We closed SNA on July 13, 2023. A copy of the associated Position Close report is here.

With deep customer relationships and innovative solutions for future equipment needs, this global supplier has a durable business ready for a changing industry. Snap-on Services Corp (SNA: $206/share) remains a Long Idea after 3Q21 earnings.

We leverage more reliable fundamental data, as proven in The Journal of Financial Economics[1], and shown to provide a new source of alpha, with qualitative research to highlight this firm whose stock present excellent risk/reward.

Snap-on Has Very Attractive Risk/Reward

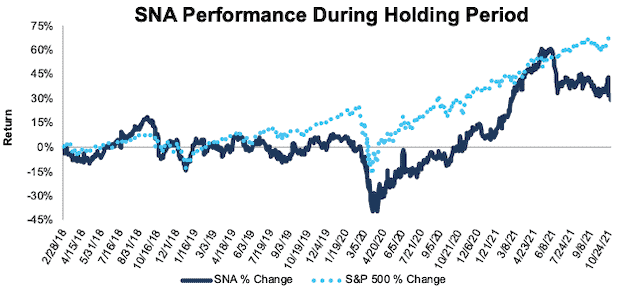

We made Snap-on a Long Idea in February 2018 and the stock has underperformed the market by 39% since then. However, given the company’s strong market position and cheap valuation, we continue to see upside in the stock.

Figure 1: Long Idea Performance: From Date of Publication Through 10/26/2021

Sources: New Constructs, LLC and company filings

What’s Working: Snap-on beat on both its top and bottom lines in 3Q21. Total revenue in 3Q21 rose 10% year-over-year (YoY) and is 15% above 3Q19 levels. The company’s Commercial and Industrial segment (30% of revenue in 3Q21), which expands its offerings beyond traditional auto tools and into the aerospace, power generation, and military markets, also showed signs of continued recovery from the pandemic as the segment’s revenue was up 11% YoY from 3Q20.

While other businesses with more complex supply chains may struggle to maintain inventory levels, Snap-on’s vertically integrated business enables it to better navigate the current global challenges. Snap-on’s available inventory during the supply crunch is an advantage that will help the company keep existing customers and effectively compete for new ones as other tool and equipment suppliers struggle to maintain desired inventory levels. Management spoke to the company’s advantageous supply chain position in its 3Q21 earnings call when it mentioned that its vertically integrated business, “certainly puts us in a better position to grow and probably capture new customers who might not be serviced by these people (i.e. competitors).”

Snap-on benefits from long-term demand in the automotive repair industry as it supplies auto service technicians, auto service centers, and car dealerships with tools, equipment, and diagnostic tools. For years, the average age of vehicles on the road in the U.S. has steadily increased, which creates more repair opportunities for service providers. The average age of a vehicle in 2021 of 12.1 years is up from 11.9 years in 2020.

The proliferation of driver assistance systems provides more runway for Snap-on’s diagnostic segment over the long run as demand for third-party repairs and system calibrations rise. Snap-on is already meeting this demand by offering diagnostic platforms that give repair shops the ability to make manufacturer-compliant calibrations to driver assistance systems.

Over the long term, the company’s core operations are positioned in markets that have strong growth projections. The following is a list of market growth forecasts corresponding to Snap-on’s core operations from various research providers:

- global hand tools and woodworking tools: 4% compounded annually from 2021 to 2026 according to ResearchAndMarkets

- global power tools: 6% compounded annually from 2021 to 2025 according to Global Market Insights

- global automotive diagnostics: 11% compounded annually from 2021 to 2030 according to Allied Market Research

What’s Not Working: Faster revenue growth in the company’s lower-margin undercar equipment drove Snap-on’s operating margin down from 19.7% in 3Q20 to 19.4% in 3Q21.

Though the company saw strong revenue growth overall in 3Q21, not every segment saw positive trends. Lower sales to the military, aerospace industry, and natural resources industry partially offset the rise in sales from technical education, heavy duty, and general industry customers.

Driving demand still hasn’t recovered to pre-pandemic levels, which is not good news for a company with large exposure to the automotive industry. While the trailing-twelve-months (TTM) number of vehicle miles traveled rose from 2.8 million in February 2021 to 3.0 million in July 2021, the TTM vehicle miles traveled is still 7% below pre-pandemic levels.

Though the transition of the automobile industry to electric vehicles (EVs) further weighs the stock down, it also creates new demand for EV-specific equipment. Snap-on is working with an undisclosed automobile manufacturer to develop equipment packages to market to dealerships for new EV models that are coming out.

Furthermore, while EVs theoretically should require less maintenance, overall maintenance costs for EVs are 1.6x more than traditional vehicles in their first year of service. Service technicians also spend twice as long diagnosing and 1.5x longer fixing EVs compared to traditional vehicles. Clearly, service technicians will need more tools and diagnostic equipment to keep up with the growing demand for EV maintenance and repairs.

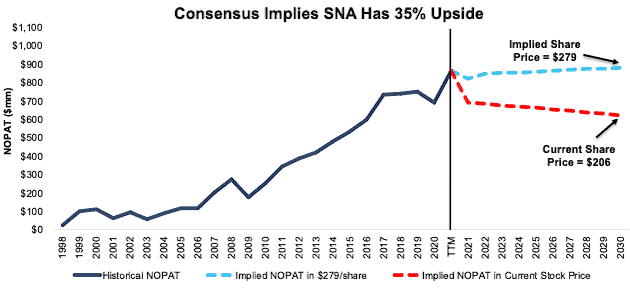

SNA Is Still Priced for Permanent Profit Decline: We calculate Snap-on’s price-to-economic book value (PEBV) ratio of 0.9 based on its pre-pandemic three-year average net operating profit after tax (NOPAT) from 2017-2019. This ratio means that the stock is priced for profits to permanently fall 10% below pre-pandemic levels.

Below, we use our reverse DCF model to analyze the expectations for future growth in cash flows baked into different stock price scenarios for Snap-on.

In the first scenario, we assume Snap-on’s:

- NOPAT margin falls to 18% (five-year average, vs. 19% TTM) from 2021 through 2030, and

- revenue falls by 1% compounded annually from 2021 to 2030 (vs. consensus CAGR of 10% for 2021-2022)

In this scenario, Snap-on’s NOPAT falls by 1% compounded annually over the next decade and the stock is worth $206/share today – equal to the current price. See the math behind this reverse DCF scenario. In this scenario, Snap-on’s NOPAT in 2030 would be $624 million, or its lowest level (excluding 2020) since 2016. For reference, Snap-on grew NOPAT by 16% compounded annually before the pandemic from 2009 to 2019.

Shares Could Reach $279 or Higher: If we assume Snap-on’s:

- NOPAT margin falls to 18% (five-year average) from 2021 through 2030, and

- revenue grows at a 10% CAGR through 2022 (same as consensus 2021-2022 CAGR), and

- revenue grows <1% a year from 2023 – 2030, then

the stock is worth $279/share today – 33% above the current price. See the math behind this reverse DCF scenario. In this scenario, Snap-on grows NOPAT by 3% compounded annually over the next decade. For reference, Snap-on grew NOPAT by 9% compounded annually from 2014-2019.

Should Snap-on grow profits closer to historical levels, the upside in the stock is even greater.

Figure 2: Snap-on’s Historical and Implied NOPAT: DCF Valuation Scenarios

Sources: New Constructs, LLC and company filings

This article originally published on October 27, 2021.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Our research utilizes our Core Earnings, a more reliable measure of profits, as proven in Core Earnings: New Data & Evidence, written by professors at Harvard Business School (HBS) & MIT Sloan and published in The Journal of Financial Economics.