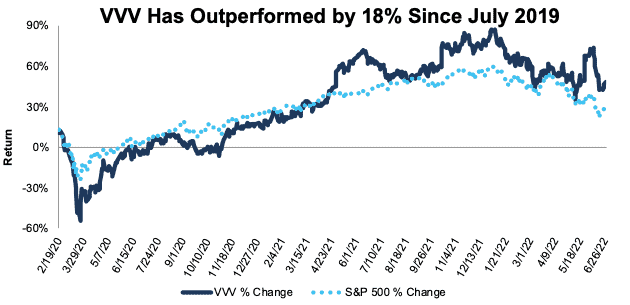

We first made Valvoline (VVV: $29/share) a Long Idea in July 2019. Since then, the stock is up 49% compared to a 30% gain for the S&P 500. The company’s ability to execute its transition strategy gives this stock much more upside. As we’ll show the stock could be worth at least $40/share today – a 38%+ upside.

This report leverages our cutting-edge Robo-Analyst technology to deliver proven-superior[1] fundamental research and support more cost-effective fulfillment of the fiduciary duty of care.

VVV Has Long-term Upside Based on the Company’s:

- large store footprint

- growing retail business

- retail market share gains

- opportunities to grow in new verticals

Figure 1: Long Idea Performance: From Date of Publication Through 6/27/2022

Sources: New Constructs, LLC

What’s Working

Retail Revenue Growth: Price increases and strong demand for the company’s products and services drove revenue growth for Valvoline in fiscal 2Q22. The company’s global products segment rose 29% year-over-year in fiscal 2Q22, while retail services rose 23%. Same-store retail sales grew 13% YoY in fiscal 2Q22.

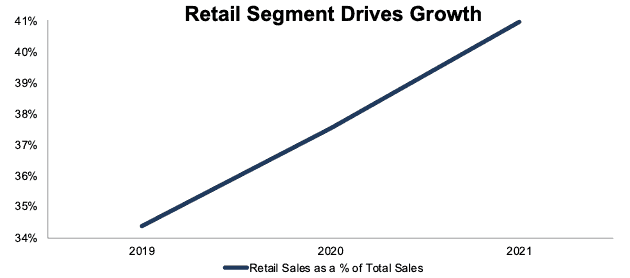

Retail Footprint: In our original report, we highlighted the potential for Valvoline to create even more shareholder value by growing its retail segment. Since then, retail has driven the company’s revenue growth. Valvoline’s retail segment grew from just 34% of total revenue in fiscal 2019 to 41% in fiscal 2021, per Figure 2.

Figure 2: Valvoline’s Retail Revenue as a Percent of Total Revenue: Since Fiscal 2019

Sources: New Constructs, LLC and company filings

Valvoline Keeps Gaining Market Share: Valvoline’s retail presence drives strong same-store sales. The company’s same-store sales have grown year-over-year (YoY) in 15 consecutive years and have grown faster than the U.S. quick oil change market in each of the past four years. In fiscal 2021, same-store sales rose 21% YoY, while the U.S. market grew just 10% over the same time.

Growth Opportunities: Looking ahead, the company has opportunities to grow retail sales through opening new stores, acquisitions, and expanding service offerings.

The company grows stores through opening new company stores, adding new franchised stores, and acquiring existing stores. From fiscal 2017 – 2021, Valvoline added 467 stores. At the end of fiscal 2Q22, Valvoline’s management indicated the company looks to add ~150 (midpoint forecast) new stores in fiscal 2022, or 9% of fiscal 2021’s systemwide stores.

From fiscal 2017 – 2021, the company acquired 241 stores, or 23% of fiscal 2016’s systemwide stores. While acquisitions can often lead to shareholder value destruction, Valvoline has created shareholder value while pursuing its blended organic and inorganic growth strategy. The company’s economic earnings, which capture changes to the income statement and balance sheet, have grown from $200 million in fiscal 2016 to $288 over the TTM.

The company will also grow its business as it enters the heavy-duty truck servicing market. Valvoline sees large opportunity given it can complete services in 75 minutes or less in a market where services times can take up to 24 hours or more.

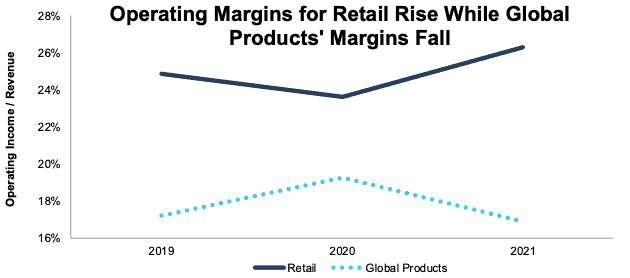

Valvoline’s Improving Retail Margins: Valvoline’s rising retail segment operating margins nearly offset the falling margins from its global products segment. The company’s net operating profit after tax (NOPAT) margin fell from 14.3% in fiscal 2019 to 14.1% in fiscal 2021. Should the company succeed in spinning-off its global products business, Valvoline shareholders would be left with a faster-growing, higher margin business with strong growth opportunities.

Figure 3: Valvoline’s Operating Margin by Segment: Since Fiscal 2019

Sources: New Constructs, LLC and company filings

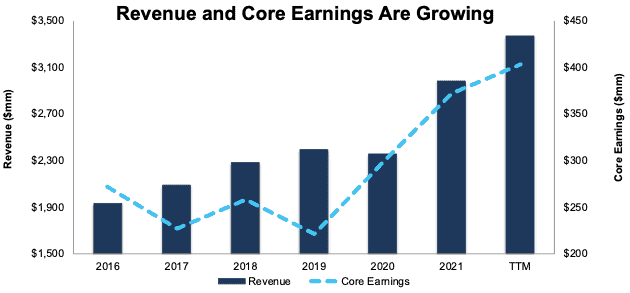

Core Earnings Have Grown at a 6% CAGR Since Fiscal 2016: Valvoline’s top-line growth has translated to bottom line profits since it separated from Ashland (ASH) in fiscal 2016. Valvoline has grown revenue from $1.9 billion in fiscal 2016 to $3.4 billion over the trailing twelve months (TTM). Valvoline’s Core Earnings grew from $272 million in fiscal 2016 to $372 million in fiscal 2021, or 6% compounded annually. Over the TTM, the company’s Core Earnings are $403 million.

Figure 4: Revenue & Core Earnings Since Fiscal 2016

Sources: New Constructs, LLC and company filings

What’s Not Working

Rising Labor Costs: Rising labor costs are a headwind to the company’s retail segment. In addition to higher salaries, the company has “pulled forward” several labor-related expenses in fiscal 2022 to retain and attract employees.

Though the sharp increase in the cost of labor pressured the company’s margins in fiscal 1H22, the company has increased prices to offset higher costs, actions which the company believes will begin to improve margins in fiscal 3Q22.

Electric Vehicles Need Servicing, Too: While the future of the oil change market is tied directly to the number of internal combustion engines (ICE) vehicles on the road, Valvoline’s future will extend beyond oil changes. In fact, Valvoline has already begun expanding into the EV market with a pilot program it started in February 2022.

The company’s extensive retail footprint makes it a natural fit to provide routine EV maintenance. Though EVs may require less preventative maintenance than ICE vehicles, the number of light-duty cars and trucks on the road in 2050 will be 76% higher than in 2020 according to the U.S. Energy Information Administration’s (EIA) estimate.

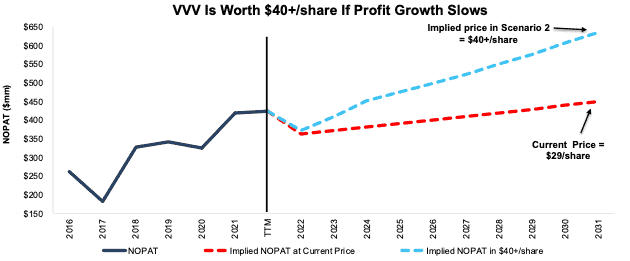

Stock Is Priced for Decline in Profits

Valvoline’s price-to-economic book value (PEBV) ratio is just 0.9, which means the market expects its profits to fall and permanently remain 10% below TTM levels. Below, we use our reverse discounted cash flow (DCF) model to analyze the expectations for future growth in cash flows baked into a couple of stock price scenarios for Valvoline.

In the first scenario, we quantify the expectations baked into the current price. We assume:

- NOPAT margin remains at fiscal 2Q22 levels of 12% (lowest since fiscal 2017 and below five-year average of 13%) from fiscal 2022 – 2031 and

- revenue grows just 2% (well below fiscal 2022 – 2024 consensus estimate CAGR of 12%) compounded annually from fiscal 2022 to 2031.

In this scenario, Valvoline’s NOPAT grows just 1% compounded annually over the next decade, and the stock would be worth $30/share today – nearly equal to the current price. For reference, the company’s NOPAT grew 10% compounded annually over the past five years.

Shares Could Reach $40+ Even Without a Spin-off

If we assume Valvoline’s:

- NOPAT margin remains at fiscal 2Q22 levels throughout fiscal 2022, improves to 12.5% in fiscal 2023, and equals 13.1% from fiscal 2024 – 2031 and

- revenue grows at a 5% CAGR from fiscal 2022 – 2031, then

the stock would be worth at least $40/share today – 38% above the current price. In this scenario, Valvoline grows NOPAT by 4% compounded annually over the next 10 years. For reference, Valvoline has grown NOPAT by 10% compounded annually over the past five years. Should Valvoline’s NOPAT growth improve to historical levels, the stock has even more upside.

Figure 5: Valvoline’s Historical and Implied NOPAT: DCF Valuation Scenarios

Sources: New Constructs, LLC and company filings

A Spin-off Could Unlock Even More Value for Shareholders

Looking ahead, Valvoline is pursuing a separation of its retail and global products segments. Valvoline’s strong retail footprint enables the company to transition to a high-touch, customer service-focused, high margin business.

If we assume Valvoline spins-off its global products segment and the remaining retail business:

- maintains an 18% NOPAT margin (equal to estimated retail NOPAT margin in fiscal 2021), and

- grows revenue at a 5% CAGR from fiscal 2022 – 2031 (compared to retail segment revenue CAGR of 22% from fiscal 2019 – 2021), then

the retail business is worth $5.9 billion, or $33/share today. In this scenario, Valvoline’s retail NOPAT grows by 5% compounded annually over the next 10 years.

If we assume Valvoline spins off its global products segment at 10% below the segment’s estimated economic book value[2], global products would be worth $2.4 billion, or ~$14/share today. The combined value of the two segments would be $47/share, or 57% above the current price.

Should Valvoline grow its retail NOPAT at an even faster rate, or if the market values the global products spin-off at a higher value, Valvoline’s shares have even more upside.

This article originally published on June 29, 2022.

David Trainer, Kyle Guske II, Matt Shuler, and Brian Pellegrini receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Our research utilizes our Core Earnings, a more reliable measure of profits, as proven in Core Earnings: New Data & Evidence, written by professors at Harvard Business School (HBS) & MIT Sloan and published in The Journal of Financial Economics.

[2] Global products estimated EBV equals estimated Fiscal 2021 global products NOPAT divided by Valvoline’s current WACC plus the estimated EBV adjustments attributable to the global products segment.