The “Retail Apocalypse” should really be called the “Bad Retailer Apocalypse.” It’s true, the rise of e-commerce has had a massive impact on the retail sector, but smart companies find ways to adapt and grow in this new environment. Further, e-commerce is a long-term positive for well-run retail companies because it drives their less profitable competitors out of business more quickly.

This retail giant has been one of the largest and most profitable companies in the sector for decades. The failure of many, lesser retailers creates room for it to grow. Meanwhile, it continues to invest intelligently in e-commerce and improvements to the consumer experience to remain competitive in the digital age. Target Corporation (TGT: $85/share) is this week’s Long Idea.

Returning to Profit Growth

We initially selected Target as a Long Idea on April 28, 2015. We were optimistic about the company’s improving return on invested capital (ROIC), cheap valuation, and the prospect of continued growth in consumer spending.

Over the following three years, the stock declined by 13%, and we closed our recommendation on May 7, 2018, after the company’s ROIC declined from 10% to 9% due to a $300 million (9%) decline in net operating profit after tax (NOPAT) in 2017. It seemed as if our optimism had been misplaced and that the company was losing ground to its competitors, most notably Walmart (WMT).

After strong growth in 2018 and a blowout quarter in Q1 2019, it’s clear we were too early to give up on this pick. Target’s investments in e-commerce and store remodels are driving sales growth, improving profitability, and setting the company up to succeed long-term.

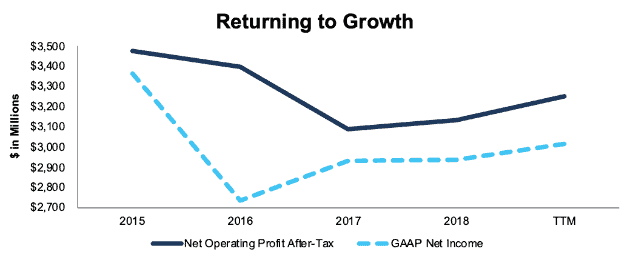

Figure 1 shows the trajectory of Target’s profits since 2015. After significant declines in 2016 and 2017, NOPAT increased by 1% last year and is up 6% year-over-year in the trailing twelve month (TTM) period.

Figure 1: TGT’s NOPAT and GAAP Net Income Since 2015

Sources: New Constructs, LLC and company filings

Target’s GAAP net income presents a misleading (and understated) picture to investors. While NOPAT declined in 2017, GAAP net income increased due to a $350 million (12% of GAAP net income) benefit from tax reform. As a result of this inflated profitability in 2017, GAAP earnings were flat in 2018 despite the growth in NOPAT noted above. Investors who only look at reported earnings will have a misleading view of Target’s profit growth.

Store Remodels Are Paying Off

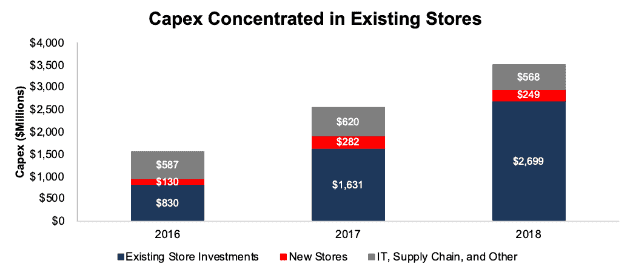

Target’s intelligent capital allocation, focused on renewed investment in its stores to improve the customer experience, drives the company’s recent profit growth. The company’s capital expenditures doubled from 2016-2018, while its investments to remodel and improve existing stores more than tripled, as shown in Figure 2.

Figure 2: TGT Capex From 2016-2018

Sources: New Constructs, LLC and company filings

Target has remodeled 400 of its ~1,800 stores over the past two years, and it plans to remodel an additional 600 over the next two years. The remodel efforts focus on modernizing the overall design of stores while making certain departments – such as Beauty and Home – more interactive so guests can test products and visualize how they would fit in their homes.

Leveraging its brick and mortar footprint to drive online sales: The remodels also improve Target’s ability to fulfill digital orders through its stores. The stores are now the centerpiece of its digital fulfillment strategy by offering customers curbside pickup options and even same-day delivery through the acquisition of Shipt.

Target’s strategy shows how brick and mortar stores can be a competitive advantage in an e-commerce world. By utilizing its stores as distribution centers and pickup locations, Target can leverage its geographic footprint to provide a service that is even more convenient than Amazon.

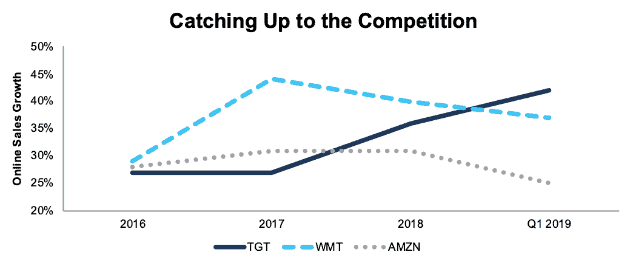

Online sales growth is better than Amazon and Walmart: In Q1 2019, Target’s online sales increased by 42% year-over-year. Curbside pickup and same-day delivery accounted for half of its online sales. While Target’s e-commerce business remains significantly smaller than Walmart’s or Amazon (AMZN), it’s now growing faster than both of them, as shown in Figure 3.

Figure 3: Online Sales Growth for TGT, WMT, and AMZN Since 2016

Sources: New Constructs, LLC and company filings

Benefitting from Competitors’ Decline

Target’s investments in store remodels, curbside pickup, and same-day delivery all solidify its key competitive advantage: convenience. CEO Brian Cornel reaffirmed this goal in the company’s 2018 annual report, writing that he wants to make Target, “America’s easiest place to shop.”

Convenience helps Target retain existing customers and attract new customers whose preferred shopping destinations have closed or gone out of business. Customers who used to shop at Sears, Toys R’ Us, Gymboree, and other recently bankrupt retailers will be looking to shop elsewhere, and Target’s convenience makes it an attractive alternative.

Evidence from the 2018 holiday season suggests that Target was the biggest winner from the Toys R’ Us bankruptcy, and it appears to be gaining market share from mall apparel retailers as well. As part of its efforts to attract these new customers, Target has partnered with high-end fashion brands, e.g, Vineyard Vines.

These efforts drove a 4% increase in store traffic and a 5% increase in comparable sales in Q1. For comparison, Walmart’s comparable sales increased by 3% in Q1. By making its shopping experience convenient and enjoyable, Target makes it easy for shoppers to come to them when rival stores close.

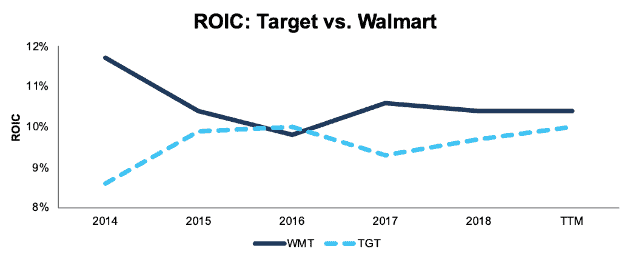

Closing the Gap Against Walmart

Target has historically lagged Walmart in terms of profitability. From 1998-2013 (the first 15 years we have data for both companies) Target averaged an ROIC of 10% while Walmart averaged an ROIC of 13%. However, Figure 4 shows that the two companies’ ROIC’s have converged over the past four years.

Figure 4: ROIC For TGT and WMT Since 2014

Sources: New Constructs, LLC and company filings

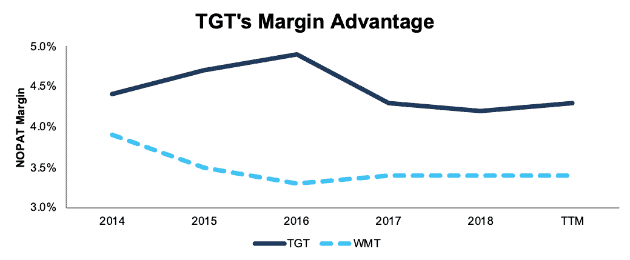

While both Walmart and Target appear to be taking market share from other brick and mortar retailers, Target has managed to do so without sacrificing margins. Target has always been the higher margin retailer of the two due to its more affluent customer base[1]. Since 2014, the gap between the two retailers has widened. Target has maintained its NOPAT margins of ~4.5% while Walmart has sacrificed margins to gain online market share. See Figure 5.

Figure 5: NOPAT Margins for TGT and WMT Since 2014

Sources: New Constructs, LLC and company filings

Target’s higher margins give it more operational flexibility to adapt to shifting economic trends by cutting prices or raising wages as needed.

Diversified Product Lines Blunt Tariff Impact

Tariffs remain an ongoing concern for Target. CEO Brian Cornell said on the company’s Q1 earnings call:

“As a guest focused retailer, we’re concerned about tariffs because they lead to higher prices on everyday products for American families.”

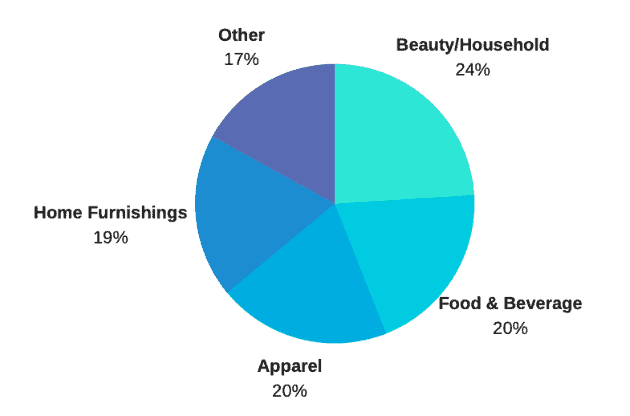

However, Cornel also emphasized that Target’s multi-category product portfolio gives it a significant advantage compared to more specialized retailers. No single product category accounts for more than 24% of Target’s revenue, as shown in Figure 6.

Figure 6: Target’s 2018 Revenue by Product Category

Sources: New Constructs, LLC and company filings

In the long-term, tariffs could represent an opportunity for Target to gain more market share. If tariffs raise the prices of certain products – apparel, for example – Target can absorb lower margins on those goods and count on profitability from other segments for a limited time. Specialized apparel retailers, on the other hand, might not be able to handle the tariffs and be forced to close stores, which reduces Target’s competition and gives it the opportunity to gain new customers.

Executive Compensation Plan Is a Hidden Strength

Target’s executive compensation plan properly aligns executives’ interests with those of shareholders. Apart from base salary and annual cash bonuses, Target executives receive long-term equity compensation in the form of performance based restricted stock units. These awards are tied to the achievement of adjusted sales growth, EPS growth, and ROIC.

The focus on improving ROIC helps to ensure prudent stewardship of capital. Target’s focus on ROIC manifests in its capital expenditure strategy to focus on remodeling existing store instead of chasing growth by opening new stores. Target’s high quality corporate governance should give investors confidence that management will continue to make these types of intelligent capital allocation decisions.

Improving ROIC Correlated with Creating Shareholder Value

Numerous case studies show that getting ROIC right is an important part of making smart investments. This paper compares our analytics on a mega cap company to other major providers. The Appendix details exactly how we stack up. The technology that enables this research is featured by Harvard Business School.

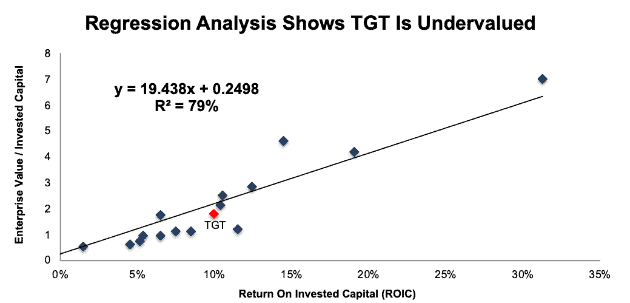

Per Figure 7, ROIC explains 79% of the difference in valuation for the 17 brick and mortar retailers Target lists as peers in its proxy statement. TGT trades at a discount to peers as shown by its position below the trend line.

Figure 7: ROIC Explains 79% Of Valuation for TGT Peers

Sources: New Constructs, LLC and company filings

If the stock were to trade at parity with its peers, it would be worth $110/share – 29% above the current stock price. With Target taking market share from other brick and mortar retailers, it arguably deserves a premium valuation compared to its peers.

Cheap Valuation Creates Buying Opportunity

Target shares popped nearly 20% in the wake of its most recent earnings report, but even with this recent jump the stock remains undervalued.

At its current price of $85/share, TGT has a price-to-economic book value (PEBV) ratio of 1.0. This ratio means the market expects no meaningful growth in TGT’s NOPAT over the remaining life of the firm. This expectation seems overly pessimistic for a firm that has grown NOPAT by 5% compounded annually over the past 20 years.

If TGT can maintain 4.5% margins and grow NOPAT by just 4% compounded annually for the next decade, the stock is worth $108/share today – a 27% upside. See the math behind this dynamic DCF scenario.

Sustainable Competitive Advantages That Will Drive Shareholder Value Creation

Here’s a summary of why we think the moat around Target’s business will enable the company to generate higher profits than the current valuation of the stock implies. This list of competitive advantages helps TGT offer better products/services at a lower price and prevents competition from taking market share.

- Executing on the company’s core value proposition, i.e. making their stores “America’s easiest place to shop.”

- Successful implementation of omnichannel sales model that gives shoppers a variety of buying options, from in-store to pickup to same-day delivery

- Diversified product portfolio and superior margins that gives TGT more flexibility to adapt to changing economic conditions

What Noise Traders Miss with TGT

These days, fewer investors focus on finding quality capital allocators with shareholder friendly corporate governance. Instead, due to the proliferation of noise traders, the focus tends toward technical trading tends while high-quality fundamental research is overlooked. Here’s a quick summary for noise traders when analyzing TGT:

- Understated earnings growth due to the impact of tax reform on 2017 GAAP net income

- Superior corporate governance drives superior capital allocation

- The “Retail Apocalypse” is an opportunity, not a threat, because TGT can benefit from competitors closing stores

Catalyst: Earnings Beats Can Send Shares Higher

As Target continues to take market share from competitors and increase traffic through store remodels, it should be able to continue to beat expectations on the top and bottom line as it did in Q1. More strong earnings reports should reassure investors that Target’s growth is part of a larger trend rather than an aberration.

Even if Target can’t beat expectations overall, strong performance from its online sales channel should boost shares. If Target can continue to grow online sales faster than Amazon and Walmart, investors should start to value the company at more of a premium.

Dividends and Buybacks Provide 8% Yield

Target has increased its dividend in 47 consecutive years. Over the past five years, Target has increased its dividend by 8% compounded annually. The current quarterly dividend of $0.64/share provides a 3% annualized yield.

In addition to dividends, Target returns capital to shareholders through share repurchases. In 2018, the company repurchased $2.1 billion (5% of market cap) worth of shares. Combined, Target’s dividend and buyback activity provides shareholders with an 8% yield.

Insider Trading and Short Interest Trends are Mixed

Insider activity has been minimal over the past 12 months, with 490 thousand shares purchased and 336 thousand shares sold for a net effect of 154 thousand shares purchases. These purchases represent less than 1% of shares outstanding.

There are currently 27 million shares sold short, which equates to 5% of shares outstanding and 5 days to cover. It’s hard to tell how much of this short interest comes from investors betting against Target specifically compared to those who are bearish on retail as a whole. The SPDR S&P Retail ETF (XRT) is currently the most shorted ETF on the market, with short interest representing 525% of assets.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

As investors focus more on fundamental research, research automation technology is needed to analyze all the critical financial details in financial filings. Below are specifics on the adjustments we make based on Robo-Analyst[2] findings in Target’s 2018 10-K:

Income Statement: we made $1.1 billion of adjustments, with a net effect of removing $196 million in non-operating expense (1% of revenue). We removed $462 million in non-operating income and $658 million in non-operating expenses. You can see all the adjustments made to TGT’s income statement here.

Balance Sheet: we made $10.3 billion of adjustments to calculate invested capital with a net increase of $8.4 billion. You can see all the adjustments made to TGT’s balance sheet here.

Valuation: we made $16.7 billion of adjustments with a net effect of decreasing shareholder value by $16.7 billion million. Despite this decrease in value, TGT remains undervalued. You can see all the adjustments made to TGT’s valuation here.

Attractive Funds That Hold TGT

The following funds receive our Attractive-or-better rating and allocate significantly to Target.

- First Trust NASDAQ Retail ETF (FTXD) – 6.5% allocation and Very Attractive rating

- Edgar Lomax Value Fund (LOMAX) – 5.1% allocation and Attractive rating

- Smead Value Fund (SMVLX) – 4.9% allocation and Very Attractive rating

- Segall Bryant & Hamill Workplace Equality Fund (WEQIX) – 4.1% allocation and Attractive rating

This article originally published on June 5, 2019.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Target shoppers make ~$13,000 more annually per household than Walmart shoppers, according to data from Kantar Retail’s ShopperScape.

[2] Harvard Business School features the powerful impact of our research automation technology in the case New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.