Our Long Idea reports aim to identify firms that, despite market fears and other noise, have profitable businesses and highly undervalued stock prices. These reports, along with all of our research, leverage cutting-edge technology to provide clients with a cleaner and more comprehensive view of every measure of profits and enable them to pick better stocks and avoid excessive risk.

Long Ideas to Close

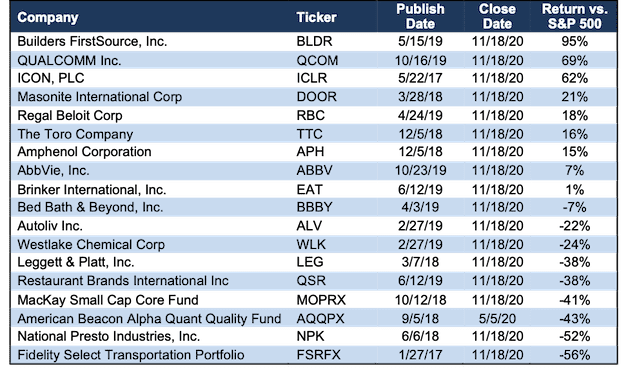

Figure 1 provides a list of Long Ideas we are closing along with the performance vs. the S&P 500 since each report was published.

When closing positions, we analyze key aspects of the firm and its stock, such as trends in fundamentals, alternative stocks within the same industry offering better risk/reward, internal controls, and price movements.

Figure 1: Closed Long Ideas: Performance as of Closing Prices on 11/17/20

Sources: New Constructs, LLC and company filings

Below, we provide details on why we’re closing each position.

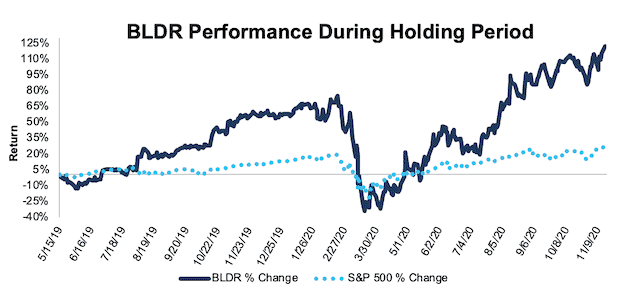

Builders FirstSource, Inc. (BLDR)

We made Builders FirstSource, Inc. (BLDR: $36/share) a Long Idea on May 15, 2019. At the time, BLDR received a Very Attractive rating. Our long thesis highlighted the firm’s superior ROIC to peers, leading market share, and the strength of the housing market at that time.

During the one-and-a-half-year holding period, BLDR outperformed the S&P 500 by 95%, rising 122% compared to just a 27% gain for the S&P 500.

While the firm’s economic earnings are still trending higher, the stock now earns a Neutral rating, given the large increase in share price.

With the stock trading at all-time highs, we believe there are more attractive ways to get exposure to the housing market such as, D.R. Horton, Inc. (DHI), Meritage Homes Corp (MTH), and NVR, Inc. (NVR), all of which provide better risk/reward. We’re taking the gains and closing this long position.

Figure 2: BLDR vs. S&P 500 – Price Return – Successful Long Idea

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

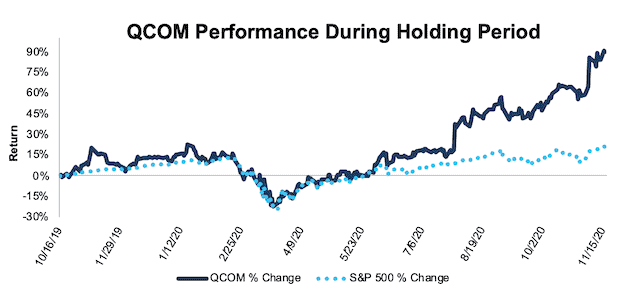

Qualcomm Inc. (QCOM)

We made Qualcomm Inc. (QCOM: $149/share) a Long Idea on October 16, 2019. At the time, QCOM received a Very Attractive rating. Our long thesis highlighted Qualcomm’s misleading GAAP earnings which understated the firm’s core earnings[1] and executive compensation plan tied to ROIC.

During the 398-day holding period, QCOM outperformed the S&P 500 by 69%, rising 90% compared to just a 21% gain for the S&P 500.

Qualcomm’s NOPAT margin has fallen from 31% in 2019 to 24% TTM while its invested capital turns have declined from 1.5 to 1.2 over the same time. Falling NOPAT margin and declining invested capital turns drive the firm’s ROIC lower from 46% in 2019 to 29% TTM. Given the ROIC decline and drop in economic earnings, QCOM now earns a Neutral rating. With the stock trading at all-time highs, we’re taking the gains and closing this long position.

Figure 3: QCOM vs. S&P 500 – Price Return – Successful Long Call

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

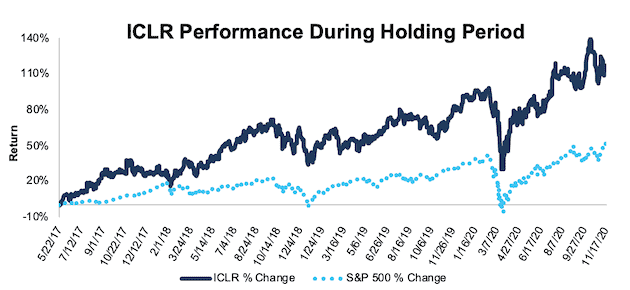

ICON, PLC (ICLR)

We made ICON, PLC (ICLR: $190/share) a Long Idea on May 22, 2017. At the time, ICON received a Very Attractive rating. Our long thesis highlighted that the firm’s expanding market, strong brand reputation, and rising ROIC.

During the nearly three-and- a-half-year holding period, ICLR outperformed the S&P 500 by 62%, rising 113% compared to a 51% gain for the S&P 500.

While the stock still earns an Attractive rating, its invested capital turns have declined from 1.8 in 2018 to 1.6 TTM, while its ROIC has fallen from 24% to 21% over the same time.

Going forward, we believe HCA Healthcare Inc. (HCA) and Universal Health Services, Inc. (UHS) offer even better risk/reward in the Healthcare Sector. We’re taking the gains and closing this long position.

Figure 4: ICLR vs. S&P 500 – Price Return – Successful Long Idea

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

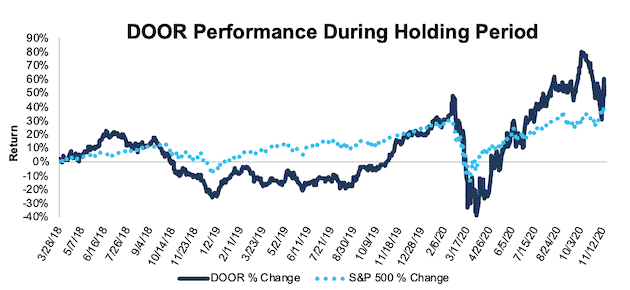

Masonite International Corp (DOOR)

We made Masonite International Corp (DOOR: $96/share) a Long Idea on March 28, 2018. At the time, DOOR received an Attractive rating. Our long thesis highlighted Masonite’s long-term customer relationships, large market share, favorable housing market conditions, and operational improvements.

During the 965-day holding period, DOOR outperformed the S&P 500 by 21%, rising 60% compared to a 39% gain for the S&P 500.

DOOR now earns a Neutral rating. The firm’s NOPAT margin has fallen from 8% in 2017 to 6% TTM, while its invested capital turns have decreased from 1.3 to 1.2 over the same time. Falling NOPAT margin and declining invested capital turns drive the firm’s ROIC lower from 9% in 2017 to 7% TTM.

As we noted with Builders FirstSource above, there are several stocks that offer better risk/reward in the housing market. We’re taking the gains and closing this long position.

Figure 5: DOOR vs. S&P 500 – Price Return – Successful Long Idea

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

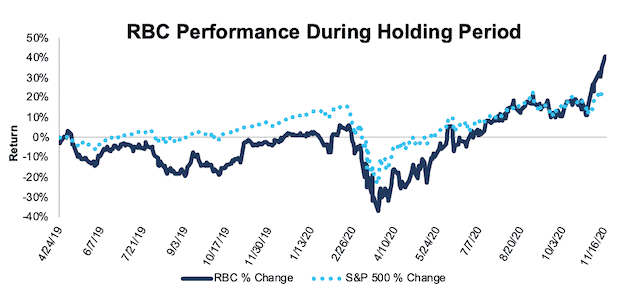

Regal Beloit Corp (RBC)

We made Regal Beloit Corp (RBC: $119/share) a Long Idea on April 24, 2019. At the time, RBC received an Attractive rating. Our long thesis highlighted the firm’s innovation in the HVAC market, executive compensation plan tied to ROIC, and misleading GAAP net income that likely caused the market to underappreciate Regal Beloit’s profitable turn-around.

During the one-and-a-half-year holding period, RBC outperformed the S&P 500 by 18%, rising 41% compared to a 23% gain for the S&P 500.

Regal Beloit now earns a Neutral rating, in large part due to its deteriorating fundamentals. The firm’s NOPAT margin has fallen from 9% in 2018 to 8% TTM, while its invested capital turns have declined from 0.8 to 0.7 over the same time. Falling NOPAT margin and invested capital turns drive the firm’s ROIC lower from 7% in 2018 to 5% TTM. Additionally, the firm’s core earnings have fallen from $223 million in 2017 to $187 million TTM.

With deteriorating fundamentals, and higher stock price, the stock is no longer as cheap as when we first made it a Long Idea. We’re taking the gains and closing this long position.

Figure 6: RBC vs. S&P 500 – Price Return – Successful Long Idea

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

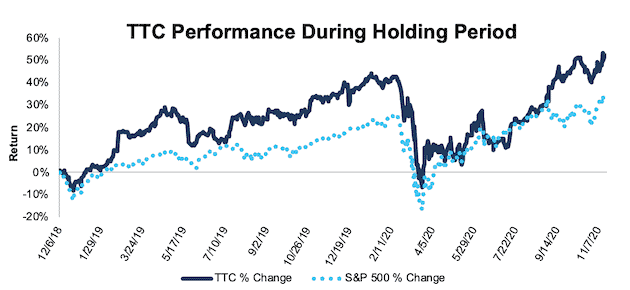

The Toro Company (TTC)

We made The Toro Company (TTC: $89/share) a Long Idea on December 5, 2018. At the time, TTC received a Neutral rating. We noted that TTC, along with two other companies, would be an excellent buy if a bear market dropped its price to a more attractive entry point.

During the nearly two-year holding period, TTC outperformed the S&P 500 by 16%, rising 53% compared to a 34% gain for the S&P 500.

The firm still earns a Neutral rating, but its NOPAT margin has fallen from 11% in 2018 to 10% TTM, while its invested capital turns have fallen from 2.4 to 1.6 over the same time. Falling NOPAT margin and invested capital turns drive the firm’s ROIC from 27% in 2018 to 16% TTM.

While TTC has outperformed the market over the past two years, Allison Transmission Holdings Inc. (ALSN), PACCAR Inc. (PCAR), and Caterpillar Inc. (CAT) offer better risk/reward for investors looking for exposure to the Industrials Sector. We’re taking the gains and closing this long position.

Figure 7: TTC vs. S&P 500 – Price Return – Successful Long Idea

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

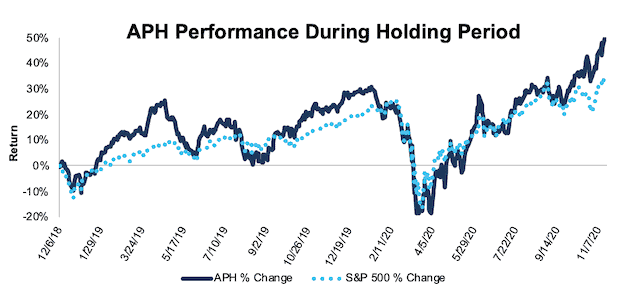

Amphenol Corporation (APH)

We made Amphenol Corporation (APH: $127/share) a Long Idea on December 5, 2018, in the same report with The Toro Corporation. At the time, APH received a Neutral rating. We noted that APH would be a great buy if its PEBV ratio fell to ~1.4. Investors could have picked up even greater value in March 2020 when the share price fell to $73 and the PEBV ratio reached 1.3.

During the 713-day holding period, APH outperformed the S&P 500 by 15%, rising 51% compared to a 34% gain for the S&P 500.

Amphenol still earns a Neutral rating, but the firm’s profitability has declined. The firm’s NOPAT margin has fallen from 16% in 2018 to 15% TTM, while its invested capital turns have fallen from 1.1 to 0.9 over the same time. Falling NOPAT margin and invested capital turns drive the firm’s ROIC lower from 17% in 2018 to 14% TTM. Amphenol’s core earnings have slightly fallen from $1.2 billion in 2018 to $1.1 billion TTM.

We’re taking the gains and closing this long position.

Figure 8: APH vs. S&P 500 – Price Return – Successful Long Idea

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

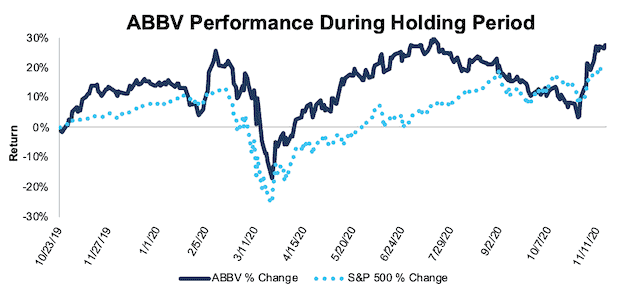

AbbVie, Inc. (ABBV)

We made AbbVie, Inc. (ABBV: $99/share) a Long Idea on October 23, 2019. At the time, ABBV received an Attractive rating. Our long thesis highlighted AbbVie’s understated reported earnings relative to core earnings.

During the just over one-year holding period, ABBV outperformed the S&P 500 by 7%, rising 27% compared to a 21% gain for the S&P 500.

This outperformance is in line with what professors from Harvard Business School (HBS) & MIT Sloan show in “Core Earnings: New Data & Evidence”, that “trading strategies that exploit {adjustments provided by New Constructs} produce abnormal returns of 8% per year.”

We think there are other Healthcare stocks that offer better risk/reward. We’re taking the gains and closing this long position.

Figure 9: ABBV vs. S&P 500 – Price Return – Successful Long Idea

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

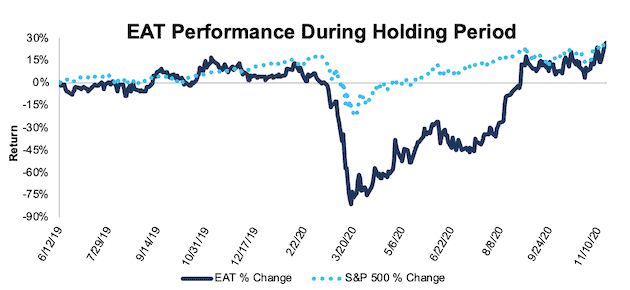

Brinker International, Inc. (EAT)

We made Brinker International, Inc. (EAT: $51/share) a Long Idea on June 12, 2019. At the time, EAT received a Very Attractive rating. EAT was one of three restaurant stocks in the report that we identified as being undervalued. Our long thesis highlighted Brinker International’s strong cash flow generation and growth potential through delivery.

During the 524-day holding period, EAT slightly outperformed the S&P 500 by 1%, rising 26% compared to a 25% gain for the S&P 500.

Brinker International now earns an Unattractive rating. Even before the COVID-related disruptions to the restaurant industry, Brinker International’s fundamentals were deteriorating. The firm’s core earnings have fallen every year since they reached $201 million in 2016. Over the TTM, the firm’s core earnings are just $32 million.

Instead of Brinker International, we prefer Darden Restaurants, Inc. (DRI), Cracker Barrel Old Country Store, Inc. (CBRL), and Bloomin' Brands Inc. (BLMN) as restaurants well-positioned to see through the dip caused by the COVID-19 pandemic. We’re taking the gains and closing this long position.

Figure 10: EAT vs. S&P 500 – Price Return – Successful Long Idea

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

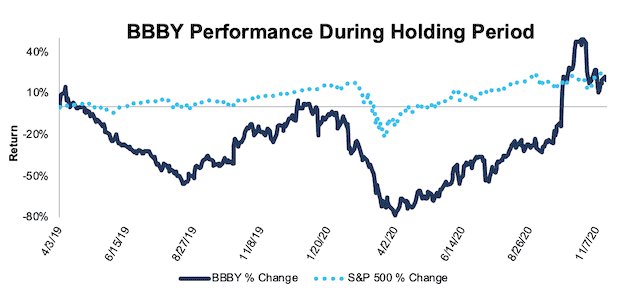

Bed Bath & Beyond, Inc. (BBBY)

We made Bed Bath & Beyond, Inc. (BBBY: $20/share) a Long Idea on April 3, 2019. At the time, BBBY received an Attractive rating. Our long thesis suggested Bed Bath & Beyond was a prime candidate for an activist-driven turnaround. We identified several opportunities to drive dramatic improvement in Bed Bath & Beyond’s profitability. We also saw value in the firm’s reputation, the high-touch nature of its industry, and the growing demand for the global home décor market as areas where Bed Bath & Beyond could unlock more value.

During the 595-day holding period, BBBY slightly underperformed the S&P 500 by 7%, rising 19% compared to a 26% gain for the S&P 500.

Bed Bath & Beyond now earns a Very Unattractive rating and the firm’s profitability has continued to deteriorate. The firm’s NOPAT margin has fallen from 5% in 2018 to -1% TTM, while its invested capital turns declined from 1.7 to 1.6 over the same period. Falling NOPAT margin and invested capital turns drive the firm’s ROIC from 8% in 2018 to -2% TTM.

While the firm’s new management is committed to driving the turnaround we envisioned in our original Long Idea, Walmart Inc. (WMT), Target Corporation (TGT), Williams-Sonoma Inc. (WSM), and Best Buy Co, Inc. (BBY) are retailers that offer better risk/reward moving forward. We’re closing this position.

Figure 11: BBBY vs. S&P 500 – Price Return – Unsuccessful Long Idea

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

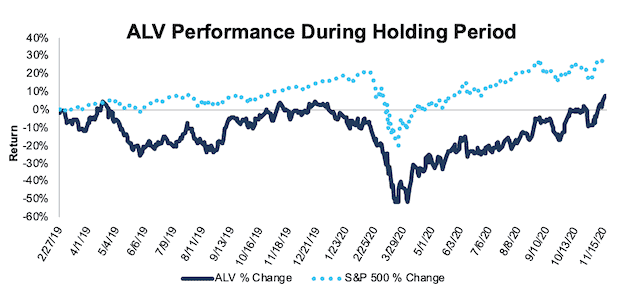

Autoliv Inc. (ALV)

We made Autoliv Inc. (ALV: $90/share) a Long Idea on February 27, 2019. At the time, ALV received a Very Attractive rating. Our long thesis highlighted Autoliv’s rising economic earnings despite its falling GAAP net income.

During the 630-day holding period, ALV underperformed the S&P 500 by 22%, rising 8% compared to a 29% gain for the S&P 500.

Autoliv now earns a Neutral rating and the firm’s profitability has significantly diminished. Autoliv’s NOPAT margin has fallen from 8% in 2018 to 4% TTM, while its invested capital turns declined from 1.5 to 1.3 over the same time. Falling NOPAT margin and invested capital turns drive Autoliv’s ROIC from 12% in 2018 to 5% TTM. While the firm’s GAAP net income has fallen from $190 million in 2018 to $154 TTM, its economic earnings have fallen at a much faster rate from $260 million to -$3 million over the same time.

General Motors Co. (GM) and Standard Motor Products, Inc. (SMP) offer better risk/reward for investors seeking exposure to the automobile industry. We’re closing this position.

Figure 12: ALV vs. S&P 500 – Price Return – Unsuccessful Long Idea

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

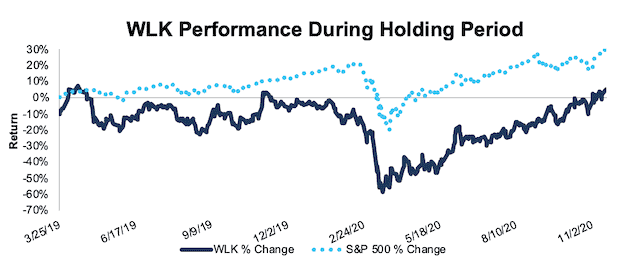

Westlake Chemical Corp (WLK)

We made Westlake Chemical Corp (WLK: $76/share) a Long Idea on February 27, 2019, in the same report with Autoliv Inc. At the time, WLK received a Very Attractive rating. Just like with Autoliv, our long thesis highlighted Westlake Chemical’s rising economic earnings in the face of falling GAAP net income.

During the more than one-and-a-half-year holding period, WLK underperformed the S&P 500 by 24%, rising just 5% compared to a 29% gain for the S&P 500.

Westlake Chemical now earns an Unattractive rating and the firm’s profitability has significantly declined. Westlake Chemical’s NOPAT margin has fallen from 13% in 2018 to 5% TTM, while its invested capital turns declined from 0.8 to 0.6 over the same time. Falling NOPAT margin and invested capital turns drive the firm’s ROIC from 11% in 2018 to 3% TTM. Westlake Chemicals economic earnings have fallen from $273 million in 2018 to -$351 million TTM.

The firm’s deteriorating profitability means the stock no longer offers favorable risk/reward. We’re closing this position.

Figure 13: WLK vs. S&P 500 – Price Return – Unsuccessful Long Idea

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

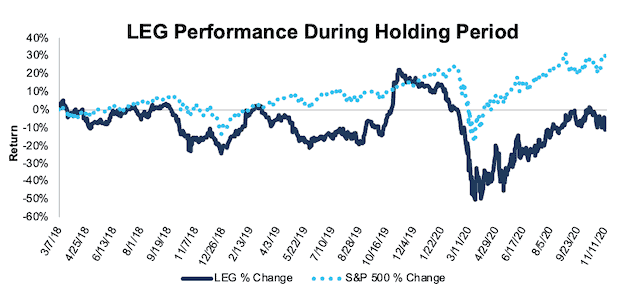

Leggett & Platt, Inc. (LEG)

We made Leggett & Platt, Inc. (LEG: $43/share) a Long Idea on March 7, 2018. At the time, LEG received an Attractive rating. Our long thesis highlighted Leggett & Platt’s leading market share, understated profitability, and undervalued stock price.

During the 987-day holding period, LEG underperformed the S&P 500 by 38%, falling 5% compared to a 32% gain for the S&P 500.

Leggett & Platt now earns a Neutral rating and the firm’s profitability has significantly deteriorated. The firm’s economic earnings have fallen each year since reaching $159 million in 2016. Over the TTM, Leggett & Platt’s economic earnings are just $24 million. The firm’s core earnings have followed a similar trend from $334 million in 2016 to $254 million TTM.

Leggett & Platt’s worsening fundamentals means its stock no longer presents favorable risk/reward. We’re closing this position.

Figure 14: LEG vs. S&P 500 – Price Return – Unsuccessful Long Idea

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

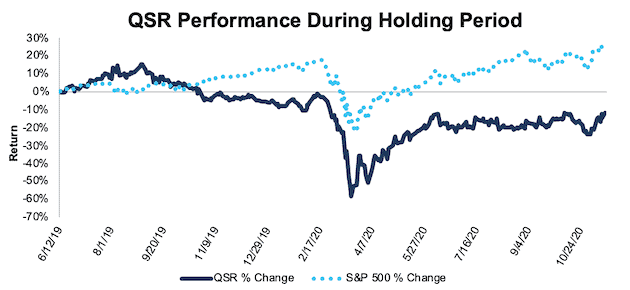

Restaurant Brands International Inc (QSR)

We made Restaurant Brands International Inc (QSR: $59/share) a Long Idea on June 12, 2019, in the same report with Brinker International above. At the time, QSR received an Attractive rating. Our long thesis highlighted Restaurant Brands’ rising ROIC, growing store count, innovative menus, and rapid service.

During the 525-day holding period, QSR vastly underperformed the S&P 500 by 38%, falling 13% compared to a 25% gain for the S&P 500.

Restaurant Brands now earns a Neutral rating. The firm’s NOPAT margin has fallen from 30% in 2018 to 27% TTM, while its ROIC has declined from 8% to 7% over the same time.

We prefer best-in-class operator McDonald's Corporation (MCD) whose TTM NOPAT margin and ROIC are nearly double Restaurant Brand’s TTM margin and ROIC. We’re closing this position.

Figure 15: QSR vs. S&P 500 – Price Return – Unsuccessful Long Idea

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

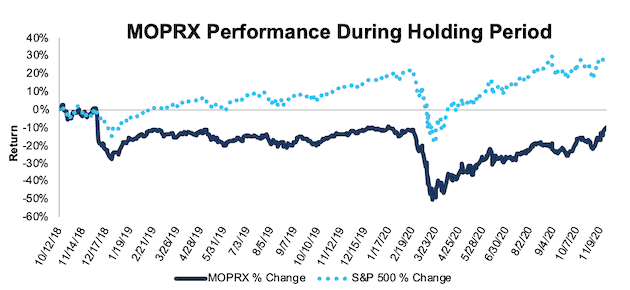

MainStay MacKay Small Cap Core Fund (MOPRX)

We made MainStay MacKay Small Cap Core Fund (MOPRX: $27/share) a Long Idea on October 12, 2018. At the time, MOPRX received an Attractive rating. Our long thesis highlighted the fund’s investment philosophy that recognized the flawed nature of GAAP net income and the correlation between ROIC and creating shareholder value.

During the more than two-year holding period, MOPRX vastly underperformed the S&P 500 by 41%, falling 10% compared to a 30% gain for the S&P 500.

MOPRX now earns a Very Unattractive rating. The fund’s total annual costs have more than doubled since our original article and the fund now allocates only 25% of its assets to Attractive-or-better rated stocks.

Artisan Mid Cap Value Fund (ARTQX), Pacer US Cash Cows 100 ETF (COWZ), and Alpha Architect U.S. Quantitative Value ETF (QVAL) are funds that currently offer better risk/reward. We’re closing this position.

Figure 16: MOPRX vs. S&P 500 – Price Return – Unsuccessful Long Idea

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

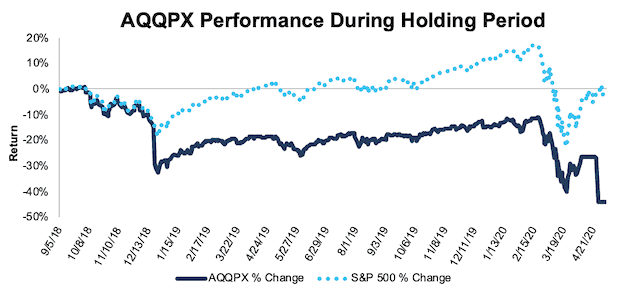

American Beacon Alpha Quant Quality Fund (AQQPX)

We American Beacon Alpha Quant Quality Fund (AQQPX: $13/share) a Long Idea on September 5, 2018. At the time, AQQPX received a Very Attractive rating. Our long thesis highlighted the fund’s superior stock selection methodology.

During the 608-day holding period, AQQPX vastly underperformed the S&P 500 by 43%, falling 44% compared to a 1% decline for the S&P 500.

This position closed when AQQPX was liquidated on May 5, 2020.

Figure 17: AQQPX vs. S&P 500 – Price Return – Unsuccessful Long Idea

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

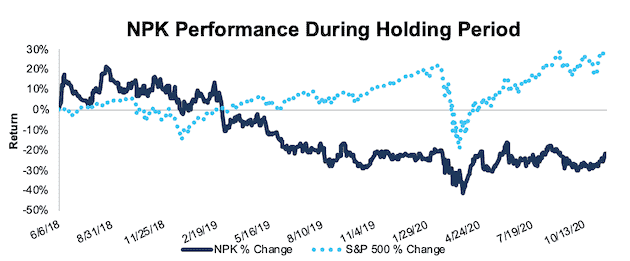

National Presto Industries, Inc. (NPK)

We made National Presto Industries, Inc. (NPK: $90/share) a Long Idea on June 6, 2018. At the time, NPK received a Very Attractive rating. Our long thesis highlighted National Presto Industries’ rising economic earnings despite a decline in GAAP net income, the firm’s strong defense segment, ability to control costs, and smart capital allocation.

During the nearly two-and-a-half-year holding period, NPK vastly underperformed the S&P 500 by 52%, falling 22% compared to a 30% gain for the S&P 500.

The firm’s PEBV ratio of 0.5 is the cheapest it’s been since 2012. However, National Presto Industries disclosed a material weakness in internal controls, which means there is an increased risk for misstatement of the firm’s financial statements. Additionally, the firm’s ROIC and NOPAT margin have deteriorated in recent years.

Given the firm’s Suspended rating and decline in fundamentals, National Presto Industries no longer presents favorable risk/reward. We’re closing this position.

Figure 18: NPK vs. S&P 500 – Price Return – Unsuccessful Long Idea

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

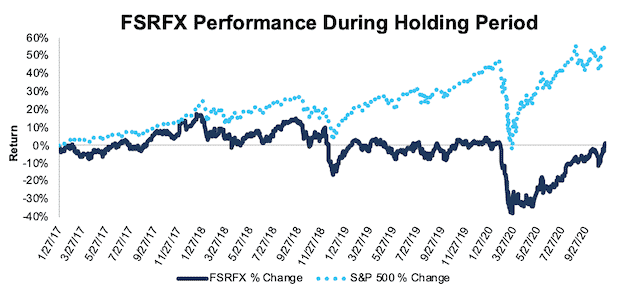

Fidelity Select Transportation Portfolio (FSRFX)

We made Fidelity Select Transportation Portfolio (FSRFX: $94/share) a Long Idea on January 27, 2017. At the time, FSRFX received an Attractive rating. Our long thesis highlighted the fund’s superior allocation to Attractive-or-better rated stocks compared to its benchmark and low total annual costs.

During the more than two-year holding period, FSRFX vastly underperformed the S&P 500 by 56%, rising just 1% compared to a 57% gain for the S&P 500.

FSRFX now earns a Neutral rating. The fund’s allocation to Attractive-or-better rated stocks has fallen from 35% in 2017 to just 11% today. For comparison, State Street Industrial Select Sector SPDR Fund (XLI), FSRFX’s benchmark, allocates 19% of its capital to Attractive-or-better rated stocks.

As previously noted, there are several funds that offer better risk/reward than FSRFX. We’re closing this position.

Figure 19: FSRFX vs. S&P 500 – Price Return – Unsuccessful Long Idea

Sources: New Constructs, LLC and company filings

This article originally published on November 18, 2020.

Disclosure: David Trainer owns DHI and HCA. David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1]Our core earnings are a superior measure of profits, as demonstrated in Core Earnings: New Data & Evidence a paper by professors at Harvard Business School (HBS) & MIT Sloan. The paper empirically shows that our data is superior to “Operating Income After Depreciation” and “Income Before Special Items” from Compustat, owned by S&P Global (SPGI).