“SpaceX has a rocket blow up on the launch pad, but it’s ok because now they’re going to colonize Mars.” – Sam McBride of New Constructs

The escalating promises from Elon Musk are running out of credibility. Words alone cannot fix the fact that Tesla (TSLA: $198/share) is quickly running out of cash, faces a strengthening competitive market and has extreme optimism baked into the current valuation of the stock. You know sentiment is shifting against Tesla when savvy short sellers like Jim Chanos join the fray. For all but the cult followers, frankly, shorting Tesla is an easy call given the hype in the valuation of the stock.

Issue #1: Cash Losses Accelerating

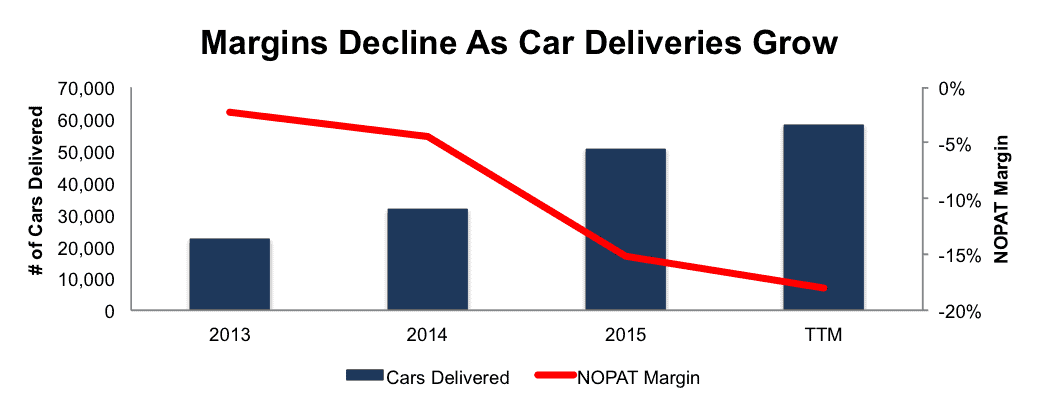

In terms of true profits (as opposed to GAAP or non-GAAP profits), Tesla has never been profitable. The company’s economic earnings have declined from -$195 million in 2010 to -$1.4 billion in 2015 and -$1.7 billion over the last twelve months (TTM). The rapid decline in economic earnings comes despite revenue growing 103% compounded annually from 2010-2015. Further highlighting the profitability issues at Tesla, the company’s after-tax profit (NOPAT) margin has deteriorated from -2% in 2013 to -18% TTM, while the number of cars delivered has nearly tripled, per Figure 1.

Figure 1: NOPAT Margins Heading The Wrong Direction

Sources: New Constructs, LLC and company filings.

Issue #2: Non-GAAP Masks Severity of Losses

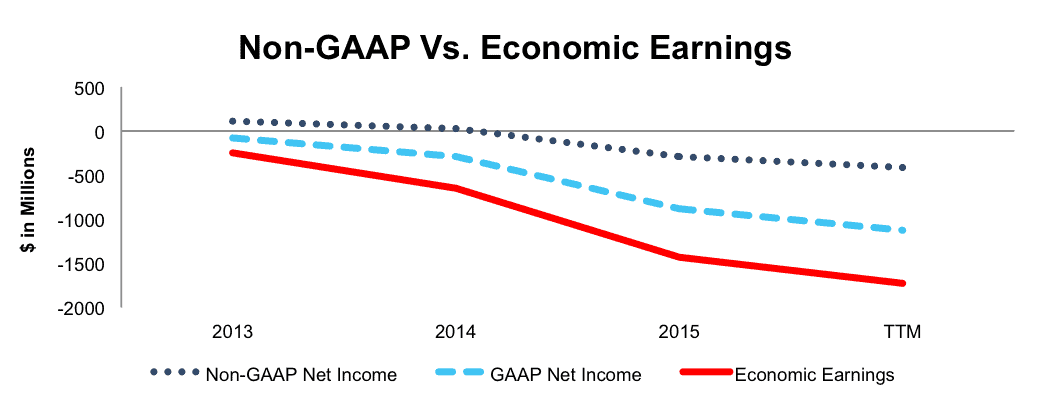

We’ve previously identified (as has the SEC) Tesla as one of the worst offenders when it comes to use of misleading non-GAAP metrics. Non-GAAP metrics allow a company to mask the severity of losses or even create the illusion of profitability. Tesla’s non-GAAP metrics greatly overstate the true condition of the firm. Per Figure 2 below, Tesla reported a non-GAAP loss of -$294 million in 2015, despite economic earnings reaching -$1.4 billion in the same year.

Figure 2: Discrepancy Between Non-GAAP & Economic Earnings

Sources: New Constructs, LLC and company filings.

Tesla’s decision to remove stock-based compensation from its non-GAAP metrics accounts for much of the discrepancy seen in Figure 2. In 2015, the company removed $198 million (5% of revenue) in stock-based compensation expense when calculating its non-GAAP net income. Furthermore, Tesla’s $3.3 billion employee stock option liability shows the company that trying to ignore these costs does not work. If Tesla were in a decent financial position, it wouldn’t have to rely on stock options to pay its employees, which brings us to issue #3, Tesla’s significant cash burn.

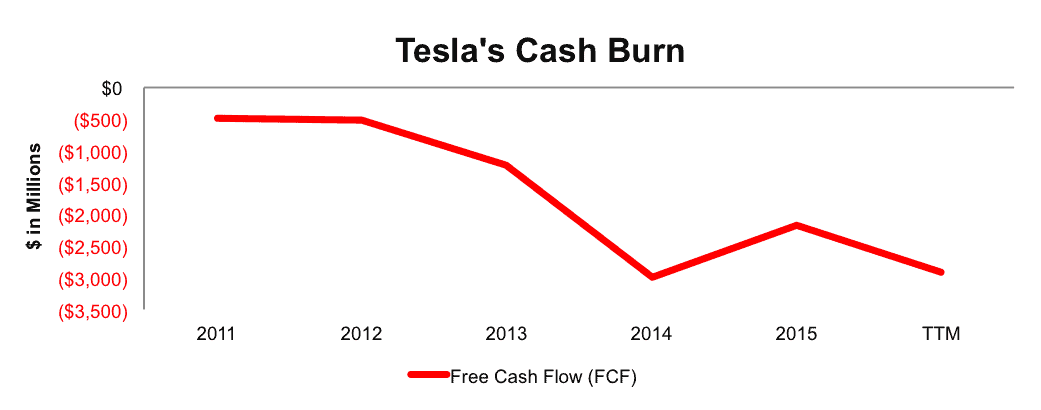

Issue #3: Burning Through Cash & Constant Need For Capital

It’s no secret that building a car company from the ground up requires significant capital. However, Tesla’s cash drain shows no signs of slowing as the company ages. Since 2011, Tesla has burned through cumulative $7.4 billion in cash. The rate of cash burn is only accelerating, per Figure 3. In 2015, TSLA’s free cash flow (FCF) sat at -$2.2 billion and over the last twelve months, FCF has worsened, to -$2.9 billion. Don’t expect this cash drain to stop anytime soon, as Oppenheimer estimates TSLA will need $12.5 billion by the end of 2018 to manage a combined TSLA & SCTY, despite Elon Musk’s claim that a capital raise would not be needed in 2016.

Figure 3: Tesla’s TTM Free Cash Flow Is -$2.9 Billion

Sources: New Constructs, LLC and company filings.

It’s important to note that Wall Street and investment banks love the large cash burn because it means big money when TSLA raises more capital. Were Tesla to raise capital again, it would be the seventh capital raise since 2012. Tesla has raised more than $6.5 billion in these issuances, which include:

- $222 million in October 2012 through an equity sale.

- $1.1 billion in May 2013 through debt and equity offerings

- $2.3 billion in February 2014 in convertible debt

- $750 million in June 2015 as a credit line

- $738 million in August 2015 through an equity sale.

- $1.46 billion in May 2016 through an equity sale.

Investment banks make big money when helping companies raise capital; so you should not be surprised to see positive ratings on TSLA from Wall Street analysts. Meanwhile, investors are increasingly diluted.

Going forward, the Solar City (SCTY) acquisition looks to make the cash burn much worse, which brings us to issue #4, corporate governance regarding the SolarCity acquisition.

Issue #4: Questionable Governance Surrounding SolarCity Acquisition

When TSLA and SCTY shareholders vote on the proposed merger on November 17, investors need to question whether this merger is just another promise by Musk to distract from larger issues facing both companies.

We’ve previously raised concerns about Tesla’s proposed acquisition of SolarCity (SCTY). When the deal was announced, Tesla would be paying $27.50/share for SCTY, at which price the deal would earn TSLA a -9% ROIC. At the same time, we found that in order to earn an ROIC equal to its weighted average cost of capital (WACC), the most TSLA should pay for SCTY was ~$3/share. More recently, noted short-seller Jim Chanos called the acquisition “a shameful example of corporate governance at its worst”, and he makes an important point. Apart from the dumbfounding misallocation of capital, there is significant overlap between the executives and board members of both TSLA and SCTY. Acquiring, or rather bailing out SCTY, a previous Danger Zone stock, not only allows Elon Musk to save the company from potential bankruptcy, but also helps line the pockets of executives along the way.

We also find it odd that Tesla chose not to disclose plans to buy SCTY during its most recent equity sale. We believe investors would have been less willing to buy shares knowing that TSLA would be paying a significant premium to purchase a money losing company. Misallocations of capital and withholding material information aside, one of the biggest issues facing Tesla comes from outside the company, which brings us to issue #5, increasing competition

Issue #5: Profitable Competitors Are Now Entering The Market

A month after our initial report on Tesla, we followed up with short commentary on General Motors’ (GM) plans to introduce an all-electric vehicle. At the time, Tesla’s affordable mass-market car was still only a rumor, and later turned out to be the Model 3. As it turned out, GM was only one of many automobile manufacturers readying electric or hybrid vehicles to compete directly with Tesla. In fact, nearly all major auto firms are either producing electric vehicles, such as the Audi A-3 e-tron, BMW i3, Chevrolet Volt, Ford Fusion Energi, Nissan LEAF, Volkswagen e-Golf or the Toyota Prius, or have plans to do so in the near future.

More recently, Chevrolet announced details surroundings its mass-market electric vehicle, the Chevy Bolt. The Bolt is expected to have a greater mileage range than Tesla’s Model 3 (based on Tesla’s initial range expectation) and is expected to reach dealerships in late 2016, nearly a year before Model 3 deliveries begin.

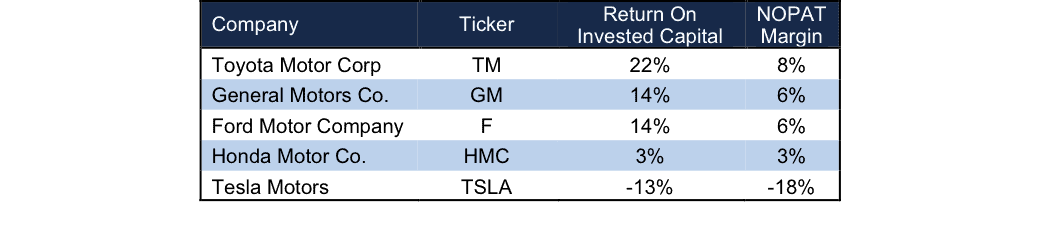

While one can debate the competitors’ cars’ aesthetics, or whether Tesla can meet its aggressive delivery schedule, the one fact that is not debatable is that each of these competitors runs significantly more profitable operations. Per Figure 4, Tesla’s NOPAT margin and ROIC fall well below Toyota (TM), General Motors (GM), Ford (F), and Honda (HMC).

Figure 4: Tesla Faces Uphill Battle With Competitors

Sources: New Constructs, LLC and company filings.

The large incumbents may not have embraced the electric car as quickly as Tesla. However, each had the operating flexibility (other profitable combustion vehicles) of waiting for Tesla to prove that the electric market was sustainable and worthy of significant investment. The more profitable competition can now ramp up investment, leverage years of manufacturing experience, and create economies of scale to catch and, possibly, surpass Tesla.

At the end of the day, Tesla could still be the leader in all-electric vehicles, yet fail to reach the expectations already embedded in its stock price. Herein lies the biggest issue with TSLA, its valuation. The current stock price implies significant profit growth despite increasing competition, negative margins, and worries over cash flow, which brings us to issue #6, TSLA’s sky high valuation.

Issue #6: Sky High Valuation Implies Unrealistic Expectations

We’ve touched on TSLA’s overvaluation in the past, and the stock has fallen 12% year-to-date. However, even if one chooses to ignore the cash burn, the large amounts of capital needed to ramp up production of the Model 3, and the ever-growing competition, the stock remains greatly overvalued.

To justify its current price of $198/share, Tesla must immediately achieve 6% NOPAT margins (equal to Ford & General Motors, compared to the current -18%) and grow revenue by 39% compounded annually for the next 12 years. In this scenario, Tesla would be generating over $214 billion in revenue 12 years from now, which is greater than Ford and GM’s 2015 revenue, and nearing Toyota’s (2015’s largest global automaker) 2015 revenue. As noted above, this scenario also assumes Tesla is able to grow revenue and NOPAT/free cash flow without spending on working capital or fixed assets. Using this assumption allows us to create a truly best case scenario and highlight just how overvalued TSLA remains. For reference, Tesla’s invested capital has grown on average $1.2 billion (30% of 2015 revenue) per year since 2011.

Even if Tesla were able to immediately achieve 6% NOPAT margins and grow revenue by 33% compounded annually for the next decade, the stock is worth only $76/share today – a 62% downside. This scenario also assumes Tesla is able to grow revenue and NOPAT/free cash flow without spending on working capital or fixed assets.

The argument here is not whether there’s opportunity for Tesla to carve out a sizeable niche in the electric market. The argument is whether it is prudent to bet on Tesla achieving anything close to the expectations for future cash flows embedded in its current stock price.

To expect Tesla to achieve margins equal to some of the largest automakers in the world, while growing revenues over 30% per year seems overly optimistic. We believe Tesla might achieve one or the other, but certainly not both. We think the joy ride this stock has given investors over the years could come to an abrupt end. Holding this stock at these levels exposes investors to more risk than we believe prudent for almost any investor.

Fundamentals Always Catch Up: Watch Out Below When It Happens

Tesla’s share price over the past few years is the perfect example of the popularity of momentum investing. The stock trades on headlines and press releases while the fundamentals are largely ignored. However, as those headlines shift from praises of Tesla’s future to questions surrounding its present operational ability, we believe the market sentiment is shifting. The days when investors ignored large, fundamental issues have passed. And recently, numerous questions have entered the headlines on Tesla, including concerns about:

- The ability to meet its production goals

- The ability to meet the Model 3 delivery date, especially given delays in production of previous models

- The safety of it cars, including the autopilot features

- The ability to produce mass-market cars profitability, given Tesla’s margins have only declined while selling cars twice the price of the upcoming Model 3.

The recent shift in market sentiment means investors have stopped blindly ignoring the fundamental holes in Tesla’s business model. Even Elon Musk has acknowledged the shift.

Q3 Results Will Be a Big Catalyst

In a late August email to employees, he pushed staff to rally around boosting sales and cutting costs, in order to show positive GAAP profits and “throw a pie in the face of all the naysayers on Wall Street who keep insisting that Tesla will always be a money-loser.” This email was followed by a report from Pacific Crest noting “aggressive Model S discounting to maximize Q3 deliveries.”

Furthermore, in that August email, when referencing the need for additional capital, Mr. Musk noted “we will be in a far better position to convince potential investors to bet on us if the headline is not “Tesla Loses Money Again”, but rather “Tesla Defies All Expectations and Achieves Profitability.” Unfortunately for Mr. Musk, achieving profitability would not defy expectations by any means, because as shown above, the current market expectation already implies Tesla will be wildly profitable.

Nonetheless, it should come as no surprise that Tesla reported record Q3 deliveries, considering Mr. Musk’s email combined with the report of aggressive discounting mentioned above. What the press release failed to address was the detrimental impact on company margins. We already know that Tesla was pushing to show profitability and improve sentiment around another capital raise. However, if Q3 results show that margin’s declined and the sales push only helped the top line, how can one make an argument that Tesla will be profitable anytime in the near future?

Creating unsustainable profitability through discounting is not a long-term solution to any of the issues noted above. At the same time, such a practice is only a drop in the huge bucket of expectations baked into its current stock price. When Q3 results are released, a decline in margins could be the tipping point that sends shares sliding as the market realizes that even Tesla’s GAAP profitability can be an illusion; simply a posturing for future capital raises.

This article originally published here on October 17, 2016.

Disclosure: David Trainer, Kyle Guske II, and Kyle Martone receive no compensation to write about any specific stock, sector, style, or theme.

Scottrade clients get a Free Gold Membership ($588/yr value). Login or open your Scottrade account & find us under Quotes & Research/Investor Tools.

Click here to download a PDF of this report.

Photo Credit: Min Liu (Flickr)

2 replies to "Tesla: Running Out of Energy? – Danger Zone"

Folks:

If you’re wondering why you don’t have any comments, it’s because you’re barking up the wrong tree.

Play the numbers game all you want, but Tesla Motors isn’t about money, gain or greed. It’s about a sustainable future… period! And since Elon Musk has gotten this far, and forced the whole auto industry to follow, he will always have all the followers and support, including financial, that he’ll needs.

Go ahead, short Tesla at your own risk! You might even get a return, but either way, Elon has already won this round, electric vehicles will be the only kind made in a decade.

tinker

“Play the numbers game all you want, but Tesla Motors isn’t about money, gain or greed.”

You’re right. Tesla’s valuation is not about the numbers. It’s about FAITH. And when you have faith, math is not important. Math is just god’s way of testing your belief in the Book of Elon.

As for EVs being the only type of cars being sold in 10 years, you may be right (although probably too optimistic, in 20 years may be more appropriate), but are you sure Tesla will be around in 10 years?

Cuz you can’t pay employees with faith. The Book of Elon does not buy you food.