We leverage our Robo-Analyst to comb through the 10-Q’s and 10-K’s, including the footnotes and MD&A, of the ~3,000 companies under coverage to ensure we provide the most reliable fundamental data to our clients. Through this diligence, we found unusual items in the filings of Dropbox Inc. (DBX) and several other companies during the first week of The Real Earnings Season.

Dropbox’s Write-Downs Understate Earnings

While analyzing its 2020 10-K, analyst Garrett O’Grady found that Dropbox recorded a $398 million impairment (155% of 2020 GAAP net income) related to its real estate assets. In response to the COVID-19 pandemic, Dropbox implemented its “Virtual First” work policy, which made remote work the primary experience for all employees. As a result, the firm will sublease a significant amount of its current office space, and it had to take an asset write-down on the sub-leased portion of its office space where the carrying value exceeded its fair value.

How We Treat Asset Write-Downs: Asset write-downs, such as Drobox’s “impairment charge,” are one of many reasons why GAAP net income doesn’t tell the whole story of a company’s profitability. We remove write-down charges to calculate a firm’s true recurring profits. Asset write-downs also allow management to erase equity from the balance sheet, which can artificially improve profitability metrics like return on assets.

We add-back the after-tax value of asset write-downs to our measure of invested capital. Without this diligence, investors will get a misleading picture of Dropbox’s true profitability. After adjusting for all unusual gains/losses, Dropbox’s Core Earnings of $116 million are much higher than GAAP net income of -$256 million in 2020.

Other Interesting Items We Found

Since February 19, 2021, we have parsed 681 10-Q and 10-K filings, which means Dropbox’s impairment charge isn’t the only unusual item our analysts have found. Below are a few other notable items we discovered while rigorously analyzing the footnotes and MD&A:

Consolidated Edison, Inc. (ED) – Service Interruption Liability

- While analyzing Consolidated Edison’s 2020 10-K, analyst Alex Sword came across a liability for service interruption that investors may be unaware of. On page 19, the firm discloses that in the event of a service interruption, it’s liable for up to $15 million in reimbursements for food and prescription medicine spoilage losses.

Marriott International, Inc. (MAR) – Contractual Obligation

- Analyst Cody Fincher noticed on page 36 of Marriott’s 2020 10-K that the firm has a contractual obligation to purchase the leasehold interest in land and a hotel for $300 million from a hotel owner. As part of this agreement, Marriott also has an option to buy the underlying land for an additional $200 million. After COVID-19 crushed the current value of many hotel properties, Marriott could be on the hook to purchase property at a large premium.

Avis Budget Group, Inc. (CAR) – Unusual COVID-Related Charge

- On page 37 of Avis Budget Group’s 2020 10-K, analyst Robbie Woodward, found an unusual COVID-19 charge that impacts GAAP net income. Avis recorded a $10 million (1% of reported Loss before income taxes) write-down related to lost vehicles from a fire in an overflow parking lot. We remove this non-operating charge from our measure of net operating profit after tax (NOPAT) and Core Earnings. As noted above, we also add-back the write-down to invested capital to hold companies accountable for all the capital invested in their businesses over their operating lives.

The Power of the Robo-Analyst

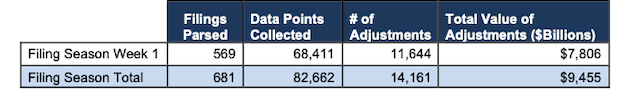

We analyzed 569 10-K and 10-Q filings last week, from which our Robo-Analyst[1] technology collected 68,411 data points. Our analyst team made 11,644 forensic accounting adjustments with a dollar value of $7.8 trillion. The adjustments were applied as follows:

- 4,278 income statement adjustments with a total value of $453 billion

- 4,739 balance sheet adjustments with a total value of $3.1 trillion

- 2,627 valuation adjustments with a total value of $4.3 trillion

Figure 1: Filing Season Diligence for the Week of February 22 – February 27

Sources: New Constructs, LLC and company filings.

Every year in this six-week stretch from mid-February through the end of March, we parse and analyze roughly 2,000 10-Ks to update our models for companies with 12/31 and 1/31 fiscal year ends. This effort is made possible by the combination of expertly trained human analysts with our “Robo-Analyst.” Featured by Harvard Business School in “Disrupting Fundamental Analysis with Robo-Analysts”, our Robo-Analyst research automation technology uses machine learning and natural language processing to automate and improve financial modeling.

Only our “novel dataset”, which leverages our Robo-Analyst technology, enables investors to overcome flaws with legacy fundamental datasets to apply reliable fundamental data in their research. Core Earnings: New Data & Evidence, forthcoming in The Journal of Financial Economics, reveals the problems with fundamental data provided by legacy firms like Bloomberg, Refinitiv, FactSet (FDS) and S&P Global (SPGI).

This article originally published on March 1, 2021.

Disclosure: David Trainer, Garrett O’Grady, Cody Fincher, Alex Sword, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Harvard Business School features the powerful impact of our research automation technology in the case New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.