We published an update on this Long Idea on August 11, 2021. A copy of the associated Earnings Update report is here.

Investors often forget about due diligence and lose sight of underlying fundamentals when macroeconomic headlines drive the conversation about a sector or stock.

This small-cap infrastructure company has dramatically improved its profitability over the past three years. However, ongoing policy uncertainty from Washington D.C. – where every other week is “infrastructure week” – has left the stock significantly undervalued. Primoris Services Corporation (PRIM: $20/share) is this week’s Long Idea.

Disciplined Capital Allocation Drives Turnaround

PRIM was founded in 1960 and went public through a reverse merger in 2008. One of the company’s primary reasons for going public was the desire to use its stock as acquisition currency. From 2008-2014, the company completed a significant number of acquisitions that increased its invested capital from $48 million to $691 million, which equates to a compounded annual growth rate of 56%.

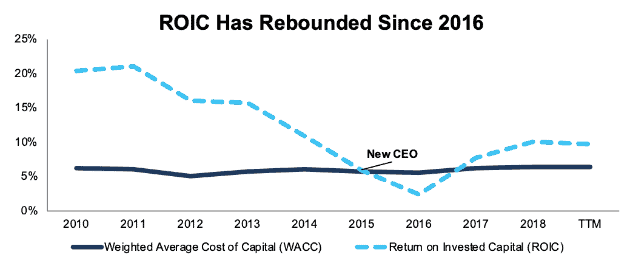

These acquisitions led to a significant decline in return on invested capital (ROIC), from 83% in 2008 to 11% in 2014. Plummeting oil and gas prices, which led to decreased demand from many of PRIM’s key power and pipeline customers, led ROIC to fall even further to 2% – below the company’s weighted average cost of capital (WACC) – by 2016.

However, as Figure 1 shows, ROIC has rebounded back to 10% over the past two years. This rebound began shortly after the appointment of CEO David King in 2015.

Figure 1: PRIM’s ROIC and WACC Since 2010

Sources: New Constructs, LLC and company filings

Since King took over as CEO, PRIM has been much more disciplined on the capital allocation front. Invested capital increased by just 5-8% annually in 2015, 2016, and 2017. PRIM did spend $111 million (10% of invested capital) in 2018 to acquire Willbros, but, unlike previous acquisitions, this deal improved both ROIC and economic earnings.

GAAP Earnings Hide Growth

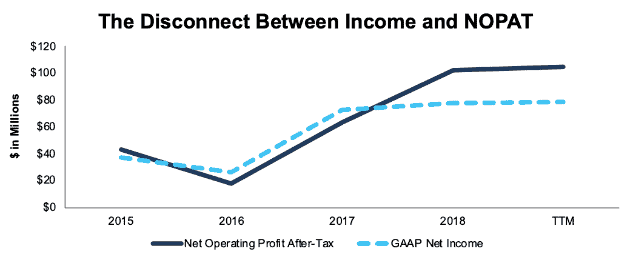

While PRIM has significantly improved its ROIC since 2016, reported earnings don’t fully capture the company’s turnaround. As Figure 2 shows, GAAP net income only increased by 7% in 2018 while net operating profit after tax (NOPAT) grew by 61%.

Figure 2: PRIM’s NOPAT and GAAP Net Income Since 2015

Sources: New Constructs, LLC and company filings

The majority of this disconnect stems from $13 million (1% of revenue) in merger-related costs that artificially decreased PRIM’s core profitability. PRIM also recognized a $1 million non-recurring charge due to tax reform in 2018.

The merger-related costs are disclosed directly on the income statement, so it’s easy for investors to adjust for this non-recurring expense. However, the company’s low analyst coverage – just 3 sell-side analysts follow the stock – and the fact that it doesn’t report adjusted non-GAAP metrics make it less likely that investors will make this easy adjustment.

Cyclical Fears Ignore Changes to the Business

In addition to improving its ROIC, PRIM has taken steps in recent years to reduce the cyclicality in its business. These efforts should result in a company that may not hit the same highs of profitability that it saw in 2008-2013, but it also won’t be as exposed to volatility in commodity prices.

PRIM has focused on two key initiatives to reduce the cyclicality of its business:

- Expanding into New Business Lines:The Willbros acquisition, in addition to boosting ROIC, gave PRIM exposure to the electric transmission business (i.e. power grids and cable lines). This segment provides another relatively consistent, high margin business to smooth out the volatility from the riskier power and pipeline segments.

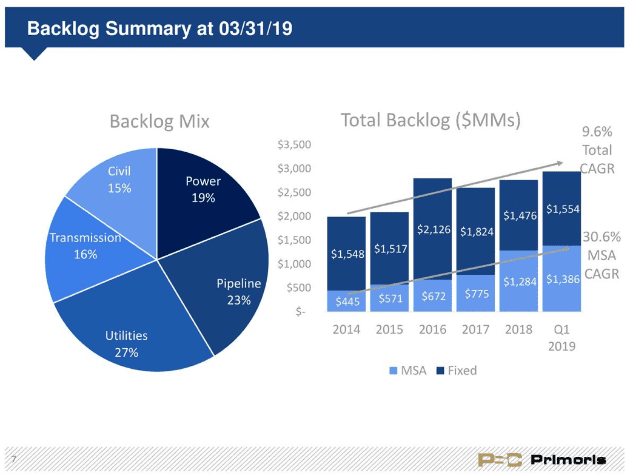

- Focusing on Master Services Agreements:Management has placed a major emphasis on shifting more of the company’s revenue towards work performed under Master Services Agreements (MSA’s) rather than fixed contract work. MSA’s create long-term, ongoing, recurring revenue relationships with customers, while fixed contracts only cover a single project. MSA’s have gone from 22% of PRIM’s contracted backlog in 2014 to 47% at the end of Q1 2019. This shift towards MSA’s should make future revenues more stable.

Figure 3, from the company’s Q1 2019 investor presentation, illustrates the success of both of these initiatives. It shows a relatively even distribution between the company’s five segments and a steady increase in total backlog, with MSA backlog driving the majority of the growth.

Figure 3: PRIM’s Backlog Mix and Growth Since 2014

Sources: PRIM Q1 Investor Presentation

Lower Customer Concentration Reduces Risk

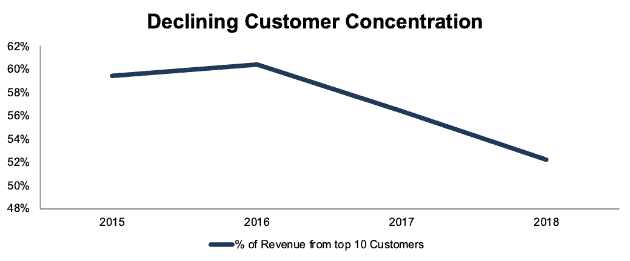

PRIM’s moves to diversify its business segments have also helped diversify its customer base. Figure 4 shows that the share of the company’s revenue from its top 10 customers declined from 60% in 2016 to 52% in 2018.

Figure 4: Percent of Revenue From 10 Largest Customers Since 2015

Sources: New Constructs, LLC and company filings

Declining customer concentration reduces the impact that the loss of any one customer would have on PRIM. It also gives the company more leverage in negotiations with customers due to the fact that it’s easier for PRIM to walk away from a large contract if it doesn’t meet the company’s margin goals.

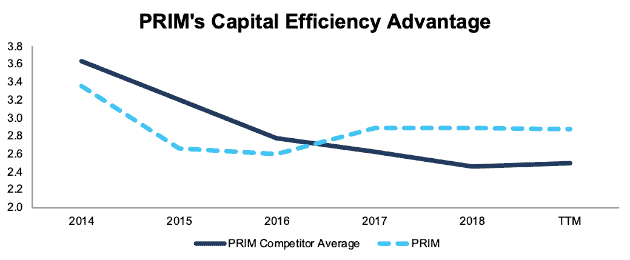

Superior Capital Efficiency Drives Competitive Advantage

As PRIM has increased its focus on intelligent capital allocation since 2015, the company has gone from lagging its peer group in terms of capital efficiency to becoming one of the leaders. Figure 5 compares PRIM to the eight publicly traded engineering and construction firms it lists as peers in its proxy statement on the basis of average invested capital turns (annual revenue/average invested capital).

Figure 5: Average Invested Capital Turns Since 2014: PRIM vs. Peers

Sources: New Constructs, LLC and company filings

Investors that do not analyze balance sheets will miss PRIM’s superior capital turns. The company’s NOPAT margin of 3.5% is exactly in-line with its peer group, but its superior balance sheet efficiency represents a real, underrated competitive advantage.

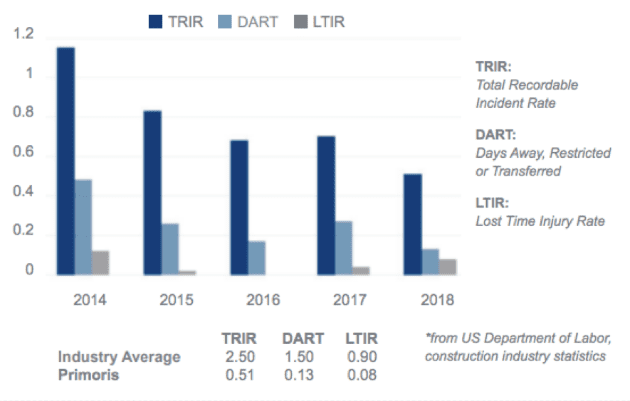

Superior Safety Record Shows Operational Efficiency

PRIM’s disciplined approach to capital allocation has also allowed the company to place a higher focus on operational efficiency. This focus can be seen in the steady improvement in the company’s safety record. PRIM highlighted a record low total recordable incident rate (recorded safety incidents for every 200,000 man hours worked) of 0.51 as one of its major achievements in its 2018 annual report. Figure 6, from the annual report, shows that PRIM’s safety record is dramatically better than the industry as a whole and continues to improve.

Figure 6: PRIM Safety Record Since 2014

Sources: PRIM 2018 Annual Report

PRIM’s superior safety record gives it a number of tangible advantages over peers, including:

- Reduced risk of OSHA inspections

- Potential for lower insurance premiums

- Selling point to potential customers when bidding on projects

- Easier to attract employees who know their safety will be protected on the job (especially important right now in a tight labor market)

Valuation Implies Permanent Profit Decline

Despite PRIM’s growing business and competitive advantages, the stock looks cheap, even according to traditional valuation metrics. PRIM has a P/E of 13, which is below the Industrials sector average of 20. Investors don’t appear to recognize the ways in which this business is now more profitable and consistent than in past years.

At its current price of $20/share, PRIM has a price to economic book value (PEBV) ratio of 0.9, which means the market expects PRIM’s NOPAT to permanently decline by 10%. This expectation seems pessimistic for a company that has grown NOPAT by 10% compounded annually since 2008. Our reverse discounted cash flow (DCF) model shows just how high shares could rise assuming conservative profit growth.

If PRIM can maintain 2018 NOPAT margins of 3.5% and grow NOPAT by just 5% compounded annually over the next decade (half its historical growth rate), the stock is worth $32/share today – a 57% upside. See the math behind this dynamic DCF scenario.

Sustainable Competitive Advantages That Will Drive Shareholder Value Creation

Here’s a summary why we think the moat around Primoris Services Corporation’s business will enable the company to generate higher profits than the current valuation of the stock implies. This list of competitive advantages helps PRIM offer better products/services at a lower price and prevents competition from taking market share.

- Increasing share of revenues coming from long-term MSA contracts

- Superior capital efficiency compared to peers

- Excellent safety record that is significantly better than the overall industry

What Noise Traders Miss with PRIM

These days, fewer investors focus on finding quality capital allocators with shareholder friendly corporate governance. Instead, due to the proliferation of noise traders, the focus tends toward technical trading tends while high-quality fundamental research is overlooked. Here’s a quick summary for noise traders when analyzing PRIM:

- Balance sheet efficiency advantage vs peers (better capital turns)

- Recurring profits (NOPAT) are greater, and rising faster, than reported profits

- Overall industry trends obscure the company-specific changes that make PRIM less exposed to cyclical declines

- Valuation implies permanent profit decline and gives PRIM significant upside

Policy Resolution (Either Way) Could Boost Shares

Markets hate uncertainty, and uncertainty has dominated the infrastructure conversation ever since the 2016 election. PRIM rose 50% in the year after Trump’s election on the hopes of a big infrastructure deal, but the stock has since fallen over 25% as every single infrastructure discussion has fizzled out.

As long as this policy uncertainty persists, PRIM and other infrastructure stocks will be caught in this cycle of hope and disappointment. The best hope for investors is that the debate eventually resolves one way or another, and the market starts to focus to fundamentals again.

Obviously, a deal that increased spending on infrastructure would be the best result for PRIM, but even if the debate eventually resolves with no increased spending, any resolution should be a positive in the long-term. The news might send shares lower initially, but the end of the policy uncertainty should lead to a greater focus on fundamentals and allow investors to recognize the substantial improvements in this business since 2015.

Corporate Governance Could be Improved

PRIM provides annual bonuses for executives based on the board’s subjective analysis of overall performance, as well as EPS and backlog targets for the CEO.

It’s unclear what factors the board considers with its discretionary bonuses and whether it factors in capital allocation. The company’s recent improvement in ROIC does suggest that this may be a point of emphasis now, but without more disclosure we can’t know for sure.

Regardless, we’d prefer that PRIM explicitly tie a portion of executive compensation to ROIC. This would help ensure that the company maintains a disciplined approach to capital allocation, and it should be greeted positively by investors, who overwhelmingly support linking management pay to ROIC.

Dividend Provides Slight Yield, but Focus Is on Paying Down Debt

PRIM currently pays a quarterly dividend of $0.06/share, which gives it an annualized dividend yield of 1.2%. The company did not raise its dividend in 2018 and does not plan to this year either as it focuses on paying down the debt it incurred from the Willbros acquisition.

PRIM repurchased $20 million (2% of market cap) worth of shares in 2018, using up the entirety of its buyback authorization. The company does not currently have the authorization to repurchase any more shares as it dedicates cash flow towards reducing its debt burden.

Insider Trading and Short Interest Trends are Mixed

Insider activity has been significant and mixed over the past 12 months, with 4.6 million shares purchased and 6.1 million shares sold for a net effect of 1.5 million shares sold. These sales represent 3% of shares outstanding.

There are currently 613 thousand shares sold short, which equates to 1% of shares outstanding and 3.7 days to cover. Short interest has decreased 39% from its high of 1 million in September 2018 and continued profit growth could push the remaining shorts out and send shares higher.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

As investors focus more on fundamental research, research automation technology is needed to analyze all the critical financial details in financial filings. Below are specifics on the adjustments we make based on Robo-Analyst[1] findings in Primoris Services Corporation’s 2018 10-K:

Income Statement: we made $75 million of adjustments, with a net effect of removing $25 million in non-operating expense (1% of revenue). We removed $25 million in non-operating income and $50 million in non-operating expenses. You can see all the adjustments made to PRIM’s income statement here.

Balance Sheet: we made $375 million of adjustments to calculate invested capital with a net increase of $45 million. The most notable adjustment was $136 million in off-balance sheet operating leases. This adjustment represented 14% of reported net assets. You can see all the adjustments made to PRIM’s balance sheet here.

Valuation: we made $520 million of adjustments with a net effect of decreasing shareholder value by $520 million. You can see all the adjustments made to PRIM’s valuation here.

Attractive Funds That Hold PRIM

There are no funds that receive our Attractive-or-better rating and allocate significantly to Primoris Services Corporation.

This article originally published on May 22, 2019.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Harvard Business School features the powerful impact of our research automation technology in the case New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.