We published an update on SNA on Oct 27, 2021. A copy of the associated Earnings Update report is here.

To determine the true profitability of a firm, investors must make numerous adjustments to reported earnings. Through this diligence, we uncovered a firm whose reported 2017 earnings understate the true profit growth of the business. With better-than-reported fundamentals, a long history of dividend growth, and undervalued stock price, Snap-On Inc. (SNA) earns a spot on this month’s Dividend Growth Stocks Model Portfolio and is this week’s Long Idea.

SNA’s Profits Growing Faster Than Reported

SNA’s history of profit growth is well documented. However, investors only analyzing reported net income may be surprised to find profits are growing even faster than they realize. On page 29 of SNA’s 10-K, the company disclosed a $31 million charge related to patent related litigation and a $15 million charge related to employment-related litigation. Combined, these two charges equaled 8% of reported GAAP net income.

By removing these non-recurring charges, we show that SNA’s profit growth is even better than reported results indicate. In 2017, SNA’s GAAP net income grew 2% year-over-year (YoY) while after-tax operating profit (NOPAT) grew 8% YoY.

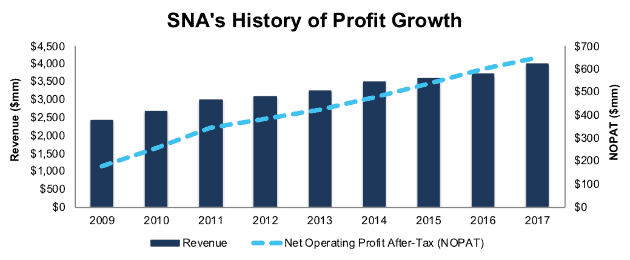

Beyond 2017, SNA has grown revenue by 6% compounded annually since 2009 while NOPAT has grown 18% compounded annually, per Figure 1. Accelerated NOPAT growth has been fueled by rising NOPAT margins, which have improved from 7% in 2009 to 16% in 2017. Longer-term, SNA has grown NOPAT by 17% compounded annually since 1998.

Figure 1: SNA’s Revenue & Profit Growth Since 2009

Sources: New Constructs, LLC and company filings

SNA’s margin improvement has been more than enough to offset the drop in average invested capital turns, which have fallen from 1.0 in 2009 to 0.82 in 2017. As a result, SNA has improved its return on invested capital (ROIC) from 7% in 2009 to a 13% in 2017. The firm has also generated a cumulative $1.1 billion (12% of market cap) in free cash flow over the past five years.

SNA’s Strong Brand and Business Model Provide Margin Advantage

Snap-On is a global manufacturer and distributor of hand and power tools, tool storage, diagnostics software, and vehicle service equipment such as lifts and wheel balancers. Its customers include vehicle dealerships, repair centers, mechanics, and firms in the aviation, agriculture, construction, mining, and power generation industries.

Its main competitors include tool manufacturers such as Makita, Hitachi, GearWrench, and Stanley Black and Decker (SWK), which owns numerous brands such as DeWalt and Craftsman. SNA also competes with private label tools such as those sold at Home Depot (HD) and Lowe’s (LOW).

SNA built its brand on quality of product, lifetime warranty, and its unique mobile sales force that could service and deliver tools to customers at their own shop. The strength of this brand has allowed SNA to charge higher prices for a quality product, and in turn, steadily improve its NOPAT margin.

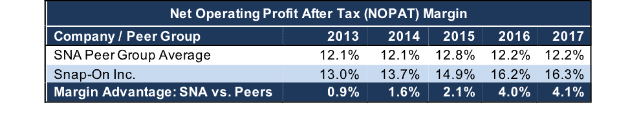

Per Figure 2, the market weighted average NOPAT margin of SNA’s peer group has remained nearly flat since 2013. However, SNA’s margins have improved from 13% in 2013 to over 16% in 2017. Specifically, SNA’s NOPAT margin is much higher than the 9% earned by Stanley Black & Decker, which is one of the best comparables in the tools industry. This margin advantage gives SNA greater flexibility to offer discounts, rebates, or special pricing to remain competitive, while still growing profits.

Figure 2: SNA’s Margin Advantage Is Increasing Since 2013

Sources: New Constructs, LLC and company filings.

Bear Case: Credit Concerns Overblown

Snap-On provides many of its tools and diagnostic equipment on credit, which allows technicians and repair shops to purchase tools and repay over an average term of four years. Bears will point to SNA’s rising finance and contract receivables as reason to believe the stock is in bubble territory and set for a crash.

While receivables have been rising, the percentage of underperforming loans remains only marginally above average. Meanwhile, industry growth trends provide SNA a long-term growth opportunity.

SNA considers its receivables to be nonperforming when they are on nonaccrual status or more than 90 days past due. In 2017, 1.75% of finance receivables and 0.54% of contract receivables were classified as nonperforming. Over the past five years, nonperforming finance and contract receivables have averaged 1.58% and 0.47%, respectively. An increase of 17 and 7 basis points respectively would not significantly impact profits. 0.17% of finance receivables is just under $3 million while 0.07% of contract receivables is less than $1 million. Assuming the entire increase in nonperforming finance and contract receivables results in write-offs, the total amount would represent just 0.46% of 2017’s NOPAT.

While any significant credit exposure poses some risk, and SNA’s nonperforming receivables have increased, they are insignificant (0.46% of NOPAT). The company’s history should also reassure investors. During the depths of the recession in 2008 and 2009, SNA still classified the amount of financing receivables on nonaccrual status as “insignificant”.

The bear case is further weakened by SNA’s valuation. Not only does the stock look cheap when analyzed against peers, but the stock’s valuation also implies profit growth will fall well short of historical trends, as we’ll show below.

Improving ROIC Correlated with Creating Shareholder Value

Numerous case studies show that getting ROIC right is an important part of making smart investments. Ernst & Young recently published a white paper that proves the material superiority of our forensic accounting research and measure of ROIC.

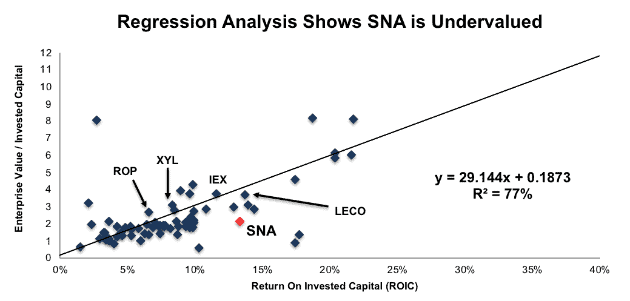

Per Figure 3, ROIC explains 77% of the difference in valuation for the 76 Industrial Machinery & Equipment stocks under our coverage. SNA’s stock trades at a significant discount to peers as shown by its position below the trend line in Figure 3. SNA’s enterprise value per invested capital (a cleaner version of price to book) of 2.1 implies that the market expects its ROIC to decline below 7%.

Figure 3: ROIC Explains 77% Of Valuation for Industrial Machinery & Equipment Stocks

Sources: New Constructs, LLC and company filings

If the stock were to trade at parity with its peers, it would be worth $331/share – a 106% upside to the current stock price. Given the firm’s improving margins and ROIC, one would think the stock would garner a premium valuation. Below we’ll use our DCF model to quantify just how high shares could rise assuming conservative profit growth.

SNA’s Undervalued Stock Offers Significant Upside Potential

Despite the strong fundamentals, SNA is up just 3% over the past two years while the S&P is up 44%. A significant portion of this underperformance occurred in the recent market selloff. SNA is down 13% since January 26 since the larger market sell off.

This drop in valuation leaves SNA significantly undervalued, both by traditional metrics and when analyzing the expectations baked into the stock price. SNA’s P/E ratio of 16.8 is below the Industrials sector average of 21.5 and the S&P 500 average of 25.5. When we analyze the expectations baked into the stock price, we also find that SNA holds significant upside potential.

At its current price of $160/share, SNA has a price-to-economic book value (PEBV) ratio of 1.1. This ratio means the market expects SNA’s NOPAT to grow by no more than 10% over the remaining life of the firm. This expectation seems overly pessimistic for a firm that has grown NOPAT by 18% compounded annually since 2009 and 17% compounded annually since 1998.

If SNA can simply maintain 2017 NOPAT margins of 16% and grow NOPAT by just 4% compounded annually for the next decade, the stock is worth $193/share today – a 21% upside. Given the positive impact of the recently enacted tax legislation (details below), such a scenario could prove conservative. Should SNA’s margins improve while revenue growth continues in its end markets, the stock would hold even greater upside potential.

Tax Reform Boosts Margins

SNA stands to benefit from tax reform more than most companies as it pays a cash tax rate of 30%, higher than the median S&P 500 company at 28%. Even if we assume that SNA loses its current tax deductions and just pays the new statutory rate of 21%, that would be worth an additional $87 million based on 2017 NOPAT, a 13% increase and a bump up in NOPAT margin to 18.5% from the current 16.3%.

Industry Trends Are A Strong Tailwind

In addition to the short-term profit growth from tax reform, SNA stands to benefit over the long-term from growth in the automotive industry. Specifically, an increase in number of cars, whether self-driving or service cars (such as Uber), miles driven, and complexity of vehicles all increase the need for maintenance, and therefore the demand for automotive tools.

In the short-term, IHS Markit, a leading industry research provider, projects auto sales growth to remain at record levels in 2018. To service these cars, an increased number of technicians will be needed. The Bureau of Labor Statistics estimates that employment in the automotive service technicians and mechanics market will grow 6% a year through 2026. Each of these technicians represents a potential customer for SNA.

Longer-term, IHS Markit estimates that vehicle miles travelled will grow to an all-time high of 11 billion per year by 2040, which represents a 65% increase since 2017. As the average age of vehicles in use rises (all-time high in 2016, last year of reported data), consumers are also keeping cars longer than ever. IHS Market reported that the average length of ownership hit 79 months in 2016 (latest data available), up from 52 months in 2006.

An increase in miles travelled can lead to an increase in maintenance costs. YourMechanic, a car repair and maintenance provider, found that maintenance costs per 25k miles driven rise significantly during the first 100,000 miles driven. Ultimately, the need for repair and service mechanics, Snap-On’s main customers, will rise as more miles are driven on aging cars.

Lastly Snap-On’s diagnostic tools, which aid in identifying and addressing needed repairs, have experienced growth above and beyond the overall firm. This segment also earns higher operating margins. Since 2013, SNA’s repair systems and information group revenue has grown 7% compounded annually, compared to a 5% compounded annual growth rate in SNA’s overall revenue. The segment’s operating margin has averaged 24% since 2013, well above the 16% and 14% average of the Snap-On Tools Group and Commercial & Industrial Group segments respectively.

The rise of ‘mobility as a service’ providers could spur continued growth in SNA’s repair systems and information group segment. These providers, such as Uber, Lyft, and others, are expected to purchase 10 million cars in 2040, up from 300,000 in 2017. With growing fleets competing for consumer transportation dollars, the need to quickly diagnose and return vehicles to service increases and provides SNA another growth opportunity.

In conjunction with lowered tax rates and rising industry trends, increased profitability can provide SNA additional capital. This capital can be used to invest in new products (the company recently released its new catalog with 1,300 new products), increase its dividend, or even continue repurchasing shares at a discount as it has done in the past.

Stock Repurchases and Dividend Provide Yield of Nearly 4%

A long streak of dividend increases is widely considered to be a sign of a company’s strong competitive advantage. SNA has paid quarterly dividends without interruption or reduction since 1939. Furthermore, SNA has increased its dividend consecutively over the last nine years. SNA’s annual dividend has grown from $1.58/share in 2013 to $2.95/share in 2017, or 17% compounded annually. The current dividend equals a 2.0% dividend yield. This streak of growing dividend payments landed SNA on this month’s Dividend Growth Stocks Model Portfolio.

In addition to dividends, SNA has returned capital to shareholders via share repurchases. SNA has repurchased $110 million, $120 million, and $289 million in 2015, 2016, and 2017 respectively. At the end of 2017, SNA had $391 million of repurchase capacity left under its current authorization. If SNA management purchases shares in line with the averages of the past three years, it would repurchase $173 million next year. A repurchase of this size equates to 1.9% of the current market cap. When combined with the 2.0% dividend yield, the total yield to shareholders could reach 3.9%.

Executive Compensation Plan Could be Improved but Hasn’t Led to Value Destruction

SNA’s executive compensation plan, which includes base salary, annual incentives, and long-term incentives, is based on reaching target financial, strategic, and individual goals. Annual incentive goals include operating income, return on net assets, and business specific goals for each executive. Long-term incentives are awarded stock options and performance-based shares. Performance share goals include operating income, return on net assets, stock price, and sales. Metrics such as those in SNA’s executive compensation plan are better than commonly used non-GAAP metrics but could still be improved.

We would prefer to see executive compensation tied directly to value creation, specifically tied to ROIC, since there is a strong correlation between improving ROIC and increasing shareholder value. Most importantly though, SNA’s current exec comp plan has not led to executives getting paid while destroying shareholder value. The company has generated positive economic earnings, the true cash flows of the business, in each of the past 10 years and increased economic earnings from $27 million in 2007 to $340 million in 2017, or 29% compounded annually.

Insider Trading is Minimal While Short Interest Shows Market Pessimism

Insider activity has been minimal over the past twelve months with 21 thousand shares purchased and 178 thousand shares sold for a net effect of 157 thousand shares sold. These sales represent less than 1% of shares outstanding. There are currently 6.4 million shares sold short, which equates to 11% of shares outstanding and 11 days to cover. Short interest has fallen nearly 7% from the prior month, however, with over 10% of shares sold short. Continued earnings beats could send shares higher and cause a short squeeze.

Auditable Impact of Footnotes & Forensic Accounting Adjustments

Our Robo-Analyst technology enables us to perform forensic accounting with scale and provide the research needed to fulfill fiduciary duties. In order to derive the true recurring cash flows, an accurate invested capital, and an accurate shareholder value, we made the following adjustments to Snap-On’s 2017 10-K:

Income Statement: we made $331 million of adjustments, with a net effect of removing $93 million in non-operating expense (2% of revenue). We removed $119 million in non-operating income and $212 million in non-operating expenses. You can see all the adjustments made to SNA’s income statement here.

Balance Sheet: we made $1.3 billion of adjustments to calculate invested capital with a net increase of $830 million. The most notable adjustment was $358 million in other comprehensive income. This adjustment represented 9% of reported net assets. You can see all the adjustments made to SNA’s balance sheet here.

Valuation: we made $1.7 billion of adjustments with a net effect of decreasing shareholder value by $1.7 billion. Apart from $1.3 billion in total debt, which includes $74 million in operating leases, the largest adjustment to shareholder value was $202 million in underfunded pensions. This pension adjustment represents 2% of SNA’s market cap. Despite the decrease in shareholder value, SNA remains undervalued.

Attractive Funds That Hold SNA

The following funds receive our Attractive-or-better rating and allocate significantly to Snap-On Inc.

- Vaughan Nelson Select Fund (VNSYX) – 4.0% allocation and Very Attractive rating.

- AdvisorShares Focused Equity ETF (CWS) – 3.9% allocation and Attractive rating.

- WBI Tactical LCGD Shares (WBIE) – 3.8% allocation and Very Attractive rating.

- Advisory Research All Cap Value Fund (ADVGX) – 3.7% allocation and Attractive rating.

- Catalyst/Lyons Tactical Allocation Fund (CLTIX) – 3.6% allocation and Very Attractive rating.

This article originally published on February 28, 2018.

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

Click here to download a PDF of this report.

Photo Credit: nattanan23 (Pixabay)