Many actively managed mutual funds operate with “black box” strategies that give investors little information about how the managers pick stocks. Fund documents will give vague platitudes about how the managers use “fundamental analysis” to find “highly profitable” companies that are “undervalued”, but these terms lack clear definition.

This lack of clarity is a significant problem for investors. A manager that uses “fundamental research” that is based on analysis of accounting earnings and flawed metrics such as price to earnings or price to book is not as reliable as a manager that focuses on return on invested capital (ROIC)[1].

Even if managers claim they leverage ROIC in the process, investors usually have no way of verifying this claim. Leveraging our Robo-Analyst technology[2], which analyzes the holdings of all 7,764 ETFs and mutual funds under coverage, we found a mutual fund with managers that put their money where their mouth is when it comes to ROIC. Despite its high quality, investors seem to be avoiding this fund due to its three-star Morningstar rating. This mutual fund, Thrivent Large Cap Value Fund (TLVIX), is this week’s Long Idea.

Holdings Analysis Reveals Quality Asset Allocation

TLVIX makes it clear in its fund documents that ROIC is the key metric it analyzes when picking stocks, saying:

“The management team seeks to identify companies with stable or increasing operating performance, defined by return on invested capital (ROIC).”

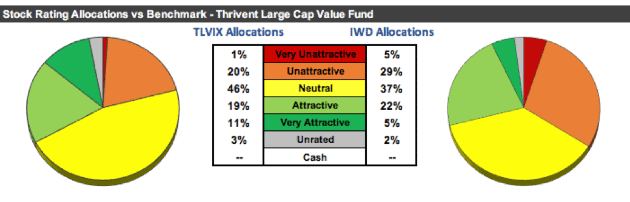

This focus on ROIC helps TLVIX do a better job of picking high quality holdings and avoiding risky stocks compared to its peers. Figure 1 shows that TLVIX allocates a higher percentage of its assets to Attractive-or-better stocks and a lower percentage to Unattractive-or-worse stocks than its benchmark, the iShares Russell 1000 Value ETF (IWD).

Figure 1: TLVIX Asset Allocation Compared to IWD

Sources: New Constructs, LLC and company filings

Per Figure 1, TLVIX allocates 30% of its assets to Attractive-or-better rated stocks compared to 27% for IWD. More impressively, it allocates more than double the amount (11% to 5%) to Very Attractive stocks. On the flip side, TLVIX allocates just 21% of its assets to Unattractive-or-worse rated stocks compared to 34% for IWD.

A big part of the difference in holdings quality comes from the superior ROIC of TLVIX’s holdings, which earn an 11% ROIC on average compared to just 7% for IWD.

ROIC Drives Valuation

TLVIX also understands that ROIC plays an important role in determining stock valuations. Our regression analysis shows that ROIC explains ~60% of the difference for S&P 500 stocks, and the causal relationship is even more significant when we look at stocks in the same sector.

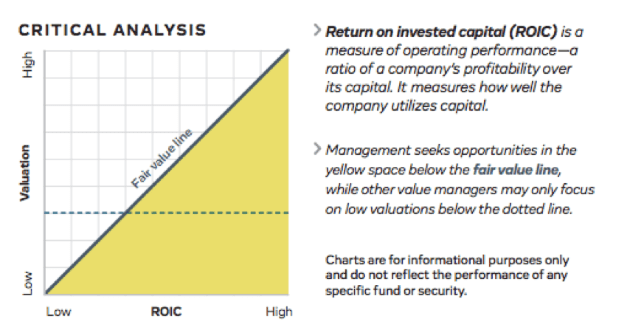

Figure 2, from TLVIX’s promotional material, shows that they embrace a similar philosophy. Rather than having a set cutoff for valuations, they understand that higher ROIC companies merit similarly higher valuations.

Figure 2: TLVIX Valuation Methodology

Sources: Thrivent Mutual Funds

Regular readers will find Figure 2 familiar, as it looks very similar to the charts we use to analyze valuation in our Long Idea and Danger Zone articles. This framework is a central element in ROIC: The Paradigm For Linking Corporate Performance To Valuation.

Sound Methodology Leads to Quality Holdings

What a fund manager says about their methodology is important, but what really matters is whether or not that methodology leads them to pick high-quality stocks. As our analysis above shows, TLVIX does allocate more heavily towards high-quality holdings.

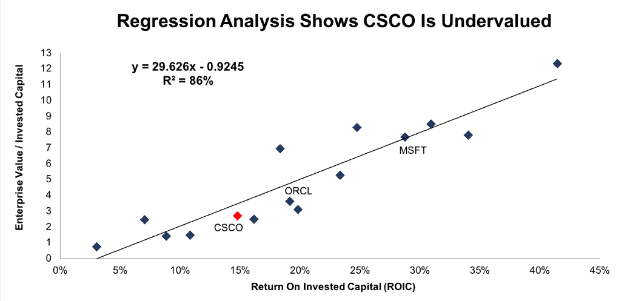

We can see how TLVIX’s methodology leads it to pick high-quality stocks by looking at its top holding, Cisco Systems (CSCO), which accounts for ~5% of its portfolio.

CSCO is a stock that many value investors might screen out from the start due to its P/B of 4.3, which is above the 3.4 P/B of the S&P 500. However, as Figure 2 shows, higher ROIC stocks deserve higher valuations, and CSCO’s 15% ROIC puts it in the top quintile of all 2,800+ companies under our coverage.

Figure 3 compares CSCO to the peer group listed in its proxy statement[3] on the basis of ROIC and enterprise value/invested capital (a cleaner version of price to book). Essentially, it recreates the chart from Figure 2, and shows that CSCO lies in the yellow area of opportunity below the line.

Figure 3: ROIC Explains 86% of Valuation for CSCO Peers

Sources: New Constructs, LLC and company filings

If the stock were to trade at parity with its peer group, it would be worth $53/share – a 25% upside to the current stock price. Despite looking expensive by some traditional valuation metrics, CSCO is actually significantly undervalued.

CSCO is not the only stock where TLVIX takes advantage of this disconnect. Figure 3 shows that Oracle (ORCL) and Microsoft (MSFT) also sit below the trendline (just barely in MSFT’s case). Not coincidentally, both of these stocks are in TLVIX’s top-10 holdings.

By utilizing ROIC as part of its valuation methodology, TLVIX is able to identify highly profitable companies trading at a discount to their fair value.

Low Costs Benefit Investors

Not only does TLVIX offer high-quality stock selection, it does so at a reasonable price. The fund’s total annual costs of 0.62% make it the 47th cheapest out of 940 Large Cap Value ETFs and mutual funds that we cover. Its costs are about half of the cap-weighted average of 1.23% for other funds in its style.

Backward-Looking Research Misses This Fund

Despite its low costs and high-quality holdings, TLVIX has just $1.1 billion in assets. 481 other Large Cap Value funds have more investor money allocated to them.

As we’ve written before, investors are good at finding cheap funds, but not as good at identifying funds with high-quality holdings. Most investors do not realize they can get high-quality research on fund holdings, so they continue to rely on backward-looking research.

TLVIX earns just a three-star rating from Morningstar, which means that it won’t even show up on the radar of many investors. Many financial advisors won’t recommend a fund to their clients if it doesn’t have a five-star rating.

While Morningstar ratings are a useful way to track a fund manager’s performance, they shouldn’t be the final say on fund selection. Research from the Wall Street Journal shows that funds with different star ratings tend to converge over the long-term, a fact that Morningstar acknowledges in the article, saying:

“The star rating works well when it’s used as intended: as a first-stage screen that helps identify lower-cost, lower-risk funds with good long-term performance. It is not meant to be used in isolation or as a predictive measure. Reversion to the mean is a powerful force that can affect any investment vehicle.”

Combining holdings-based analysis with performance measures can help give investors a more complete picture. They can see which high-flying funds may be due for a crash, and which funds with mediocre performance – such as TLVIX – may have high-quality holdings and are due to soar.

Investors deserve comprehensive fund research that takes into account all aspects of a fund’s history, strategy, costs, and holdings. Advisors that just steer investors to five-star funds without performing further diligence are not fulfilling their Fiduciary Duty of Care.

This article originally published on July 11, 2018.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Ernst & Young’s recent white paper “Getting ROIC Right” proves the superiority of our holdings research and analytics.

[2] Harvard Business School features the powerful impact of our research automation technology in the case New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.

[3] Excluding outlier Apple (AAPL)