We published an update on this Long Idea on June 29, 2022. A copy of the associated Earnings Update report is here.

These days, businesses want direct relationships with consumers. Content providers are launching streaming services and retail brands are moving online. It’s easier than ever for companies to reach consumers directly, and with the rise of Big Data, that direct relationship is more valuable than ever.

This recent spin-off is transitioning from a business model that primarily sells to consumers through third-party retailers to one that owns the customer relationship. This transition creates volatility in the short-term, but it will make the company significantly more profitable in the long-term. Valvoline (VVV: $20/share) is this week’s Long Idea.

Increasing Focus on Quick-Lube

Valvoline, established in 1866, was the first trademarked motor oil brand in the U.S. Historically, the company has focused on selling its branded products to consumers through third-party retailers such as NAPA Auto Parts, AutoZone (AZO), Advance Auto Parts (AAP), and O’Reilly Auto Parts (ORLY).

However, this business faces pressure due to the decline of “do-it-yourself” (DIY) car maintenance and the rise of “do-it-for-me” (DIFM). A variety of factors, including increased complexity of newer cars and a growing consumer preference for convenience, have led consumers to opt for professional service rather than changing their oil or performing other car maintenance themselves.

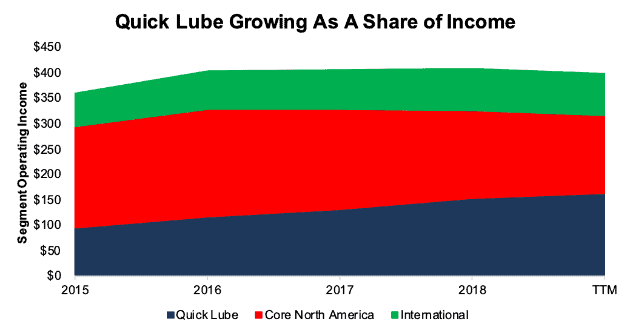

Valvoline targets this growing group of consumers through its Quick Lube segment, which owns or franchises ~1,300 service locations throughout the U.S. and Canada. Since its spin-off from Ashland (ASH) in 2016, Valvoline has rapidly grown this segment to offset the decline in its third-party retail business (which it calls “Core North America”). Figure 1 shows that operating income for the Quick Lube segment surpassed Core North America for the first time during the TTM period.

Figure 1: VVV’s Segment Operating Income Since 2015

Sources: New Constructs, LLC and company filings

Operating income for the Quick Lube segment grew from $95 million in 2015 to $153 in 2018, or 17% compounded annually. Quick Lube operating income is up to $162 million TTM. From 2015 to the TTM period, Quick Lube’s share of segment operating income has grown from 26% to 41%.

GAAP Earnings Mislead Investors

Transitioning from a 3rd party retail model to the Quick Lube model has been challenging for Valvoline. In particular, the Core North America segment has struggled due to the decline of the DIY customer base as well as increasing competition from private label motor oil brands.

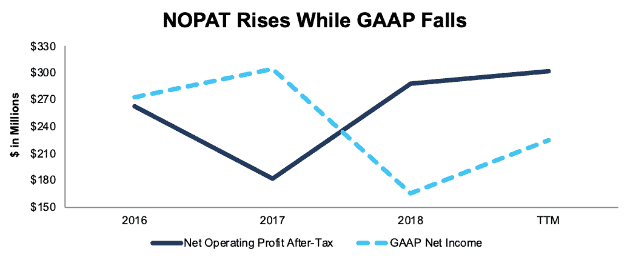

However, GAAP earnings exaggerate the extent of the company’s challenges. Figure 2 shows that GAAP net income declined by 45% in 2018 even though net operating profit after tax (NOPAT) increased by 59%. Longer-term, TTM GAAP net income is down 18% from 2015, while NOPAT is up 15% over the same time.

Figure 2: VVV NOPAT and GAAP Net Income: 2015-TTM

Sources: New Constructs, LLC and company filings

The disconnect in 2018 comes from $77 million (3% of revenue) in non-recurring charges due to tax reform. In addition, 2017 earnings were inflated due to $138 million (7% of revenue) in non-cash pension gains.

As a result, Valvoline’s GAAP net income tells the story of a company that is struggling. Valvoline has missed earnings expectations in 6 out of the past 8 quarters, contributing to a 15% decline in the stock price over the past two years.

Our adjustments, on the other hand, suggest the company’s profits, despite recent volatility, have grown over the past year.

Steady Increase in Demand

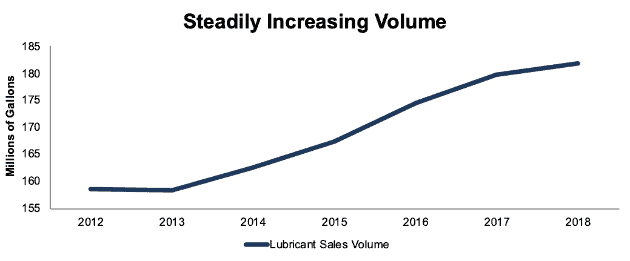

The strength of Valvoline’s business can be seen in the long-term increase in volume of lubricant sold. Figure 3 shows the total gallons of lubricant sold by the company has grown from 159 million in 2012 to 182 million in 2018, or 2% compounded annually.

Figure 3: Millions of Gallons of Lubricants Sold: 2014-2018

Sources: New Constructs, LLC and company filings

No matter the channel it sells through, consumer demand is rising, and Valvoline has shown an ability to consistently grow the overall sales of its products.

Advantages of the Quick-Lube Model

Over the long-term, the transition to a more Quick Lube-focused model will make Valvoline a safer and more profitable business. Quick Lube has significant advantages over the 3rd party retail model, including:

- Direct Customer Relationship: As noted above, Quick Lube lets Valvoline own the relationship with its consumers. It can gather data to personalize service and market more effectively, and it gets the opportunity to upsell higher value products and services.

- Vertical Integration: As both the manufacturer and distributor of its products, Valvoline can earn higher margins than when it has to split profits with the retailer.

- Higher Barriers to Entry: It’s relatively easy to start a motor oil brand to sell through retailers or online. By contrast, the Quick Lube model requires significant real estate investment and the ability to attract and train employees to deliver an adequate level of service.

Due to these advantages, Valvoline’s Quick Lube segment has an operating margin of 22% compared to 15% for the Core North America segment.

Valvoline doesn’t break out its assets by segment, so we can’t analyze the return on invested capital (ROIC) of these business lines. However, over 60% of the company’s Quick Lube locations are franchised, which suggests the capital requirements for this segment are relatively low, and the ROIC is fairly high. A recent company presentation said that new investments earn 2x their cost of capital (WACC), and that the company overall earns an ROIC above 20%. This latter number matches our own data and calculation that shows VVV’s overall ROIC is 20.4% for the TTM period.

Gaining Market Share

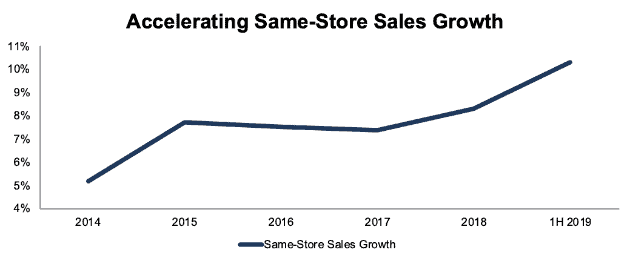

Valvoline isn’t just shifting sales from DIY consumer to DIFM. It’s also rapidly gaining market share in the DIFM oil change market. Consumers are already shifting more towards quick lube operators in the DIFM segment, and sales by oil change and lubrication shops increased by 4% in 2018, according to data from the Auto Care Association. Valvoline’s Quick Lube locations grew same-store sales by 8%, or double the industry rate, as shown in Figure 4. Through the first six months of 2019, same-store sales grew by 10% year-over-year.

Figure 4: VVV’s Quick Lube Same Store Sales Growth: 2014-TTM

Sources: New Constructs, LLC and company filings

On top of its same-store sales growth, Valvoline is rapidly growing its store count through new store openings and acquisitions of smaller quick lube chains. This rapid expansion drove a 22% increase in overall revenue (and 18% in reported operating income) for the Quick Lube segment in 2018.

Superior Efficiency Provides Advantages

Valvoline’s vertical integration and highly recognizable brand make its locations more efficient and profitable than independent quick lube operators. The average quick lube shop earned ~$862 thousand in revenue in 2018, while the average Valvoline quick lube shop topped $1 million in sales, which means their stores earn at least 16% more revenue than an average shop. According to a recent company presentation, their locations average ~40 oil changes per day compared to ~30 for the quick lube industry as a whole.

This superior efficiency explains Valvoline’s ability to earn a high return on new investments. The company can acquire independent quick lube operators, re-brand, add them to its distribution network, and quickly increase sales and profits.

In addition, the company’s superior efficiency may be related to its emphasis on promoting from within. According to a Wall Street Journal report from 2018, employees who started as technicians manage nearly all of the company-owned quick lube locations and occupy 83 out of the 84 regional manager roles. This emphasis on promoting from within helps to establish a consistent corporate culture, ensure that management understands the problems faced by technicians, and makes Valvoline a more attractive choice for prospective employees.

Bear Case: Amazon Basics Threat Is Overhyped

The bear case for Valvoline assumes that the growth of the Quick Lube segment won’t be enough to offset the decline of Core North America. In particular, the concern is that competition from private label brands will cause margins in this business to collapse.

This concern intensified last fall when Amazon (AMZN) announced it would start selling private label motor oil under the AmazonBasics brand. In the wake of this announcement, JPMorgan downgraded VVV to “Underweight”, and the stock fell 6%.

However, AmazonBasics is not the category killer that many investors believe it to be. Research shows that AmazonBasics has gained significant market share in electronics and accessories, but it’s struggled to break through in other categories. In particular, there are two key reasons why Amazon’s private label motor oil doesn’t represent a major threat to Valvoline:

- Oil Recycling: Most DIY oil changers recycle their used motor oil, and many take advantage of the oil recycling services offered by major auto parts retailers. If you’re already going to the store to recycle your oil anyway, it’s easier to just buy new oil there rather than online, so the typical convenience advantage of e-commerce doesn’t exist in this space. As a result, e-commerce accounts for just 5% of motor oil sales.

- No New Value Proposition: AmazonBasics motor oil is manufactured by Warren Distribution, the same company that already manufactures Walmart’s (WMT) private label motor oil brand, Supertech. With no real innovation on the production side and a price point equal to many other private label brands, there’s no reason to believe AmazonBasics motor oil will be a significant disruptor in this space.

Competition from private label brands has been and will continue to be a challenge for Valvoline’s Core North America segment, but Amazon doesn’t represent the threat that bears believe.

Bear Case: EV’s Won’t Spell Doom for VVV

Longer-term, the bear case against Valvoline is that the growth of electric vehicles – which don’t require motor oil and need less servicing than traditional vehicles – will make its business model obsolete. However, the widespread adoption of EV’s is farther off than most realize, and even if they do become dominant, Valvoline has the potential to adapt its business.

Despite the hype around EV’s, they currently account for just one in 250 cars on the road and 2% of new global auto sales. Even the most optimistic projections of EV adoption have them accounting for only 32% of the world’s passenger vehicles by 2040.

If EV’s do completely replace gas-powered cars, Valvoline’s Quick Lube model will enable it to adapt and survive. Its bread and butter oil change service might go away, but the company still performs plenty of services – such as tire rotation, air conditioner recharge, air filter replacement, light bulb replacement, and wiper blade replacement – that will still be required on EV’s.

In addition, the company could add new services as EV adoption grows. For instance, it could install rapid charging stations at its locations, introduce software troubleshooting, and develop more advanced coolants for batteries and fuel cells.

The significant backlog at Tesla’s (TSLA) service centers shows that there will continue to be demand for maintenance services as the share of EV’s grows. Who knows, perhaps Tesla or another automaker/dealer could consider Valvoline as an acquisition target in order to improve their service capabilities. Surveys show that millennials are significantly less likely to use dealerships for service and maintenance than previous generations, so automakers and dealers might be looking to get into the quick lube business.

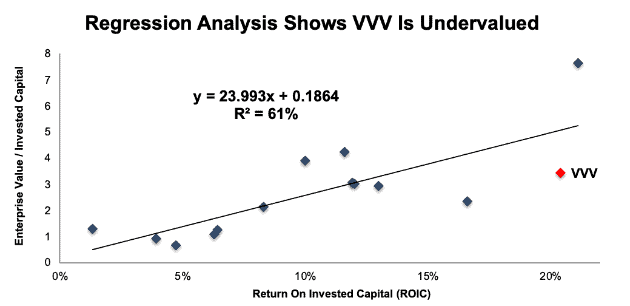

ROIC Analysis Shows Shares Are Undervalued

Numerous case studies show that getting ROIC right is an important part of making smart investments. Per Figure 5, ROIC explains 61% of the difference in valuation for the 14 companies Valvoline lists as peers in the lubricants/chemicals space in its proxy statement. VVV trades at a discount to peers as shown by its position below the trend line.

Figure 5: ROIC Explains 61% Of Valuation for VVV Peers

Sources: New Constructs, LLC and company filings

If the stock were to trade at parity with its peers, it would be worth $31/share – 53% above the current stock price. With Valvoline taking market share from other oil change peers, it arguably deserves a premium valuation compared to its peers.

Cheap Valuation Creates Buying Opportunity

VVV is down 15% since its spinoff in 2016 despite the fact that the firm’s NOPAT and economic earnings have increased since then. As a result, shares now have significant upside potential.

At its current price of $20/share, VVV has a price-to-economic book value (PEBV) ratio of 1.0. This ratio means the market expects no meaningful growth in VVV’s NOPAT over the remaining life of the firm. This expectation seems overly pessimistic for a firm that is steadily growing sales volume and shifting to a more profitable business.

If VVV can maintain its current NOPAT margin of 13% and grow NOPAT by just 5% compounded annually for the next decade, the stock is worth $32/share today – a 60% upside. See the math behind this dynamic DCF scenario.

Even if you believe that the rise of EV’s will be a long-term headwind, VVV still has upside. If we use the same 10-year forecast from the above scenario, but then assume that revenue will decline by 3% annually and NOPAT margins will shrink to 11% over the following 20 years, the stock is worth $22/share – an 11% upside. See the math behind this dynamic DCF scenario. In this scenario, VVV’s NOPAT decreases by 1% compounded annually over the course of the next 30 years.

Sustainable Competitive Advantages That Will Drive Shareholder Value Creation

Here’s a summary of why we think the moat around Valvoline’s business will enable the company to generate higher profits than the current valuation of the stock implies. This list of competitive advantages helps VVV offer better products/services at a lower price and prevents competition from taking market share.

- Highly recognizable brand with a reputation for quality and reliability

- Vertical integration leads to higher cost efficiency for Quick Lube business

- Ability to rapidly integrate newly acquired locations at a high ROIC

- Direct customer relationships create lasting value no matter what type of car people drive

What Noise Traders Miss with VVV

These days, fewer investors focus on finding quality capital allocators with shareholder friendly corporate governance. Instead, due to the proliferation of noise traders, the focus tends toward technical trading tends while high-quality fundamental research is overlooked. Here’s a quick summary for noise traders when analyzing VVV:

- Understated earnings growth due to the impact of tax reform on 2018 GAAP net income

- Despite short-term volatility, transition from 3rd party retail to Quick Lube model will be beneficial long-term

- Amazon is not as significant a threat in this space as investors fear

- Electric cars still need service, and manufacturer service locations cannot meet existing demand

Catalyst: Earnings Beats Can Send Shares Higher

Valvoline faces significant pessimism from analysts due to its recent history of earnings misses. Five out of the nine sell-side analysts covering the stock rate it as a Hold or Sell. Consensus estimates have earnings flat year-over-year for the current quarter.

As Quick Lube becomes a larger part of Valvoline’s business, its growth should become enough to offset the struggles of Core North America. In addition, the company has announced a cost-saving initiative and promotional pricing in order to stabilize its legacy business.

Longer-term, international expansion could be a major growth driver for the company. Valvoline announced a joint venture with Masters Too to develop a quick lube model in China earlier this year. If the company successfully exports this high-growth business to an international consumer base, the upside potential is enormous.

Exec Comp Should Return to ROIC Emphasis

Due to its recent spinoff from Ashland (ASH), Valvoline’s executives continued to earn long-term awards based on targets set by its former parent company through 2018. These targets included return on investment (ROI), which is similar to ROIC.

However, the new long-term targets set by the company focus on EPS and total shareholder return, while annual bonuses are based on operating income and lubricant volume. The company continues to emphasize ROIC in reports and presentations, but it would be better if it continued to clearly link executive compensation to this important metric.

Dividends and Buybacks Provide 4% Yield

Valvoline has increased its dividend in each of its three years as an independent company. Since 2016, Valvoline has increased its dividend by 47% compounded annually. Its current annualized dividend of $0.42 equates to a dividend yield of 2.1%

In addition to dividends, Valvoline returns capital to shareholders through share repurchases. In 2018, the company repurchased $325 million (8% of market cap) worth of shares. The company currently has $75 million remaining on its purchase authorization. If it exercises the rest of this authorization, Valvoline’s dividend and buyback activity provide shareholders with a potential 4% yield.

Insider Trading and Short Interest Trends are Minimal

Insider activity has been minimal over the past 12 months, with 33 thousand shares purchased and 94 thousand shares sold for a net effect of 62 thousand shares sold. These sales represent less than 1% of shares outstanding.

There are currently 5.7 million shares sold short, which equates to 3% of shares outstanding and 4 days to cover. There doesn’t appear to be much appetite to bet against this stock.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

As investors focus more on fundamental research, research automation technology is needed to analyze all the critical financial details in financial filings. Below are specifics on the adjustments we make based on Robo-Analyst[1] findings in Valvoline’s 2018 10-K:

Income Statement: we made $128 million of adjustments, with a net effect of removing $122 million in non-operating expense (5% of revenue). We removed $3 million in non-operating income and $125 million in non-operating expenses. You can see all the adjustments made to VVV’s income statement here.

Balance Sheet: we made $518 million of adjustments to calculate invested capital with a net decrease of $76 million. You can see all the adjustments made to VVV’s balance sheet here.

Valuation: we made $1.8 billion of adjustments with a net effect of decreasing shareholder value by $1.8 billion million. Despite this decrease in value, VVV remains undervalued. You can see all the adjustments made to VVV’s valuation here.

Attractive Funds That Hold VVV

The following fund receives our Attractive-or-better rating and allocates significantly to Valvoline.

- American Beacon Shapiro SMID Cap Equity Fund (SHDPX) – 3.4% allocation and Attractive rating

This article originally published on July 10, 2019.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Harvard Business School features the powerful impact of our research automation technology in the case New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.