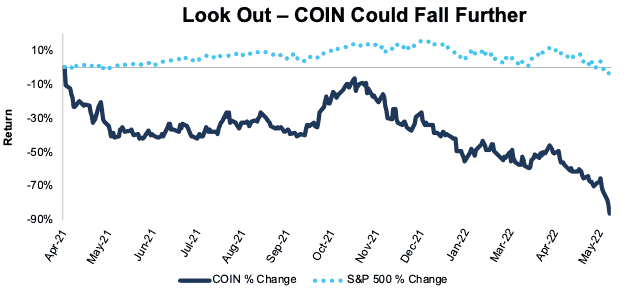

With Coinbase (COIN: $60/share) down 77% year-to-date (YTD) and 85% since we first put the company in the Danger Zone in March 2021, investors might be thinking now is the time to get shares at a discount. Think again. Coinbase’s 1Q22 results and guidance do not bode well for the future, and we think shares are worth as little as $17/share even with optimistic assumptions for long-term margins and revenue growth.

This report leverages our cutting-edge Robo-Analyst technology to deliver proven-superior[1] fundamental research and support more cost-effective fulfillment of the fiduciary duty of care.

Figure 1: COIN Performance Vs. S&P 500 Since Initial Danger Zone Through 5/12/22

Sources: New Constructs, LLC and company filings

Weakness in 1Q22 a Sign of Things To Come

As noted in our prior update in March 2022, the growth and profitability achieved by Coinbase in 2021 was unsustainable – 1Q22 proved as much. In the quarter Coinbase’s:

- net operating profit after-tax (NOPAT) margin fell to -19%, down from 43% in 1Q21

- invested capital turns fell from to 0.4, down from 1.4 in 1Q21

- return on invested capital (ROIC) fell to -7%, down from 58% in 1Q21

- free cash flow (FCF) was -$1.4 billion, compared to $969 million in FCF in 2021.

Coinbase’s own preferred metrics were weak as well:

- trading volume reached its lowest level of the past five quarters

- monthly transacting users (MTUs) fell 19% quarter-over-quarter

- average transaction revenue per user (ATRPU) was $35 in 1Q22, down from $64 in 2021, $45 in 2020, and slightly above $34 in 2019.

Guidance Is No Better

Going forward, we expect Coinbase’s margins and revenue growth rates to decline as competition increasingly eats into its business. Increased volatility, or further downward movement, in the crypto market could also spook retail investors after big losses so far this year.

Management’s 2022 guidance does little to assuage the concerns that the business is headed the wrong direction. Guidance shows:

- MTUs is expected to be lower in 2Q22 than 1Q22

- total trading volume expected to be lower in 2Q22 than 1Q22

- expected range for MTUs in 2022 anywhere from 5 to 15 million, not exactly a precise estimate

- ATRPU in 2022 is expected to return to “pre-2021” levels, which certainly implies a decline

In the 1Q22 earnings call, management also noted that their goal “is to roughly operate the company as breakeven, smoothed out over time for the time being”. In other words, the record profitability of 2021 is in the rearview.

Don’t Ignore New Bankruptcy & Regulatory Risk

As noted in Coinbase’s latest 10-Q, the company has to address the real risk of bankruptcy. The following statement was added this quarter:

“in the event of a bankruptcy, the crypto assets we hold in custody on behalf of our customers could be subject to bankruptcy proceedings and such customers could be treated as our general unsecured creditors.”

This public acknowledgement could spark fear in the company's clients. The fear of bankruptcy proceedings could drive clients to cash out their investments as quickly as possible, further weakening Coinbase’s business, and bringing the company even closer to bankruptcy.

As cryptocurrency rose in popularity among investors, regulations have increased as well. The infrastructure bill passed last year contains provisions increasing the requirements for cryptocurrency tax reporting, and we expect that is just the beginning. Additional regulations could diminish the popularity of cryptocurrency as an asset class and negatively impact Coinbase’s growth trajectory.

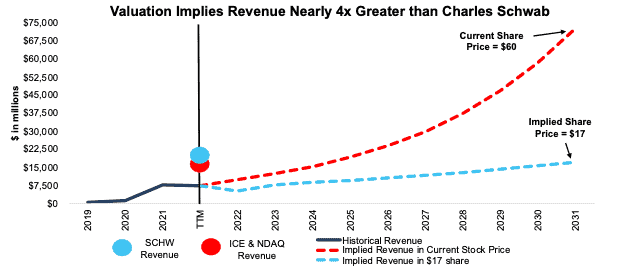

Coinbase Is Priced to Be Bigger Than the Largest Exchanges in the World

Despite COIN falling 85% since the opening price on its IPO date, the stock is still significantly overvalued. Below, we use our reverse discounted cash flow (DCF) model to illustrate the lofty expectations for future cash flows implied by Coinbase’s current valuation.

To justify its current price of ~$60/share, Coinbase must:

- achieve a 6% NOPAT margin (half of Fidelity National Info Services TTM margin), over the long term (from 2022-2031) despite consensus for negative earnings in 2022 and management’s goal of “breakeven” operations and

- grow revenue by 25% compounded annually through 2031 (compared to consensus estimates of 4% CAGR from 2021-2024)

In this scenario, Coinbase would earn $73 billion in revenue by 2031, which is greater than the combined TTM revenue of the 10 largest Financial & Commodity Market Operators[2] plus Charles Schwab (SCHW) and Robinhood (HOOD). Coinbase would also earn $4.1 billion in NOPAT in 2031, which would rank second, behind only Charles Schwab, in the group of companies noted in the revenue comparison.

Given management’s goal to operate the business at “breakeven” for “the time being”, even a 6% NOPAT margin may be optimistic.

71% Downside Even if Consensus Is Right

We review an additional DCF scenario to highlight the downside risk in Coinbase even if the company grows at consensus rates and gradually improves its margins from negative 19% in 1Q22 to 6% long-term.

If we assume Coinbase’s:

- NOPAT margin equals 1% in 2022 (just above breakeven) and improves to 6% by 2027,

- revenue grows at consensus rates in 2022, 2023, and 2024 (-37%, 54%, and 14%[3]), and

- revenue grows by 10% compounded annually from 2025-2031, then

COIN is worth just $17/share today – a 71% downside.

A 6% margin over the long-term may prove optimistic for a few reasons. First, Coinbase plans to increase hiring, expand internationally, and greatly increase its technology and general and administrative expenses in the near-term.

Second, as we’ve noted in the past, competition looms large, and can eat away at any opportunity for outsized margins (i.e. race to zero fees) given Coinbase’s reliance upon transaction fees for the majority of its revenue. Traditional exchange operators, brokers, and payment companies such as PayPal (PYPL) or Block (SQ) could see Coinbase’s weakness a chance to take market share and limit Coinbase’s long-term profit potential.

Third, it is unlikely Coinbase can simply stop spending to again achieve its high profitability of 2021, at least over the long-term. Coinbase must continually spend on marketing and advertising, not just to promote its product, but also to convince new users of crypto’s underlying usefulness.

Stock exchange operators don’t have this problem (or expense), because despite criticisms, the stock market and its derivatives are widely accepted forms of financial value and provide tangible uses such as risk management, raising of capital, etc. Crypto on the other hand faces criticism and questions about its use at every turn, which Coinbase must dispel, at no small cost.

Figure 2 compares Coinbase’s implied future revenue in the scenarios above to its historical revenue as well as Charles Schwab’s 2021 revenue and the combined 2021 revenues of Intercontinental Exchange and Nasdaq.

Figure 2: Coinbase’s Historical and Implied Revenue: DCF Valuation Scenarios

Sources: New Constructs, LLC and company filings

Each of the above scenarios also assumes Coinbase’s change in invested capital equals 10% of revenue in each year. This growth in invested capital is under half the change in invested capital as a percent of revenue in both 2020 and 2021. If we assume Coinbase’s invested capital increases at a similar rate to 2020 and 2021, the downside risk is even larger.

Selling for Cash on Hand Could be Best Case Scenario

As Coinbase continues to heavily spend on expanding its platform and keeping up with the latest developments in the crypto market, investors may see lasting profits as a faraway dream, rather than a medium-term reality. In such a scenario, the best-case scenario (rather than spending money on a money-losing business) could be to sell the business for the value of its cash net of liabilities, or $1.0 billion. However, even this scenario is a bit of a moving target, given that Coinbase burned $1.4 billion in cash in 1Q22 alone. With that said, the value of Coinbase’s net cash as of 1Q22 is $5/share.

Worse yet, if potential investors or suitors see the company’s ability to maintain as a “going-concern” as tenuous, which would be likely in such a scenario, they could push for a lower price or even be scared off by concerns about lawsuits.

Looking Beyond the Current Rating

Coinbase’s record profitability in 2021 drives our Robo-Analyst rating on the stock to Attractive. However, 1Q22 results and management guidance reveal that the financial performance of the business in 2021 is not sustainable and that profits are going to be much lower in the medium and long term. Our human analysts’ view is that the stock holds worse risk/reward than its current Robo-Analyst rating suggests. Looking forward, we expect the company’s profitability to diminish as expenses rise and growth slows with crypto adoption losing momentum and regulations rising. Should the company’s performance follow our expectation, its Robo-Analyst stock rating will be downgraded soon as its record 2021 results slide further and further into the past.

This article originally published on May 13, 2022.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Our research utilizes our Core Earnings, a more reliable measure of profits, as proven in Core Earnings: New Data & Evidence, written by professors at Harvard Business School (HBS) & MIT Sloan and published in The Journal of Financial Economics.

[2] Companies in this group include Cboe Global Markets (CBOE), CME Group (CME), Deutsche Boerse AG (DBOEF), Fidelity National Information Services (FIS), Interactive Brokers Group (IBKR), Intercontinental Exchange (ICE), MarketAxess Holdings (MKTX), Nasdaq Inc. (NDAQ), Tradeweb Markets (TW), and Virtu Financial (VIRT).

[3] Consensus estimates based on seven analyst estimates in 2022, 24 in 2023 and 14 analyst estimates in 2024.