Despite making a post-pandemic recovery, this company is priced as if profits will never return to pre-pandemic levels. ManpowerGroup (MAN: $99/share) remains a Long Idea after 3Q21 earnings.

We leverage more reliable fundamental data, as proven in The Journal of Financial Economics[1], and shown to provide a new source of alpha, with qualitative research to highlight this firm whose stock present excellent risk/reward.

ManpowerGroup’s Attractive Risk/Reward

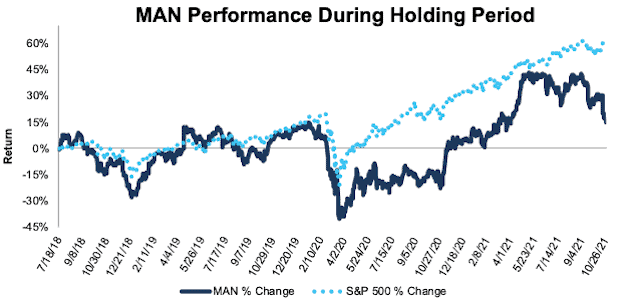

We made ManpowerGroup a Long Idea in July 2018 and the stock has underperformed the market since then. However, the stock’s 20% decline since September 2, 2021 is overblown and presents investors with an opportunity to “buy the dip” in a stock with plenty of upside.

Figure 1: Long Idea Performance: From Date of Publication Through 10/26/2021

Sources: New Constructs, LLC and company filings

What’s Working: ManpowerGroup’s total revenue rose 12% year-over-year (YoY) in 3Q21, while its Experis and Talent Solutions segment revenues exceeded pre-pandemic levels. Experis and Talent Solutions accounted for 37% of the company’s total 2020 gross profit, so the growth in these segments bodes well for a future rebound to and above 2019 levels. The company expects its business recovery to continue as it guided for 5-9% YoY revenue growth in 4Q21.

Growth in the company’s higher margin Experis and Talent Solutions segments have improved ManpowerGroup’s profitability, despite operating in a highly competitive industry. The company steadily improved its net operating profit after tax (NOPAT) margin from 1.1% in 2010 to 2.6% in 2019 before the pandemic. After falling to 1.6% in 2020, margins have improved to 1.9% over the TTM. Rising margins drive ManpowerGroup’s return on invested capital (ROIC) from 5% in 2010 to 9% in 2019. Over the trailing-twelve-months (TTM), the company’s ROIC is 7%, which is up from 5% in 2020.

As one of the largest staffing companies in the world, ManpowerGroup leverages its global presence to deliver innovative offerings to clients, which creates a long runway for continued growth. For example, ManpowerGroup’s Experis Career Accelerator, an AI-driven platform, leverages the company’s large amount of employer and employee data to assist the company in finding in-demand roles and provide better job matches across its network.

Unlike most other businesses, which are struggling to manage inflationary pressure, ManpowerGroup’s fee structure means that inflation has little effect on the company’s operations, as increased costs are passed directly to its clients.

What’s Not Working: As a provider of staffing, recruiting, and workforce consulting services, the decline of supply in the labor market is a headwind for ManpowerGroup’s growth.

Even though revenue from Southern Europe, the company’s largest region, grew 13% YoY in 3Q21, the company expected a stronger showing from France after many of the heavy, pandemic-related restrictions were lifted in the country. While investors may have been disappointed with the lackluster growth in 3Q21, we expect employment service demand to eventually reach pre-pandemic levels, given the expected growth rate of the industry.

In the United States, the long-term decline in labor participation remains in place. The labor force participation rate in the U.S. steadily fell from 67% in 1998 to 63% in 2019. In 2020, the participation rate fell even lower to 62%, its lowest level since 1975. More recently, the pandemic caused many baby-boomers to retire and exit the labor force completely, while others have delayed reentering the labor force due to unemployment benefits and concerns about childcare and personal health.

Nevertheless, there is still room for employment service companies, such as ManpowerGroup, to grow. Despite the unfavorable labor participation trends, ResearchAndMarkets expects the global employment services market to grow 9% compounded annually from 2021-2025.

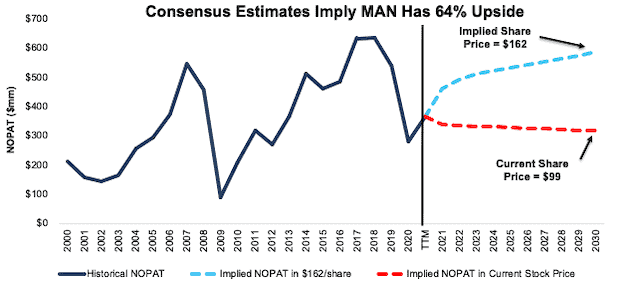

MAN Is Priced as If Profits Will Fall Below 2013 Levels: We calculate ManpowerGroup’s price-to-economic book value (PEBV) ratio of 0.5 based on its pre-pandemic three-year average NOPAT from 2017-2019. This ratio means that the stock is priced for profits to permanently fall 50% below pre-pandemic levels. However strong the headwinds from a decline of supply in the labor market may be, we do not think they will be strong enough to hurt ManpowerGroup’s business as much as the stock price implies.

Below, we use our reverse DCF model to analyze the expectations for future growth in cash flows baked into different stock price scenarios for ManpowerGroup.

In the first scenario, we assume ManpowerGroup’s:

- NOPAT margin remains at TTM levels of 1.9% (vs. five-year average of 2.5%) from 2021 through 2030, and

- revenue falls by 1% compounded annually from 2021 to 2030 (vs. consensus CAGR of +8% for 2021-2023)

In this scenario, ManpowerGroup’s NOPAT grows by just 1% compounded annually over the next decade and the stock is worth $99/share today – equal to the current price. See the math behind this reverse DCF scenario. In this scenario, ManpowerGroup’s NOPAT in 2030 would be $318 million, which would be the lowest profits for the company since 2013 (excluding 2020). For reference, ManpowerGroup grew NOPAT by 20% compounded annually from 2009 to 2019 before the pandemic.

Shares Could Reach $162 or Higher: If we assume ManpowerGroup:

- improves NOPAT margin to 2.2% (below three-year average of 2.3% vs. 1.9% TTM) from 2021 through 2030, and

- grows revenue grows at an 8% CAGR through 2023 (same as consensus 2021-2023 CAGR), and

- grows revenue by 2% a year from 2024 – 2030, then

the stock is worth $162/share today – 64% upside to the current price. See the math behind this reverse DCF scenario. In this scenario, ManpowerGroup grows NOPAT by 1% compounded annually from 2019 to 2030. In this scenario, ManpowerGroup’s NOPAT in 2030 is still 8% below 2018 levels and just 9% above 2019 levels.

Should ManpowerGroup grow profits closer to historical levels, the upside in the stock is even greater.

Figure 2: ManpowerGroup’s Historical and Implied NOPAT: DCF Valuation Scenarios

Sources: New Constructs, LLC and company filings

This article originally published on October 27, 2021.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Our research utilizes our Core Earnings, a more reliable measure of profits, as proven in Core Earnings: New Data & Evidence, written by professors at Harvard Business School (HBS) & MIT Sloan and published in The Journal of Financial Economics.