We published an update on MCD on May 4, 2022. A copy of the associated Earnings Update report is here.

We published an update on MCD on May 5, 2021. A copy of the associated Earnings Update report is here.

We closed the TTC and APH positions on November 18, 2020. A copy of the associated Position Update report is here.

The market’s record volatility shows no sign of letting up, and further downside may be ahead. Misleading accounting earnings beats can no longer prop up valuations, trade tensions create an uncertain future, and economic earnings across the market continue to decline.

However, it’s not all bad news for investors. Over the long-term, market corrections present great money making opportunities. Now that our unconflicted and comprehensive fundamental research is widely accessible, investors are better equipped to buy quality companies at cheap prices during bear markets.

This week, we’re highlighting three stocks that aren’t necessarily great buys now, but could be if a market correction knocks their prices down. These three stocks – McDonald’s Corporation (MCD: $185/share), The Toro Company (TTC: $62/share) and Amphenol Corporation (APH: $90/share) – are this week’s Long Ideas for any dry powder you might have after a market correction.

Focus on ROIC – It Drives Valuations

The winners both during and after a market crash, as we have shown, tend to be companies that earn a high return on invested capital (ROIC). Furthermore, there is a strong correlation between improving ROIC and increasing shareholder value. To that end, we began our search looking for companies with consistently high ROICs.

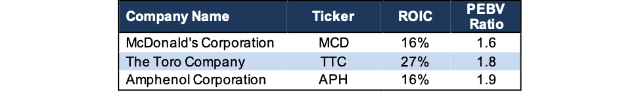

In addition to high ROICs, the firms below have a history of rising economic earnings and positive free cash flow. Each of these companies are high-quality, value creating businesses. However, as Figure 1 shows, their price to economic book value (PEBV) ratios show that the market still expects a significant amount of growth from these companies. PEBV compares the current valuation of a company to its zero-growth value, so a PEBV of 1 would mean that the market expects the company’s cash flows to stay flat into perpetuity.

Figure 1: Three Stocks Worth Buying Should Prices Decline

Sources: New Constructs, LLC and company filings

These companies are still less expensive than the S&P 500 – with a PEBV of 2.5 – but more expensive than the stocks we typically recommend. Our rating system considers a PEBV below 1.6 to be “Attractive” and a PEBV below 1.1 to be “Very Attractive”. Each of these stocks looks Attractive or Very Attractive based on the quality of their earnings, but they need cheaper valuations to earn an overall Attractive rating.

McDonald’s Corporation (MCD)

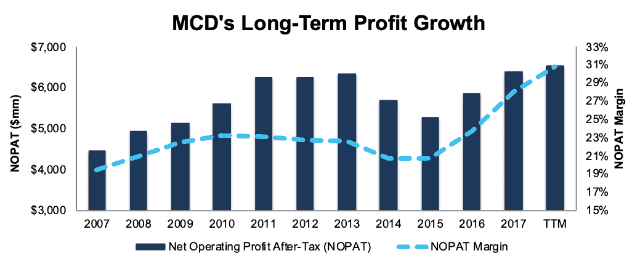

McDonald’s has been a favorite company of ours for quite some time. Despite fluctuations within the fast food industry, changes in consumer trends, and macro-economic conditions, McDonald’s has outperformed its competition. Over the past decade, the company has grown after-tax profit (NOPAT) by 4% compounded annually and increased its NOPAT margin from 19% in 2007 to 31% TTM. The company has earned a double-digit ROIC in every year beginning in 2005, currently earns a top-quintile 16% ROIC, and has generated $28.7 billion (20% of market cap) in cumulative free cash flow over the past five years.

Figure 2: MCD’s NOPAT and Margin Since 2007

Sources: New Constructs, LLC and company filings

With over 37,000 restaurants in 120 countries, McDonald’s distribution and global reach is largely unmatched within its industry. Of the 38 Restaurants & Bar firms under coverage, MCD has the second highest ROIC and fifth highest NOPAT margin. Wendy’s (WEN), one of MCD’s closest competitors earns a bottom-quintile 4% ROIC (1/4th of MCD) and a 13% NOPAT margin (less than half MCD).

At its current price of $185/share, MCD has a price-to-economic book value (PEBV) ratio of 1.6. A 15% decrease in stock price to ~$157/share would give MCD a more reasonable PEBV of 1.3.

In this scenario, MCD would earn an Attractive Risk/Reward rating, up from the Neutral rating it earns now. Even at its current valuation, MCD investors still benefit from a 2.5% dividend yield and 42 consecutive years of dividend increase. A market correction would make this high-quality company an even more attractive stock.

If we assume MCD can maintain current NOPAT margins (31%) and grow NOPAT by just 4% compounded annually for the next decade, the stock is worth $190/share – just 3% above the current price, but a 21% upside from $157/share. See the math behind this dynamic DCF scenario here.

The Toro Company (TTC)

As a manufacturer of turf maintenance, landscaping, and snow/ice management equipment, The Toro Company isn’t a flashy name. However, a lack of hype does not mean TTC’s business is not impressive.

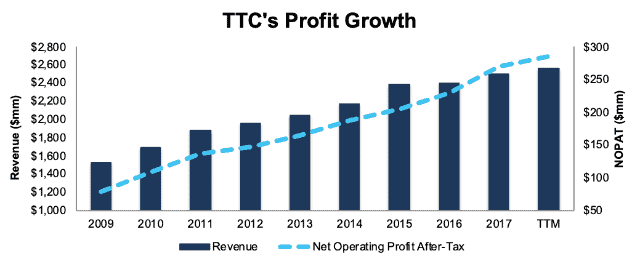

Since 2009, TTC has grown revenue by 5% compounded annually and NOPAT by 6% compounded annually. TTM NOPAT is up 13% over the prior TTM period. The firm’s NOPAT growth can be attributed to its rising profitability, as its NOPAT margin has increased from 5% in 2009 to 11% TTM while its ROIC improved from 12% to 27% over the same time.

Figure 3: TTC’s Revenue & NOPAT Since 2009

Sources: New Constructs, LLC and company filings

With ~70% of TTM revenue coming from its professional markets, Toro’s revenue largely comes from golf course management firms, landscape contractors, sports field and grounds managers, and local governments managing roads, landscaping, and irrigation. Toro has leveraged its expertise in landscape equipment to carve out a highly profitable market position. Of the 23 Equipment & Machinery firms under coverage, Toro earns the highest ROIC and the fourth highest NOPAT margin.

At its current price of $62/share, TTC has a PEBV of 1.8. A 25% decrease in TTC’s stock price to ~$46/share would give the stock a PEBV of 1.3 and better risk/reward. We’d rather buy TTC after a correction than the current price, when significant profit growth is already priced in.

If TTC can maintain TTM pre-tax margins (15%) and grow NOPAT by just 6% compounded annually for the next decade, the stock is worth $57/share today – 4% below the current stock price, but a 24% upside from $46/share. See the math behind this dynamic DCF scenario here.

Amphenol Corporation (APH)

As a provider of electrical and fiber optic connectors used in automobiles, industrial machinery, Internet of Things devices, and more, APH garners a premium valuation like many technology firms. However, APH stands out vs. peers due to its high ROIC and history of value creation.

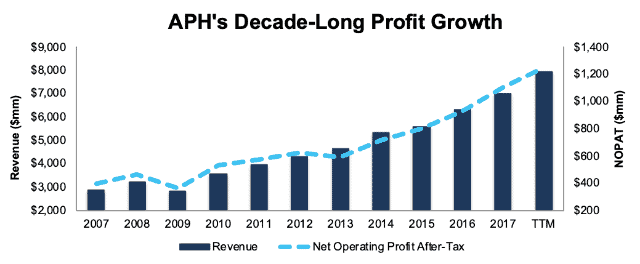

Over the past decade, APH has grown NOPAT by 11% compounded annually while improving its NOPAT margin from 14% to 16%. TTM NOPAT is up an impressive 19% year over year. It has earned a double-digit ROIC in every year since 2003 and currently earns a 16% ROIC.

Figure 4: APH’s Rising Profits Over Past Decade

Sources: New Constructs, LLC and company filings

Amphenol’s strong profit growth is a credit to its strong position in rapidly growing industries and its diversification within the technology sector. In 3Q18, no one segment (out of eight) accounted for more than 20% of sales. With segments ranging from Military to IT & Communications to Automobiles, APH is well-suited to weather a downturn in any one end market.

Best of all, each of APH’s segments are exhibiting strong growth as the number of interconnected devices grows each day. In 3Q18, its three biggest segments, IT & Communications (20% of sales), Industrial (19% of sales) and Mobile Devices (18% of sales) grew 18%, 12%, and 30% year-over-year, respectively. Its Automotive segment (17% of sales) also grew 10% YoY.

Similar to MCD above, APH’s ability to convert this revenue growth into profits is nearly unmatched by peers. Of the 19 Electronic Equipment & Parts firms under coverage, APH has the second highest NOPAT margin and third highest ROIC.

At its current price of $90/share, APH has a PEBV of 1.9. A 25% decrease in APH’s stock price to ~$67/share would give the stock a PEBV of 1.4 and much better risk/reward. We’d rather buy APH after a correction than the current price, when significant profit growth is already priced in.

If APH can maintain TTM pre-tax margins (21%) and grow NOPAT by just 9% compounded annually for the next decade, the stock is worth $82/share today – 4% below the current price, but a 22% upside from $67/share. See the math behind this dynamic DCF scenario here.

The Importance of Quantifying Expectations

At the end of the day, despite the initial scare factor of a correction, a decline in these companies’ stock prices would change very little about the strength of their businesses. When searching for value, it’s important to understand the expectations already baked into a stock price. Only then can you truly assess whether a firm is under or overvalued.

While these three firms’ stock prices may continue to rise due to their already strong cash flows, overpaying for them now could hurt your performance. Waiting for companies to fall to attractive price levels can make a world of difference for a portfolio. Ultimately, these are some great companies, but too expensive to be good stocks. If the market crashes, keep an eye on these stocks as potential investments when the price is right.

This article originally published on December 5, 2018.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.