors claiming they can unlock value unless they articulate a focus on ROIC and long-term cash flows. Look past the typical noise and focus on fundamentals. Find companies that consistently generate profit, earn a quality return on invested capital, and have a stock price where expectations for future cash flows are low.

Disclosure: David Trainer and Sam McBride receive no compensation to write about any specific stock, sector, style, or theme.

Click here to download a PDF of this report.

Photo Credit: www.gotcredit.com (Flickr)