We closed the CBRL position on April 29, 2022. A copy of the associated Position Update report is here.

We closed the EAT and QSR positions on November 18, 2020. A copy of the associated Position Update report is here.

Earlier this week, we put Shake Shack (SHAK) in the Danger Zone. We showed that the burger chain’s rapid pace of store expansion was destroying value for shareholders, and the expectations implied by its stock price were unrealistic.

On the flip side, these three restaurant stocks are significantly undervalued compared to their cash flows. These companies are actually growing same-store sales faster than SHAK, but they don’t get the same amount of buzz from the market due to their more conservative approach to new store openings.

Cracker Barrel (CBRL: $165/share), Restaurant Brands International (QSR: $67/share), and Brinker International (EAT: $40/share) are this week’s Long Ideas.

Undervalued Compared to Peers

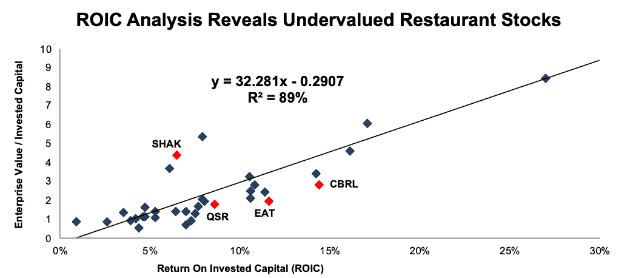

All three of these companies earn a return on invested capital (ROIC) above the 7% median for the 37 bar and restaurant stocks that we cover. As shown in Figure 1, ROIC explains 89% of the difference in valuation for these companies. CBRL, QSR, and EAT all trade at a significant discount to their peers as shown by their position below the trendline, while SHAK trades at a significant premium.

Figure 1: ROIC Explains 89% of Valuation for Bar and Restaurant Stocks

Sources: New Constructs, LLC and company filings

All three stocks have 50%+ potential upside if they were to trade at parity with their peers. Figure 2 has details.

Figure 2: Potential Upside Based on Regression Analysis For CBRL, QSR, and EAT

Sources: New Constructs, LLC and company filings

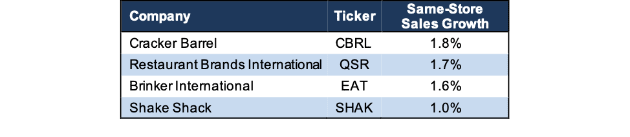

All Three Are Growing Same-Store Sales

CBRL, QSR, and EAT may not be exciting names, but all three companies currently offer solid growth prospects. In fact, all three reported superior same-store sales growth than SHAK over the past year.[1] See Figure 3.

Figure 3: Same-Store Sales Growth Over the Past Year

Sources: New Constructs, LLC and company filings

In addition, all three companies have improved their ROIC’s over the long-term. While the market overhypes companies that expand at an uneconomical pace (e.g. SHAK), these three companies are quietly executing on a strategy to deliver long-term growth and value to shareholders. Below, we dig deeper into the fundamentals and valuation for CBRL, QSR, and EAT.

Cracker Barrel (CBRL): Attractive Rating

We originally selected CBRL as a Long Idea on March 29, 2017. We closed the position 432 days later, on June 5, 2018, for a 2% loss. At the time, CBRL’s ROIC had begun to decline, and it appeared as if the company’s long-term growth had stalled. In hindsight, this ROIC decline was just a minor blip. CBRL continues to be one of the most consistent companies we cover in terms of growing profits (NOPAT) and ROIC.

Corporate Governance Drives Superior Capital Allocation: CBRL’s superior corporate governance is a hidden advantage. The company’s executive compensation plan ties 50% of long-term stock compensation to achievement of ROIC targets. This emphasis on intelligent capital allocation incentivizes executives to create value for shareholders, not just chase growth for the sake of growth and short-term stock performance.

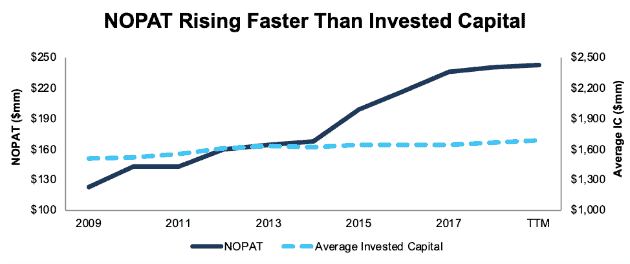

Since 2009, CBRL has expanded from 588 locations to 666 today, or 1% compounded annually. The company’s invested capital has grown at the same 1% compounded annual rate. However, NOPAT has grown by 8% compounded annually, as shown in Figure 4.

Figure 4: NOPAT and Invested Capital for CBRL Since 2009

Sources: New Constructs, LLC and company filings

As a result of NOPAT growing faster than invested capital, CBRL’s ROIC improved from 8% in 2009 to 14% TTM. NOPAT growth slowed over the past two years, as a result of rising labor costs and challenges in the retail business, but the company’s ROIC remains high and all its competitors face the same challenges.

Growth Potential Remains High: Even with the retail side of the business struggling, rising check volumes and price increases on the restaurant side drove a 1.8% increase in same-store sales through the first nine months of fiscal year 2019 (which runs through the end of July).

CBRL opened eight new locations this year, and it appears poised to continue this steady rate of expansion going forward. In particular, the company has seen strong sales in the first four locations opened on the west coast over the past two years and that region could be an area of strong growth going forward.

Shares Are Undervalued: Despite its track-record of profit growth, CBRL shares remain undervalued. At its current valuation of $165/share, the stock has a price to economic book value (PEBV) ratio of 1. This ratio means the market expects NOPAT to never grow from its current level. This expectation seems pessimistic for a company that has grown NOPAT by 8% compounded annually over the past decade.

Even if CBRL’s slow growth rate of the past two years represents a new normal, the stock still has significant upside. If CBRL can maintain TTM margins of 8% and grow NOPAT by just 3% compounded annually over the next decade (less than half its historical growth rate), the stock is worth $222/share today, a 35% upside to the current stock price. See the math behind this dynamic DCF scenario.

If CBRL can return to the level of growth it averaged over the past decade, CBRL could approach the $274/share valuation implied by Figures 1 and 2.

Restaurant Brands International (QSR): Attractive Rating

QSR was formed in 2014 through the merger of Burger King and Tim Hortons. The company also acquired Popeyes in 2017 and is the fifth largest fast food company in the world.

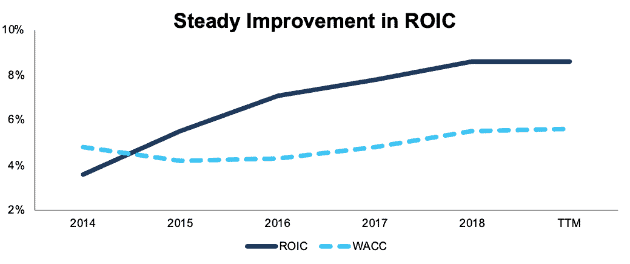

Rising ROIC: Due to a history of large acquisitions, QSR carries ~$16 billion (79% of total assets) of goodwill and other intangible assets on its balance sheet. We’re normally skeptical of companies with a large amount of goodwill, but QSR has demonstrated its ability to earn a solid return on the capital invested in these acquisitions. Figure 5 shows the company’s ROIC improved from just 4% in 2014 – below the company’s weighted average cost of capital (WACC) – to 9% TTM.

Figure 5: ROIC and WACC for QSR Since 2014

Sources: New Constructs, LLC and company filings

Goodwill and intangibles represent such a large portion of total assets for QSR because, unlike the other companies in this piece, almost 100% of its locations are franchised. The company’s asset-light, excluding goodwill, business model allowed it to increase its total restaurant count by 5% in 2018 while decreasing its invested capital by 15%.

New Products Drive Growth: In addition to expanding its store count, QSR grew same-store sales at all three of its chains in 2018. New products, such as an updated kid’s menu at Tim Horton’s and limited items like the Spicy Crispy Jalapeno Chicken Sandwich at Burger King played a key role in driving growth.

QSR has made a big bet on meatless products to drive growth in 2019. Burger King tested a meatless version of its Whopper at 59 locations around St. Louis in April, and the response was so overwhelming that the company announced a nationwide launch less than a month later. Meanwhile, Tim Hortons recently unveiled a meatless version of its breakfast sandwiches using plant-based sausage patties from Beyond Meat (BYND).

Even with this product innovation, Burger King keeps its menus simple to ensure rapid service. QSR magazine ranked Burger King as the fastest drive thru in America last year. The chain boasted average wait times of just 193 seconds last year, 80 seconds faster than McDonald’s (MCD), which features a more diverse menu.

Cheap Valuation Creates Upside Potential: QSR shares are up 30% so far in 2019, but the stock remains undervalued. At its current price of $66/share, the stock has a PEBV of 1.2, which implies the market expects NOPAT to grow by no more than 20% for the remainder of QSR’s corporate life. This expectation seems pessimistic for a company that has grown NOPAT by 15% compounded annually over the past three years.

If QSR can maintain 2018 margins of 30% and grow NOPAT by just 5% compounded annually – equal to its recent rate of new store openings – for 10 years, the stock is worth $118/share today, a 74% upside to the current stock price. See the math behind this dynamic DCF scenario.

Brinker International (EAT): Very Attractive Rating

EAT operates the Chili’s and Maggiano’s restaurant chains. The company has 945 company-owned Chili’s locations, 678 franchised Chili’s locations, and 52 company-owned Maggiano’s locations.

Generating Strong Free Cash Flow: The fast-casual restaurant business has struggled in recent years as consumers have shifted more towards fast food and quick service restaurants. As a result, EAT has decreased its invested capital from $2 billion in 2016 to $1.6 billion TTM by focusing on franchises and closing underperforming stores.

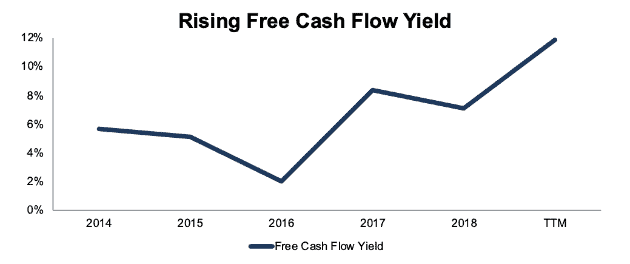

Scaling back invested capital allowed EAT to maintain a strong 12% ROIC despite a decline in NOPAT. The company generates significant free cash flow, as shown in Figure 6.

Figure 6: FCF Yield for EAT Since 2014

Sources: New Constructs, LLC and company filings

Over the trailing-twelve months, EAT has generated $376 million (12% of enterprise value) in free cash flow. EAT returns a significant amount of this cash back to shareholders in the form of dividends and buybacks. The company currently offers a 3.8% dividend yield. Its buyback activity has reduced the total share count from 64.6 million in 2014 to 37.5 million today, a 42% decrease.

Delivery Provides Growth Potential: Same-store sales grew by 1.6% through the first nine months of 2019. Strong traffic growth at domestic Chili’s locations drove this growth. Going forward, the rise of delivery apps like DoorDash, Uber Eats, and GrubHub provides growth potential for EAT.

EAT already offers third-party delivery services for Maggiano’s, and this business is growing double digits year-over-year. On its latest earnings call, management said they were close to finding a third-party partner for the Chili’s business. With so many delivery apps fighting for market share, Chili’s should be able to get a good deal that allows it to generate growth through the delivery business while still earning a healthy margin and ROIC.

Trading at a Discount to EBV: At its current valuation of $40/share, EAT has a PEBV of 0.9. This ratio means the market expects NOPAT to permanently decline by 10%. For a company with growing same-store sales and a high ROIC, this expectation seems overly pessimistic.

If EAT can maintain 2018 margins of 7% and grow NOPAT by just 2% compounded annually for the next decade, the stock is worth $58/share today, a 45% upside to the current stock price. See the math behind this dynamic DCF scenario.

Even if it takes the market a while to appreciate EAT’s strong cash flows, the high dividend offers investors a nice reward for owning this stock.

This article originally published on June 12, 2019.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Last full fiscal year for QSR and SHAK, last nine months for CBRL and EAT