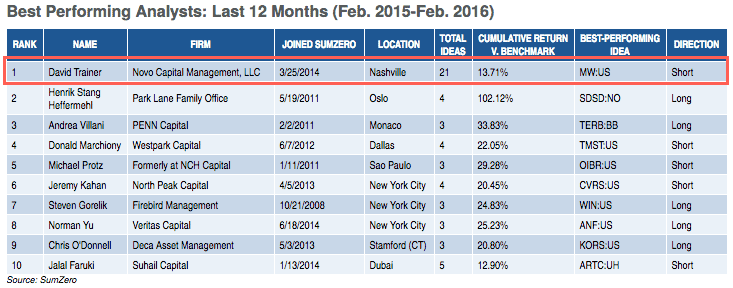

Bloomberg just reported (PDF here) that New Constructs’ CEO David Trainer is the #1 stock picker over the last twelve months (LTM) per SumZero Rankings. SumZero is a highly exclusive buy-side only platform for connecting allocators and money managers. Each of the 12,000 managers/contributors is pre-screened before being allowed to join. New Constructs joined SumZero in 2014 and has submitted 33 separate ideas with an aggregate annualized return of over 24%.

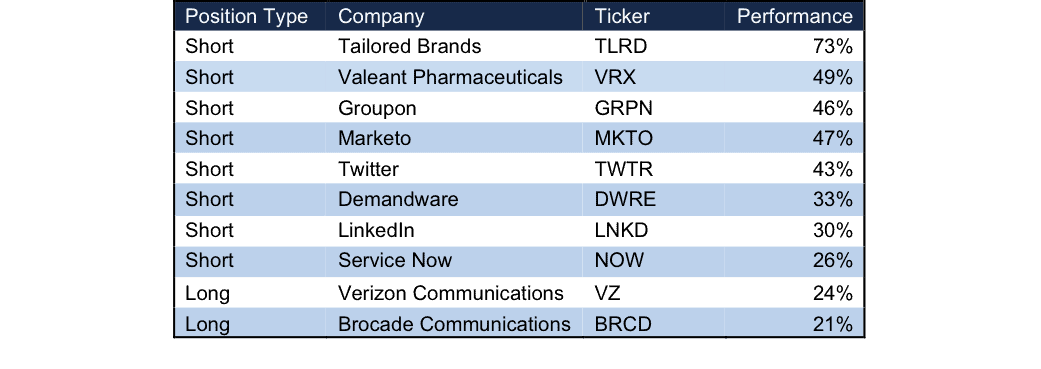

As a member of our mailing list, you get access to these investment ideas before we send it to SumZero. Figure 1 highlights some of our most successful ideas posted to SumZero.

Figure 1: SumZero Stocks Performance Since Publishing Date

Sources: New Constructs, LLC and company filings

In these reports, we look past the traditional reported numbers to derive the true recurring profits (or losses) of the business. Only then are we able to identify under or overvalued companies. The following is just a sampling of the ideas posted to SumZero and what is available as a client of New Constructs.

Our report explicitly pointed out that the acquisition of Jos. A Bank was a clear destruction of value. Our thesis came true when Men’s Wearhouse pre-announced 3Q15 results and the Jos. A Bank division came in well below even the most pessimistic expectations.

Prior to the Jos. A Bank acquisition, Men’s Wearhouse had grown after-tax profits (NOPAT) by 16% compounded annually from 2009-2013. Profit growth began to decline in 2014 and Men’s Wearhouse viewed Jos. A Bank as a way to boost sales and return to profit growth. However, the price paid for Jos. A Bank was too high and proved to be a poor use of capital. Based on the purchase price of $1.8 billion, and the $63 million NOPAT Jos. A Bank earned in the year prior to acquisition, the deal offered a paltry 4% return on invested capital (ROIC), which was half the ROIC Men’s Wearhouse earned in 2014.

Our report also focused on the large rise in MW’s valuation and the attendant expectations for future cash flows implied by the new price levels. For years MW had traded near its economic book value, or no growth value. As the bidding process for Jos. A Bank began, investors pushed MW shares well above the economic book value, which caused MW to be highly overvalued. Without perfect integration and execution of the Jos. A Bank business, Men’s Wearhouse shares had nowhere to go but down.

And down shares would go. When MW pre-announced poor 3Q15 results, shares fell 40% in one day. Later when the 10-Q was released, the stock fell even further and ended 2015 down 73% since our report.

Groupon’s goal of revolutionizing how consumers interact with merchants never materialized. Our Danger Zone report noted that not only was Groupon’s initial “daily coupon” business failing, its expansion towards acting as a traditional retailer would only further depress margins and profitability as the company faced steep competition in that space as well. At the end of 2014, it was clear that Groupon’s revenue growth had come at the expense of profits, which cratered to -$6 million NOPAT in 2014, down from $42 million the year before.

Compounding the issues with its middleman business model, Groupon relied heavily on its user base remaining active and interested in the daily coupon market. However, with only 48 million active users at the time of our initial report, Facebook, Twitter, and even LinkedIn dwarfed Groupon’s user base. With relatively few users, it was hard to see why investors had valued Groupon for such significant future profit growth.

The failings of Groupon’s business became clear when the company began reporting results in the second half of 2015. Expected revenues and earnings were continually being lowered as Groupon failed to profitability grow its new retail operations. All the issues came to a head when, in 3Q15, Groupon reported year over year revenue decline, guided 4Q15 metrics below expectations, and CEO Eric Lefkofsky stepped down from his position.

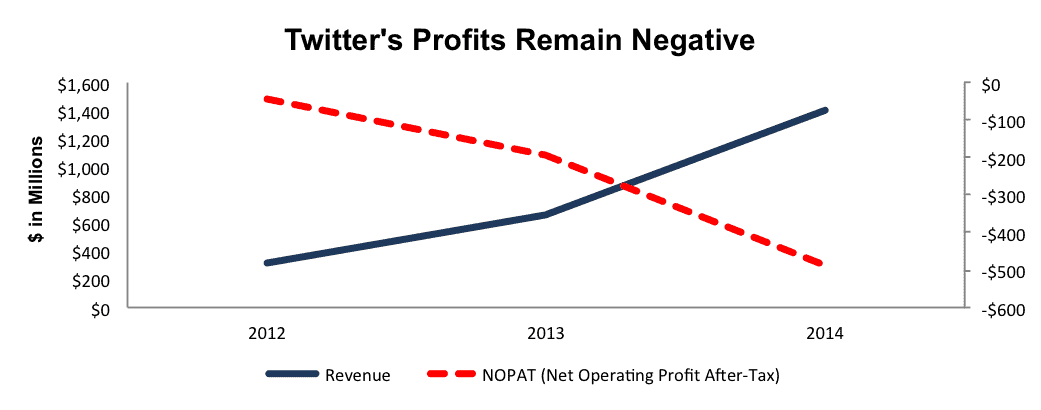

Twitter went public in 2013 touting excellent customer growth, revenue growth, and had the makings of “the next big thing.” Investors seemed willing to overlook the fact that the company had failed to operate the business in a profitable manner, and, therefore, the stock had plenty of room to fall. Figure 2 has more details.

Figure 2: Twitter’s Business Model Lacks Profits

Sources: New Constructs, LLC and company filings

We identified two big problems with Twitter’s business. The first was its cost structure. Despite achieving impressive revenue growth, Twitter’s cost of sales and marketing expenses were growing nearly as fast. Compounding the growth in costs was the increased use of stock based compensation, which had grown from 6% of total expenses in 2012, to nearly one third of the company’s expenses in 2014. Twitter conveniently removed this compensation expense when reporting its non-GAAP earnings.

The second, and bigger problem was Twitter’s flawed business model. The best interests of the users (i.e. quick, easy access to the content of their choosing) were not (and still not) aligned with the best interests of advertisers (i.e. getting more attention of users not necessarily looking for them). This conflict made us wonder how successful Twitter’s business could be long-term.

The stock dropped when Twitter reported it would have trouble growing its user base in the near-term and that CEO Dick Costolo was departing from his position.

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, sector, or theme.

Click here to download a PDF of this report.

Photo Credit: bloomberg briefs