This report details improvements we’re making to our Company Models to better handle the impact of Accounting Standards Update (ASU) 2016-01.

Background

The Financial Accounting Standards Board (FASB) passed ASU 2016-01, “Recognition and Measurement of Financial Assets and Financial Liabilities,” in January 2016 with implementation beginning in fiscal year 2018. This rule impacts the way companies account for changes in the fair value of securities on their income statement.

As part of ASU 2016-01, companies must classify securities as equity investments or equity investments accounted for under the equity method. This change had a significant impact on companies that hold a large amount of equity securities for profit, such as Berkshire Hathaway (BRK.A). Adoption of ASU 2016-01 creates noise and volatility in GAAP Earnings, Core Earnings, net operating profit after-tax (NOPAT), and invested capital. We previously updated our models to reverse the impact of this accounting rule change and ensure our models provide the most accurate picture of a company’s true operations. Details here.

The Update

Upon further investigation, we determined that our approach to reversing the impact of ASU 2016-01 could be improved. More specifically, we improved how we determine what percentage of unrealized gains and losses on equity securities are related to minority shareholders. This percentage is important because we remove it from the unrealized gains and losses on equity securities used to adjust other comprehensive income (OCI) values.

The changes that will impact invested capital directly:

- Calculate the minority interest percentage using balance sheet values instead of income statement values

- Restrict the percentage of unrealized gains and losses on equity securities related to minority shareholders to between 0% and 50%.

The Reason

We make this adjustment because, depending on what percentage of the company minority shareholders own, companies allocate a portion of unrealized gains and losses on equity securities to retained earnings and a portion to the minority interest liability. To reverse the impact of ASU 2016-01, we need to only add back to OCI the portion of unrealized gains and losses on equity securities related to non-minority interest shareholders. Since companies do not often disclose the exact percentage of the company that minority shareholders own, we must determine one.

To calculate the percentage that minority shareholders own, there are two logical approaches:

- Income Statement

- Calculation:

- Minority Interest Expense / (Net Income + Minority Interest Expense)

- Calculation:

- Balance Sheet

- Calculation:

- Minority Interest Liability / (Shareholders Equity + Minority Interest Liability)

- Calculation:

Initially, we used the income statement approach in our models. Upon further review, we found that using the balance sheet approach was more accurate, less volatile, and produced less abnormal or outlier results than using income statement values.

To further eliminate outliers, we restrict the percentage of unrealized gains and losses on equity securities related to minority shareholders to between 0% and 50%. This restriction is based on (1) in practice, most minority interest ownerships are between 10% and 30%, (2) companies do not usually disclose a minority interest unless it represents at least 10% of the company, and (3) ownership above 50% is no longer “minority” and will likely result in the company being consolidated by the owner.

Impact on our Models

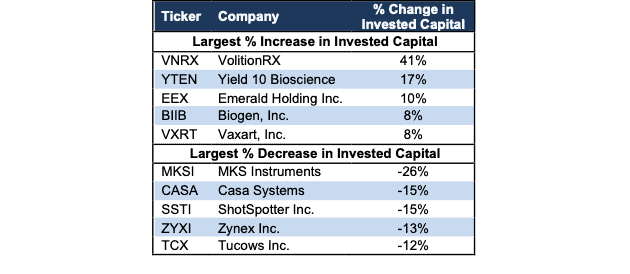

These changes will be reflected in our models beginning on March 24, 2023. While these changes will have an impact on models, we expect the impact to be mostly minimal. Figure 1 shows the ten largest changes in invested capital, and subsequently ROIC, in the current trailing-twelve-month (TTM) period as a result of this update.

Figure 1: Largest Impact from Changes to Minority Interest Calculation

Sources: New Constructs, LLC and company filings

This article was originally published on March 22, 2023.

Disclosure: David Trainer, Hunter Anderson, Kyle Guske II, and Italo Mendonça receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.