We closed this Long Idea on September 19, 2024. A copy of the associated Position Close report is here.

This infrastructure firm has fallen since March 2020, but over 90% of its backlog is positioned in markets that will see significant investment in the coming years. Primoris Services Corp (PRIM: $25/share) remains a Long Idea after 2Q21 earnings.

We leverage more reliable fundamental data, proven in The Journal of Financial Economics[1], with qualitative research to highlight these firms whose stocks present excellent risk/reward.

Primoris Can Go 44%+ Higher

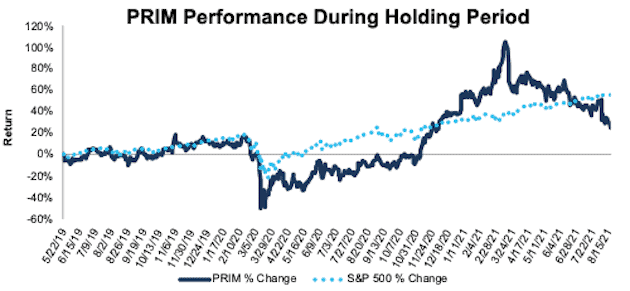

We made Primoris a Long Idea in May 2019 and the stock has slightly underperformed the market since then. However, given that the firm is building its backlog, positioning itself in long-term growth markets, and seeing early success with the recent acquisition of Future Infrastructure, we continue to see upside in the stock.

Figure 1: Long Idea Performance: From Date of Publication Through 8/17/2021

Sources: New Constructs, LLC and company filings

What’s Working: Revenue fromPrimoris’ utilities and energy/renewables segments rose 23% YoY in 2Q21, and the firm’s backlog improved from $2.8 billion to $2.9 billion YoY.

The firm is focused on strengthening relationships with customers through long-term master service agreements (MSAs), which create recurring revenue streams when compared to one-off contract agreements. MSAs represented 52% of Primoris’ backlog in 2Q21, up from 35% at the end of 2020. Since 2013, MSA revenue has grown from 24% of total revenue to 43% over the trailing twelve months (TTM).

The firm is focused on growth opportunities in utilities and energy/renewables. While these two segments combined for 86% of the firm’s revenue in 2Q21, they represent 91% of Primoris’ backlog. Primoris’ shift toward segments, such as renewables, that are expected to grow rapidly in the coming years, positions it for continued profit growth.

Primoris, as a provider of a wide range of infrastructure and construction services, has previously proven its ability to pivot amid changing market demand. When revenue from its energy services segment fell in 2015 and 2016, amidst a drop in oil prices to the lowest levels since the early 2000’s, the firm successfully refocused its business on MSAs and power, utilities, and transmission segments and grew Core Earnings from $10 million in 2016 to $125 million TTM.

Primoris’ strategic focus on recurring revenue through MSAs makes it more profitable than its peers, as it can better predict upcoming business and plan costs accordingly[2]. The firm’s return on invested capital (ROIC) has improved from 8% in 2019 to 9% TTM and is superior to the 8% weighted average ROIC of its peers.

As part of the Senate’s $1 trillion infrastructure bill, $73 billion is set aside to upgrade the power grid in anticipation of increased demand for renewable energy. Should the bill pass through the house, increased power grid spending would benefit Primoris’ transmission and distribution business, as well as its renewable energy segment.

The firm also closed on an acquisition in January 2021, and the early signs indicate that newly acquired, regionally-focused Future Infrastructure will add to Primoris’ top and bottom lines. Future Infrastructure largely led the 25% YoY growth in Primoris’ utility segment. More importantly, Primoris’ economic earnings are heading in the right direction. The firm’s economic earnings improved from -$3.1 million in 1Q21 to $14.6 million in 2Q21.

What’s Not Working: Since announcing the firm was issuing more shares on March 16, 2021, the stock has fallen 37%. However, given that investors were diluted by only 9%, the much larger decline in price presents investors with an attractive buying opportunity.

A 58% decline in revenue from the firm’s pipeline segment drove Primoris’ 3% YoY revenue decline in 2Q21. While a large permit backlog at permitting agencies challenges the segment over the near- and mid-term, the firm notes it has seen an increase in bidding activity from its customers. As the backlog of permits is worked through, these challenges should abate.

At any given time, the firm has large exposure to a limited number of customers. In 2020, Primrose generated 47% of its revenue from its top ten customers. However, the firm’s top ten customers vary from year to year. While losing a major customer could significantly lower its revenue in the short term, Primrose’s MSA agreements with a large number of customers greatly reduce this customer concentration risk.

PRIM Is Still Priced for Permanent Profit Decline: Even if the pipeline segment, which accounted for 14% of the firm’s 2Q21 revenue, continues to encounter a challenging operating environment, the stock still has upside. Primoris’ price-to-economic book value (PEBV) ratio of 0.7 implies that the market expects Primoris’ profits will permanently decline by 30%, or more than twice the size of the pipeline segment’s share of total revenue.

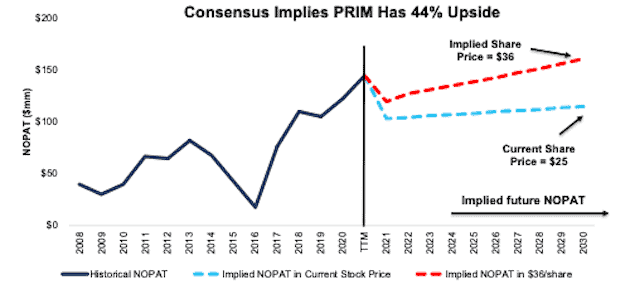

Below, we use our reverse DCF model to analyze the expectations for future growth in cash flows baked into a couple of stock price scenarios for Primoris.

In the first scenario, we assume Primoris’:

- NOPAT margin falls to 2.9% (five-year average) from 2021 through 2030,

- revenue grows by 1% compounded annually from 2021 to 2030 (vs. consensus CAGR of 10% for 2021-2023)

In this scenario, Primoris’ NOPAT falls by 1% compounded annually over the next decade and the stock is worth $25/share today – equal to the current price. See the math behind this reverse DCF scenario. For reference, Primoris grew NOPAT by 12% compounded annually over the past decade. Primoris’ shift towards utilities and renewable energy and away from more volatile oil/pipeline related businesses, will result in less cyclicality in profits than in years past. For instance, plummeting oil prices from 2014-2016 directly impacted demand for Primoris’ services, and in turn its profits. However, in 2016, the pipeline segment accounted for 20% of the firm’s total backlog. As of 2Q21, pipeline is less than half, at just 9% of the total backlog.

Shares Could Reach $36 or Higher: If we assume Primoris:

- maintains its TTM NOPAT margin of 3.3%, (10-year average) from 2021 through 2030, and

- revenue grows at a 5% CAGR through 2022 (same as consensus 2021-2022 CAGR), and

- revenue grows 3% a year from 2024 - 2030, then

the stock is worth $36/share today – 44% above the current price. See the math behind this reverse DCF scenario. In this scenario, Primoris grows NOPAT by 5% compounded annually over the next decade. For reference, Primoris grew NOPAT by 23% compounded annually over the past five years and 12% compounded annually over the past decade.

Should Primoris grow profits closer to historical levels, the upside in the stock is even greater.

Figure 2: Primoris’ Historical and Implied NOPAT: DCF Valuation Scenarios

Sources: New Constructs, LLC and company filings

Other Long Ideas That Recently Reported

Figure 3 shows other Long Ideas that have recently reported calendar 2Q21 earnings along with their relative performance.

Figure 3: More Long Ideas That Recently Reported Earnings: Through 8/17/2021

| Company | Ticker | Earnings Date | Out (under)performance vs. S&P 500 |

| Target Corporation | TGT | 8/18/21 | 137% |

| The Disney Company | DIS | 8/4/21 | (<1%)* |

| Walmart | WMT | 8/10/21 | (4%)* |

Sources: New Constructs, LLC

Performance measured from the date of publication of the first report

*Performance measured from the date of publication of the report included in our “Microbubble Winners” series

This article originally published on August 18, 2021.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Our research utilizes our Core Earnings, a more reliable measure of profits, proven by professors at Harvard Business School & MIT Sloan.

[2] Peers include Astec Industries (ASTE), Dycom Industries (DY), Granite Construction (GVA), IES Holdings (IESC), Matrix Service Company (MTRX), MYR Group (MYRG), MasTec Inc. (MTZ), Quanta Services, Inc. (PWR), Tutor Perini Corp (TPC), and Sterling Construction (STRL).