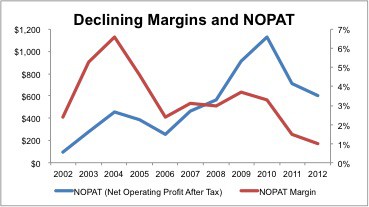

All Cap Index & Sectors: ROIC Vs. WACC Through 1Q21

This report presents the drivers of economic earnings (ROIC, NOPAT margin, invested capital turns, and WACC) for our All Cap Index and each of its sectors.

Alex Sword